Asset administration and threat administration are vital elements of any funding technique, and the digital asset house isn’t any exception. With the volatility and complexity of the crypto market, it’s important for buyers to observe their investments and assess their threat publicity rigorously.

CryptoCompare, a number one digital asset knowledge supplier, has launched its month-to-month Digital Asset Administration Evaluation, which supplies an summary of the worldwide digital asset funding product panorama.

Methodology

The report tracks the adoption of digital asset merchandise by analyzing belongings underneath administration, buying and selling volumes, and value efficiency. The assessment drew knowledge from varied sources, together with Monetary Instances, 21Shares, Coinshares, XBT Supplier, Grayscale, OTC Markets, HanETF, Yahoo Finance, 3iQ, Goal, VanEck, ByteTree, Nordic Progress Market, Bloomberg, and CryptoCompare.

Key Findings

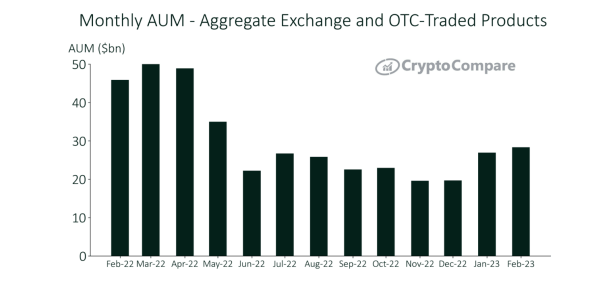

Digital asset investments continued their upward development in February, with the entire belongings underneath administration (AUM) for digital asset funding merchandise reaching a brand new excessive of $28.3 billion.

This represents a 5.25% enhance from January, the third consecutive month-to-month enhance in AUM. The AUM surge indicators buyers’ bullish sentiment and a rising urge for food for digital belongings.

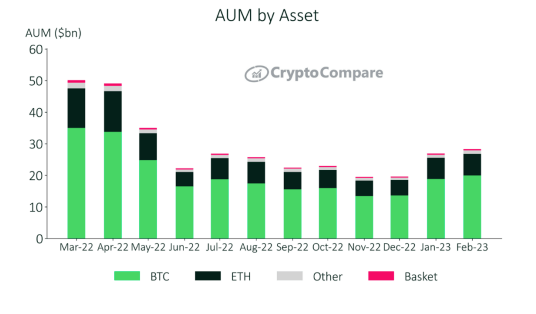

Bitcoin and Ethereum-based merchandise skilled elevated belongings underneath administration (AUM) in February. BTC-based merchandise noticed an increase of 6.06%, bringing the entire AUM to $20.0 billion, whereas ETH-based merchandise noticed a 1.72% enhance, bringing the entire AUM to $6.80 billion. Consequently, BTC and ETH merchandise now account for 70.5% and 24.0% of the entire AUM market share, respectively.

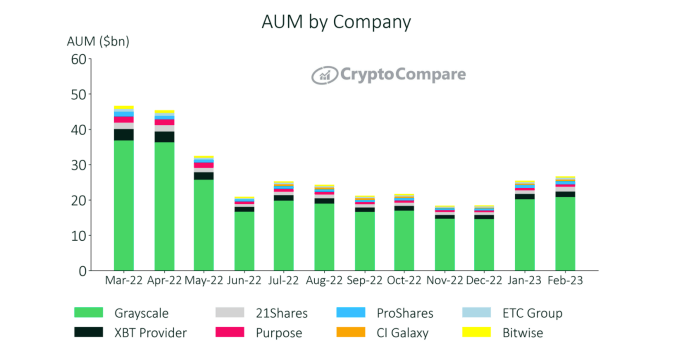

Throughout February, CI Galaxy had the best enhance in belongings underneath administration (AUM), with an increase of 37.7% to $460 million. Following intently was 21Shares, which noticed a 33.4% enhance to $1.38 billion. Regardless of these good points, Grayscale continued to carry the dominant place, with merchandise recording a complete AUM of $20.8 billion, representing a 3.02% enhance in comparison with the earlier month. XBT Supplier ($1.54 billion) and 21Shares ($1.38 billion) adopted Grayscale because the market’s second and third-largest gamers.

In accordance with the most recent report for February 2023, the common each day combination product volumes throughout all digital asset funding merchandise noticed a slight decline of 9.39% to $73.3 million.

In comparison with December 2022, volumes have elevated by 21.5%. Regardless of this enchancment, volumes are nonetheless down by 80.1% in comparison with February 2022, indicating the risky nature of the market.

BTC-based merchandise remained dominant by way of weekly web flows, with each BTC-based merchandise and Brief BTC merchandise recording optimistic flows of $5.3 million and $4.6 million, respectively.

DCG’s choice to promote its positions in Grayscale Belief Merchandise was pushed by its want to boost funds. One of the important gross sales was roughly 25% of its Ethereum Belief (ETHE) at a reduction of round 50% of the belief’s value, based on a report from the Monetary Instances cited within the report.

The complete CryptoCompare’s Digital Asset Administration Evaluation report will be discovered right here.