November 2022 was one of many worst months for the 2 hottest cryptocurrencies — Bitcoin (BTC) and Ethereum (ETH).

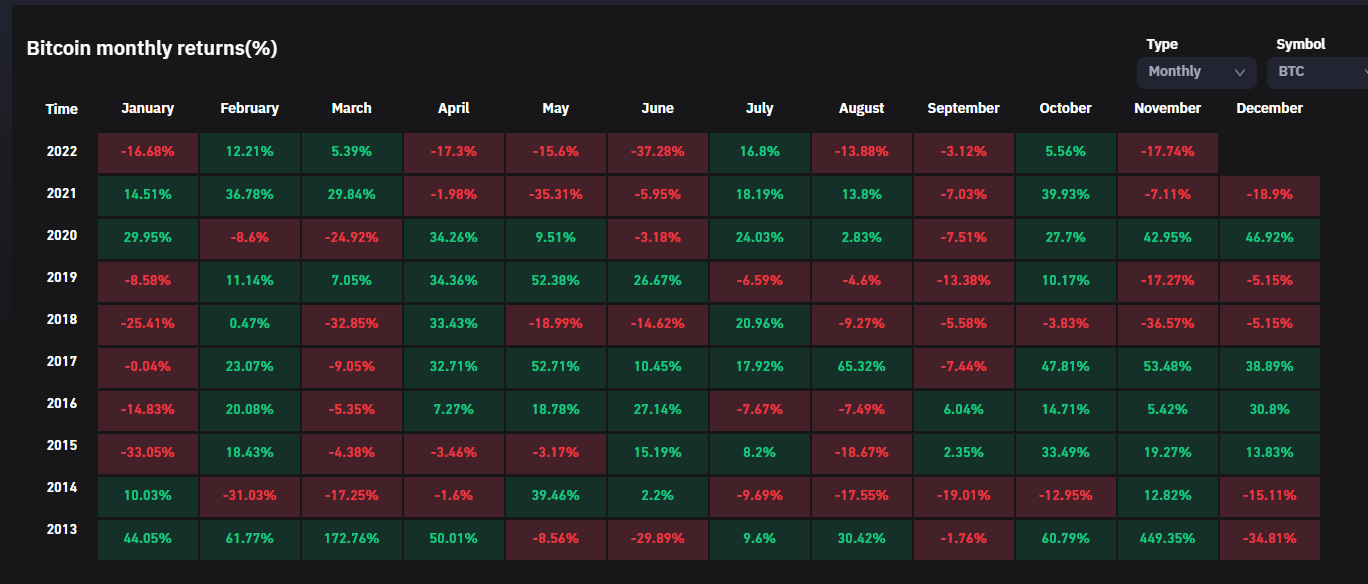

November was Bitcoin’s second worse month in 2022

Based on CryptoSlate information, Bitcoin misplaced roughly 18% of its worth prior to now 30 days — making November the second-worst month for the 12 months and its largest month-to-month loss within the final 5 months.

Whereas Bitcoin’s worth barely recovered in direction of the top of the month, FTX’s capitulation shattered retail merchants’ belief within the system. Glassnode reported that crypto buyers witnessed the fourth largest capitulation on file with a 7-day realized lack of $10.16 billion

Over 50% of BTC holders are in loss after the asset’s worth dropped to round $15,600 — the bottom profitability stage since March 2020.

Moreover, Bitcoin miners worn out their 2022 balances as the quantity of the asset offered surpassed the quantity they collected in the course of the 12 months. Miners are underneath growing promote strain because the flagship digital asset’s worth struggled under the $16,000 mark.

Bitcoin miners like Iris Vitality defaulted on a $108 million debt and ceased operations at two of its services in November. An unnamed Bitcoin miner additionally defaulted on lease in Dallas and left all of its gear behind.

#Bitcoin Shrimps (< 1$BTC) have added 96.2k $BTC to their holdings since FTX collapsed, an all-time excessive stability improve.

This cohort now now maintain over 1.21M $BTC, equal to six.3% of the circulating provide.

Professional Dashboard: https://t.co/HpXwoav6wO pic.twitter.com/7U4oPAAakD

— glassnode (@glassnode) November 28, 2022

In the meantime, regardless of all of those losses and capitulation, Glassnode reported that BTC Shrimps and Crabs have aggressively collected since FTX collapsed, resulting in an all-time excessive stability.

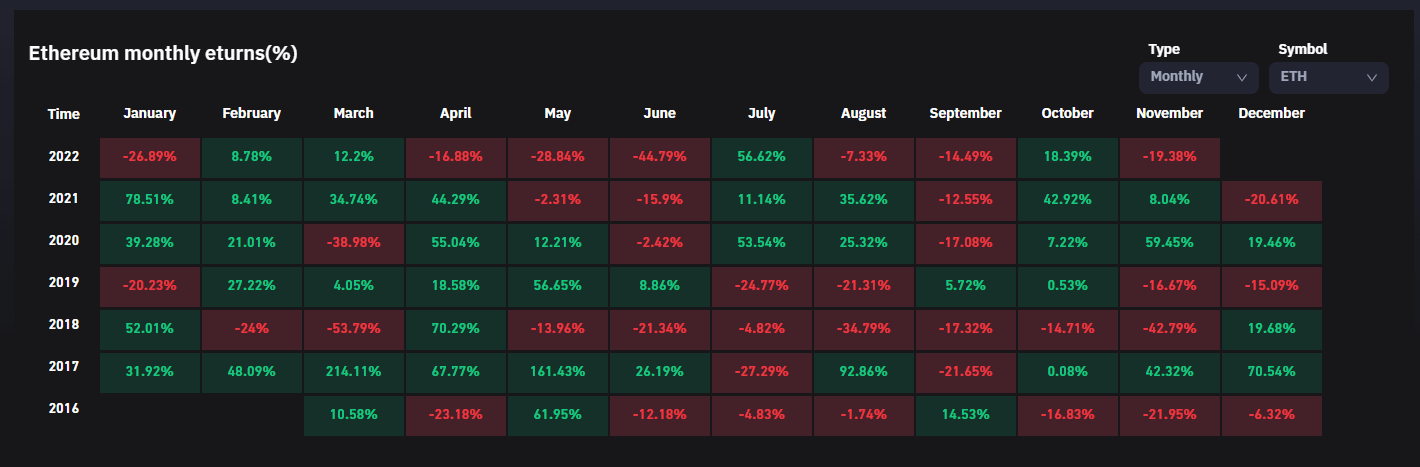

Ethereum experiences its fourth-worst month

In the meantime, November was the fourth worst month of the 12 months for Ethereum because it fell virtually 20%.

Following the collapse of FTX, ETH’s worth fell to as little as $1,110 on Nov. 10 from over $1,600. The cryptocurrency has recovered barely since to over $1,200. As of press time, ETH was down 18% over the previous 30 days.

The poor value efficiency seems to have spurred Ethereum whales and shrimps to build up. CryptoSlate’s evaluation of Glassnode information reveals that buyers in these cohorts have been accumulating Ethereum at an aggressive price.

Regardless of the late rally in direction of the top of the month, crypto analysts’ disposition in direction of the asset stays bearish. Standard crypto dealer Capo of Crypto tweeted on Nov. 28 that he expects a capitulation that might ship ETH value to round $600 to $700 quickly.

I’ve spent a whole lot of hours analyzing the market to come back to the conclusion that:

Capitulation is a matter of time. $BTC ought to attain 12ks, $ETH 600-700, altcoins ought to drop 40-50% and shitcoins 50%+.

I will not put up any extra right here till affirmation or invalidation.

Good luck!

— il Capo Of Crypto (@CryptoCapo_) November 28, 2022

In the meantime, this isn’t the primary time Bitcoin and ETH have had a foul November. In actual fact, the month has been a tough one for BTC traditionally. In 2018, BTC misplaced 37% of its worth in November.