A curated NFT market is one the place the entry to promote an merchandise is restricted. Solely creators which might be allowlisted (invited by an current member or accepted by the platform curator) can supply their objects there.

Whereas this helps construct a powerful group across the artists on the platform, it can also scale back its outreach to the general market. On this article, we are going to cowl the options of Basis and SuperRare and examine them with OpenSea, the chief amongst NFT marketplaces.

Basis

Basis is an NFT creators’ invite-only market. Launched in February 2021, Basis is likely one of the largest NFT marketplaces on the internet. The platform is known for having notable NFT auctions, corresponding to Edward Snowden’s first NFT and the Nyan Cat animation.

NFT creators should get an invitation code to have the ability to mint NFTs on the platform. The invitations can solely be despatched by members who’ve already bought not less than 1 NFT on the platform.

When an art work is bought on the first market, creators obtain 85% of the ultimate sale value. If an NFT is listed and picked up once more on the secondary market, a ten% royalty is robotically despatched to the creator who initially minted the art work.

Basis has 4 promoting choices:

- Purchase Now: This feature is a direct purchase, accepting the promoting value of the NFT you want.

- Gives: This permits the customer to ship a proposal direct to the creator.

- Reserve Auctions: A minimal value is ready, and when this situation is met, a 24-hour public sale begins.

- Personal Gross sales: A direct transaction between two customers.

Basis collects a 5% market price on all transactions, which means that creators get 95% of the full gross sales value when collectors buy their NFT(s). If it’s a secondary market sale, the vendor will get 85% of the full gross sales, as 5% goes to Basis, and 10% royalty goes to the creator.

SuperRare

SuperRare is an NFT market to gather and commerce distinctive, single-edition digital artworks. The artist must be allowlisted to have the ability to promote a group on the platform.

On major gross sales (the primary time an art work is bought, also referred to as a mint sale):

- The artist receives 85% of the sale quantity

- The SuperRare DAO Group Treasury will get 15% of the sale quantity.

On secondary gross sales (which is any sale following the first sale):

- The vendor receives 90% of the sale quantity

- The unique artist receives 10% of the sale quantity as a royalty

On all gross sales, a 3% market price is added to the sale value paid for by the customer—this goes to the SuperRare DAO Group Treasury.

The SuperRare DAO Group Treasury is answerable for establishing artist and developer grant applications and ad-hoc expenditure of treasury property as deemed essential to assist the continued progress and success of the SuperRare Community.

SuperRare Token ($RARE)

SuperRare launched a token ($RARE) to move the curation on the platform to the group (to SuperRare DAO). A part of the availability was airdropped to earlier customers who, along with the core workforce, at the moment are a part of the DAO that conducts the actions on the platform.

$RARE token holders collectively govern the SuperRare DAO – a decentralized group that can oversee key platform parameters, allocate funds from the Group Treasury, and effectuate proposals handed by group governance referring to enhancements to the community and protocol.

Apart from curation and partnerships, one other SuperRare DAO initiative is a Journal the place it shares extra details about collections and artists and offers information in regards to the NFT sector.

Metrics

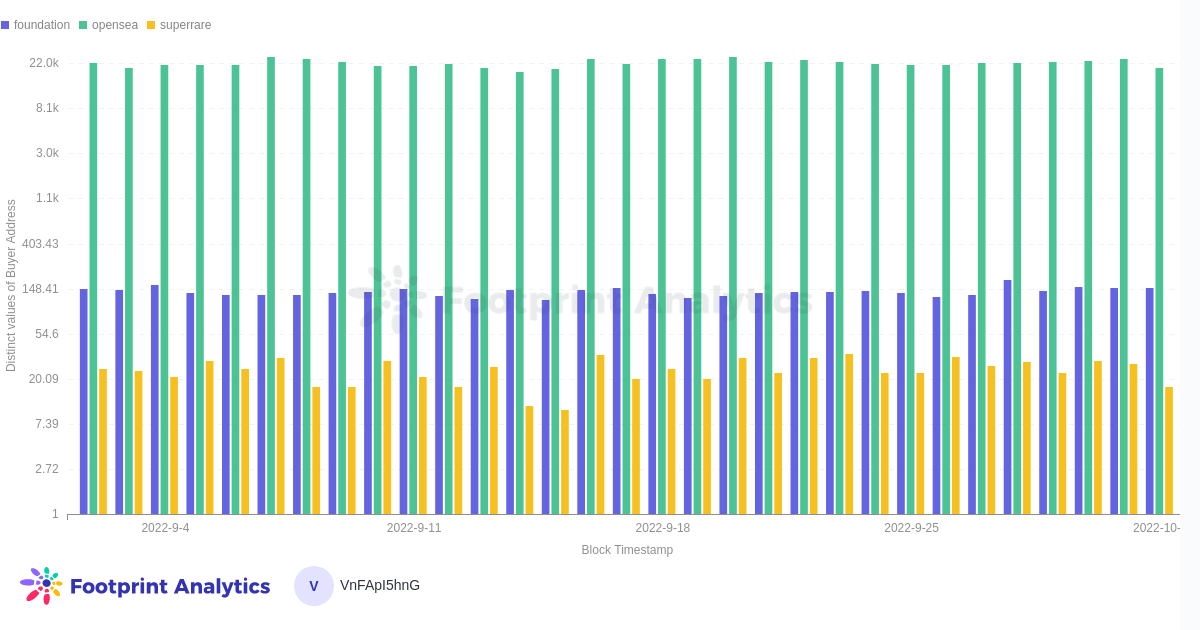

This part will current metrics of the curated NFT marketplaces and examine them towards a benchmark—OpenSea.

As they provide unique collections, the curated NFT marketplaces can cost the next price than open Marketplaces. SuperRare additionally offers a token used to handle the platform (curation, charges, treasury), giving the group an additional incentive to take part.

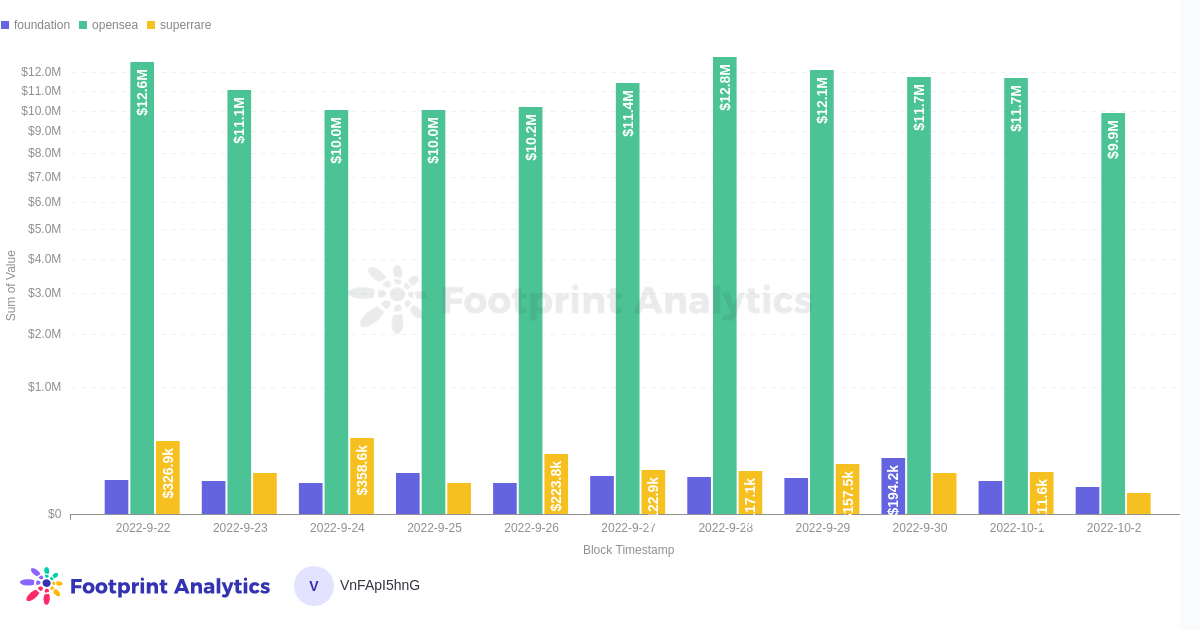

The choice to solely work with unique collections makes the every day buying and selling quantity of the curated NFT marketplaces decrease than the benchmark.

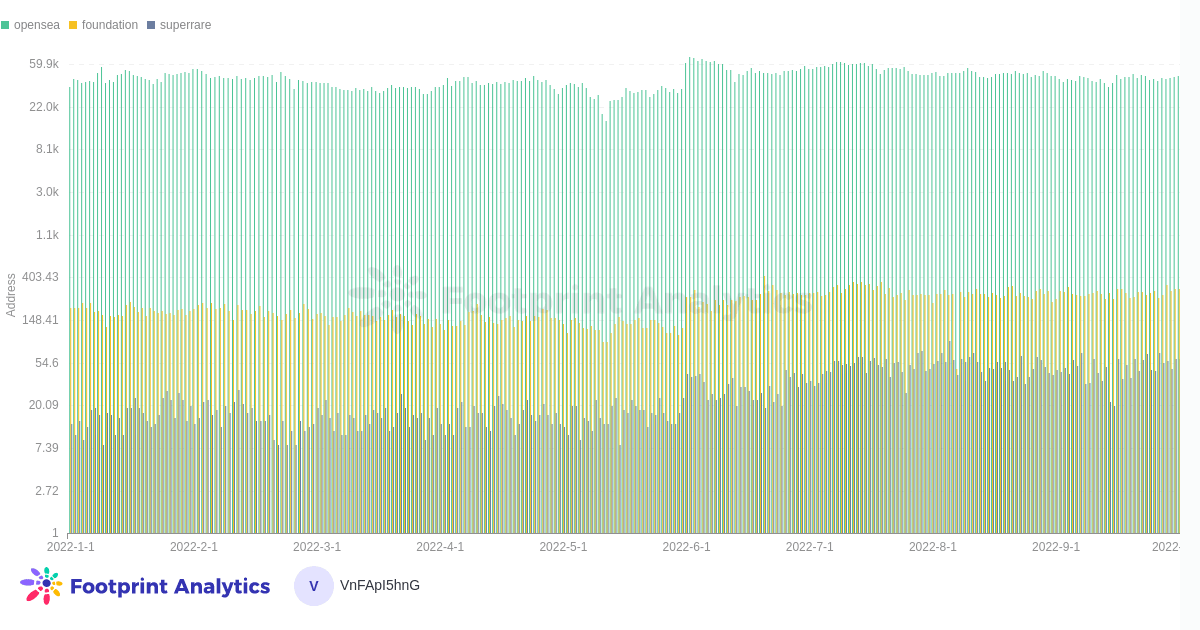

This distinction within the every day volumes is defined by the variety of customers, as OpenSea has no restrictions on collections being traded there.

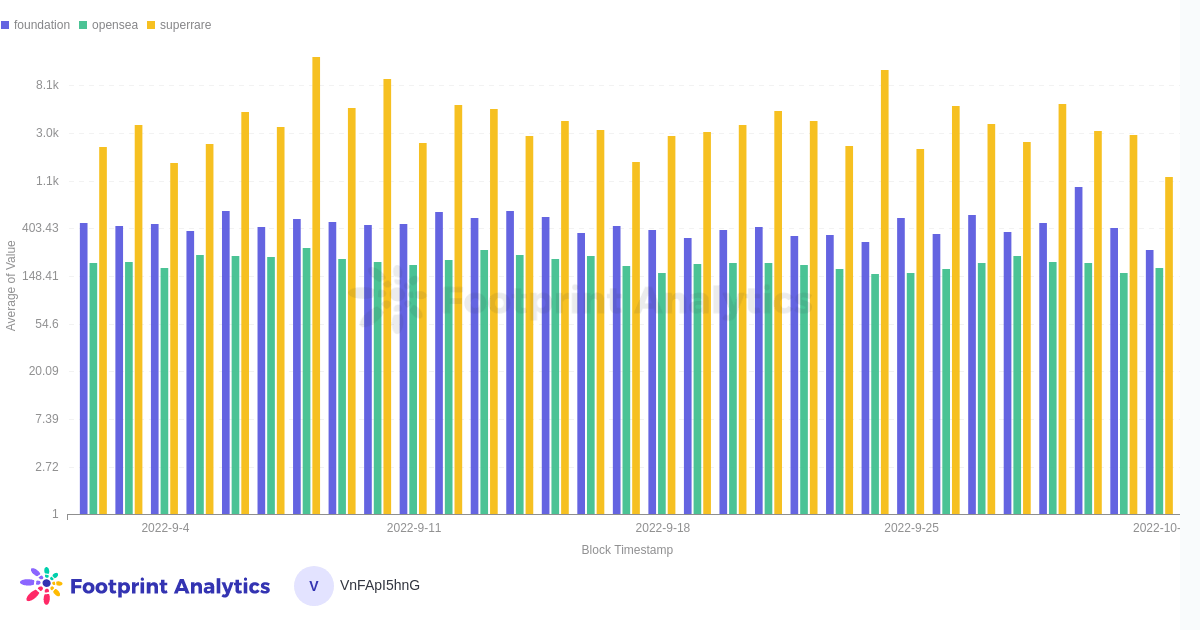

Nevertheless, because the collections are curated, the common sale value is greater on the chosen markets (Basis and SuperRare) than on the benchmark.

The common sale value is over $2,000 on SuperRare, $400 on Basis, and round $200 on OpenSea.

October 2022, Thiago Freitas

Information Supply: Footprint Analytics – Curated NFT MarketPlaces Overview

Major Takeaways

Curated NFT marketplaces established themselves in a distinct segment the place their group drives the adoption of the collections. Due to their worth proposition, they’ll shut partnerships with different firms, growing the collections’ uniqueness. As well as, SuperRare provides an additional incentive with their token ($RARE) used for governance (treasury administration and curation on the platform).

This piece is contributed by Footprint Analytics group.

The Footprint Group is a spot the place knowledge and crypto fans worldwide assist one another perceive and acquire insights about Web3, the metaverse, DeFi, GameFi, or another space of the fledgling world of blockchain. Right here you’ll discover lively, various voices supporting one another and driving the group ahead.

Footprint Web site: https://www.footprint.community

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data