The Terra collapse, wherein $60 billion of worth evaporated, has already gone down as a defining second in cryptocurrency historical past.

TerraForm Labs co-founder Do Kwon maintains the problem boiled right down to weaknesses within the UST stablecoin protocol design. Nevertheless, others have overtly known as out the challenge as a rip-off from the off.

The occasion triggered an exodus of capital, tanking costs throughout the board from which the market has but to get better.

Nonetheless, on-chain metrics present an fascinating change within the dynamics of long-term Bitcoin holders ensuing from the collapse.

Bitcoin provide held by long-term holders soared

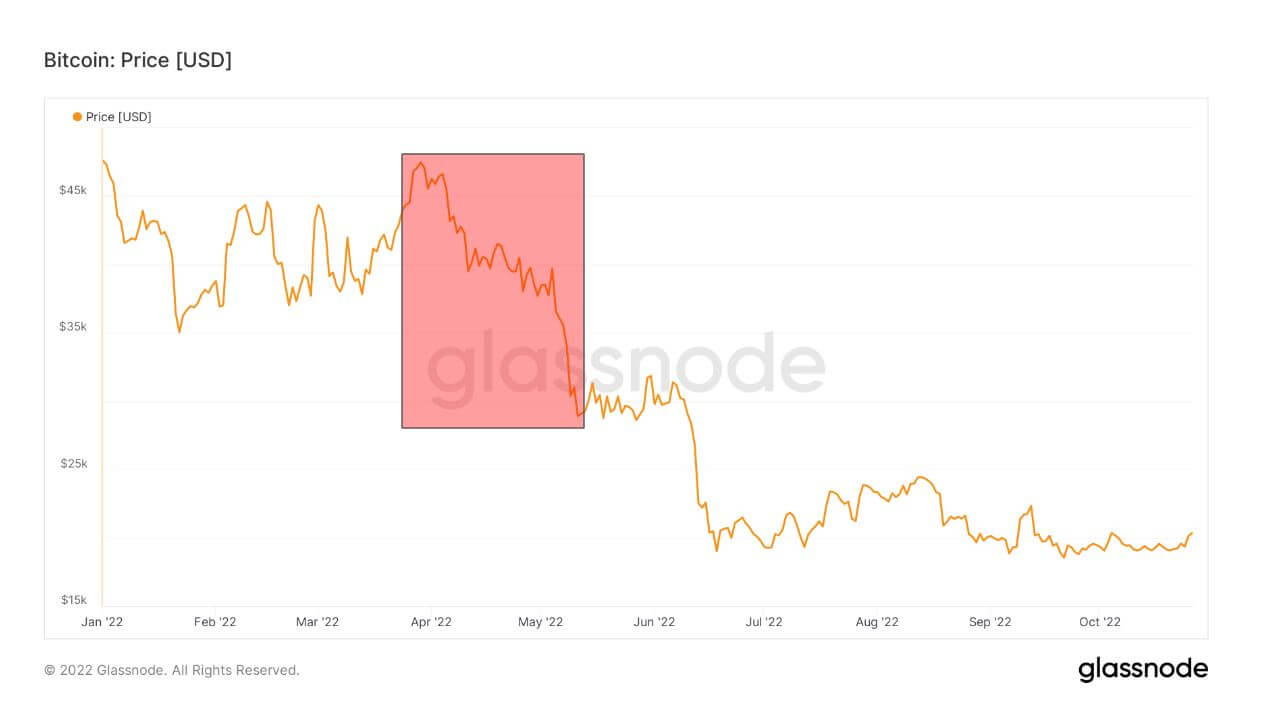

On the finish of March, Bitcoin was priced at $47,000 and ticking alongside regardless of early warnings of an inflationary spike and bother in Japanese Europe escalating additional.

Transferring into Could, BTC opened the month at $40,000. However, on Could 7, UST started shedding its greenback peg worth. By Could 13, the UST day by day shut was $0.13, having dipped as little as $0.06 on the day.

Because the disaster was unfolding, the knock-on impact noticed BTC sink to $30,000 by Could 11. And by mid-June, the value had fallen 62% from the top of March to $18,000.

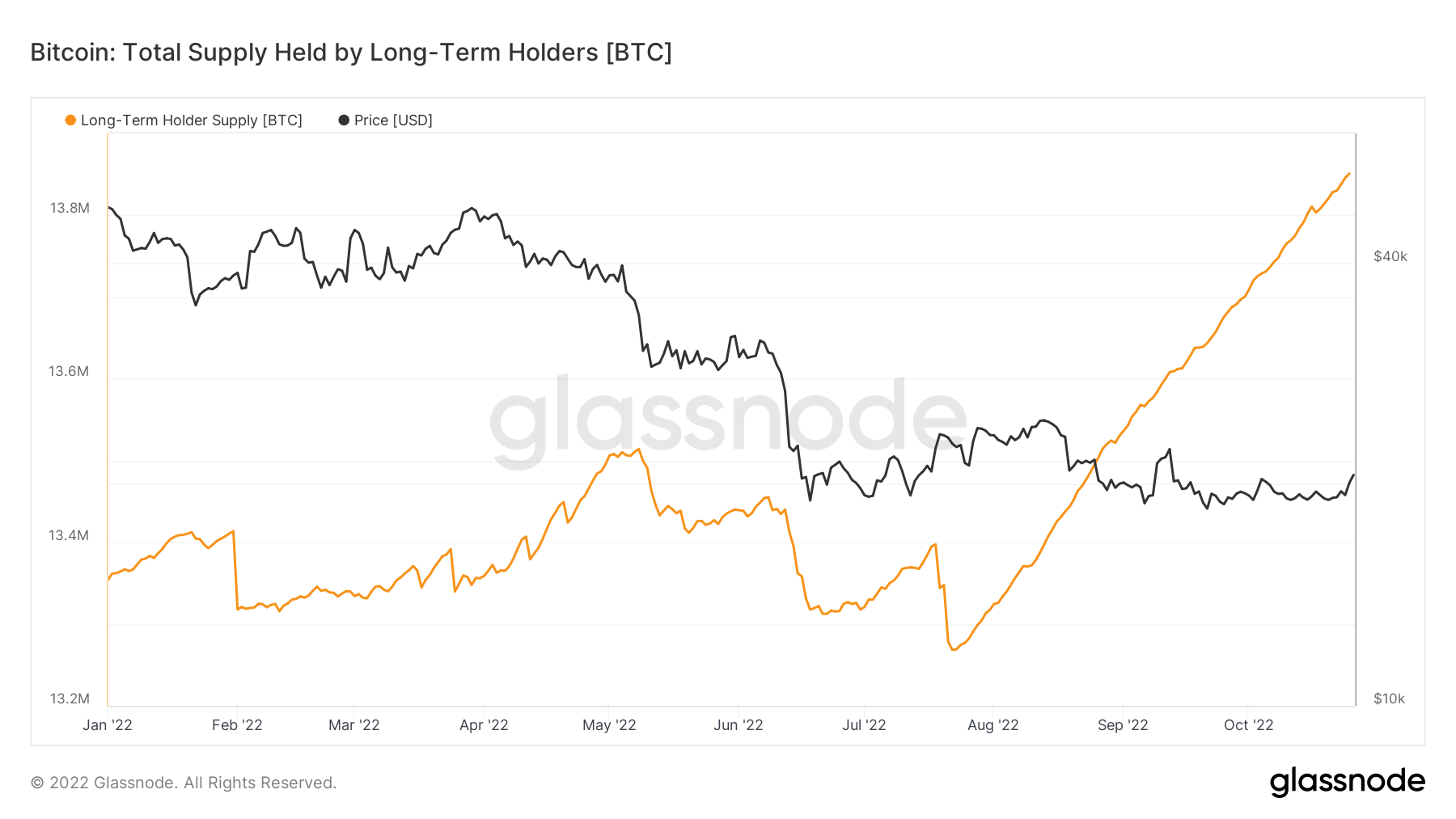

The chart under reveals the full provide held by long-term holders (LTH) – Glassnode defines LTHs as people with a place held longer than six months. It highlights a gradual drawdown in LTHs in early Could as phrase of the UST de-peg unfold.

This development bottomed by late July, resulting in a steady 45-degree takeoff in LTHs. A major purpose for this sample pertains to shopping for exercise early on in April and Could (six months in the past,) which has since matured within the classification of LTHs.

LTHs Web Place Change

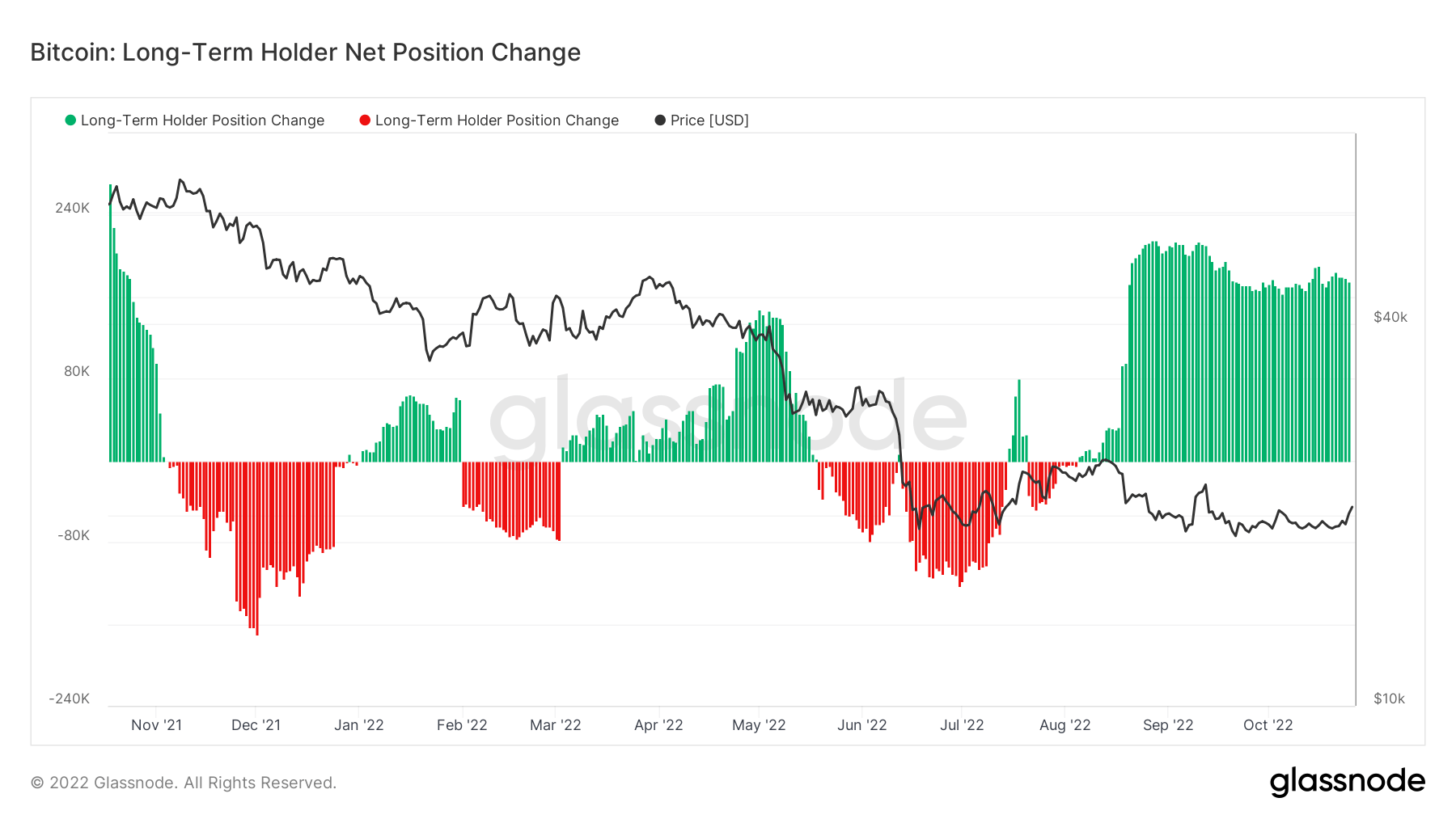

The Bitcoin: Lengthy-Time period Holder Web Place Change refers to token distribution by LTHs, who’re denoted in inexperienced as internet accumulators or in pink as internet distributors cashing out of positions.

Because the macro panorama worsened within the second half of the yr, LTHs started promoting their positions. Nevertheless, the development has flipped since September, with LTHs seeing worth at these costs and accumulating accordingly.

Quick-term vs. long-term holders

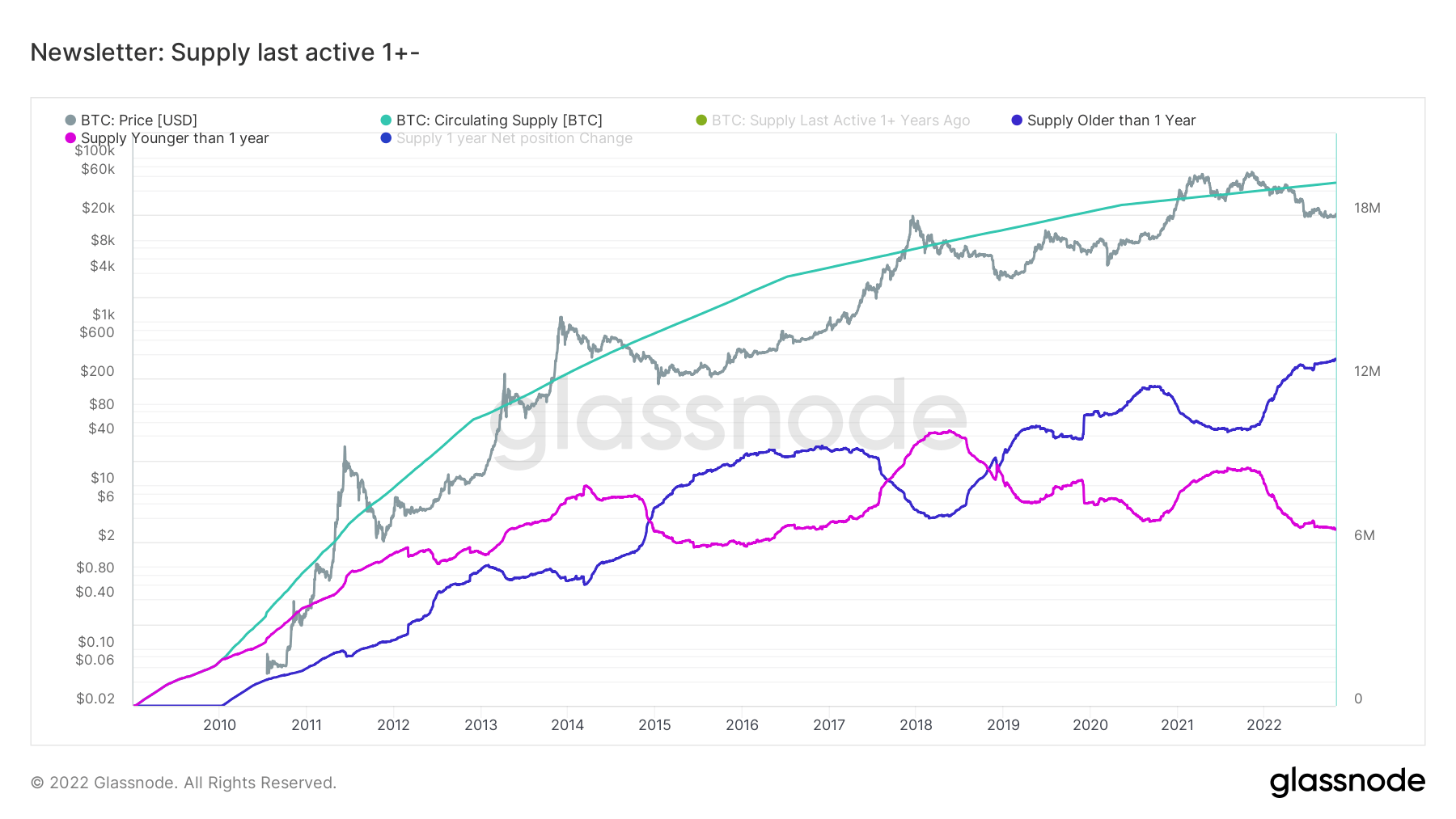

The chart under adjustments the definition of LTHs to held for multiple yr, which means Quick-Time period Holders (STHs) check with holdings of lower than a yr.

It was famous that worth peaks in BTC coincided with leveling or vital drops in STH provide. The exceptions to this have been in the course of the interval earlier than and together with the $900 worth peak in December 2013. In these cases, no sample in STHs might be discerned.

Equally, since that outlier interval, market lulls have been accompanied by an uptick in LTH provide, as LTHs accrued tokens.

Quick ahead to the current, LTHs are spiking increased, whereas STHs are lowering quickly. This has created a dramatically divergent sample not seen earlier than to this diploma.