DappRadar‘s newest report revealed that the Metaverse’s progress is pushed by demand regardless of the present situations of the bear market.

The report took the information on land gross sales and buying and selling volumes from the third quarter of 2022. Though the numbers nonetheless decreased, it was minor in comparison with the general crypto market. The report concluded that demand for Metaverse-related initiatives remains to be excessive sufficient to drive its progress.

Digital worlds

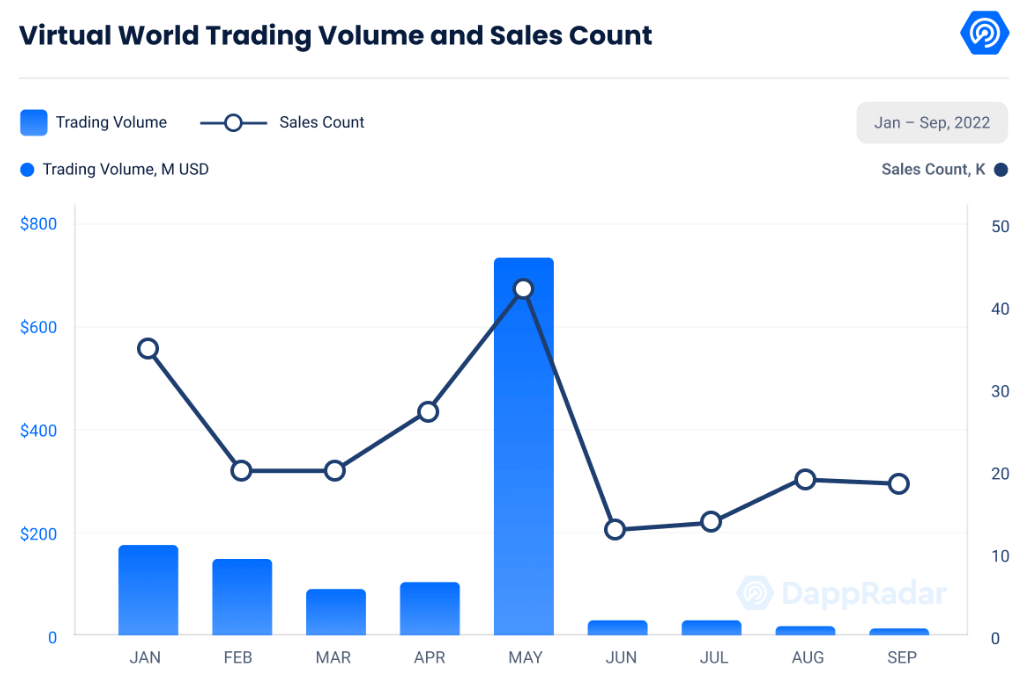

The numbers present that the buying and selling quantity of all digital worlds decreased by 91.61% within the third quarter of 2022, falling from $893 million to round $83 million. The report famous that the excessive buying and selling quantity of the second quarter is generally the results of the hype revolving across the Otherside Land sale.

Within the meantime, the variety of land transactions for all digital worlds was round 52,224 within the second quarter. This quantity declined by 37.54% to achieve round 32,620 within the third quarter. The report argues that that is an indicator of a robust curiosity in Metaverse.

The report states:

“The variety of land transactions declined by 37.54% from the earlier quarter to 52,224, indicating that the thrill surrounding some of these initiatives has not subsided however is approaching a consolidation interval.”

Prime Metaverses

The report additionally examines the buying and selling volumes of the highest 10 metaverse initiatives to disclose that their buying and selling quantity decreased by round 80% in comparison with the second quarter. Nevertheless, their gross sales quantity appeared to lower by solely 11% on common, which supported the argument that the demand for metaverse continues sturdy.

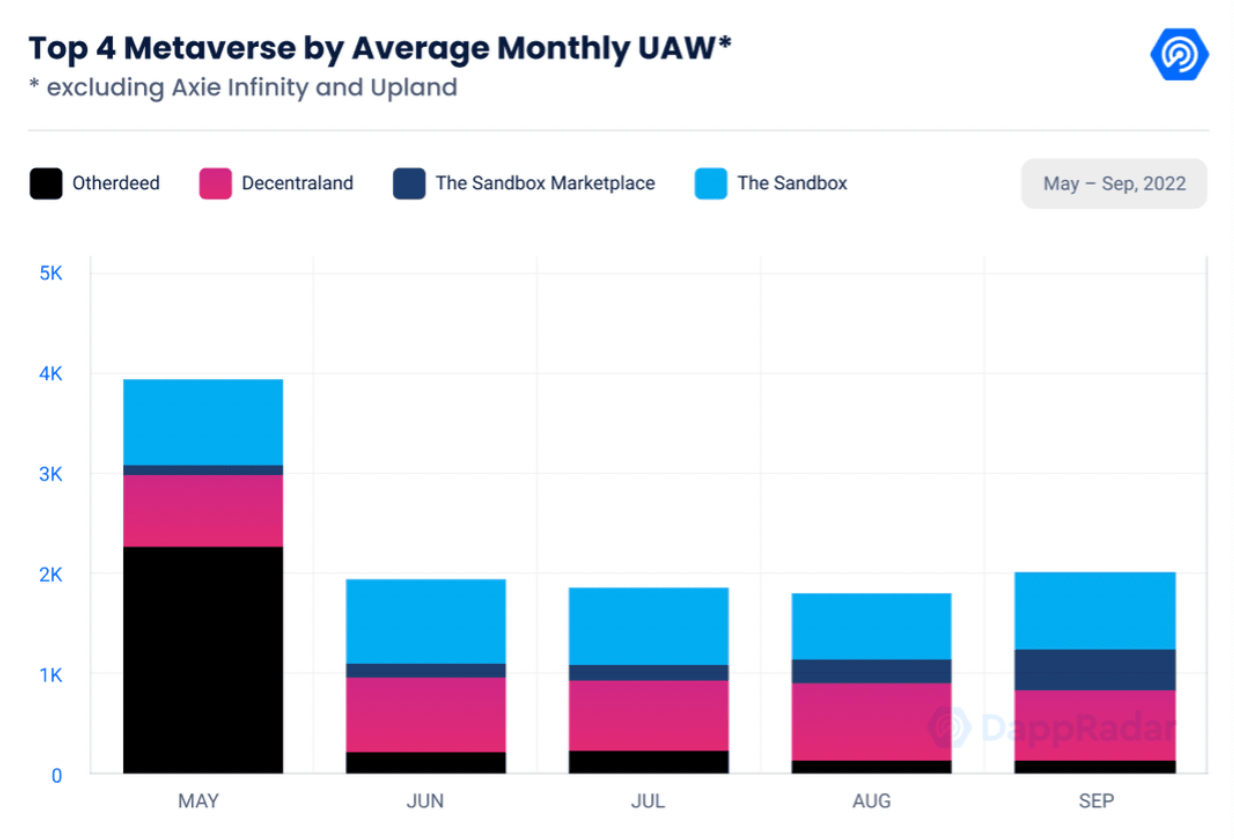

The report additionally decided the highest 4 metaverse initiatives, judging by the variety of Distinctive Energetic Wallets (UAW) on their platform. Excluding Axie Infinity and Upland, the highest 4 emerged are Otherdeed, Decentraland (MANA), The Sandbox Market, and the Sandbox (SAND).

The chart above demonstrates the variety of UAW of the highest 4 metaverse initiatives. Primarily based on the numbers, Otherdeed got here out as the most well-liked metaverse in Might, whereas The Sandbox and Decentraland managed to stay amongst the highest three.

The Sandbox maintained its common of 750 day by day UAWs since Might, whereas the exercise within the Sandbox Market has been growing since. The UAW’s on the Sandbox Market recorded an uptick of 348% to achieve 395 in September.

Equally, Decentraland additionally remained on the similar variety of common UAWs as 792. Nevertheless, Decentraland additionally hosted a sequence of occasions in September, which attracted round 56,000 day by day lively customers (DAU) to the platform. This quantity marked a 6% enhance in comparison with the DAU numbers of August.

Demand for ENS domains and investments

Different highlights from the report point out that the demand for ENS domains, investments in constructing within the metaverse, and mass model adoption additionally elevated.

All through September, a complete of 437,365 customers registered with new ‘.eth’ domains, which recorded an all-time excessive. The earlier ATH was recorded as 378,805 in July, which signifies a rise of over 13%.

Throughout the third quarter of 2022, blockchain video games and metaverse initiatives acquired a complete of $1.2 billion in funding. Blockchain video games and metaverse acquired probably the most funding with $462 million, which compensated for the 38.5% of the full quantity.

Metaverse infrastructure investments got here as a detailed second, accumulating $402 million, which is 33.5% of the full quantity.