The complete penalties of the FTX fallout are nonetheless unknown. As FTX, its U.S. subsidiary, and Alameda Analysis all filed for chapter safety, it may very well be months earlier than the general public will get to see what occurred in Sam Bankman-Fried’s crumbled buying and selling empire.

Till that occurs, what we’re left with is on-chain knowledge that may level us to the place the cash goes.

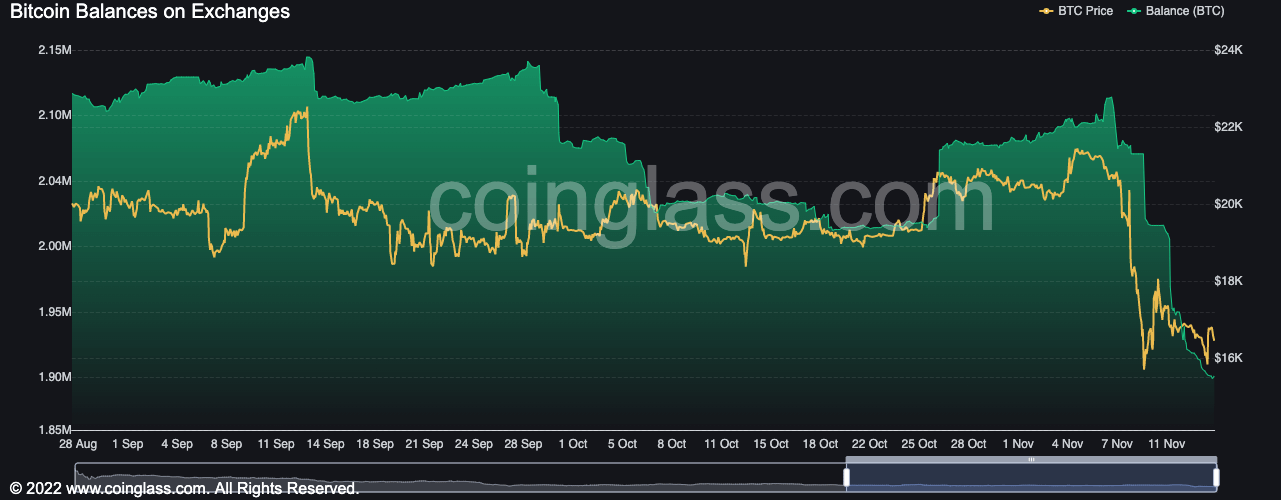

Centralized exchanges have seen large oscillations of their Bitcoin balances in September and October. These oscillations included jumps and drops starting from 10,000 BTC to 40,000 BTC, leaving large dents within the complete trade balances throughout the market.

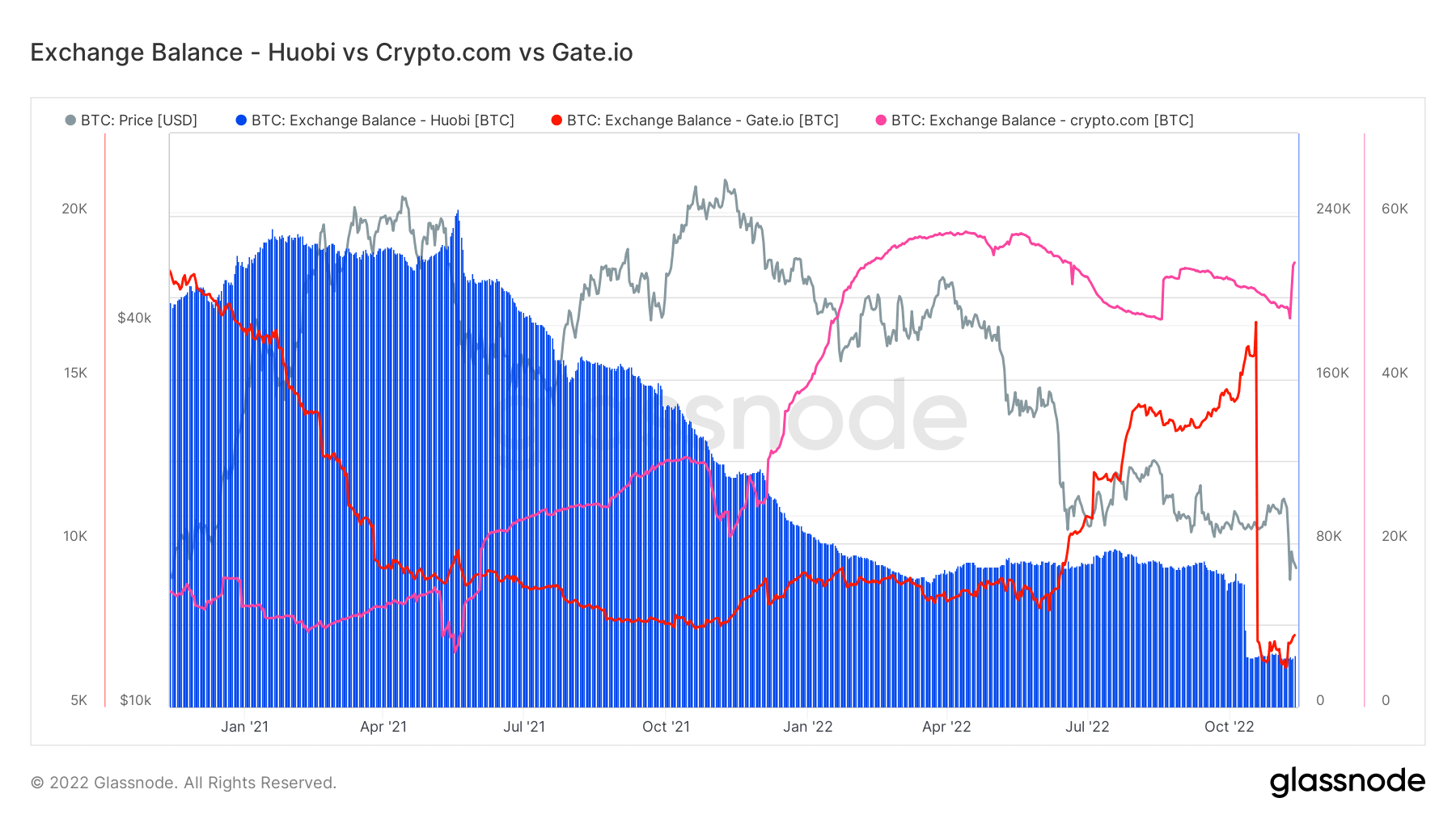

Whereas the sharp drop in Bitcoin balances we’ve seen previously week will be attributed to the FTX fallout, three exchanges stand out particularly — Huobi, Gate.io, and Crypto.com.

Trying on the Bitcoin balances on all three exchanges reveals fairly a bit of bizarre exercise within the month previous FTX’s downfall.

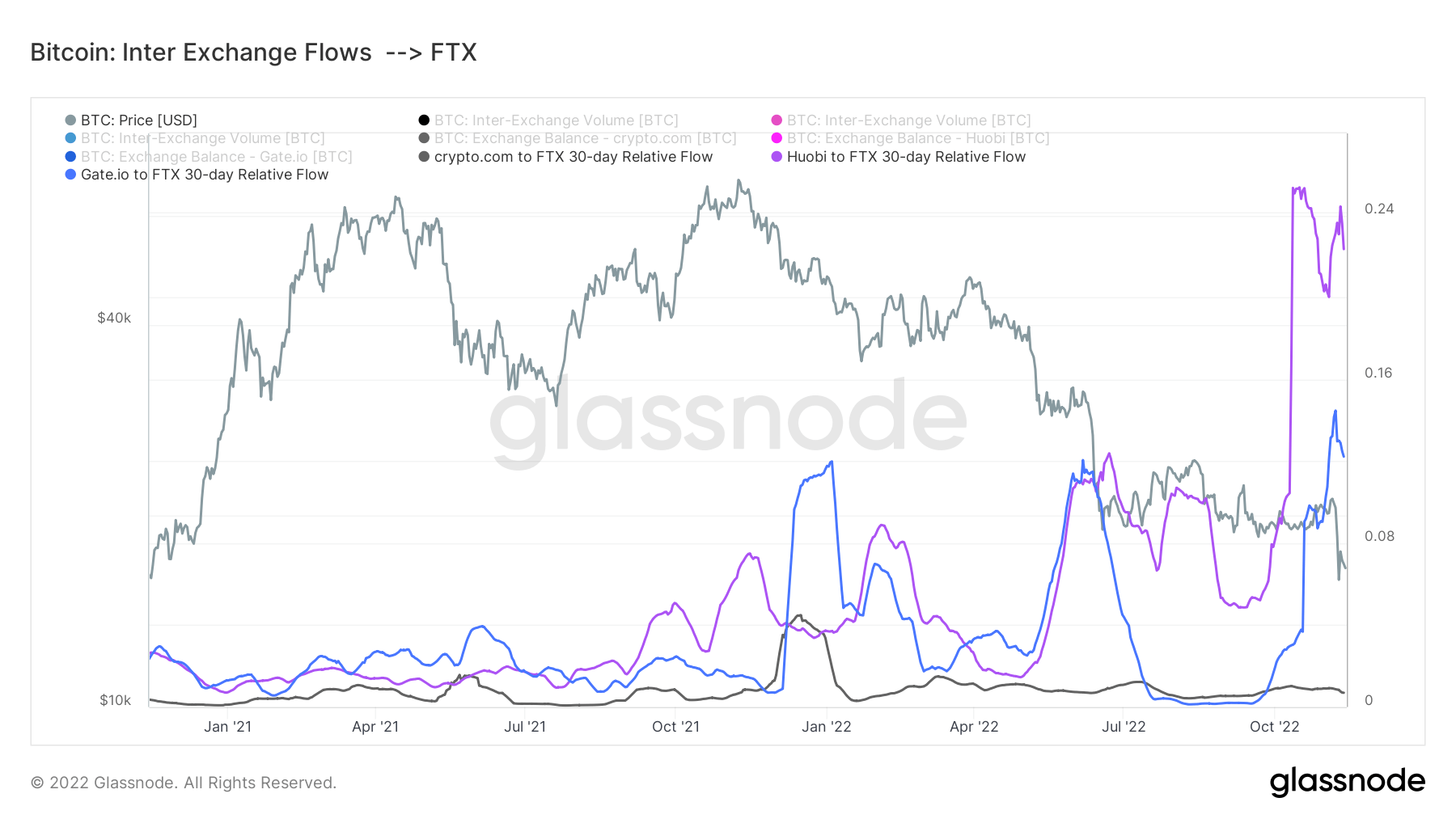

Alameda’s reckless buying and selling methods revealed final week prompted many to research whether or not the buying and selling firm used exchanges apart from FTX.

Knowledge analyzed by CryptoSlate confirmed sharp spikes in interexchange flows to FTX, with probably the most notable one being from Huobi. initially of October, Bitcoin flows from the trade to FTX tripled. Flows from Gate.io additionally noticed a vertical spike in October that continued into November.

Related spikes had been seen in January 2021 and initially of July 2022 — the previous following the drop from the ATH reached in November 2021, and the latter coinciding with the Luna collapse. The spikes seen final month dwarf earlier ones each in dimension and severity.