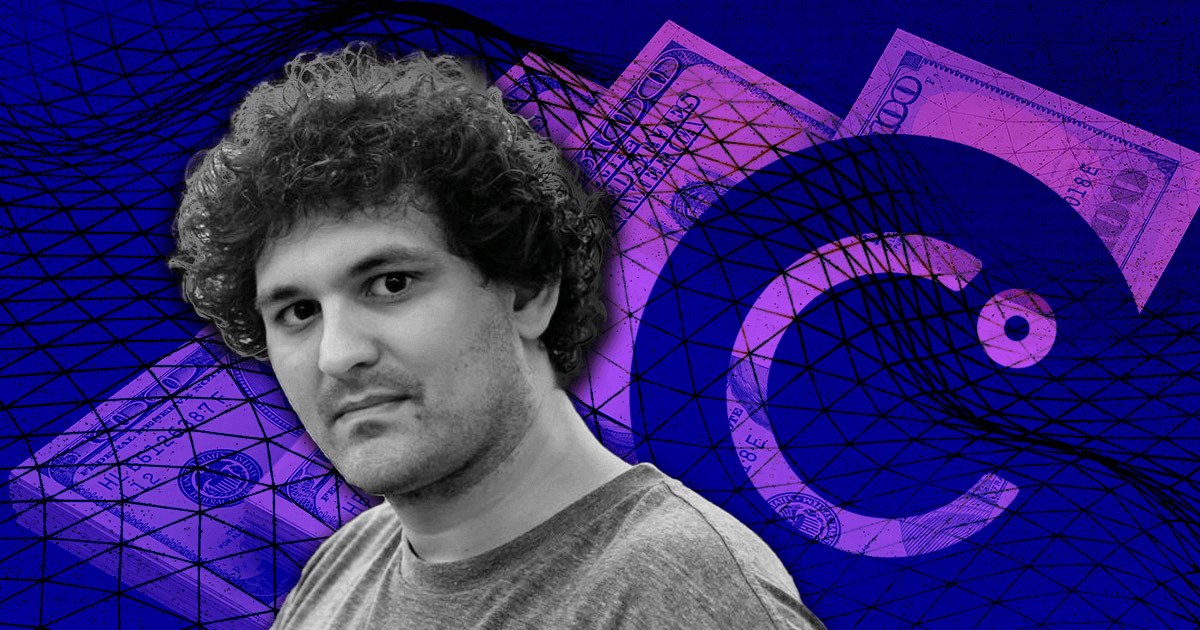

FTX CEO Sam Bankman-Fried mentioned his agency would pay a “honest market worth” for Celsius’ property if it will get concerned within the bankrupt lender acquisition course of in an Oct. 2 tweet.

to be clear — in Voyager, our bids are typically decided by honest market worth, no reductions; objective is not to earn cash shopping for property at cents on the greenback, it is to pay $1 on the $1 and get the $1 again to clients.

If we had been to become involved in Celsius, it will be the identical.

— SBF (@SBF_FTX) October 2, 2022

Celsius buyers cautious of FTX buy

Simon Dixon, the CEO of BnkToTheFuture, has expressed considerations over the opportunity of Celsius property being bought by FTX.

Proper now @SBF_FTX is elevating finance at a $32Billion valuation to be able to purchase the property that @Mashinsky scammed from us. What do you suppose he’s pitching to his buyers? “I’m about to get billions of $$$ of property for cents on the greenback. Would you like in?” It’s OUR Belongings! https://t.co/PqokxhIblf

— Simon Dixon (Beware Impersonators) (@SimonDixonTwitt) October 2, 2022

In keeping with Dixon, FTX is elevating funds at a $32 billion valuation to fund its buy of Celsius property. He continued that SBF’s pitch to buyers can be “I’m about to get billions of $$$ of property for cents on the greenback. Would you like in?”

Dixon acknowledged that the probabilities of Celsius collectors being made complete turns into slimmer if an exterior investor like FTX buys the corporate. As an alternative, he argues that “solely collectors could make different collectors complete.”

3/7) Solely collectors could make different collectors complete. Solely regulators can agree on a compliant construction. Solely #Celsius can put ahead a plan in exclusivity. Solely @CelsiusUcc can power various. Solely choose can log out. Solely collectors can vote. Solely examiner can show crime. pic.twitter.com/wkFyTEw85O

— Simon Dixon (Beware Impersonators) (@SimonDixonTwitt) October 2, 2022

Dixon mentioned:

“There are voluntary leaders of creditor curiosity teams that may co-ordinate greatest restoration for his or her pursuits – Loans, Custody, Earn, Mining, Token – it’s not my plan that wins, it’s not Celsius plan that wins, it’s collectors plan that wins.”

SBF, nonetheless, responded that if his agency had been to buy Celsius’ property, the objective can be “to pay $1 on the $1 and get the $1 again to clients.”

Stories revealed that FTX had walked away from a deal to accumulate Celius earlier due to a $2 billion gap in its stability sheet.

In the meantime, FTX has not supplied info on Voyager’s clients’ destiny because it accomplished the acquisition of the bankrupt firm.

Regulators transfer towards Celius’s plan to promote stablecoins

The US Division of Justice objected to Celsius’ request to reopen its withdrawals and promote its stablecoins in a Sept. 30 court docket submitting.

In keeping with the DOJ, you will need to have a transparent concept of Celsius’ funds earlier than the court docket makes such a choice. State regulators in Texas and Vermont additionally objected to the Celsius movement, saying the bankrupt agency might seize the chance to reopen its unlawful operations of their states.

In the meantime, the court docket has accredited Shoba Pillay’s appointment as an unbiased examiner to offer a full report on Celsius’ property and liabilities.