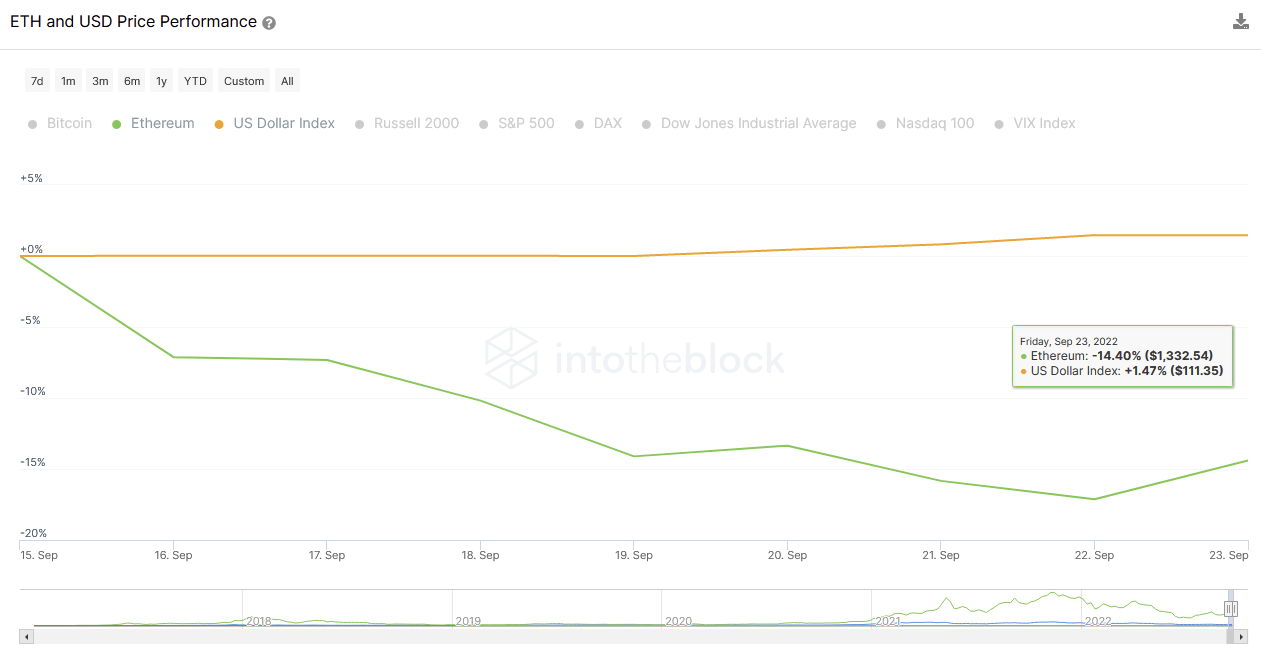

With macroeconomic situations dictating the general market sentiment and price-action, it might probably really feel like little has modified since Ethereum’s merge to a Proof-of-Stake (PoS) consensus mechanism. The value of ETH has dropped 14.4% for the reason that merge whereas the power of the U.S. greenback has surged.

Nevertheless, within the background, the merge has prompted substantial adjustments to the tokenomics of ETH. As many readers may already know, the change from Proof-of-Work (PoW) to PoS signifies that the miners who had been beforehand incentivized to construct and validate the blocks for the Ethereum mainnet are now not wanted.

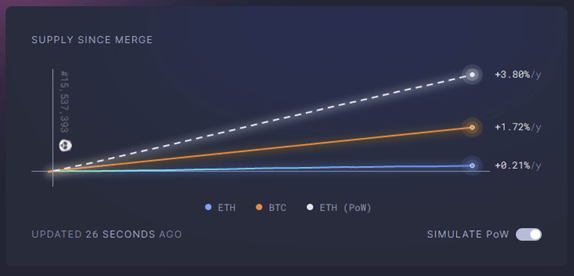

It is because validators which have staked ETH to assist safe the community have taken their place in validating blocks on the chain. In brief, this variation has resulted in an almost 95% discount in ETH emissions per block. Reside updates of this may be discovered on the ultrasound cash internet web page that tracks all statistics on ETH’s present emissions in comparison with a PoW Ethereum.

This graphic signifies that there was a major lower in ETH inflation, which implies much less ETH to go round. This provide shock will imply that future elevated demand may provoke substantial value actions. Moreover, with a portion of all ETH used for fuel being burned with every transaction at a fuel fee of 16 gwei, the ETH provide would change into deflationary.

Staking ETH is the New Norm

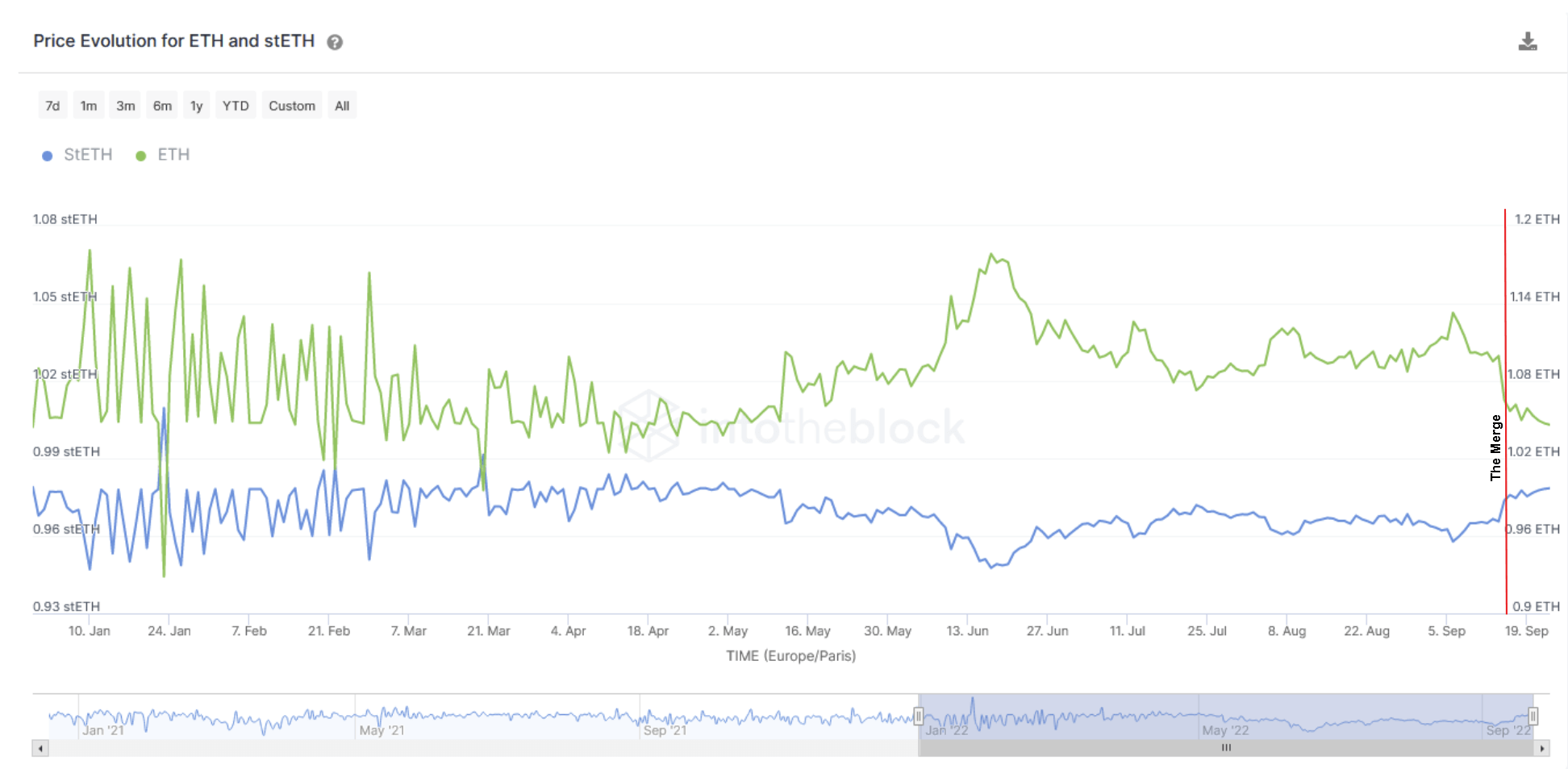

Earlier this 12 months, there was a rising dialog concerning the dangers of staking ETH and what the worth of liquid staked ETH, comparable to stETH, needs to be. For the reason that merge was profitable, it seems that many of those issues have dissipated. That is indicated by the current converging of costs between ETH and stETH as seen under, suggesting that each ought to have equal financial worth.

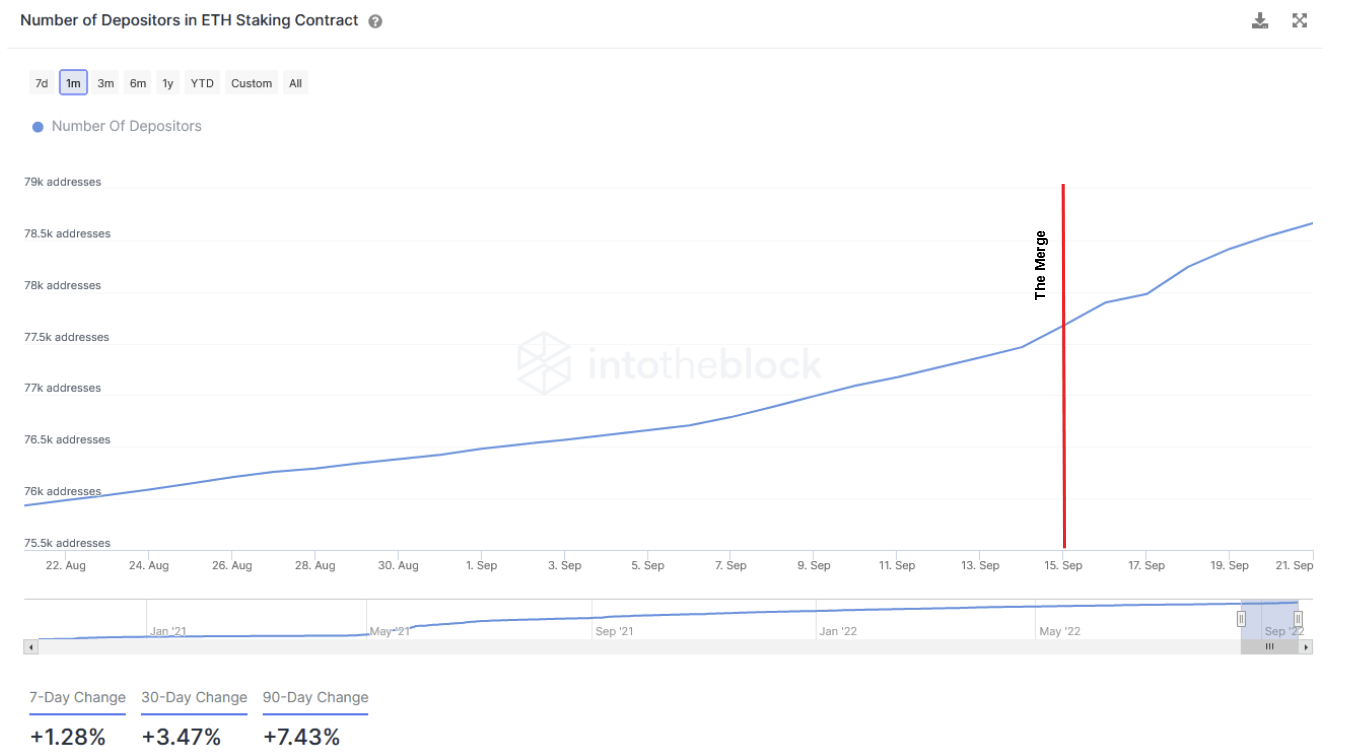

The brand new norm seems to see ETH as interchangeable to liquid-staked ETH tokens. stETH from Lido is already well-known, and different options, comparable to Rocketpool’s rETH, have been gaining traction as methods to obtain the rewards of staking whereas nonetheless having the ability to use the asset elsewhere (comparable to DeFi). As seen within the chart under, the urge for food for staking ETH has been repeatedly trending upwards and accelerated additional following the merge.

Alongside the elevated amount of ETH, the variety of addresses staking ETH has began rising sharply after the merge. That is vital for the reason that improve in staked ETH might be simply because of the results of compounding, however new addresses point out that new depositors are partaking in securing the chain and receiving rewards for doing so.

Mining rewards are gone; boosted staking rewards are right here

As talked about above, with out miner rewards, the emissions have dropped considerably. Nevertheless, rewards are nonetheless being distributed in a smaller quantity to ETH stakers. Validator nodes that suggest and validate new blocks obtain rewards for every block they efficiently add to the chain. These rewards are then distributed among the many particular person ETH stakers that delegate their ETH to the validator.

Whereas these rewards are much less (presently 4.6% APY) than what was emitted to maintain miners validating, the fee to entry these rewards is trivial in comparison with the price of constructing a mining operation.

This makes it simpler for retail and institutional alike to take part within the course of and obtain rewards. The present alpha to getting the very best staking rewards is to search out validators which might be boosting their rewards by maximal extracted worth (MEV) strategies. That is executed by applications like Flashbots MEV-Increase product or by personal MEV strategies.

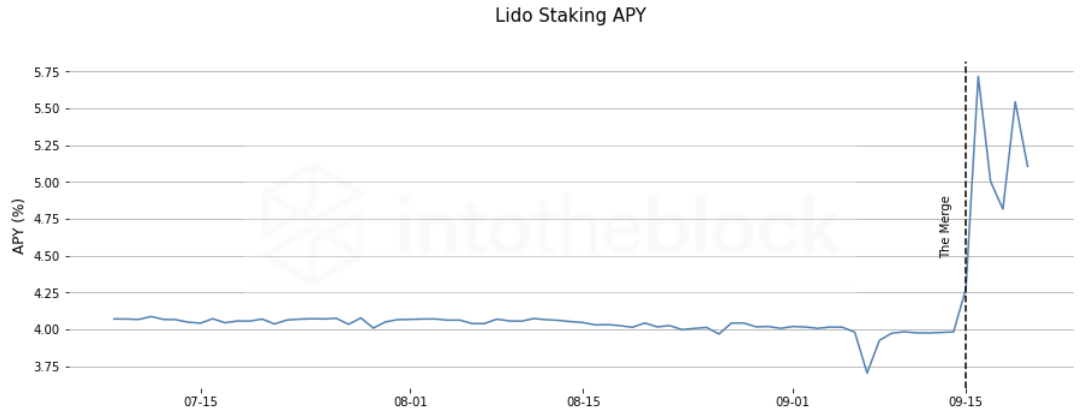

Validators utilizing MEV have yields presently outperforming the vanilla 4.6% APY supplied by staking. Lido, for instance, used MEV to spice up their APYs to ~5.5%. The graph under highlights how Lido stakers have drastically benefited from the transition to a PoS consensus chain.

Lido is just not the one group benefiting from boosted staking rewards. A current abstract analyzing block rewards during the last week created by Elias Simos exhibits that validators utilizing one in all a number of MEV strategies to spice up rewards obtain, on common, two occasions the rewards than validators proposing blocks with out it.

These variations in block rewards and yields for stakers will doubtless diminish over time as increasingly more validators undertake MEV-boosted blocks to obtain greater rewards. Whereas rewards will most certainly go down, stakers ought to nonetheless see advantages to their APY in the event that they stake with validators utilizing MEV.

To Ethereum’s Future

Although the close to time period seems to be like it is going to be significantly unstable for all risk-on belongings because of the world financial system and geopolitical outlooks, it’s an thrilling time in case you are a fan of Ethereum. The merge was an unimaginable feat and demonstrates the distinctive abilities of the devs contributing to Ethereum’s code and imaginative and prescient.

Moreover, ETH stakers are seeing greater APYs as validators incorporate different income streams into the rewards they payout to stakers. Lastly, we haven’t but seen the total potential of what the ETH provide discount will actually suggest. When exercise begins to select up once more on mainnet and fuel costs begin to climb, we may see ETH change into deflationary. These shortage shocks will deliver new dynamics to the market that would see ETH’s value quickly transfer to the upside.