Figuring out the market backside requires a whole lot of guesswork. Bitcoin’s latest volatility has resulted from varied components starting from geopolitical uncertainty and native regulation to inside implosions of the crypto market.

Miners have traditionally been one of the dependable omens of Bitcoin’s efficiency.

Bitcoin miners make up the muse of the crypto market and create robust resistance ranges that cut back volatility. As one of many largest holders of BTC, miners can swing the market by holding their cash and liquidating them.

Analyzing the state of the market requires analyzing the state of Bitcoin miners.

As beforehand lined by CryptoSlate, a number of the most strong indicators of miner well being have been hash ribbons.

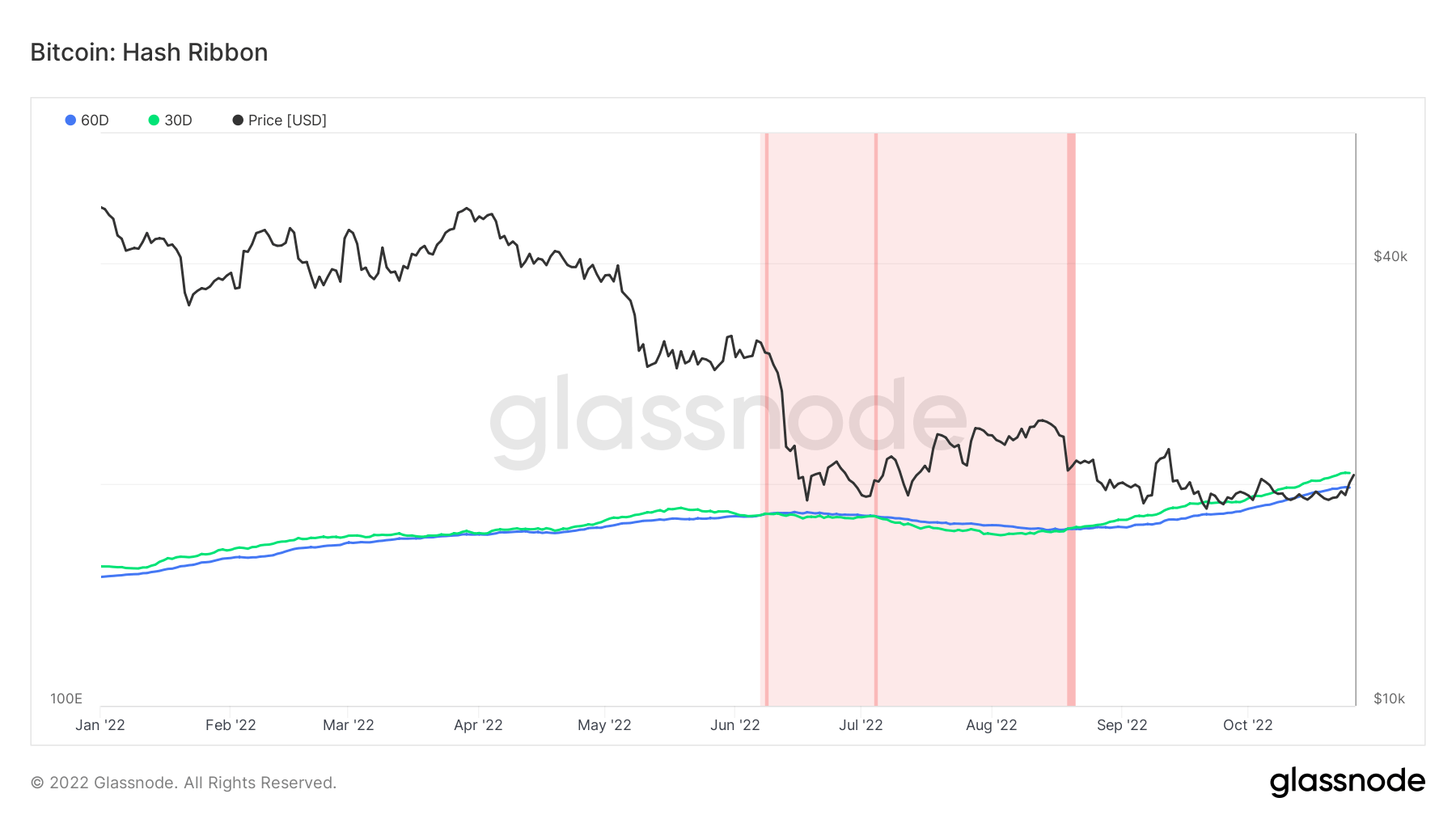

Hash ribbons point out when miners capitulate, displaying the divergence between the 30-day shifting common and the 60-day shifting common of the Bitcoin hash price; having miners capitulate exhibits that Bitcoin has develop into too costly to mine — i.e., Bitcoin’s market value is just too low to cowl the price of electrical energy required to supply it.

In line with hash ribbons, the worst of the miner capitulation is normally over when the 30-day MA of the Bitcoin hash price crosses above the 60-day MA. Because the starting of the yr, we’ve seen three separate cases of this change, proven in darkish pink on the graph beneath.

Knowledge analyzed by CryptoSlate confirmed that extreme miner capitulation started mid-June this yr and lasted till mid-August. The info is supported by crossing the hash ribbons illustrated within the graph above.

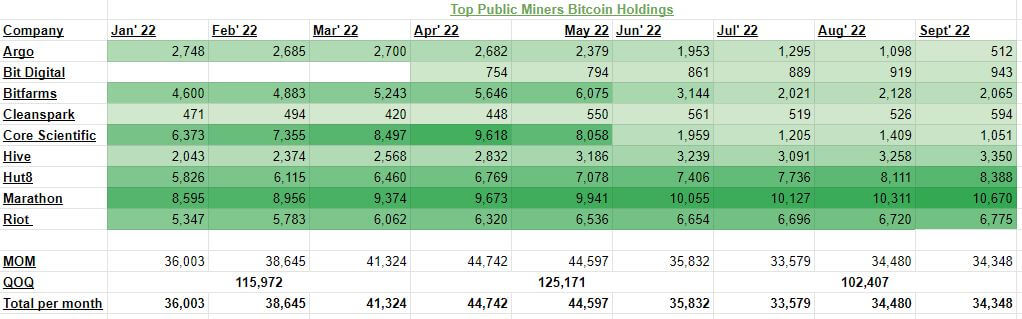

Taking a look at BTC holdings from the highest 9 largest publicly listed Bitcoin mining firms additional helps this development. A number of massive miners created heavy promoting strain between Could and June, liquidating round 8,765 BTC.

And whereas the promoting strain appears to have steadied on a month-to-month foundation since June, quarterly information paints a a lot completely different image.

The highest 9 public Bitcoin miners noticed their holdings lower from 125,171 BTC within the second quarter to 102,407 within the third quarter.

The numbers proven within the desk above decreased even additional in October. Earlier this month, Core Scientific liquidated over 1,000 BTC it held in September and reported holding simply 24 BTC on October 26.

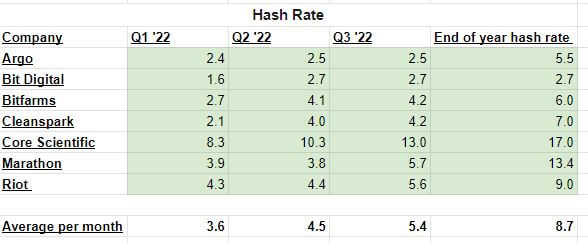

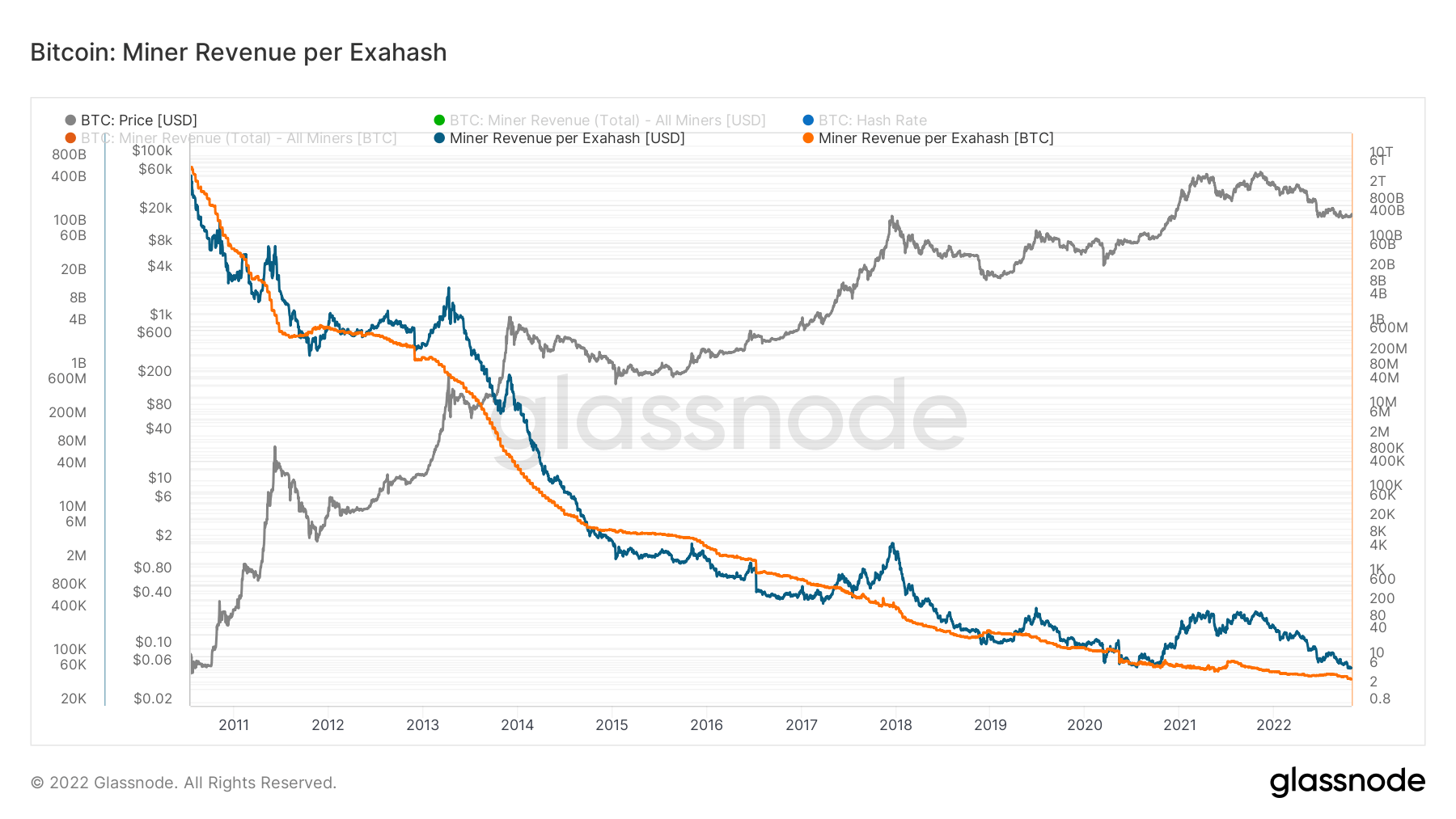

With mining problem and the hash price at their all-time excessive, miners are getting squeezed when it comes to their income and sources. The common hash price has been rising every quarter in 2022 and is predicted to extend at a fair increased price because the fourth quarter ends.

Knowledge analyzed by CryptoSlate confirmed that Bitcoin’s drop within the yr’s second half triggered a notable discount in miner income.

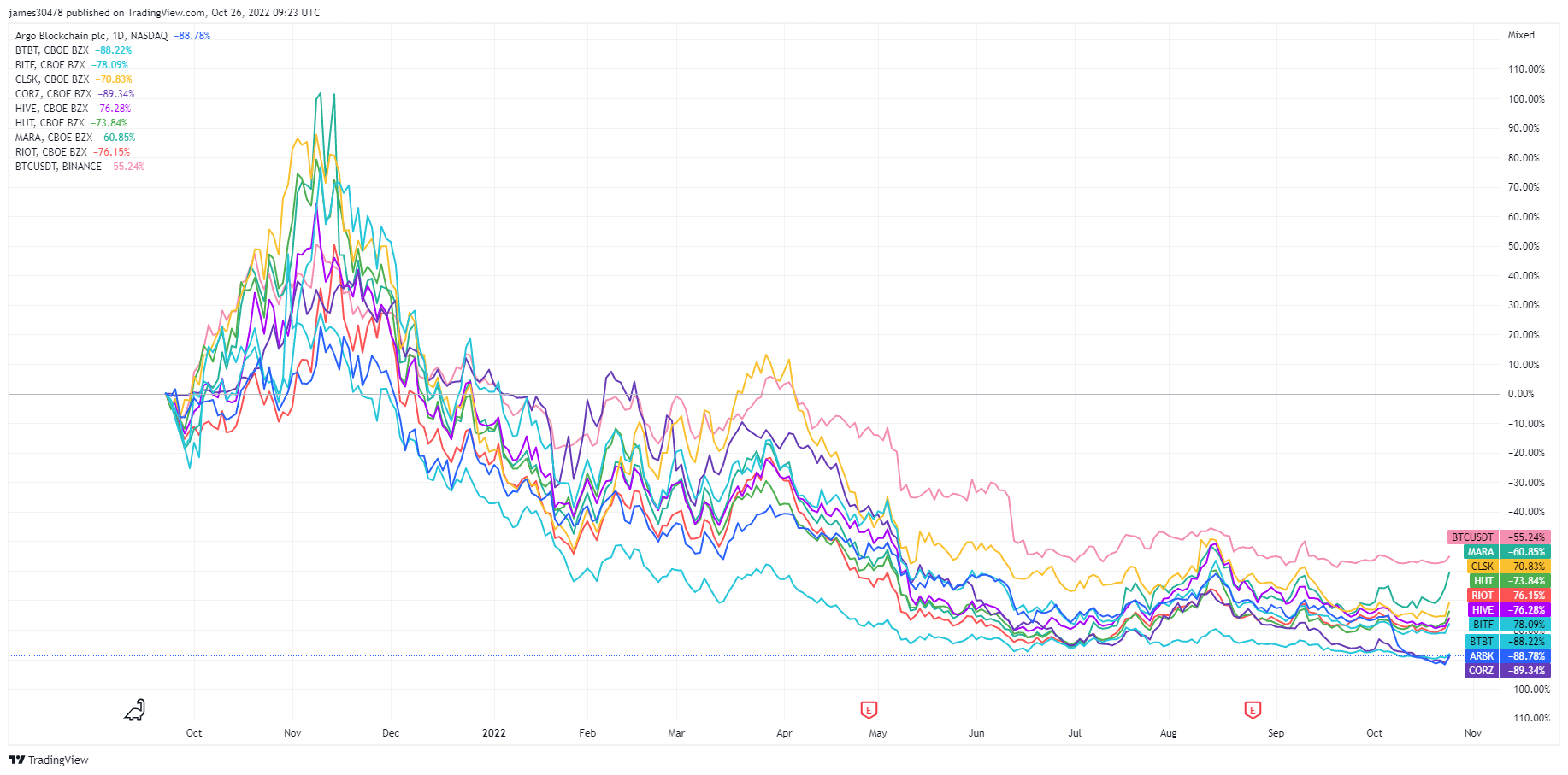

Bitcoin’s value volatility, dropping income, and lowering BTC holdings have additionally affected the inventory market. The shares of all publicly listed Bitcoin mining firms have been on a pointy drop since peaking in October 2021. Core Scientific leads the way in which, with CORZ down nearly 90% prior to now yr, with Argo Blockchain and BitDigital shut behind with an 88% drop.

With the hash price anticipated to develop even additional and no finish in sight to the bear market, we may see the continuing miner capitulation proceed till the tip of the yr. And whereas information exhibits that miners have exited the darkish pink zone and are both flatlining or consolidating, the more serious isn’t over. If present situations proceed, we may see one other miner capitulation earlier than the tip of the yr, creating further promoting strain that would additional swing the delicate market.