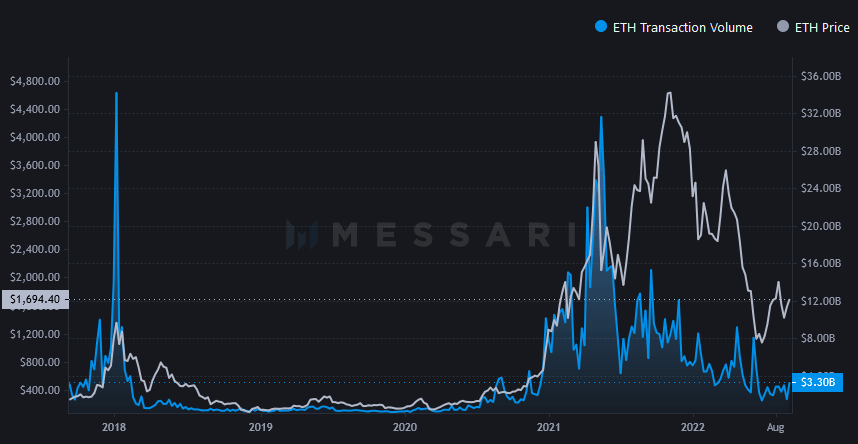

Fuel charges seek advice from the price of conducting a transaction or executing a contract. For instance, this might take the type of exchanging right into a stablecoin or minting an NFT.

For the reason that summer season of 2020, Ethereum gasoline charges took off primarily because of the explosion of DeFi use on the chain. Though community exercise has tailed off considerably since Might 2021, the adage of Ethereum being an costly chain to make use of nonetheless prevails.

Ethereum gasoline charges are priced in gwei, which is a unit of measure equal to one billionth of 1 ETH. The precise gasoline price will depend on the community’s congestion on the time of transacting, with peak intervals requiring increased gasoline charges to push via the transaction.

The present common gasoline worth is $13.28, down considerably from the Might 1 native prime, when a transaction price $474.57 on common.

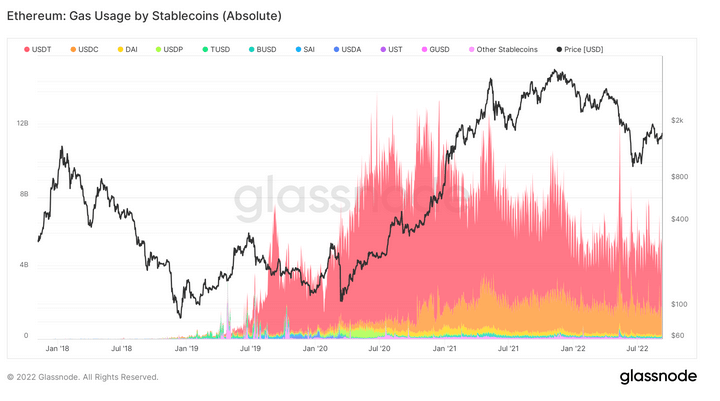

Stablecoin utilization

Stablecoins are cryptocurrencies designed to attenuate worth volatility by maintaining a hard and fast worth, whatever the worth of Ethereum.

The market gives varied sorts of stablecoins, similar to asset-backed, together with fiat, crypto, or valuable metallic belongings, and algorithmic, which add to or subtract from circulating token provide to peg the value on the desired stage.

The chart under accounts for over 150 stablecoins, however probably the most outstanding are USDT, USDC, UST, BUSD, and DAI. USDT is the most important stablecoin by quantity and market cap, however in latest occasions, USDC has closed the hole.

Save for sporadic spikes, USDT’s gasoline utilization has been trending downward since July 2020. Present utilization is equal to approximate ranges seen in January 2020.

USDC’s gasoline utilization follows a barely completely different sample by elevating to peak in April 21, once more, aside from remoted spikes increased since then, the general development has been downwards from that time.

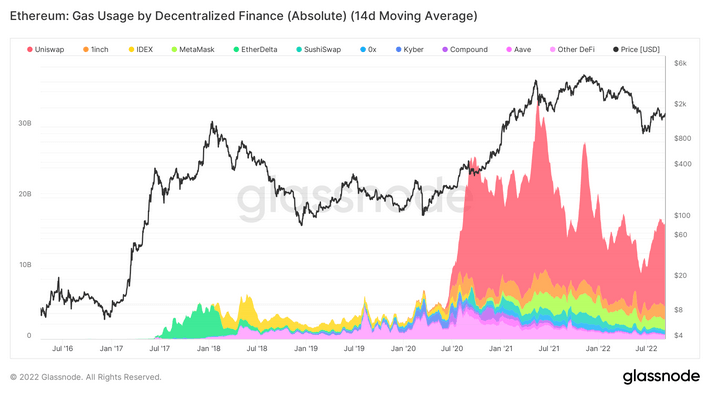

DeFi utilization

Decentralized finance (DeFi) is an rising expertise that cuts out banks and monetary establishments, linking customers straight with monetary merchandise, which generally embody lending, buying and selling, and borrowing.

Utilizing peer-to-peer monetary networks as an alternative of going via a intermediary, customers have better management over their funds and extra privateness, as DeFi protocols have a tendency to not require KYC info.

DeFi gasoline utilization was comparatively low till the summer season of 2020. From July 2020, Uniswap emerged because the main DeFi gasoline consumer, peaking round June 2021 earlier than tapering downwards.

Different vital gas-guzzling DeFi protocols embody 1inch, IDEX, and MetaMask, which have all adopted comparable actions to Uniswap. Since round April 2021, MetaMask elevated its gasoline utilization, managing to keep up its proportion over time.

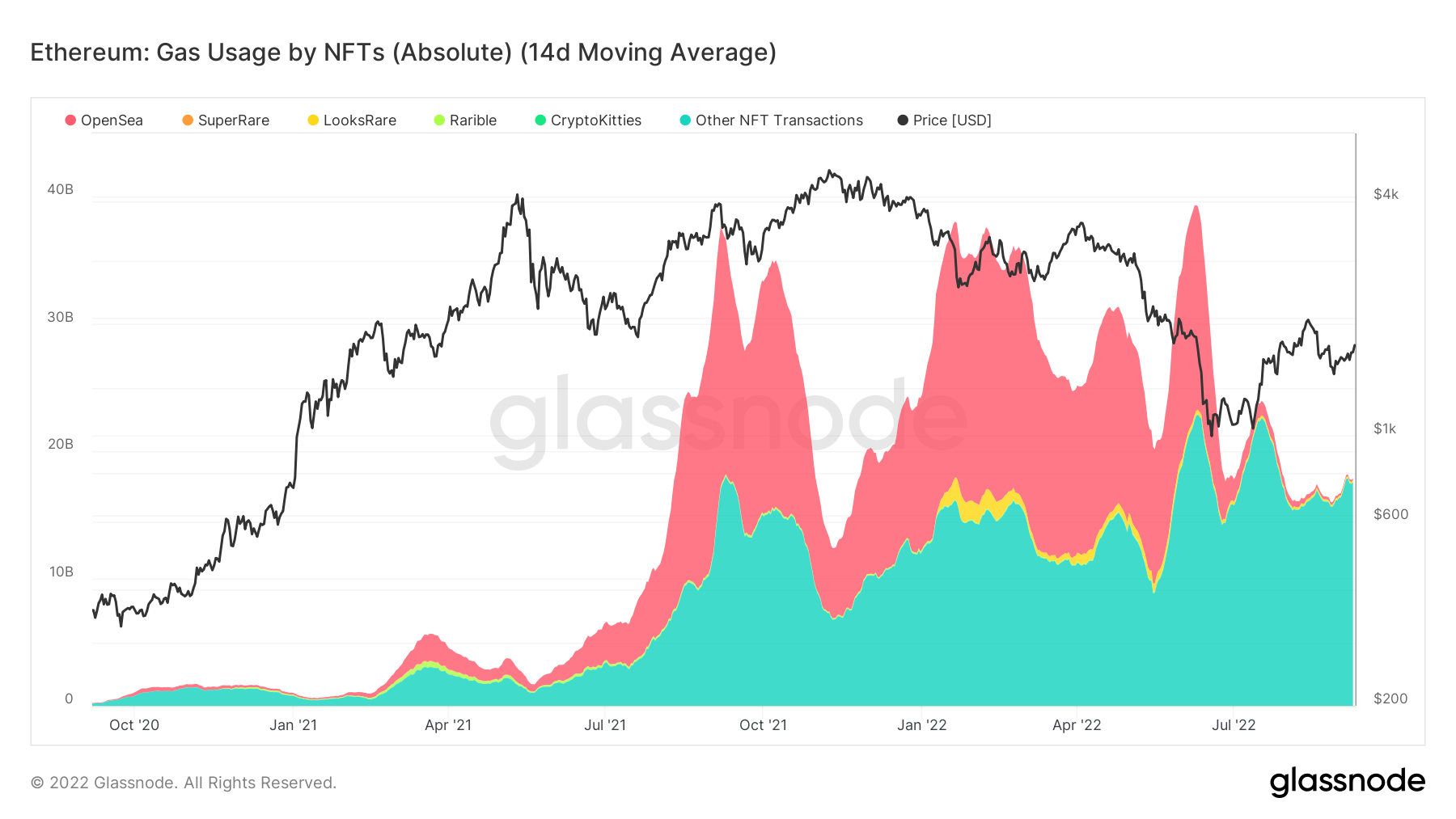

Non-fungible utilization

This class contains each ERC721 and ERC1151 token requirements and the gasoline utilization from NFT marketplaces OpenSea, LooksRare, Rarible, and SuperRare.

In the course of the 2021 bull run, OpenSea noticed the most important spikes in gasoline utilization from NFT demand. Nonetheless, from June 2022, demand has cooled considerably but stays considerably elevated in comparison with earlier years.

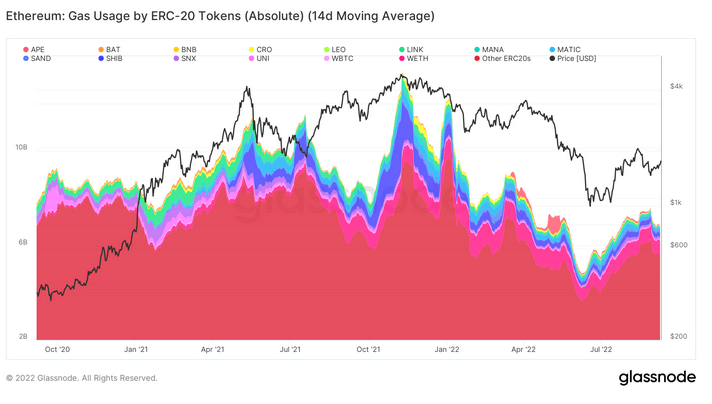

ERC-20 utilization

ERC-20 is the technical customary used for all sensible contracts on the Ethereum chain for fungible token executions. The chart under excludes gasoline utilization from stablecoin contracts.

The general gasoline consumed by ERC-20 contracts peaked round November 2021, resulting in a downtrend that bottomed in June 2022. Since then, ERC-20 gasoline utilization has reverted, bucking the macro development of the earlier three classes.

There aren’t any stand-out ERC-20 contracts that constantly topped gasoline utilization.