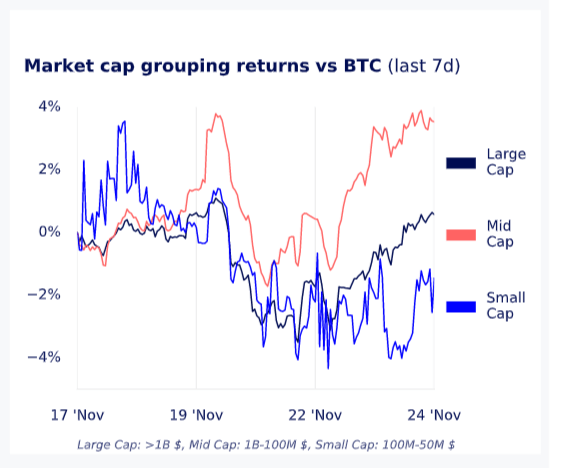

Over the previous seven days, mid-cap altcoins have outperformed large-cap and small-cap tokens by some margin in comparison with Bitcoin.

Because of this, Bitcoin’s dominance has fallen to 40% from a excessive of 45% on Nov. 17.

Tasks with a market cap above $1 billion are thought of large-cap, whereas mid-caps are these with a market cap between $100 million and $1 billion. Small-caps are tasks under $100 million however above $50 million.

The Glassnode graph under charts the expansion of the above market cap groupings towards Bitcoin. Mid-caps have gained virtually 4% towards Bitcoin, whereas large-caps have remained impartial, and small-caps misplaced round 2%.

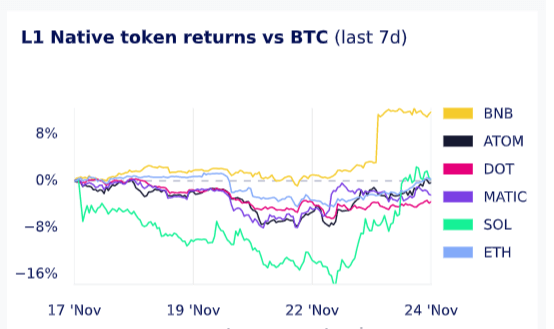

With a market cap of almost $50 billion, BNB Chain is taken into account a large-cap token. Amongst a fairly impartial return for L1s over the previous seven days, BNB has dramatically outperformed the market in comparison with Bitcoin. BNB posted roughly 14% features on Bitcoin following a surge in value on Nov. 22.

Since Oct. 23, BNB has been up 31% towards Bitcoin and 12% when denominated in USD. Additional, BNB’s market dominance hit an all-time excessive on Nov. 23 because it made up over 6% of the overall market cap of the crypto business.