The most important information within the cryptoverse for Oct. 26 contains the theft of over $1M price of Ethereum by a phishing assault, Vitalik Buterin’s tweet deeming ZKPs “crucial” for Ethereum and Binance overtaking Huobi in crypto derivatives buying and selling.

CryptoSlate Prime Tales

Over $1M price of ETH, NFTs stolen in phishing assault

A scammer, “Monkey Drainer,” stole 700 Ethereum (ETH) via a phishing assault over the previous 24 hours. The entire quantity equates to just about $1.05 million, and the assault was revealed by the on-chain sleuth ZachXBT.

1/ Over the previous 24 hrs ~700 ETH ($1m) has been stolen by the phishing scammer generally known as Monkey Drainer.

They not too long ago surpassed 7300 transactions from their drainer pockets after being round for just a few months. pic.twitter.com/6vAYBiqCxQ

— ZachXBT (@zachxbt) October 25, 2022

The attacker created faux web sites that seem as professional crypto companies to entry the victims’ pockets tackle keys and login credentials.

Vitalik says making ZK proofs ‘comprehensible’ is important for Ethereum

Ethereum co-founder Vitalik Buterin Tweeted and mentioned that making Zero-Data Proofs (ZKP) is important to maintain the Ethereum ecosystem “open and welcoming” to individuals who don’t perceive math.

Referring to ZKPs as a “moon bathtub,” Buterin tweeted:

“I’m so blissful that Ethereum has such a powerful tradition of attempting laborious to make all our moon math as comprehensible and accessible to folks as doable.”

Binance overshadows Huobi in crypto derivatives buying and selling

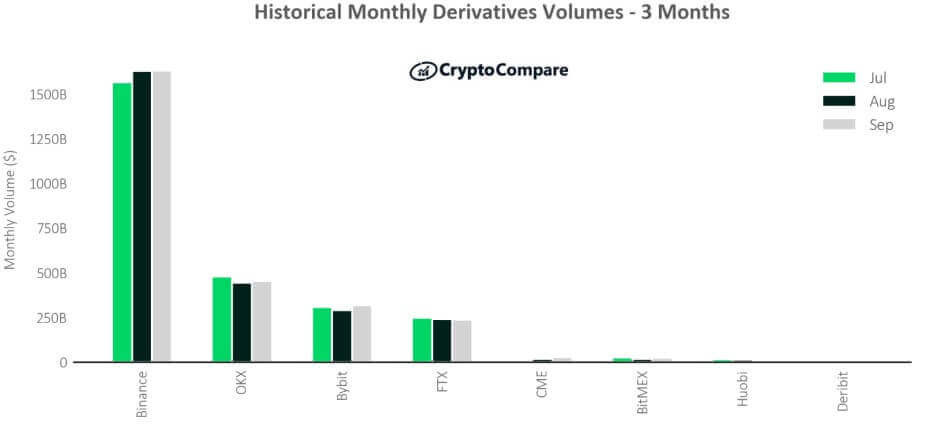

Crypto derivatives buying and selling elevated by 1.54% month over month to achieve $2.71 trillion, which compensated for 63.4% of all transactions in September.

Crypto alternate large Binance was liable for 60.1% of the derivatives buying and selling in September, whereas OKX adopted as a second with 16.8%.

ByBit got here third by controlling 11.7% of the entire derivatives market. Huobi, alternatively, was positioned sixth in dominance. It is a nice fall because it was the largest buying and selling platform for derivatives in early 2020.

Australia confirms crypto transactions can be topic to capital features tax

The Australian authorities confirmed that cryptocurrency transactions can be taxed quickly.

The federal government’s funds papers for 2022-23 have been launched, they usually thought of cryptocurrencies as an asset as an alternative of a international forex, which subjected them to taxation.

The lawmakers are presently engaged on a taxation framework. Whereas Australia didn’t disclose the proportion, it mentioned that the tax laws can be backdated to revenue years till July 1, 2021.

Is China about to catalyze the crypto bull market via Hong Kong?

Former BitMex CEO Arthur Hayes examined the connection between China and Hong Kong in an article he posted on his medium account and implied that China may make the most of Hong Kong as a “window to the world.”

He wrote:

“Hong Kong (a deepwater port on the mouth of the Pearl River Delta) has at all times been China’s window to the world. Whether or not it was delivery, capital, or narcotics provided by the largest drug seller in human historical past (the British Crown,) Hong Kong has traditionally been the place China and the West met.”

Financial Authority of Singapore proposes new measures to control crypto, stablecoins

Two session papers have been printed by the Financial Authority of Singapore (MAS) on Oct. 26, which summarized the regulatory frameworks for digital fee token providers and stablecoin customers.

The papers settle for that crypto property are “inherently speculative and extremely dangerous “ and intention to restrict the actions of digital fee token providers.

Hong Kong Financial Authority declares success and key findings from CBDC venture, mBridge

Hong Kong Financial Authority (HKMA) printed its Central Financial institution Digital Forex (CBDC) venture mBridge’s highlights and success on Oct. 26.

The report acknowledged that the mBridge’s six-week pilot program ran between Aug. 15 and Sept. 23. The venture facilitated over 160 fee and international alternate transactions that have been collectively price round $22 million.

US lawmakers specific concern over crypto companies hiring former authorities officers

A bunch of 5 U.S. Democratic lawmakers led by Senator Elizabeth Warren reached out to a number of monetary regulators within the U.S. to ask in regards to the “revolving door” between the U.S. authorities companies and the crypto trade.

The group initially mentioned that U.S. residents ought to be assured that authorities insurance policies weren’t created to “cater to the crypto trade’s need to ‘keep away from the type of regulatory crackdown it has confronted in China and elsewhere.’”

Moldova bans crypto mining amid power disaster

Moldova introduced banning crypto mining actions on Oct. 26 and pointed on the rising power disaster as a motive.

Moldova’s Fee for Emergency Conditions (CES) launched a report back to announce the ban, which additionally disclosed that Moldovan President Maia Sandu ordered authorities companies to save lots of electrical energy. Because of this, the CES moved ahead with the crypto mining ban.

CryptoSlate Unique

Op-Ed: Is Ethereum now beneath U.S. management? 99% of newest relay blocks are censoring the community

After The Workplace of Overseas Property Management (OFAC) sanctions Twister Money, Ethereum co-founder Vitalik Buterin known as validators and requested for validators to be slashed if the sanctions have been implied on the protocol stage.

Nevertheless, the variety of blocks compliant with the OFAC sanctions elevated over the previous months. Swat Bitcoin’s Editor in Chief, Tomer Strolight, tweeted in regards to the state of affairs exhibiting that round 63% of all Ethereum blocks have been OFAC compliant to attract consideration.

Why is no one speaking about this? pic.twitter.com/Nlng6kgHxr

— Tomer Strolight (@TomerStrolight) October 26, 2022

Analysis Spotlight

About 61% of BTC holders are underwater as market stagnation persists

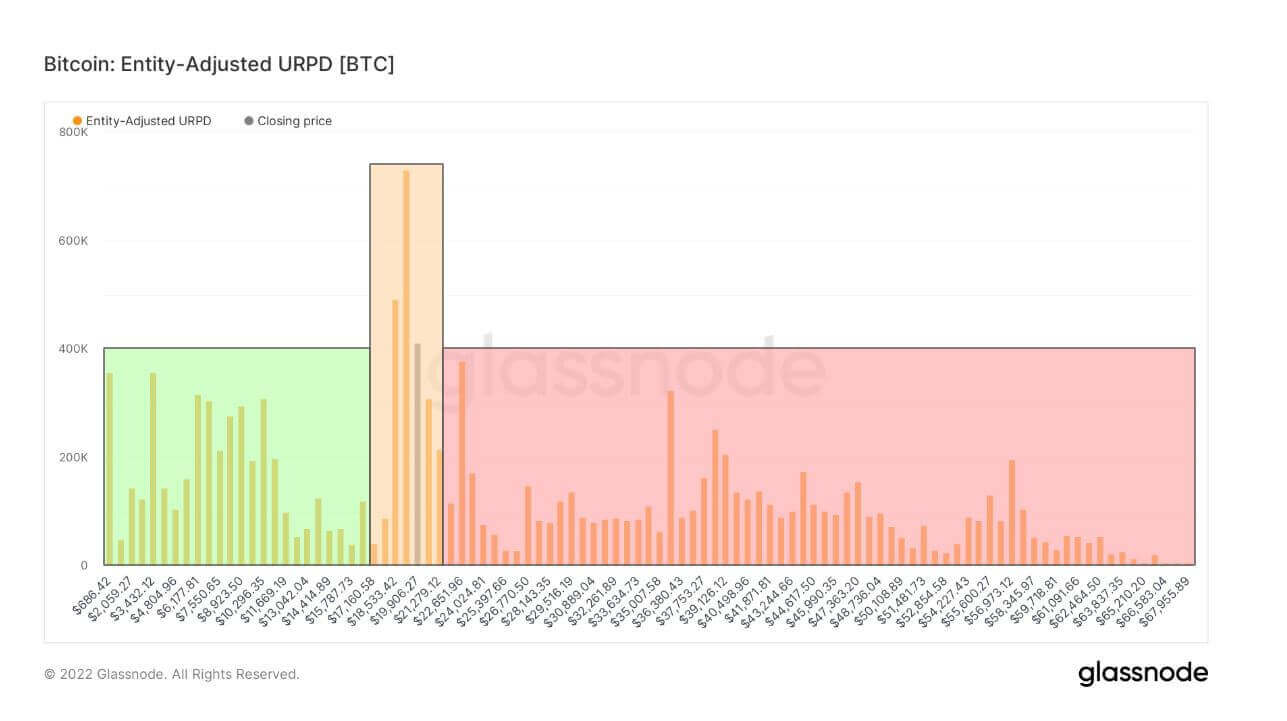

Bitcoin (BTC) recorded its lowest of the bear market at $17,600 on June 22. regardless that it bounced again to get well to $25,300 and has been lingering at a reasonably secure vary between $18,100 and $20,500 not too long ago, on-chain information signifies that almost all of Bitcoin buyers are nonetheless underwater.

The UTXO Realized Value Distribution (URPD) chart demonstrates the prevailing Bitcoins that final moved inside their respective worth buckets.

Based on the chart, buyers who purchased Bitcoin at $17,600 or beneath encompass solely 25% of all token holders. However, 61% of token holders have been underwater when Bitcoin sunk to its lowest.

Information from across the Cryptoverse

Andreessen Horowitz’s crypto fund sinks by 40%

Enterprise Capital agency Andreessen Horowitz established a $4.5 billion crypto fund in Might 2022. The bear market began quickly after, and Horowitz’s fund misplaced 40% of its market worth, as it’s reported by Wall Road Journal.

BitMex CEO quits

Crypto alternate platform BitMEX’s CEO Alexander Höptner resigned from his position, in line with Bloomberg. BitMex’s CFO Stephan Lutz was named because the interim CEO, whereas Höptner didn’t specify a motive for leaving his position.

Binance launches Binance Oracle

Based on an announcement publish on BNB Chain’s web site, Binance launches an Oracle Community to allow good contracts to run on real-world information. The BNB Chain would be the first blockchain that’ll use the Binance Oracle.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated by +2.47% to commerce at $20,753, whereas Ethereum (ETH) additionally spiked by +4.84% to commerce at $1,562.