The largest information within the cryptoverse for Nov. 29 consists of exchanges dismissing rumors of insolvency, NEXO releasing proof of reserves, Andre Cronje revealing how DeFi helped Fantom develop its reserve, U.S. politician Beto O’Rourke returning a $1 million donation to Sam Bankman-Fried, and ETH erasing 80% of deflationary beneficial properties post-FTX collapse.

CryptoSlate High Tales

Exchanges dismiss rumors of insolvency amid rampant hypothesis

With the sudden collapse of FTX, BlockFi, Celsius, and Voyager, the crypto neighborhood is questioning the solvency of extra crypto exchanges together with Binance, KuCoin, and Nexo.

Significantly, KuCoin’s Twin Funding product which guarantees as much as 200% APR has raised questions concerning the change’s liquidity state.

Nonetheless, KuCoin CEO Johnny Lyu in a current interview with CryptoSlate dismissed the insolvency rumors, including that his change is “totally liquid” and collaborating with third-party auditors to publish its proof of reserves.

Andre Cronje reveals how DeFi saved Fantom; FTM surges 17%

Fantom founder Andre Cronje acknowledged the function of DeFi incomes actions in serving to the layer-1 blockchain develop its treasury to over $51 million in 2021.

In response to Cronje, as of February 2020, Fantom was left with about $4 million from the $40 million it raised in 2018. It took benefit of yield farming on Compound and comparable DeFi platforms to generate about $2 million yearly.

In the meanwhile, Cronje stated that Fantom held over 450 million FTM tokens ($96.43 million), $100 million value of stablecoins, $100 million in different crypto property, and $50 million in non-crypto property.

NEXO releases proof of reserves exhibiting no publicity to FTX

Nexo revealed its proof of reserves which revealed that it has a 100% collateralization for about $3.4 billion of consumers’ property held in its custody. Moreover, it had $0 publicity to FTX and Alameda Analysis, because it was in a position to withdraw all its debt earlier than the change blew up.

Nexo known as on different lending platforms to be cautious when issuing uncollateralized loans as it could be tough to repay throughout bear market circumstances.

Bitcoin Volatility Index exceeds 100% for the third time in 2022

The BTC Volatility Index (BVIN) which was lingering at its all time-lows previous to the FTX collapse, has surged by over 100% in current weeks.

Historic information exhibits that in the course of the 2014-2015 bear market, BTC fell by 85% from its all-time excessive following an identical surge of the BVIN metric.

Ripple common counsel calls BlockFi chapter one other success for SEC’s ‘regulation by enforcement’ strategy

Ripple common counsel Stuart Alderoty stated that the SEC’s $100 million positive towards BlockFi might have contributed to the latter’s chapter.

Ripple CTO David Schwartz added that BlockFi might have turned to FTX for $400 million so it could possibly repay the SEC positive, on a situation that BlockFi’s property will likely be held on FTX.

BlockFi nonetheless owes the SEC about $30 million accounting to its chapter court docket filings.

ETH deflationary beneficial properties erased post-FTX collapse

As of Nov. 12, Ethereum (ETH) was at its most deflationary price of -0.00514%, nevertheless, it has retraced by over 80% to sit down at -0.00090% as of Nov. 29.

Regardless of shedding off some deflationary beneficial properties, on-chain information exhibits that ETH addressed with greater than 32 ETH has hit an all-time excessive.

Analysis Spotlight

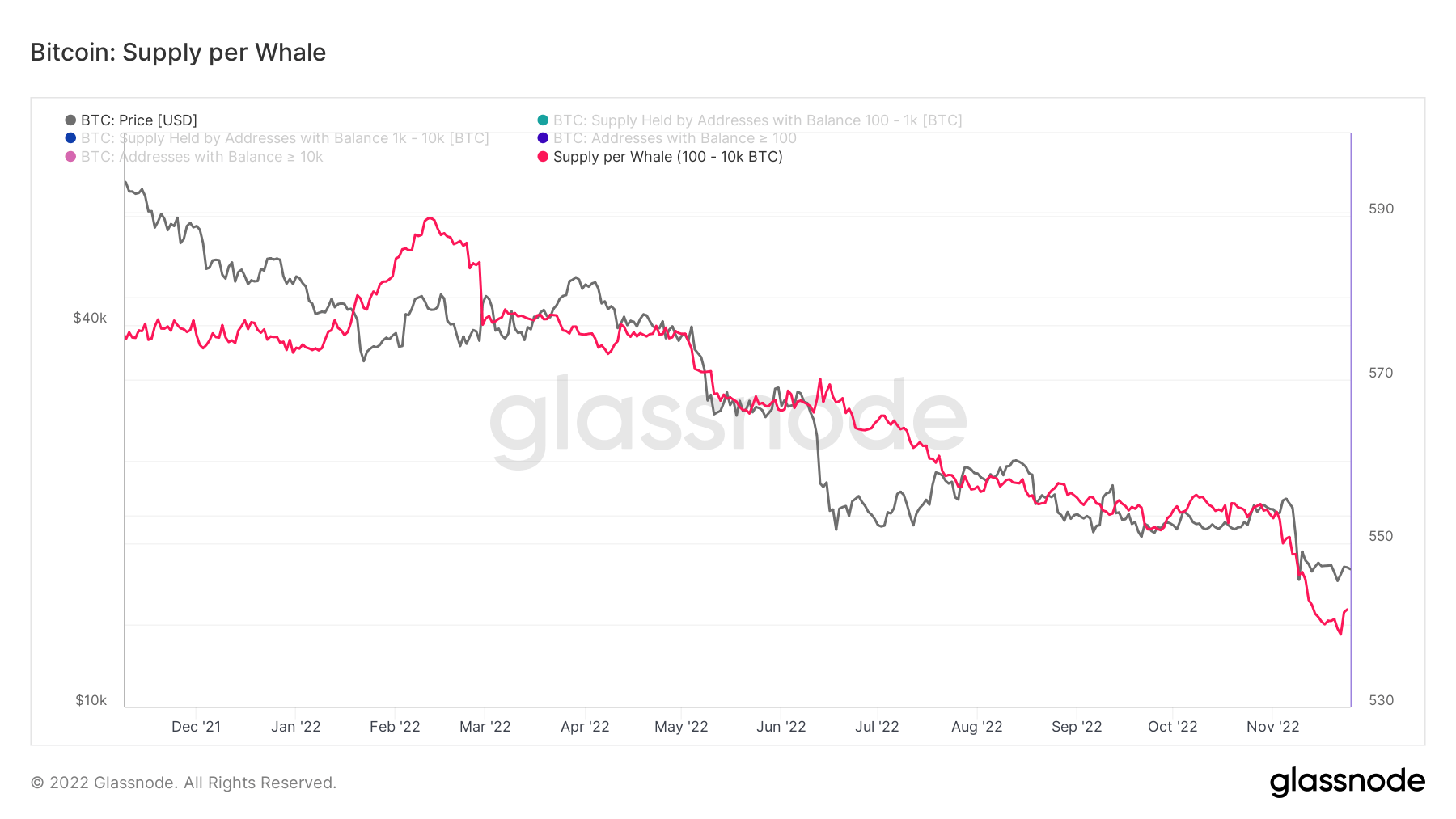

Whales have been offloading Bitcoin since 2021

CryptoSlate’s evaluation of the Bitcoin provide per whale metric exhibits that whales have been promoting off their holdings following the BTC value decline for the reason that finish of 2021.

From the chart, it’s noticed that the provision per whale metric has been mimicking Bitcoin’s value actions, notably since Dec. 2021. Consequently, extra whales have been liquidating their positions within the bear market.

Information from across the Cryptoverse

U.S politician returns $1 million to SBF

Texas gubernatorial candidate Beto O’Rourke has reportedly returned a $1 million donation embattled FTX CEO Sam Bankman-Fried (SBF) gave to help his political marketing campaign.

O’Rourke marketing campaign spokesperson Chris Evans stated the funds needed to be returned because it was unsolicited, including that O’Rourke has no direct relationship with SBF.

Phantom pockets to go multichain

Phantom which was initially launched as a Solana-only self-custody pockets has introduced plans to go multi-chain.

It’s going to add help for the Ethereum and Polygon networks, with extra functionalities for customers to handle their NFTs utilizing the browser extension.

Binance, Coinbase, and 4 others underneath probe by U.S. Congress

Chairman of the U.S. Senate Finance Committee Ron Wyden has issued letters to main crypto exchanges together with Binance, Coinbase, Bitfinex, Gemini, Kraken, and KuCoin to clarify how they defend buyers from FTX-like collapse, and programs to forestall market manipulation.

Wydan requested that the exchanges ought to embrace their stability sheet and proof of reserves data within the response which will likely be thought-about within the Congress’s subsequent sitting.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated barely by _1.35% to commerce at $16.454, whereas Ethereum (ETH) elevated by -+4.04% to commerce at $1,219.