Court docket paperwork filed in regards to the chapter of cryptocurrency alternate FTX allege that its executives, together with founder Sam Bankman-Fried, knowingly commingled and misused buyer funds for the reason that alternate’s inception.

The paperwork, filed by FTX’s chapter restoration management underneath CEO John J. Ray III, declare that Bankman-Fried, co-founder Gary Wang, Director of Engineering Nishad Singh, and others used buyer and company funds for speculative buying and selling, luxurious property purchases, enterprise investments, and political donations.

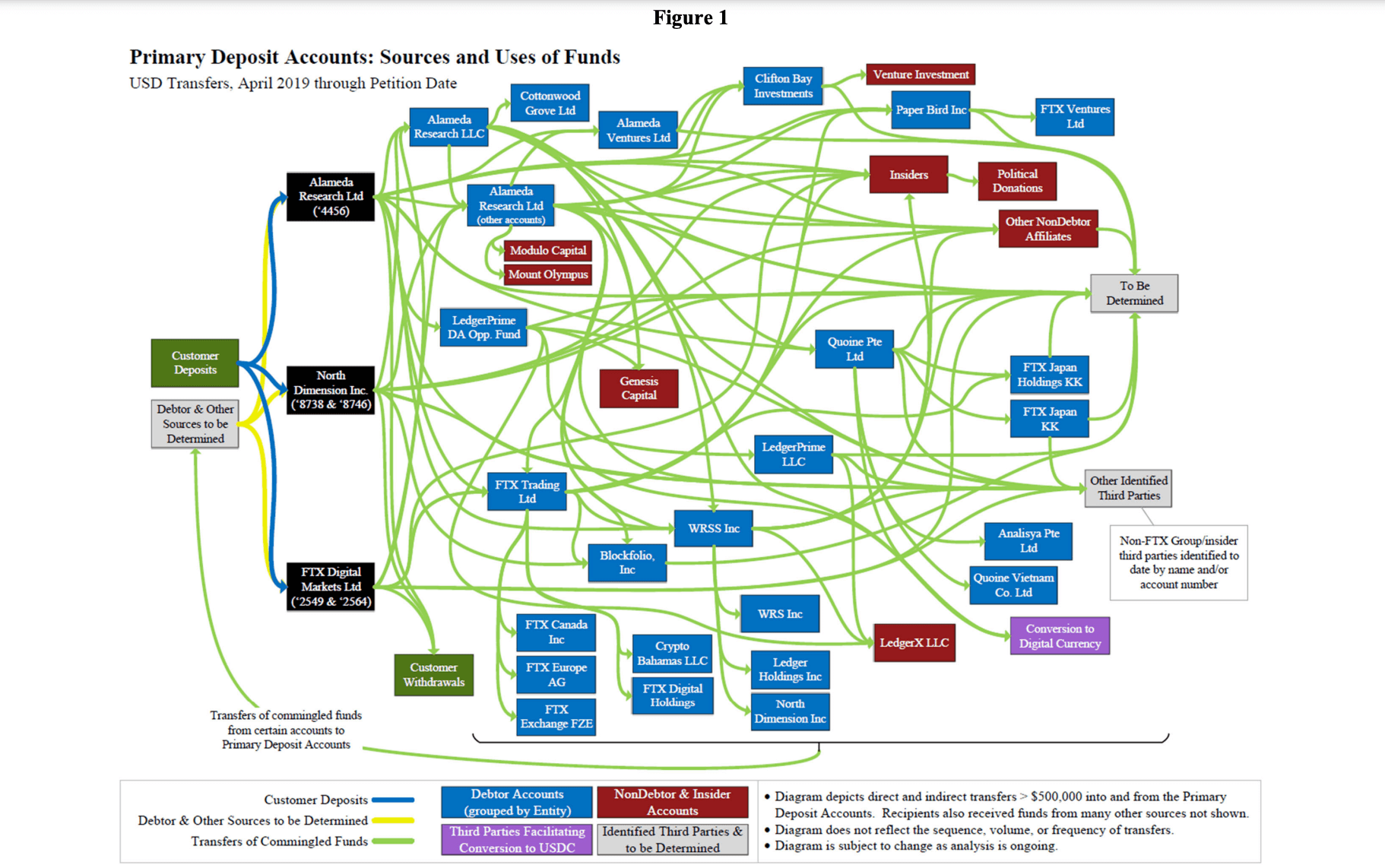

“The FTX Group commingled buyer deposits and company funds, and misused them with abandon,” the courtroom submitting reads, persevering with:

“Bankman-Fried, together with FTX.com’s co-founder, Gary Wang, and Director of Engineering, Nishad Singh (the ‘FTX Senior Executives’), and others at their course, used commingled buyer and company funds for speculative buying and selling, enterprise investments, and the acquisition of luxurious properties, in addition to for political and different donations designed to reinforce their very own energy and affect.”

In accordance with the courtroom submitting, roughly $8.7 billion in customer-deposited property had been misappropriated from the FTX.com alternate. Whereas FTX’s management underneath Ray has repeatedly harassed the issue in tracing all the misappropriated funds, its courtroom filings have continued to replicate their efforts.

FTX filed for chapter in November 2022, with CEO Sam Bankman-Fried stepping down from his function. The following scandal has gone down as the most important crypto-related alleged fraud in historical past.

John J. Ray III, who changed Bankman-Fried and has since led the corporate’s restructuring and restoration efforts, testified earlier than Congress in December 2022, describing the FTX scenario as the results of gross inexperience and a scarcity of primary company controls. He highlighted the absence of correct recordkeeping and the commingling of property as important challenges in assessing the ultimate whereabouts of misappropriated funds.

FTX’s chapter restoration management continues to work on tracing and recovering property to maximise recoveries for stakeholders. A 3rd report is predicted to be revealed in August 2023.

The publish FTX restructurers allege SBF, different execs knowingly commingled, misappropriated buyer funds since inception appeared first on CryptoSlate.