Whole charges generated from the highest 10 DeFi dApps tracks by way of DefiLlama will quantity to $4.8 billion yearly based mostly on the previous 24 hours of exercise. Throughout staking, dexes, lending, and wallets, $13.15 million in charges had been generated up to now day.

| Identify | Class | 24hr Charges | 24hrs Income |

|---|---|---|---|

| Lido | Liquid Staking | $3.38m | $337,749 |

| Uniswap | Dexes | $2.62m | $0 |

| PancakeSwap | Dexes | $2.1m | $426,372 |

| Curve Finance | CDP | $1.54m | $659,343 |

| AAVE | Lending | $1.2m | $172,860 |

| Maker | CDP | $1.08m | $545,105 |

| Raydium | Dexes | $1.01m | $124,524 |

| Dealer Joe | Dexes | $623,784 | $69,357 |

| MetaMask | Wallets | $391,846 | $391,846 |

| Camelot | Dexes | $271,722 | $63,802 |

Nonetheless, the full income for the previous day comes to only $2.78 million, which is 21% of whole charges.

Lido tops the chart for payment era, whereas Curve retains the primary slot for income, with Maker and Lido simply behind. Two of the largest gaps between charges and income may be seen in Aave and Raydium, which generated over $1 million in charges over the previous day. Nonetheless, income was $172,860 and $124,524, respectively.

Notably, whereas Uniswap is positioned second in payment era, DefiLlama reviews $0 in income as Uniswap facilitates the gathering of charges. Nonetheless, it doesn’t retain these charges as income for the protocol. As an alternative, the charges enhance the worth of liquidity tokens, functioning as a payout to all liquidity suppliers proportional to their share of the pool.

There have been discussions and proposals inside the Uniswap group relating to implementing a “protocol payment,” which might be turned on by UNI governance. This payment would enable the Uniswap protocol to earn income by taking a share of the swap charges that may in any other case go to liquidity suppliers.

The ballot was step one, “temperature examine,” which handed at a charge of 55 million to 144, that means the improve has not but been carried out. Due to this fact, Uniswap doesn’t file this as income.

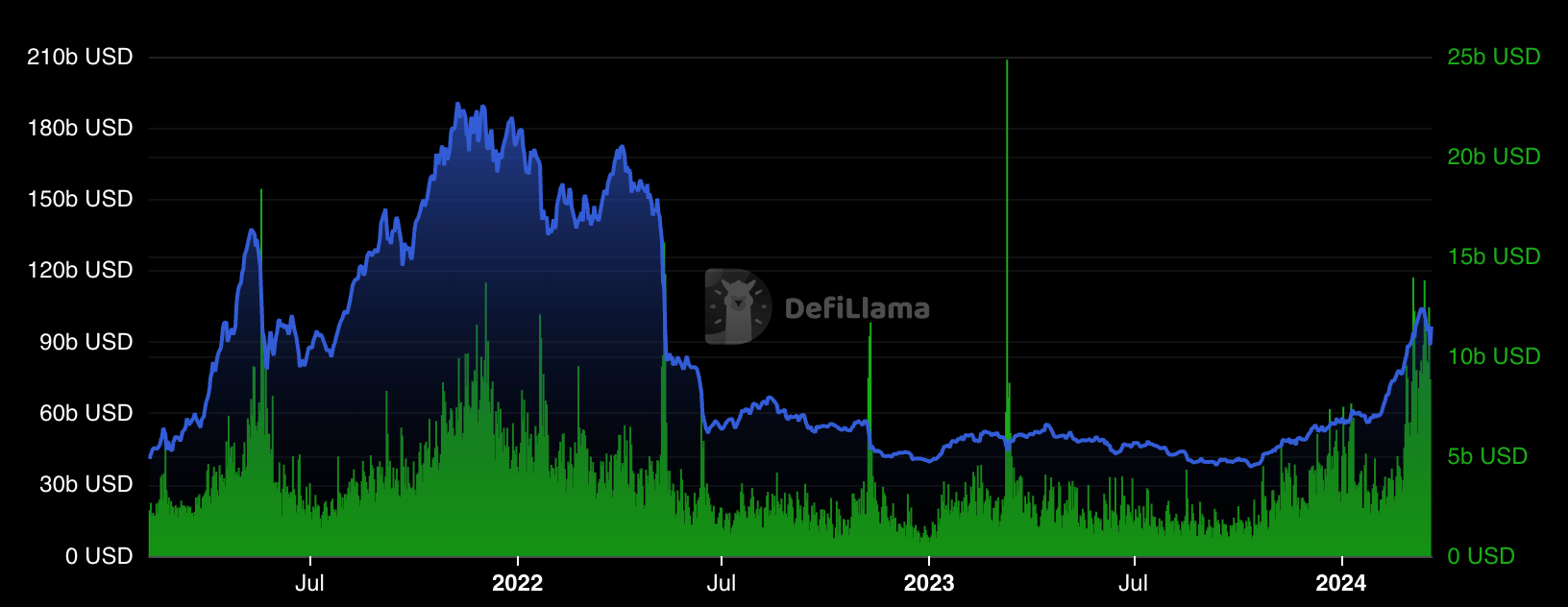

The DeFi market at the moment has a mixed market cap of $101 billion per CryptoSlate knowledge, with the sector up 5% over the previous day. DefiLlama knowledge exhibits that DeFi’s market cap resurgence has but to hit its 2021 peaks. Nonetheless, volumes have risen to equal ranges, exhibiting a extra constant development. Over the previous month, volumes round $10 billion have been commonplace after beginning the yr nearer to $5 billion.

The put up Prime 10 DeFi dApps producing a median of $4.8 billion in charges yearly appeared first on CryptoSlate.