After weeks of flatlining, Bitcoin has lastly seen some optimistic value motion, breaking by means of the $20,000 resistance. At press time, BTC stood at $20,745 and confirmed the potential to inch even nearer to $21,000.

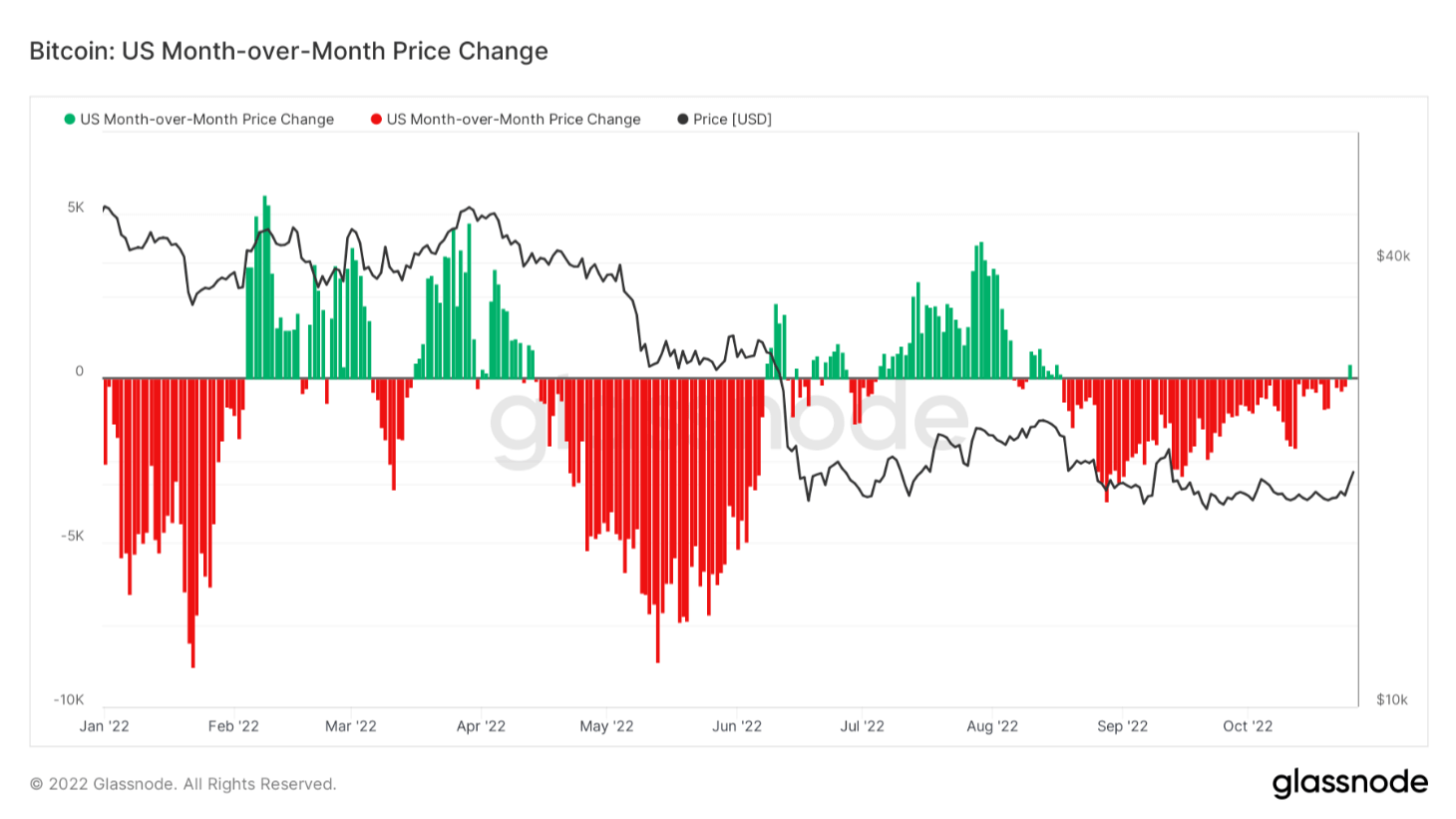

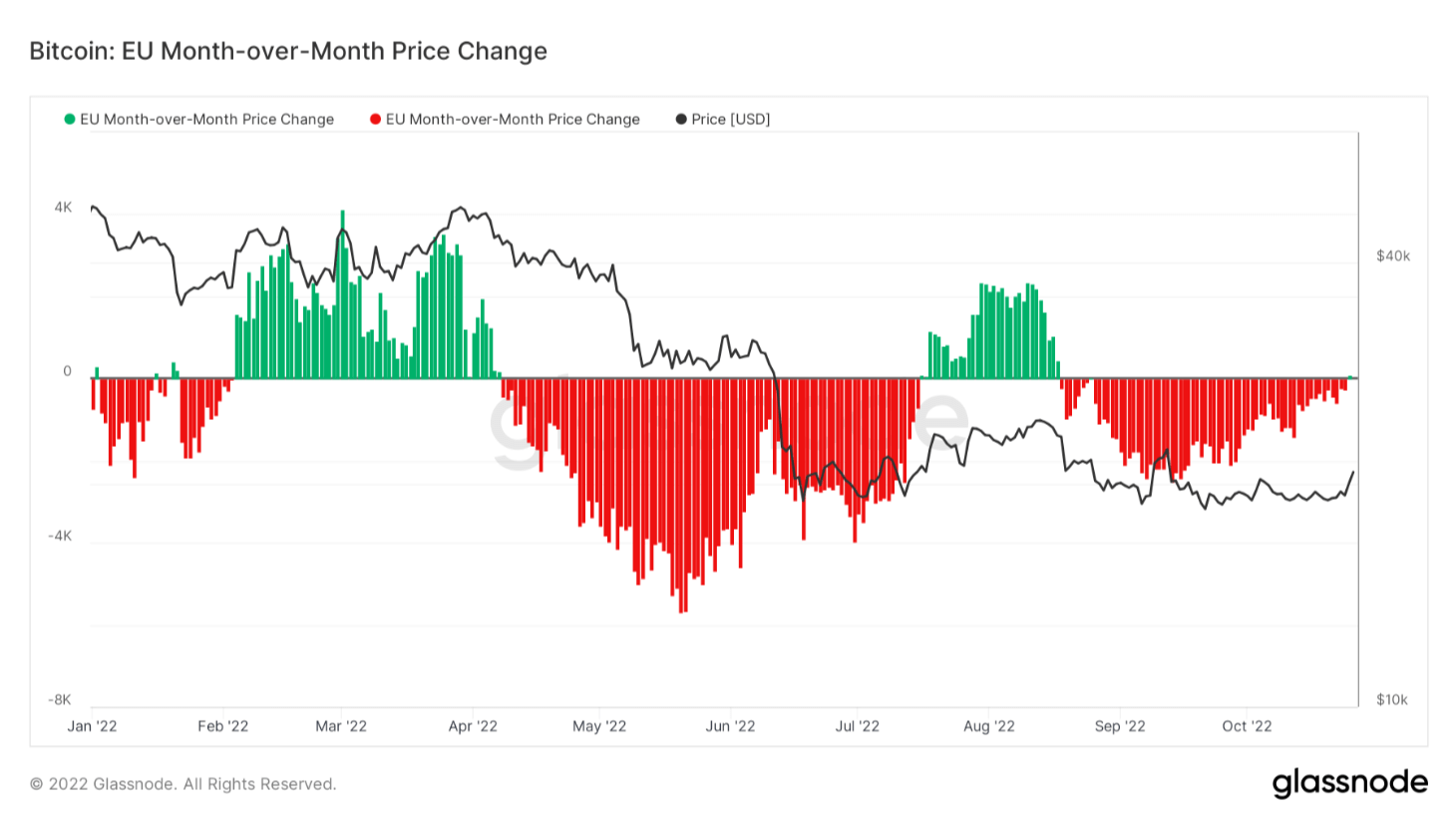

Bitcoin’s rally might have been a results of a big improve in shopping for stress from the U.S. and E.U. markets, which confirmed little curiosity in BTC prior to now months. Based on knowledge from Glassnode, that is the primary time since August 16 that the U.S. and E.U. have purchased BTC.

Traditionally, elevated shopping for stress in these two markets has correlated with value rallies.

To find out when a market has been “shopping for” Bitcoin, Glassnode makes use of its month-over-month value change metric for Bitcoin. This metric exhibits the 30-day change within the regional value set throughout U.S. and E.U. working hours.

Regional costs are constructed by assigning areas based mostly on working hours in varied markets, akin to Europe, Asia, and the U.S. The cumulative sum of the worth adjustments over time is then calculated for every area to indicate whether or not merchants have been shopping for or promoting Bitcoin.