Current on-chain metrics counsel {that a} Bitcoin (BTC) backside is perhaps forming, however the possibilities of the flagship asset dropping beneath its lowest worth are growing attributable to weak quantity.

As a consequence of present macroeconomic circumstances, amongst different causes, BTC has seen its worth drop beneath $20,000 on a number of events previously few weeks, forcing analysts to concern warnings about the potential for the asset buying and selling beneath $17,500.

New information analyzed by CryptoSlate reveals that if BTC had been to breach beneath the $17,500 degree, it might plummet to as little as $12,000 as its quantity round that time is weak.

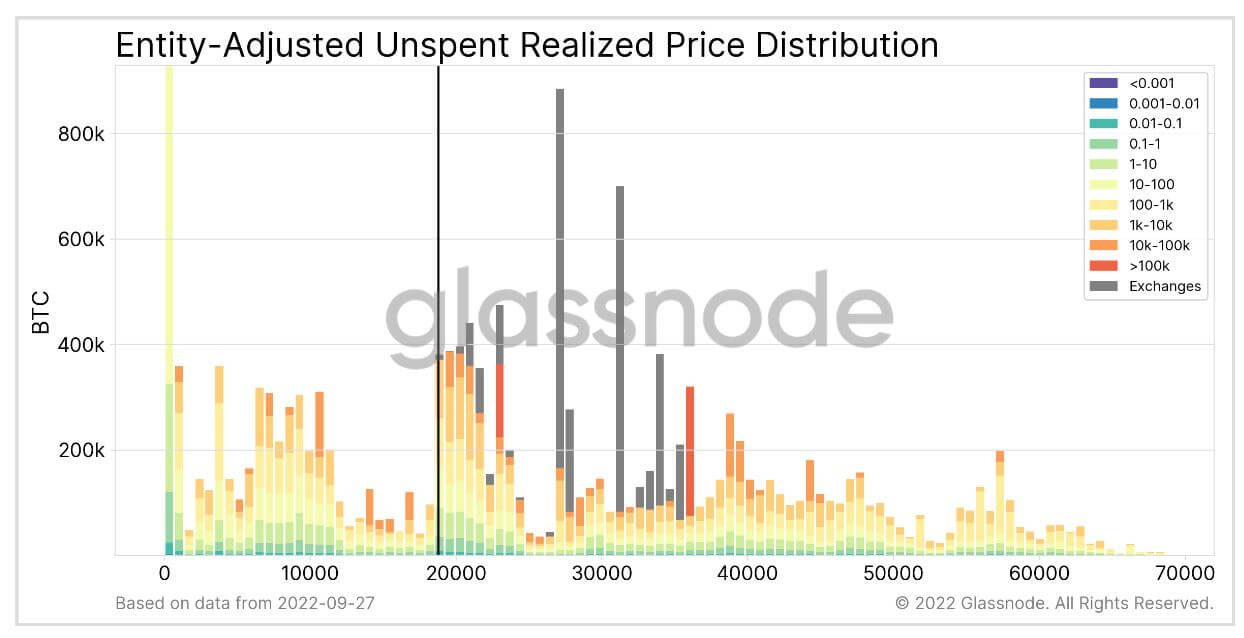

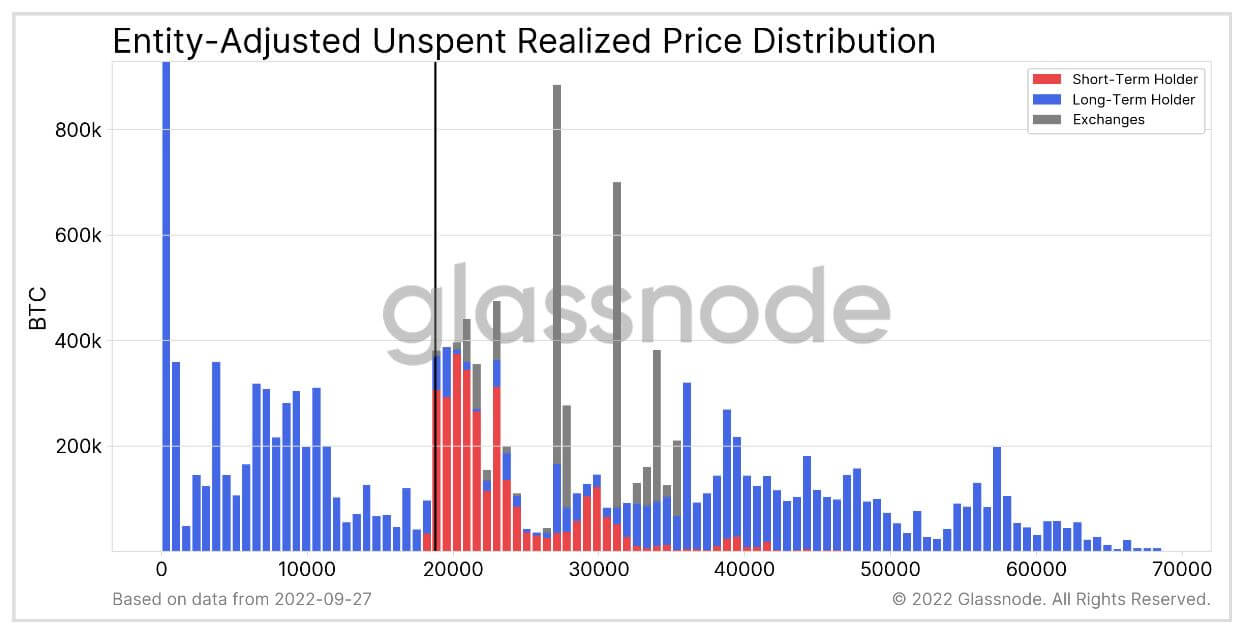

The entity-adjusted model of UTXO Realized Value Distribution (URPD) reveals this by segmenting provide into long-term holders, short-term holders, and exchanges.

The URPD identifies at what costs the present Bitcoin UTXOs had been created. With the entity-adjusted model, it’s simple to see every group of holders and the value bucket at which these entities acquired their cash.

Evaluation of the Glassnode chart reveals that a lot of the patrons lately are short-term holders, i.e., those that have held their BTC for lower than 155 days.

An additional breakdown reveals that many Bitcoin whales maintain the asset between the $10,000 and $17,000 vary. These whales might promote if the value had been to drop to round $17,000.

Analysis reveals that the majority whales are likely to promote as soon as market circumstances turn out to be unfavorable. Nonetheless, promoting at this level might considerably have an effect on BTC’s value. Usually, low quantity is a serious concern when there’s a serious deleveraging occasion.