When markets flip purple and inflation begins hovering, each regulators and customers flip to CPI as a gauge for the harm performed by hovering costs however within the chaos that ensues as markets enter right into a recession, one metric all the time appears to be neglected — the M2 cash provide.

The M2 is a measure of the cash provide in an economic system that features money and checking deposits, financial savings deposits, cash market securities, and numerous different time deposits. The property included in M2 are much less liquid than M1, which incorporates simply money and checking deposits, however are normally liquid and will be shortly transformed to money.

Central banks use M2 to form financial coverage when inflation arises, making it one of the vital vital metrics when economies begin to decelerate.

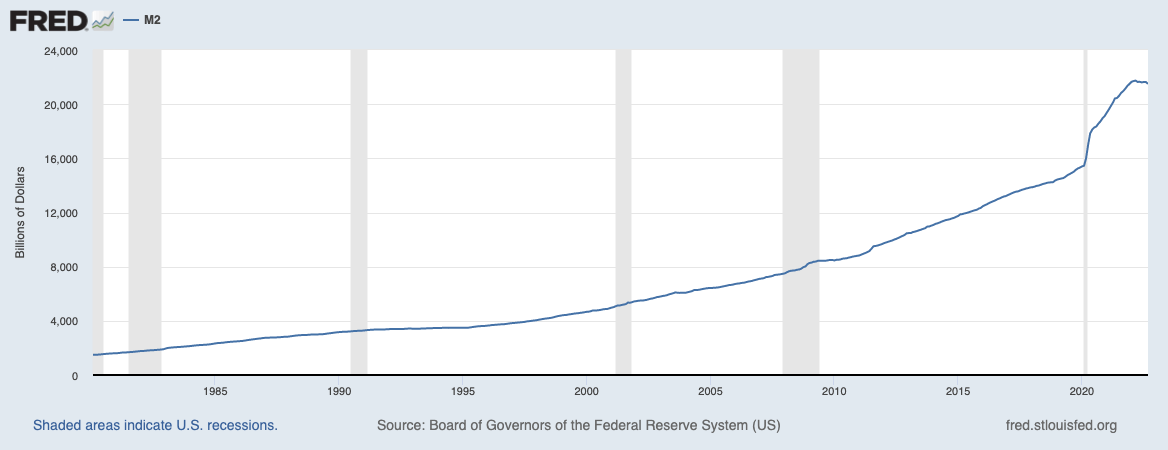

Trying on the information from the U.S. Federal Reserve reveals that M2 has been rising exponentially since 1980. Each time the Federal Reserve tried to cut back its stability sheet recession ensued. Durations of recession have traditionally sped up the expansion of M2, because the Fed’s quantitative easing method elevated the provision of cash within the economic system.

That is evident within the Fed’s information — grey areas on the graph under point out durations of recession and present the rise in M2.

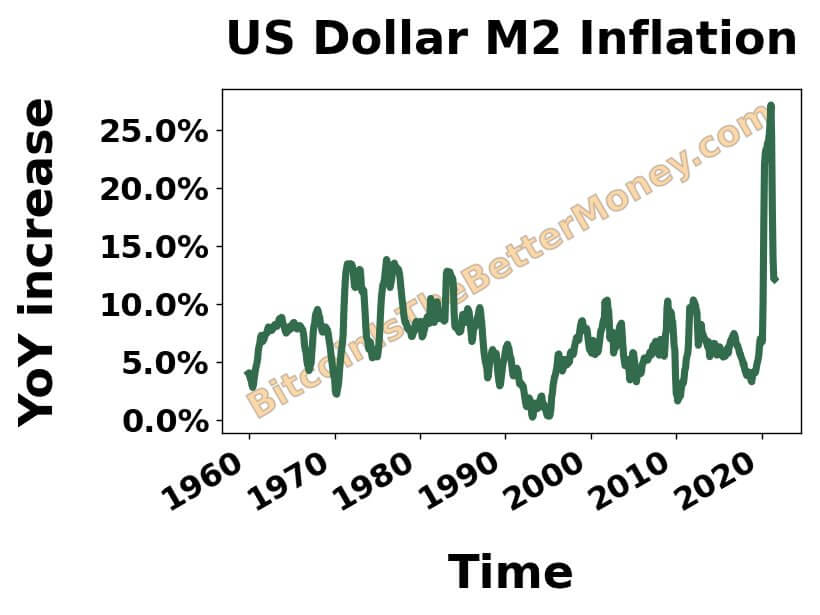

Many economists imagine that M2 is a a lot better gauge for inflation than CPI. The coveted shopper worth index tracks the common enhance throughout a basket of shopper merchandise and is used to estimate the common enhance in costs customers expertise.

Nonetheless, CPI presents common will increase and tends to indicate a a lot lower cost enhance than customers truly expertise.

The most recent numbers put the CPI enhance at round 8%. Nonetheless, customers have felt a worth enhance that far exceeds 8%. Trying on the enhance in M2 paints a way more practical image of worth will increase.

The year-over-year enhance in M2 at present stands at above 25% and feels extra in keeping with what customers expertise.

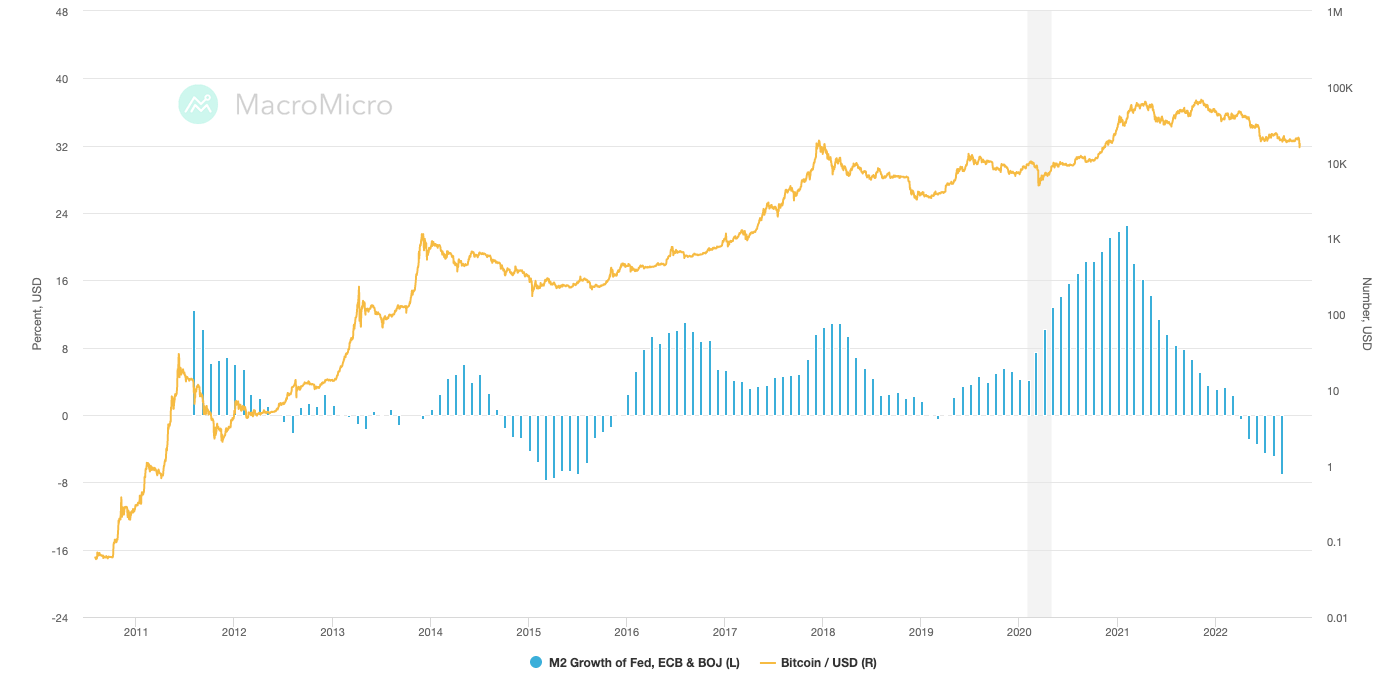

The rising M2 cash provide isn’t solely a gauge for inflation — it’s additionally a stable indicator of Bitcoin’s efficiency.

The worldwide M2 performs a key position in Bitcoin’s worth actions — when it shrinks, Bitcoin’s worth drops. When the M2 grows, Bitcoin’s worth grows as nicely.

Trying on the information for the Federal Reserve, the European Central Financial institution (ECB), and the Financial institution of Japan (BOJ) reveals the correlation between M2 and Bitcoin’s efficiency. Each time the worldwide M2 grew Bitcoin’s worth noticed a parabolic run that triggered a bull market. Each time it decreased, Bitcoin skilled a hunch that led to a bear market.

In 2015, 2019, and 2022 the Federal Reserve launched into an aggressive quantitative tightening spree. Every of these years Bitcoin’s worth hit a backside.

It’s nonetheless too early to foretell how Bitcoin will react on this cycle of quantitative tightening. The present M2 cash provide within the U.S. stands at round $21.5 trillion and is continuous to barely lower since peaking at $21.7 trillion in March this yr.

The dropping M2 correlates with Bitcoin’s worth hunch. If it continues the downward development Bitcoin’s worth might fail to recuperate and regain its yearly excessive. Nonetheless, for the present credit-based economic system within the U.S. to stay a credit-based economic system, the provision of U.S. {dollars} should proceed to rise. In the long term, the limitless cycle of printing cash may very well be good for Bitcoin.