The most important information within the cryptosphere for Oct. 10 contains Dominic Frisby’s tackle Bitcoin and gold investments, the EU Fee’s tender that alerts a regulatory framework for DeFi, and BitBoy Crypto’s allegations in opposition to the previous SEC director for accepting bribes to declare Ethereum a commodity.

CryptoSlate Prime Tales

EU alerts regulatory intent with research on’ embedded supervision’ of Ethereum DeFi

Particulars of the EU Fee’s tender on DeFi received revealed by Circle’s coverage advisor Patrick Hansen.

The EU Fee has launched a public name for tender for a research on “embedded supervision” of #DeFi on #Ethereum.

The goal is to check technol. capabilities for automated supervisory monitoring of real-time DeFi exercise.

Est. tender worth: 250k EUR.https://t.co/oZwb9QnLjG

— Patrick Hansen (@paddi_hansen) October 10, 2022

In line with Hansen, the EU Fee is working to reinforce technical experience on built-in supervision mechanics of DeFi on the Ethereum community.

The Fee is making this name though the MiCA framework launched final month excludes decentralized companies.

BitBoy Crypto alleges former SEC Director took bribes to label ETH a commodity

In line with crypto influencer BitBoy Crypto, former director of the Securities and Trade Fee (SEC) William Hinman accepted bribes to declare Ethereum (ETH) a commodity.

BitBoy Crypto made the allegations in opposition to Hinman on Oct.9 by means of his Twitter account. Cardano’s (ADA) founder Charles Hoskinson and Ripple group additionally mentioned that the accusations in opposition to Hinman are primarily based on information.

Curiosity in crypto fades as buyers pile into bonds

The Federal Reserve pushing rates of interest increased has negatively affected the crypto and inventory markets. The Fed’s try to manage inflation pressured buyers to show to U.S. Treasury bonds.

In line with numbers from September, the typical day by day buying and selling quantity recorded a 17.2% improve on the year-on-year metric, and the general buying and selling quantity reached $25.1 trillion.

As well as, the ten-year treasury chart confirmed a rise of three.89%, whereas Bitcoin and Ethereum’s ten-year charts reveal a 60% lower in worth.

‘Horrendous’ KYC dangers on present as web site detailing Celsius customers’ losses goes reside

A brand new web site was launched on Oct. 10, detailing the losses of customers of bankrupt crypto lender Celsius (CEL). Angel investor Stephen Cole discovered the web site and referred to it as “a wonderfully horrendous illustration of the dangers of KYC.”

TrueFi points discover of default to VC agency Blockwater on $3.4M mortgage

Blockwater Know-how borrowed about $16.8 million from the crypto lending platform TrueFi (TRU) in 2021. It paid round $13.4 million and requested for an extension within the reimbursement interval.

On Oct. 10, TrueFi issued a discover of default to Blockwater Know-how, asking it to repay the remaining $3.4 million.

Curiosity in XEN Crypto makes Ethereum deflationary

A brand new undertaking on Ethereum known as XEN Crypto seems to be chargeable for over 40% of all Ethereum transactions and burns. By itself, XEN minting pushed the community transaction payment above $1.

To date, customers have paid greater than $1.8 million in gasoline charges to work together with the token contract.

Brazil police, US authorities bust transnational crypto fraud ring led by ‘Bitcoin Sheikh’

Brazilian Federal Police, the U.S. Homeland Safety Investigations (HSI), and different enforcement businesses busted a crypto fraud ring known as “Bitcoin Sheikh.”

The Brazil-based fraud ring was led by Francisco Valdevino de Silva, often known as the Bitcoin Sheikh.” The group had dedicated crimes of worldwide cash laundering, working a legal enterprise, fraud, and crimes in opposition to the home monetary system.

CryptoSlate Unique

Dominic Frisby provides his tackle investing in Bitcoin, gold

The Creator of “Bitcoin: The Way forward for Cash?” Dominic Frisby gave an unique interview to CryptoSlate to speak about gold, Bitcoin, and geopolitics.

Frisby mentioned gold was his gateway to anti-fiat pondering. Nevertheless, as millennials develop into dominant on the earth financial system, that’s now not the case.

He mentioned:

“Because the world continues to shift in direction of tech and as millennials develop into a extra dominant a part of the world financial system, we should always count on Bitcoin to additionally take an more and more influential position in monetary markets, particularly in regard to being a ‘recession-proof’ asset.”

He added that holding each Bitcoin (BTC) and gold will serve the perfect in the case of defending one’s monetary integrity throughout these precarious geopolitical instances.

Analysis Spotlight

Analysis: Bitcoin mining problem adjusts over 13%, the best since Might 2021

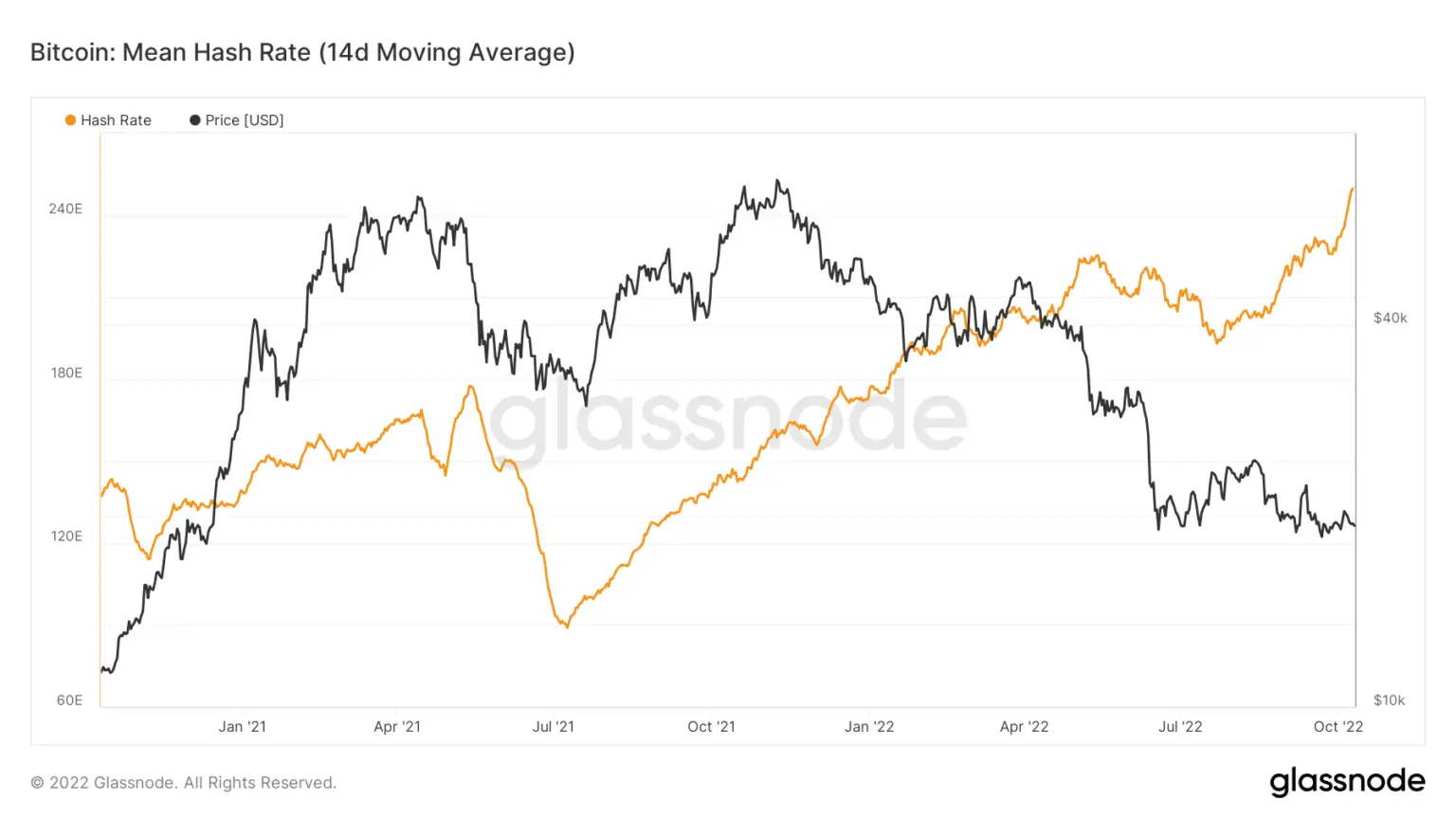

The Bitcoin community’s complete hash fee reached its all-time excessive after a pointy rise in mining problem. The speed reached 240 EH per second, and it’s anticipated to extend even additional.

The present fee equals roughly thrice greater than the community’s lows in July. On the time, the hashrate had dropped to round 89 EH/s, a two-year low.

Information from across the Cryptoverse

FTX V2 will launch on Nov. 21

Trade big FTX’s founder Sam Bankman-Fried Tweeted in regards to the upcoming enhancements to the FTX trade. SBF mentioned that the platform would get a brand new order matcher, decrease latency API pathways, and different options, all of which is able to launch on Nov. 21 because the FTX V2.

TeraWulf will increase working capability

Carbon-free Bitcoin mining firm TeraWulf introduced that it elevated its mining capability by greater than 1.6 EH/s. The announcement additionally included information about $17 million of recent capital. About $9.5 million was in a non-brokered non-public fairness placement, whereas the remaining $7.5 million was below incremental proceeds below the Firm’s Time period Mortgage.

Crypto Market

In line with CryptoSlate information from the final 24 hours, Bitcoin (BTC) decreased by 1.24% to be traded at $19,235, whereas Ethereum (ETH) additionally fell by 0.87% to commerce at $1,309.