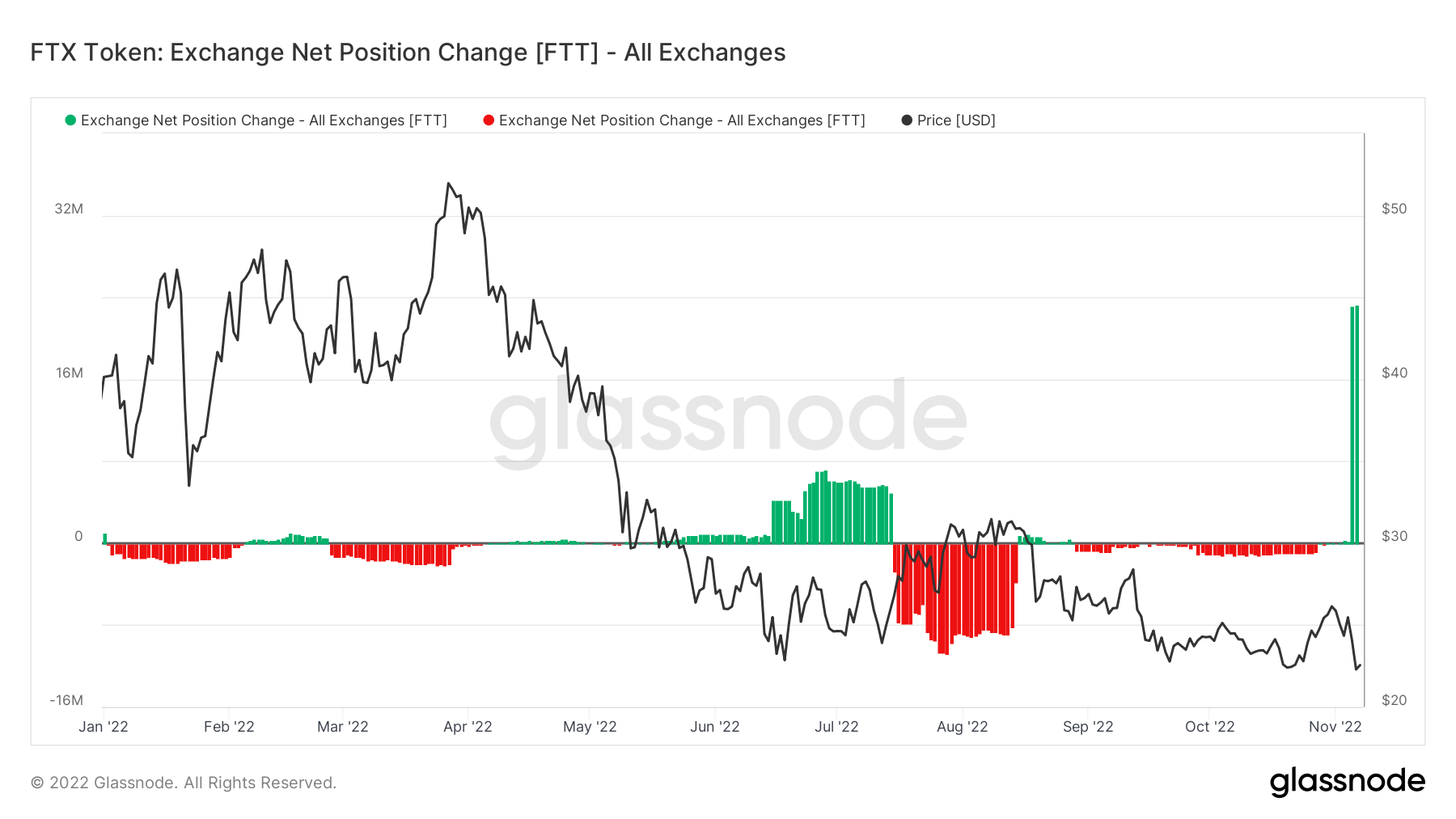

Glassnode information, as analyzed by CryptoSlate, exhibits that round 50 million FTX’s FTT tokens have been dumped on exchanges following Changpeng Zhao’s announcement that Binance would liquidate its FTT place over the approaching months.

Round 23 million FTT tokens ($584.8 million) have been transferred to Binance on Nov. 6. CZ confirmed that these tokens have been a part of its holdings that it was seeking to liquidate.

Lookonchain additional revealed {that a} whale handle transferred 491,534 FTT tokens ($10.9 million) to Binance at a loss. In line with the on-chain sleuth, the whale purchased the tokens on August 5 for $29.9 however can be promoting at a loss, contemplating the tokens have been buying and selling round $23 as of press time.

FTT dangers drastic fall

FTT’s worth is on the threat of a drastic sell-off, contemplating that round 60% of its provide is at the moment on exchanges.

A buying and selling analyst Ali Ajouz had recognized $16.5 as a assist degree for FTT in case there was a dump. Ajouz primarily based his prediction on historic information, suggesting that the weighted chance worth of the coin is between $22 and $24.

#FTT #FTTUSDT $FTT

worst case state of affairs primarily based on the historic information:

The weighted chance suggests a good value between $22 and $24. A lack of the resistance would take us to the fortieth percentile of $20.2 as a assist level. In case of a dump, we’ve $16.5 as a assist. pic.twitter.com/Y6hI14T290— Ali Ajouz (@DrAliAjouz) November 6, 2022

Nonetheless, if the coin have been to lose its resistance, it might drop to $20.2 or decrease.

This view was corroborated by Alistair Milne, the CIO of Altana Digital Forex Fund, who stated the token might drop to as little as $5.

Alameda publicly saying they’re going to purchase every thing Binance has at $22 hoping others front-run them…

… as a result of if this assist breaks, its going to $5 pic.twitter.com/lTvSJJDdpB

— Alistair Milne (@alistairmilne) November 6, 2022

In line with him, Alameda wouldn’t have made a public supply of $22 in the event that they needed the token; as a substitute, the supply was to stop the “value crashing by assist, not about getting $FTT as low-cost as doable.”

However one analyst believes that FTT will get better, saying they’re lengthy on its place. If FTT ought to lose an excessive amount of worth, it might have an effect on the over $2.2 billion loans that Alameda Analysis obtained utilizing FTT as collateral.

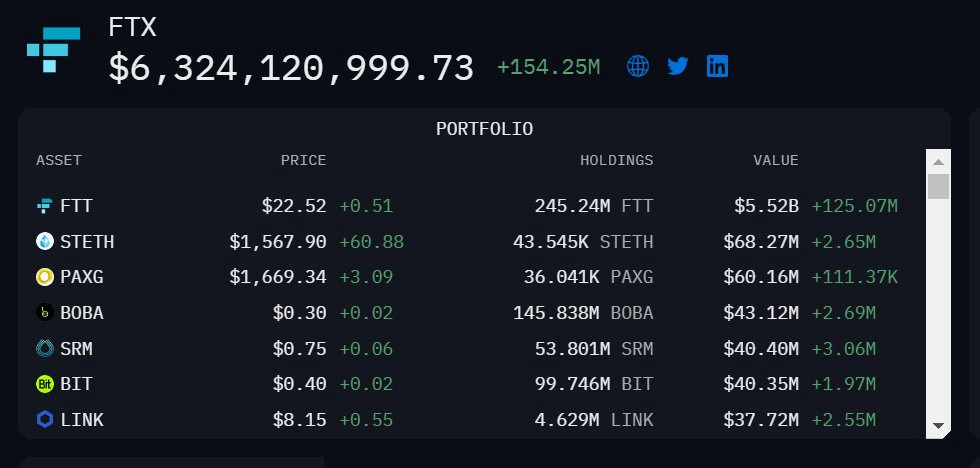

FTT dominates FTX holding

In the meantime, the Arkham Intelligence dashboard exhibits that 90% of FTX’s $6.3 billion treasury is in its native token, FTT.

In line with the dashboard, the change holds 245 million FTT tokens price $5.52 billion. FTX’s different crypto holdings embody $68.27 million of Staked Ethereum, $37 million of Chainlink, $60.16 million of Pax Gold, and many others. –the reserve doesn’t embody the agency’s Bitcoin holdings.

Its sister firm, Alameda analysis, has a treasury reserve of $165 million. For context, Binance’s treasury is over $43 billion.

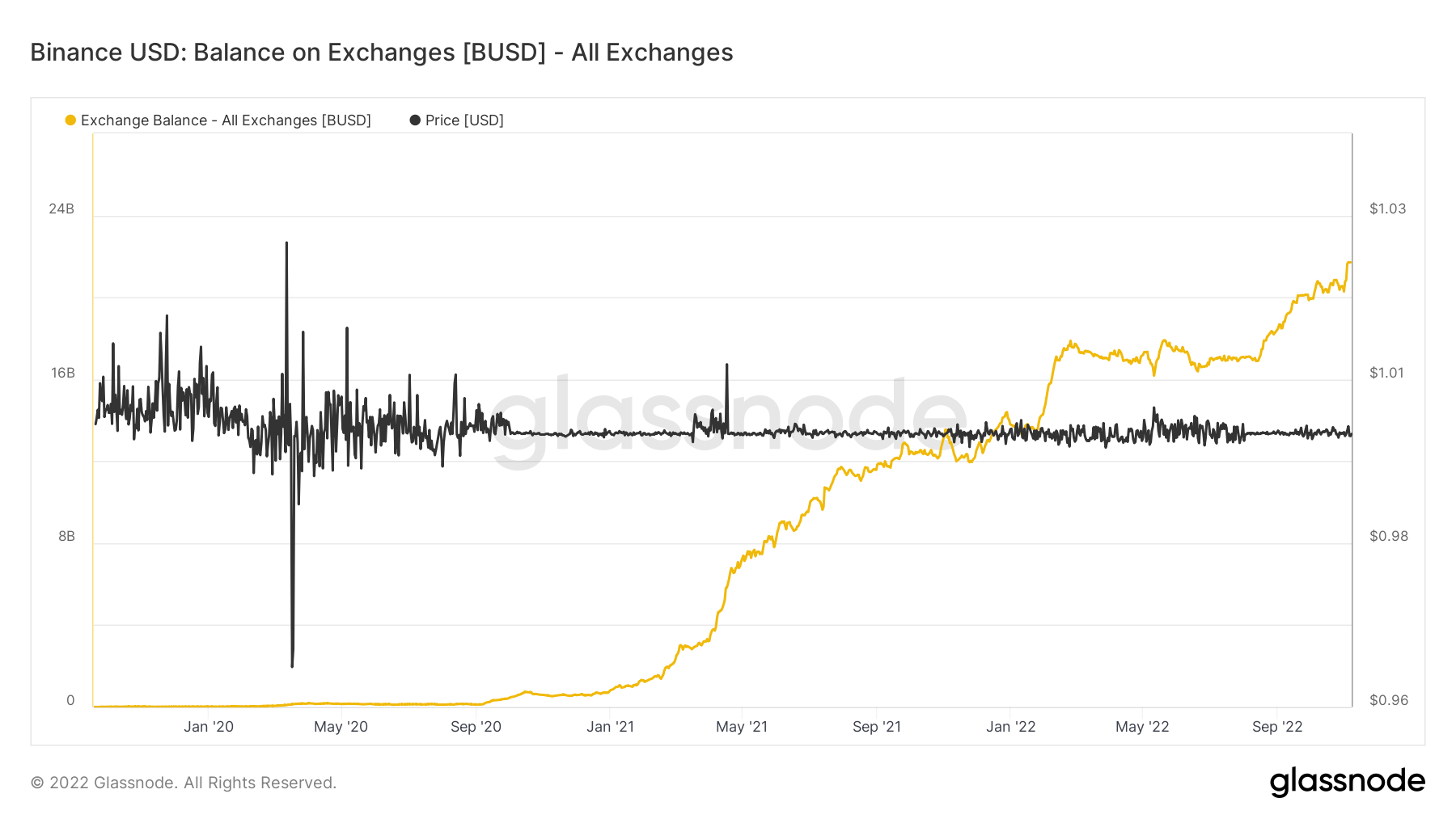

Binance USD provide hits all-time excessive

Binance has continued to consolidate its prime place within the crypto area through the bear market. Its stablecoin BUSD provide has hit an all-time excessive on exchanges, in line with the Glassnode information analyzed by CryptoSlate.

BUSD has loved elevated adoption and progress after Binance revealed that it was changing it was eradicating USD Coin (USDC), TrueUSD (TUSD), and Paxos Normal (USDP) as tradeable property on its platform.

The change continued that it might convert its customers’ steadiness in these stablecoins to BUSD. Since then, the stablecoin market cap has grown from beneath $20 billion to an all-time excessive of $22.55 billion.