The largest information within the cryptoverse for Nov. 11 contains FTX submitting for chapter as John Ray III takes over from Sam Bankman-Fried as CEO, FTX customers in search of to bypass chapter course of utilizing the “Bahamas loophole”, US Congressman accused SEC Chairman of getting doubtful ties to FTX, and Crypto.com disclosing reserve holdings to allay rumors of insolvency.

CryptoSlate High Tales

FTX information for chapter, Sam Bankman-Fried steps down from CEO position

About 130 corporations affiliated with the FTX Group have collectively filed for Chapter 11 chapter on Nov. 11. The trade stated that it’s going to work to restructure its remaining property in order to refund affected stakeholders.

As well as, John Ray III will take up the CEO position from Sam Bankman-Fried.

Binance CEO expects extra regulatory scrutiny following FTX implosion

Binance CEO Changpeng Zhao “CZ” stated it needed to again off the FTX deal, on account of the regulatory scrutiny FTX has to battle with.

CZ added that the FTX collapse will name for elevated scrutiny of crypto exchanges. For extra transparency, CZ recommends that regulators ought to think about auditing the trade’s enterprise fashions and proof-of-reserves, along with KYC and AML legal guidelines.

Crypto.com discloses partial reserves in bid to counter insolvency rumors

Following the FTX fallout, a number of crypto exchanges together with Crypto.com have moved to reveal their reserve holdings, to allay fears of insolvency.

In line with particulars shared by Crypto.com CEO Kris Marszalek, the trade holds about 53,024 Bitcoin, 391,564 Ethereum, and a few altcoins which totaled roughly $3 billion.

Pantera Capital swiftly implements precautionary measures following FTX, Alameda fallout

Enterprise Capital agency Pantera stated it performed a danger evaluation for initiatives in its funding portfolio, in order to take preventive measures following the FTX collapse.

From the evaluation report, about 95% of the initiatives in Pantera’s portfolio haven’t any publicity to FTX or Alameda. Nonetheless, two startups had been affected and can obtain additional help from the funding agency.

US Congressman says SEC’s Gensler allegedly had doubtful ties to FTX, guarantees investigation

SEC Chairman Gary Gensler, FTX CEO Sam Bankman-Fried, and Alameda CEO Caroline Ellison, reportedly have a long-standing relationship that was linked to MIT.

Consequently, rumors are spreading that Gensler had sinister ties to FTX, in an try to assist FTX acquire extra management over the crypto house.

In response to the speculations, crypto-friendly U.S. Congressman Tom Emmer stated he would launch an investigation to uncover Gensler’s position in serving to FTX acquire a regulatory monopoly.

Determined FTX customers make use of shady ways to bypass chapter course of

Within the wake of the FTX collapse, the Bahamas’ authority froze FTX’s property. Nonetheless, it licensed Bahamians to withdraw their remaining funds.

Consequently, many FTX customers are opting to collaborate with Bahamian residents to assist withdraw their funds. Whereas some crypto neighborhood members have criticized the act as unlawful, many traders together with @depression2019 stated it was higher to make use of such ways to reclaim full funds as an alternative of ready for a 5-year chapter course of.

BlockFi halts withdrawals amid FTX disaster, Genesis Buying and selling, Crypto.com emphasize transparency

The FTX fallout impact has caught up with BlockFi because it moved to droop withdrawals and buying and selling actions on its platform. BlockFi reportedly has a $400 million mortgage from FTX.US due for July 2023.

Kucoin CEO addresses rumours surrounding FTX, FTT publicity

In efforts to distance Kucoin from the FTX collapse, CEO Johnny Lyu shared some particulars of the Kucoin proof-of-reserve.

As of publication, Kucoin held about 20,504 BTC, 180,299 ETH, 69.6 million KCS, 1.08 million USDT, and 365 million USDC.

Realized Bitcoin losses spike as Grayscale GBTC trades at lower than $10k BTC equal

FTX’s collapse which began on Nov. 9 compelled Bitcoin to fall beneath $15,590. Consequently, the realized losses on the flagship asset have spiked to new highs.

Equally, Grayscale’s GBTC share has declined to an all-time low of $9,771. The GBTC is buying and selling at a 41% low cost to its web asset worth (NAV).

FTX crash pushes Bitcoin to self-custody; Ethereum switched for stablecoins

Because the FTX contagion unfolds, extra traders are transferring their Bitcoin approach from centralized exchanges into self-custody wallets. Glassnode knowledge reveals that as of Nov. 11, out of roughly 19 million BTC in circulation, as much as 78% (roughly 15 million) are held in self-custody. Consequently, Bitcoin’s illiquid provide chart has spiked to new highs.

Additional on-chain investigation revealed that the market cap of the highest 4 stablecoins has flipped that of Ethereum. By implication, extra traders are transferring funds into stablecoins to hedge in opposition to the rising crypto market uncertainty.

Analysis Spotlight

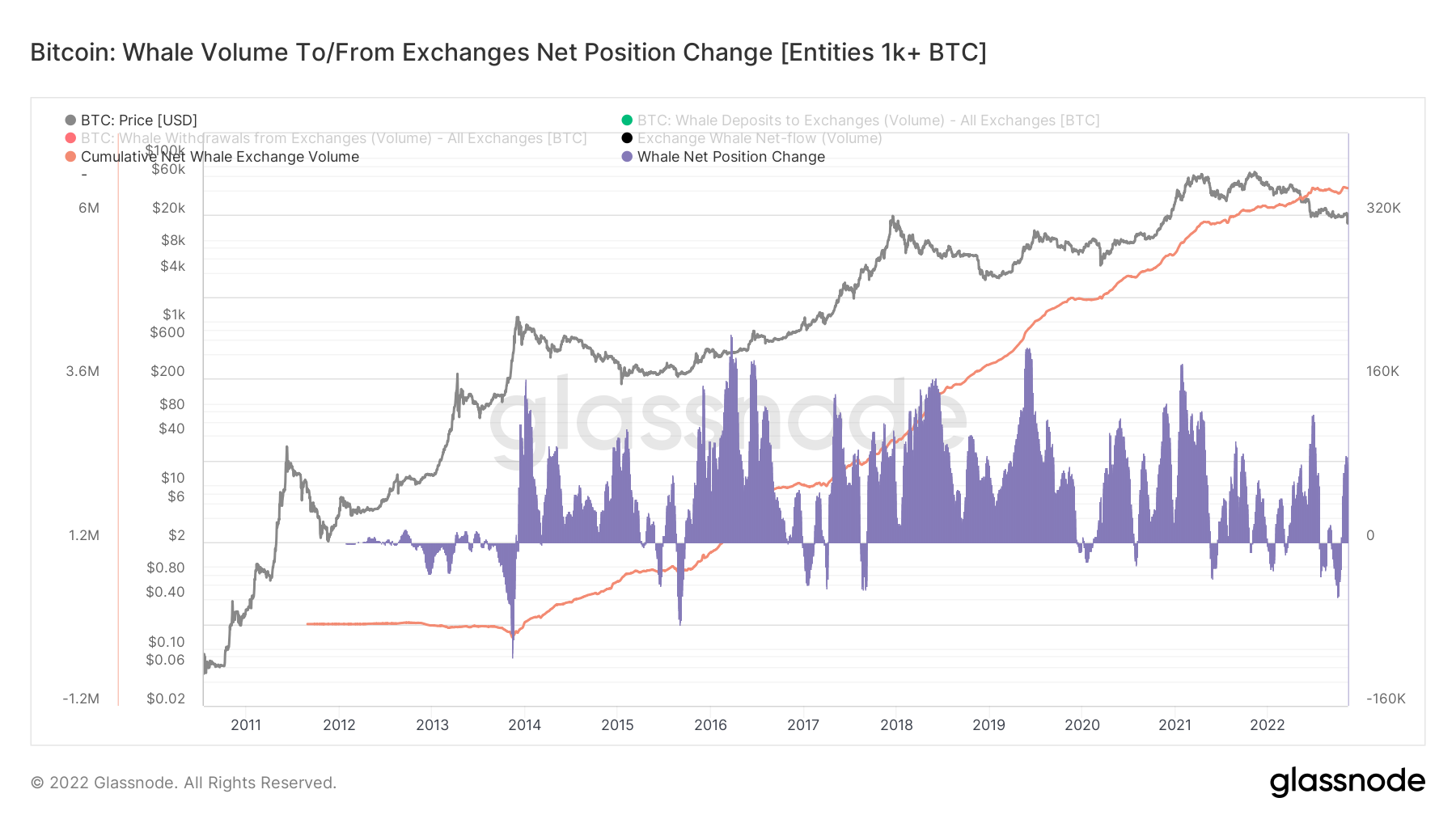

Regardless of FTX disaster, Bitcoin whales lead aggressive accumulation part

The FTX collapse has fueled bearish sentiment throughout the market. Nonetheless, on-chain knowledge analyzed by CryptoSlate signifies that Bitcoin whales rising their holdings.

As of Nov. 10, the buildup pattern rating (ATS) reached about 0.74, which signifies that Bitcoin traders are actively accumulating.

Equally, the trade web place change chart reveals that holdings of whales and tremendous whales have elevated considerably extra not too long ago.

Information from the Cryptoverse

FTX withdraws US CFTC derivatives plan

Following the chapter submitting of the FTX Group earlier on Nov. 11, Bloomberg reported that the corporate has withdrawn a derivatives clearing plan submitted to the U.S. Commodity Futures Buying and selling Fee (CFTC).

The proposal would have allowed FTX customers to entry and mitigate derivatives danger in actual time.

Deribit adjusts withdrawals and deposits process

Deribit trade has notified customers to create new pockets addresses following its Fireblocks replace. Customers had been cautioned in opposition to sending funds to their earlier accounts.

Withdrawal requests on the trade can be accredited and processed manually by a Deribit withdrawal.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) decreased by over 3% to commerce at $16,722, whereas Ethereum (ETH) declined by 2.2% to commerce at $1,258.