The fallout from FTX’s insolvency has already shaken the crypto business to its core. After a number of days of hypothesis in regards to the state of FTX’s stability sheet, the alternate yielded and admitted defeat, saying that it was in means of being acquired by Binance.

The stress that arose from hypothesis strained the market, which took a devastating hit as soon as the information was out. With nearly each token deep within the pink, many started evaluating the crash to the fallout we’ve seen in June after the Luna crash.

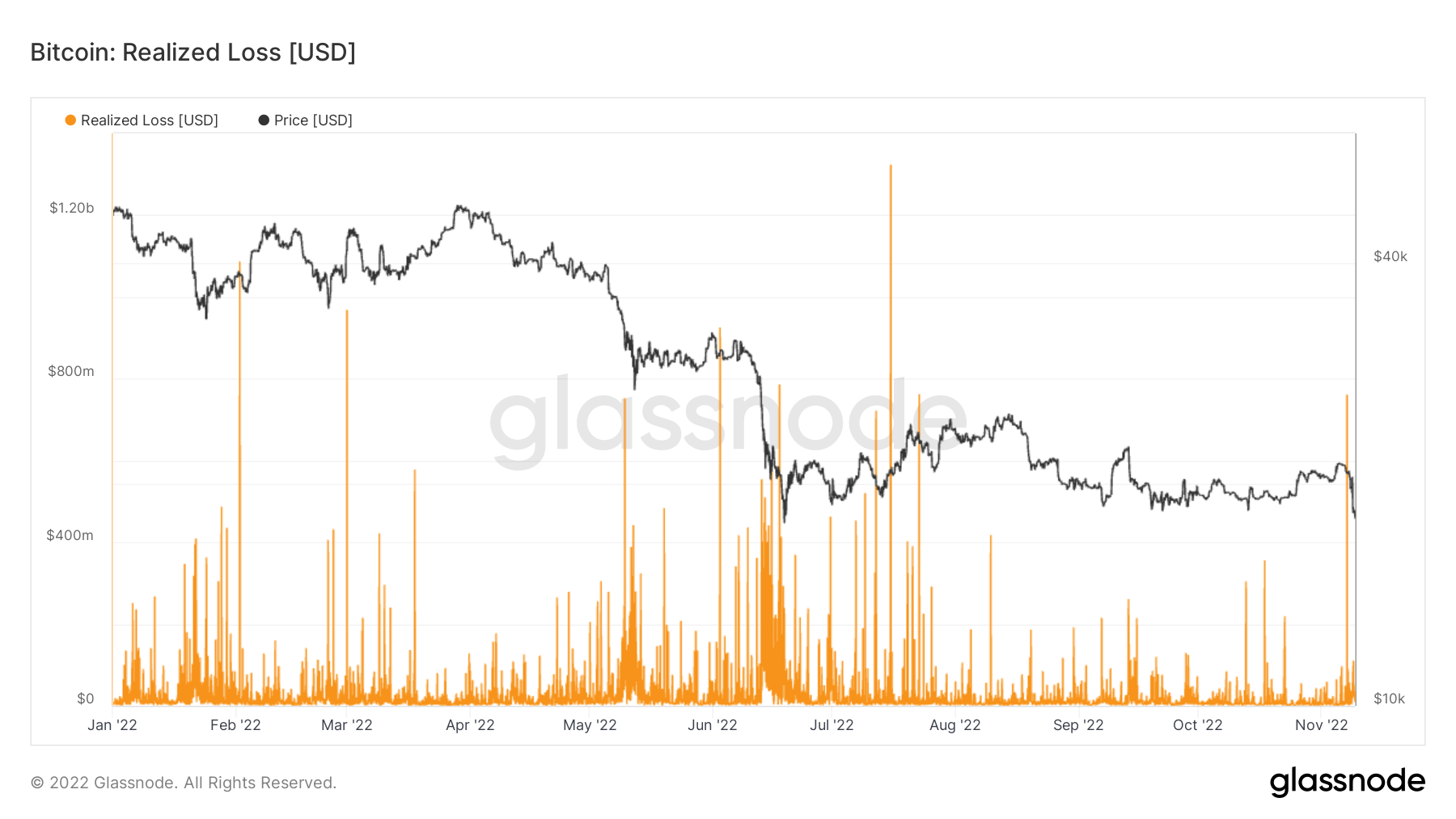

Nevertheless, the comparability tends to be fairly subjective. Knowledge analyzed by CryptoSlate confirmed that the losses from the Luna fallout dwarf the present market downturn brought on by FTX.

That isn’t to say that losses aren’t starting to mount up.

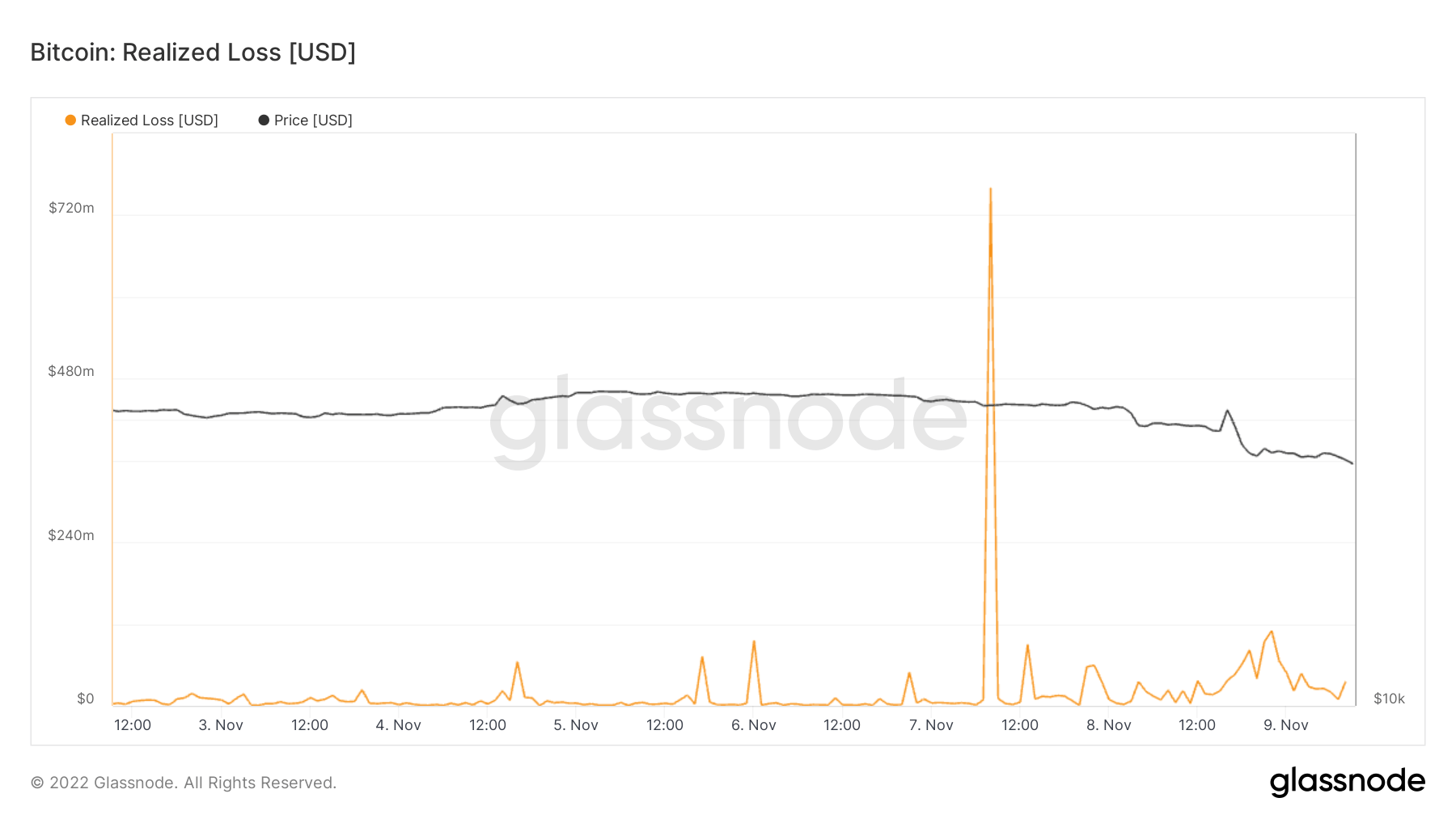

Realized loss is a metric used to indicate the full lack of all moved cash. The metric reveals the cash whose worth at their final motion was greater than the worth at their present motion. From Nov. 4 to Nov. 7, there have been a number of spikes of realized loss starting from $50 million to $100 million.

The spikes correlate to the rising pressure available in the market. As hypothesis surrounding FTX and Alameda’s liquidity started to rise, the market began gearing up for liquidations.

The three days of sporadic liquidations culminated on Nov. 7 when the market lastly capitulated. On Nov. 7 the market recorded $760 million in realized losses and noticed steady spikes of round $50 million till Nov. 9. As of Nov. 9, the full realized loss brought on by the FTX fallout stands at round $1.5 billion.

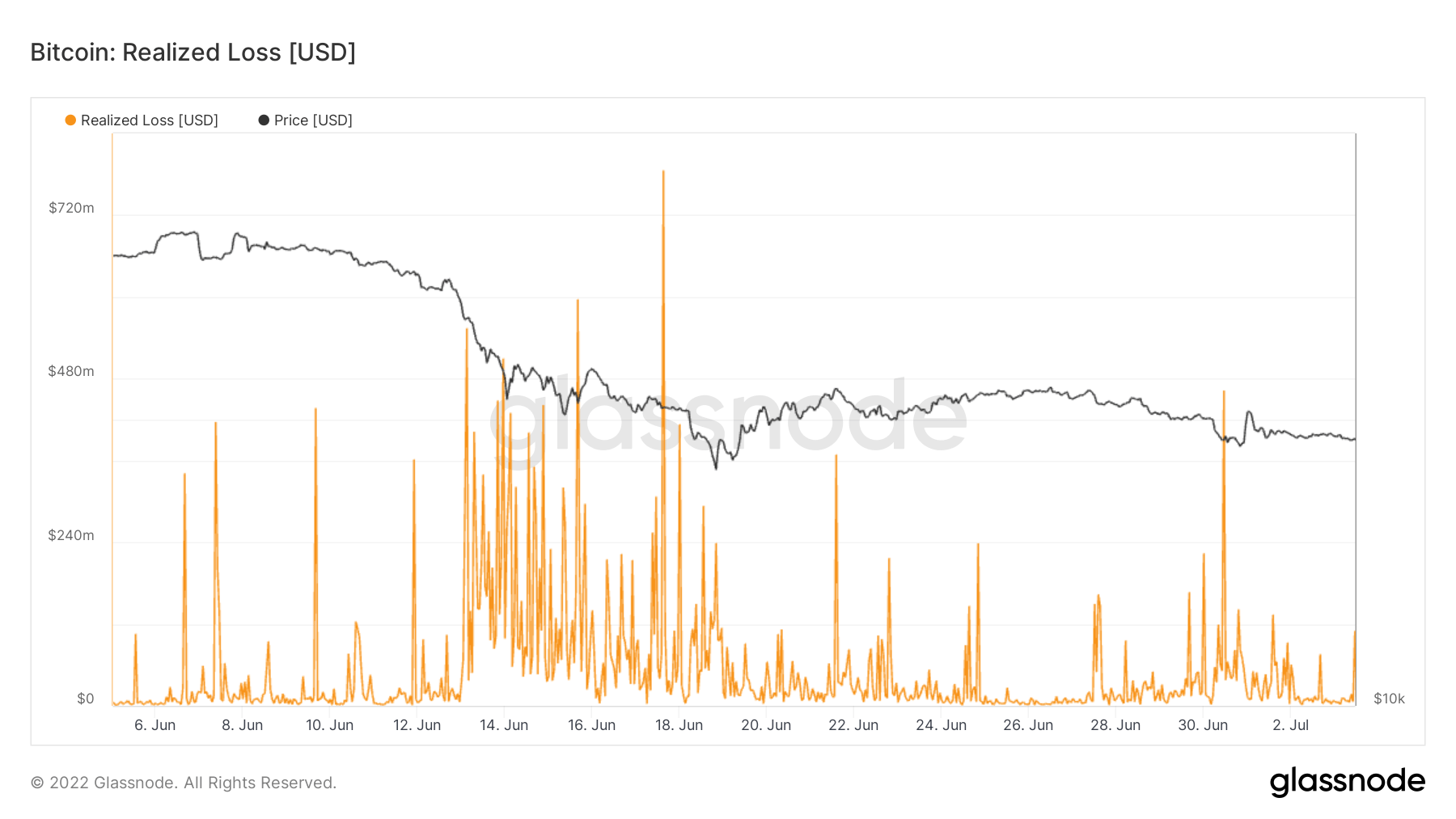

Trying on the realized loss following the Luna collapse in June reveals a way more unstable market. On the time, Bitcoin dropped to its two-year low of $17,600 and triggered a number of billion value of realized losses. These realized losses then prompted a ripple impact that led to the insolvencies of a number of the business’s greatest gamers, together with Celsius, BlockFi, Voyager, and Three Arrows Capital.

In June, the market noticed over a billion liquidations per day. Since Nov. 4, there was a complete of 500 million liquidations brought on by FTX’s collapse. Trying on the year-to-date chart for realized losses places the FTX fallout into perspective and highlights the severity of Luna’s collapse.

And whereas Luna’s collapse was each unprecedented and distinctive, the market continues to be within the early days of the FTX fallout. It would take weeks earlier than the true scope of the disaster is felt.