Solana Basis‘s Product and Know-how Chief, Matt Sorg, talked to CryptoSlate’s Akiba about Solana and its future within the crypto sphere.

Akiba began by asking what attracted Sorg to Solana. As a response, Sorg mentioned that he believed Solana to be much more totally different than different protocols when it comes to expertise, scalability, and future potential. He mentioned:

“Solana is differentiated expertise, there may be a whole lot of noise within the house about how issues l scale sooner or later however Solana is prepared as we speak and has a really clear path in scaling very arbitrarily sooner or later in a really user-friendly method.”

He additionally defined why Solana is among the prime protocols Web3 players favor. “Players have very high-performance necessities for his or her apps,” Sorg added that Solana stands out for them by having one of the best occasions in transaction affirmation.

Solana breakdowns

When Akiba requested why Solana had been breaking down a lot, Sorg defined why by giving two causes.

Initially, in accordance with Sorg, Solana doesn’t primarily have advertising considerations in thoughts. He said:

“We aren’t entrepreneurs. We name sure issues outages, whereas different chains would name them congestion.”

He additional defined that Solana nonetheless facilitated a number of hundred transactions per second in its downtimes. Sorg mentioned that is nonetheless far more than what many chains facilitate at their greatest states. Nonetheless, such a scenario could be recognized as congestion by the requirements of different chains, “however by Solana requirements,” Sorg mentioned, “it’s an outage.”

Secondly, Sorg talked about that the outages end result from its decentralized infrastructure. Though, every so often, “totally different programs can’t agree on what the subsequent block ought to be,” Sorg mentioned, “they halt as a result of they’ll’t propagate blocks.”

The way forward for blockchain and Solana

When discussing the potential for a multi-chain future, Sorg spoke concerning the significance of consolidation and shared safety. He mentioned:

“We’re going to have totally different applied sciences that’ll optimize another way. I believe there’ll be some consolidation the place totally different chains and totally different protocols will take some studying from different protocols,”

With that being mentioned, Sorg additionally acknowledged that the safety weaknesses of bridges ought to be addressed. He outlined the problem as a “laborious drawback.” It’s all about having totally different networks and counting on one chain to tie them up, which may be solved by correct “chain-level consensus and settlement.”

Concerning Solana’s place on this multi-chain future, Sorg mentioned it will likely be “much more configurable over time.” He additional added:

“Its laborious to comprehend how a lot innovation is going on inside solana when wanting from outdoors. Right this moment, the solana protocol is far more secure than January this yr. Arbitrary scling can be seen over the 12-18 months, as demand will increase, additionally extra configuration choices are popping out.”

Solana and the FTX crash

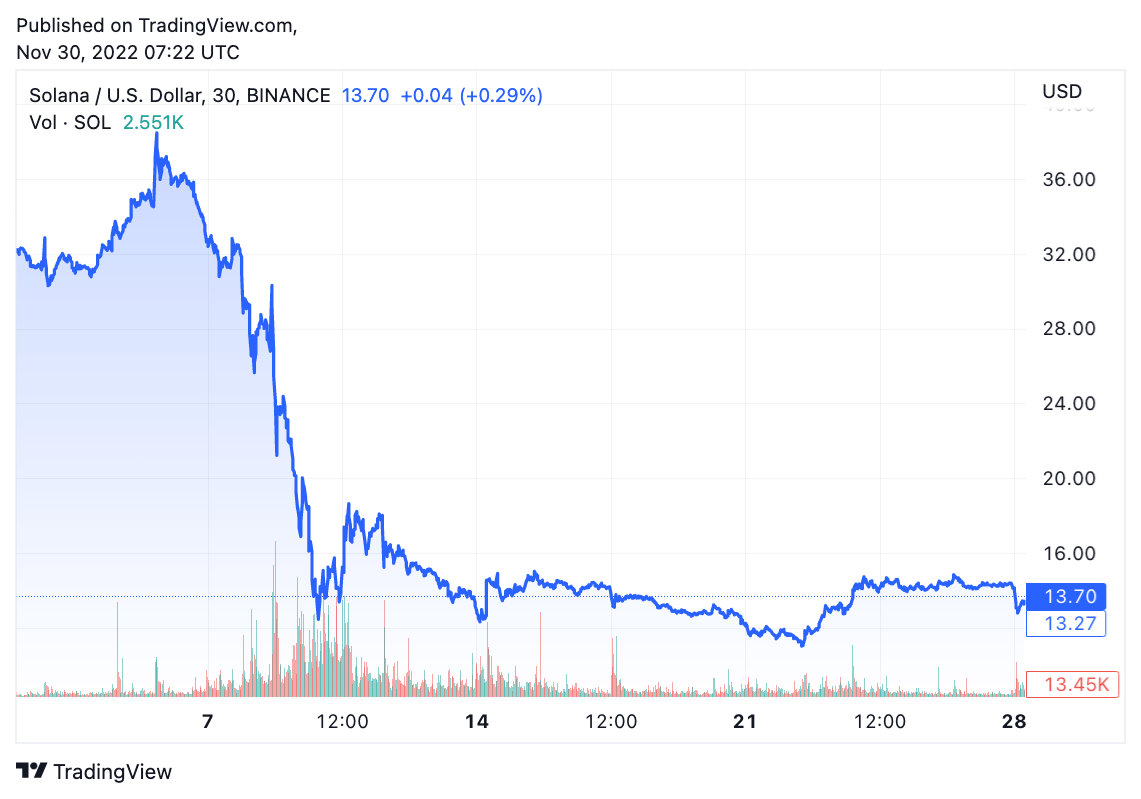

Solana token (SOL) was one of many main ones affected by the FTX crash. A couple of days after the alternate began having troubles, SOL fell by 67.7%, going from as a lot as $38.49 to as little as $12.40. It’s being traded for $13.70 on the time of writing.

The autumn resulted from Solana’s ties to the FTX. FTX’s enterprise capital aspect had a number of Solana-based tasks, which led the buyers to understand the protocol as part of FTX.

Nonetheless, Solana Basis responded to the group’s congestion considerations by stating they’ve minimal publicity to FTX. In a weblog publish printed on Nov. 14, the muse revealed that it held sure belongings value round $190 million earlier than the alternate collapsed, however their worth fell under $35 million after the crash.