Retail traders proudly owning lower than 1 BTC are accumulating Bitcoin whereas whales holding over 10,000 BTC are promoting, in keeping with knowledge analyzed by CryptoSlate.

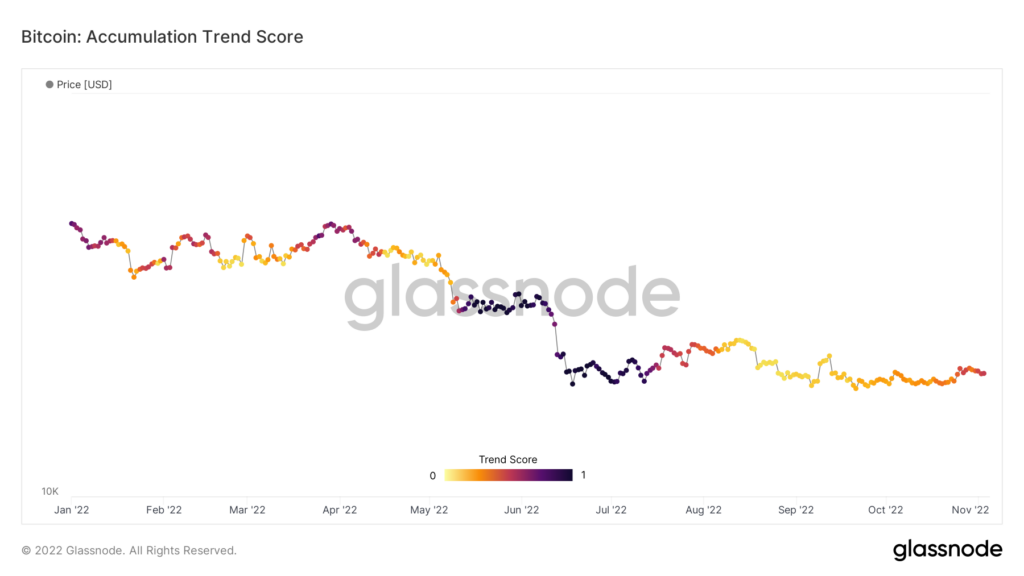

Since August, Bitcoin has been in a distribution section, as proven by the lighter colours on the graph under. The darker colours denote accumulation durations, as seen all through Might, June, and July. The primary chart under showcases the Accumulation Pattern Rating for Bitcoin throughout all coin holders.

Through the Might downturn initiated by the collapse of Terra Luna, traders continued to build up Bitcoin and acquired the dip. Nonetheless, this pattern led to August as sentiment moved bearish, inflicting Bitcoin to commerce flat all through Q3. Whereas there have been extra sellers than consumers on this interval, it doesn’t seem to have been sufficient to pressure Bitcoin under $18,000 for an prolonged interval.

Bitcoin’s means to carry round $20,000 all through Q3 amid persistent promoting strain highlights the sturdy assist at this degree. The highest cryptocurrency by market cap has been vary certain since mid-August, buying and selling between $18,000 and $22,000 all through.

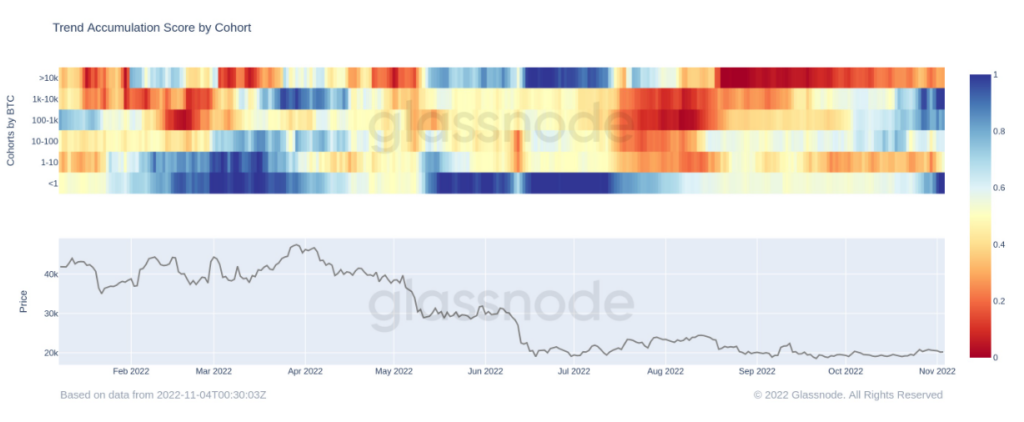

Nonetheless, analyzing Bitcoin holders cut up into cohorts primarily based on the quantity of BTC held of their wallets reveals extra detailed insights into the pattern. Bitcoin holders with lower than 1 BTC re-entered an accumulation section in late October, as did holders with between 1,000 BTC and 10,000 BTC. These with greater than 10,000 BTC have continued to promote as they’ve carried out since mid-July.

The chart under provides a transparent image of the completely different tendencies amongst completely different cohorts of Bitcoin holdings. Buyers with lower than 1 BTC have traditionally purchased at separate instances to bigger whales.

In March, smaller retail traders purchased Bitcoin closely, whereas whales began promoting across the similar interval. The one time with obvious similarities between retail and whales was June and July this yr.

Whereas Bitcoin whales should still be distributing cash by way of constant promoting, there are indicators of a reversal in current weeks. The whale cohort has moved from darkish crimson into a lightweight orange area, suggesting a extra impartial place.

Given the dearth of volatility in Bitcoin’s value because the summer season, each whales and retail traders who bought Bitcoin in June and July are prone to both be in revenue or near breaking even. Over the previous week, Bitcoin has climbed 11% after testing the $18,500 assist a number of instances.

Though bigger whales stay in a distribution section, Bitcoiners with lower than 10,000 BTC however greater than 1,000 BTC have additionally began to build up as of the tip of October.