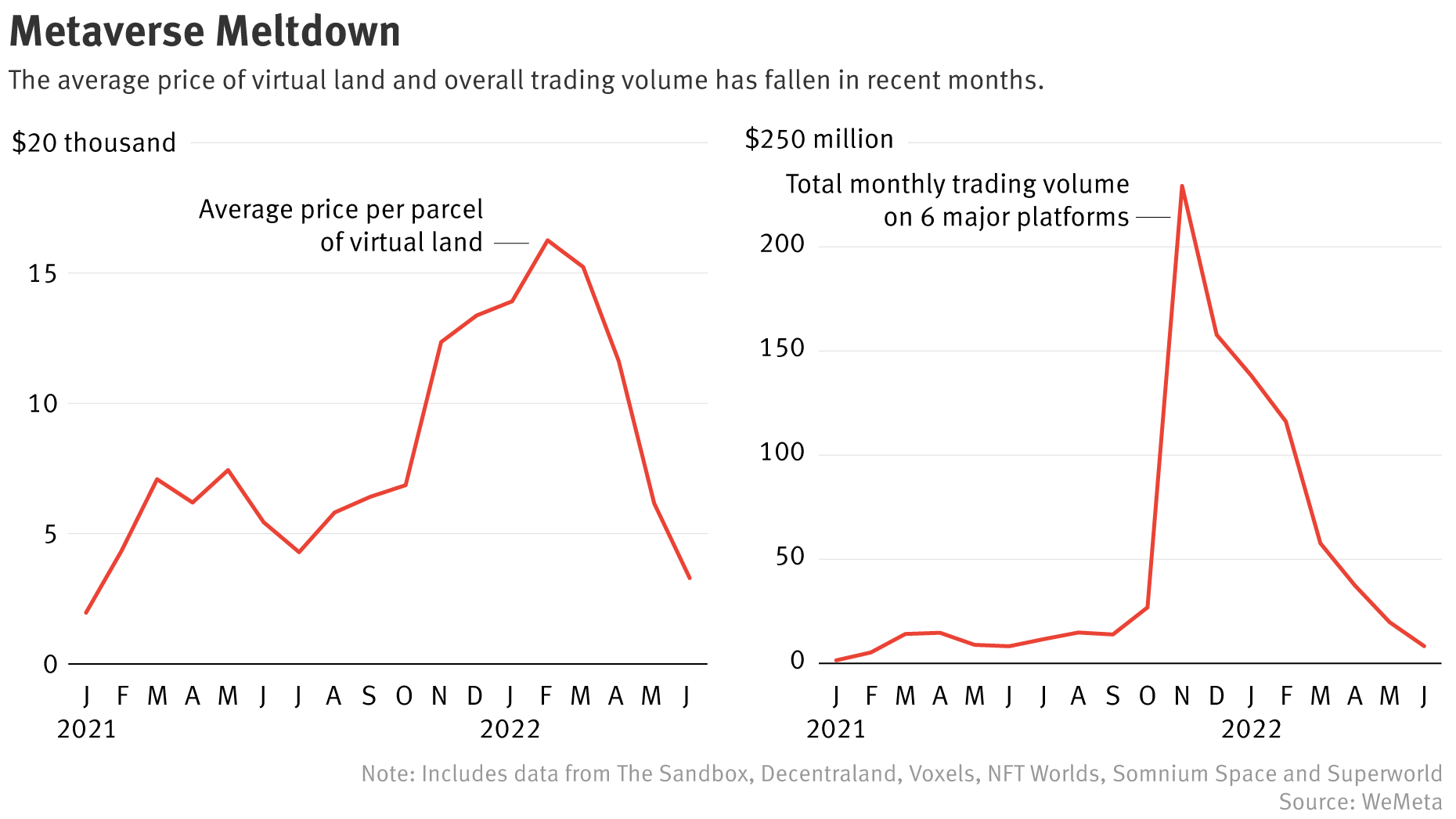

The average price and trading volume of virtual land in the Metaverse have collapsed amid the wider downturn in cryptocurrency markets, according to an analysis conducted by the Information.

Average virtual land prices have fallen by more than 80%. At the same time, trading volume is down by more than 90% from November 2021 highs.

The information was sourced from WeMeta and compiled from data on the Sandbox, Decentraland, Voxels, NFTs Worlds, Somnium Space, and Superworld platforms.

The Metaverse bust

Metaverse virtual land was touted as the next big thing not that long ago. Spiking interest had triggered a rush to acquire prime spots – mirroring the real-life real estate market.

For example, as recently as February, one investor paid $450,000 for a virtual plot next door to Snoop Dogg in the Snoopverse, which runs on the Sandbox platform.

This push largely came off the back of Facebook rebranding as Meta, in November 2021. Meta CEO Mark Zuckerberg called the Metaverse the next frontier in connecting people. Specifically, he envisioned virtual worlds as fundamentally changing the way society works. Including revolutionary concepts, such as Metaverse businesses providing employment.

But, fast forward to now and deep into crypto winter, buyers who entered at the top are nursing heavy losses as average prices and interest have plummeted.

Virtual reflecting the macro

The crash has re-opened the debate on whether virtual land is a bonafide investable asset. As mentioned by Fortune, the Metaverse incorporates instant teleportation to any location. That being so, unlike the real world, there is little advantage to buying in a prime location.

In addition, land in the Metaverse can be infinite, putting paid to the idea of virtual land as a scarce resource.

However, Metaverse land co-operative Airdott attributed the downturn to the wider macroeconomic landscape, saying, “why wouldn’t” the real world impact the virtual world? They added that they are “patiently waiting” for things to bounce back.

Planning is everything.

Why wouldn’t macro effect the liquidity in the Virtual land market the same way it does other markets?

Opportunity is not too far away in our opinions and we are patiently waiting.

Pinched this chart from @MacroAlf. 🙏#Airdott #Metaverse #NFTs pic.twitter.com/Ok7YU1dtAn

— Airdott (@airdottdao) August 8, 2022

Over the past two years, property prices have run red hot due to buyers’ demand. But, some real estate experts now say the boom is over due to the squeeze on household budgets from rising inflation and the threat of central banks continuing to increase rates.

A recent article from the Guardian pointed out that China is experiencing plunging new property sales. At the same time, the U.S market has seen the average price of homes drop sharply in June.