At the moment, inflation is a worldwide intruder that threatens to disrupt the expansion and calm waters of established economies like these in Europe and america.

Increasing vitality, gas oil, and gasoline costs are primarily liable for the present alarming charge of inflation.

At the moment, the useconomy is experiencing its highest inflation charge in 40 years. Information supplied by the usLabor Division signifies that inflation within the nation now sits at 8.2% as of the final publication in September.

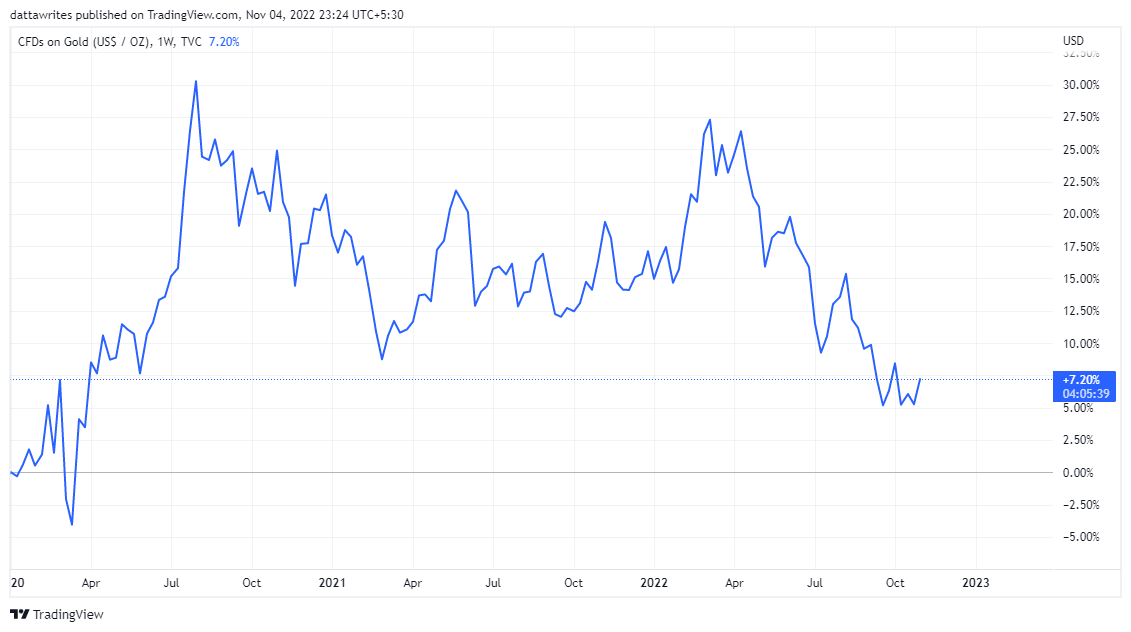

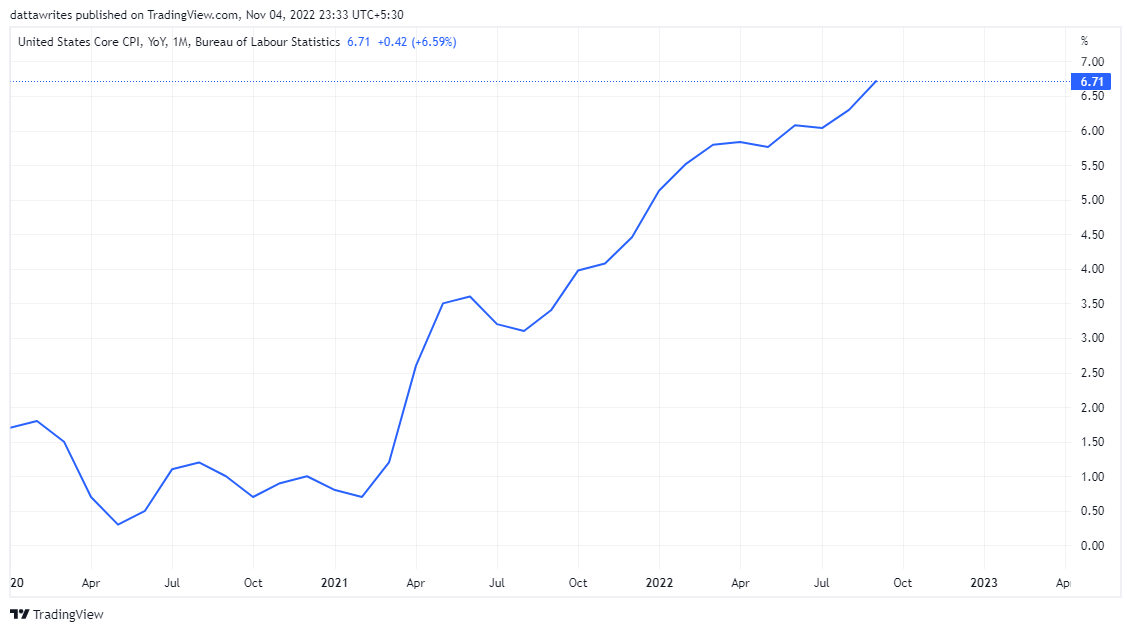

An alarming development of Inflation between 2020 – 2022

In america, the inflation charge reached 7.5% originally of this 12 months, and by June, it reached 9.0%, a lot larger than the 5.4% and 0.6% recorded in June 2021 and 2020.

Might 2020 represents the month with the bottom inflation charge of 0.1% from 2020 to 2022. Nonetheless, the low determine took a pointy nook in Might 2021 by 5.0%. Twelve months later, inflation had already grown to eight.5%, because it ready for an enormous improve within the following month.

This alarming predatory increment hurts each the fast and future state of the useconomy and the residents of the nation. Inflation comes with a common improve within the value of commodities, lowering customers’ buying energy. The Client Worth Index (CPI) has risen by 15.05% since January 2020.

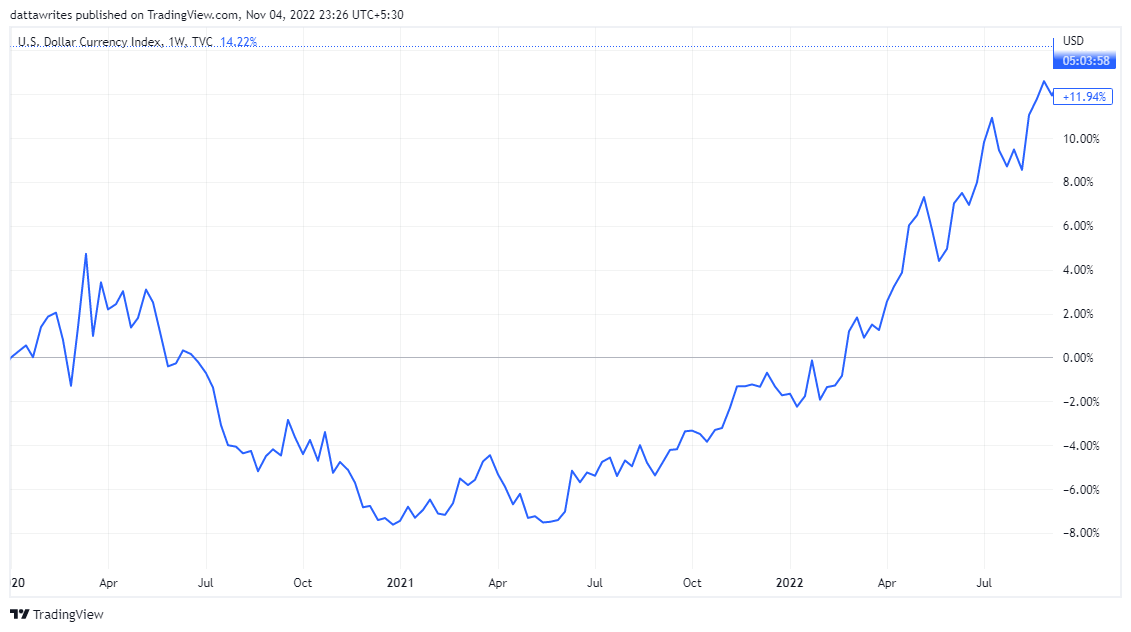

Thus, in the long term, if not checked, inflation might weaken the usdollar.

Even so, the U.S. Greenback has achieved properly in opposition to EUR and GBP. Moreover, that is because of the common inflation that has affected main economies in Europe and the UK.

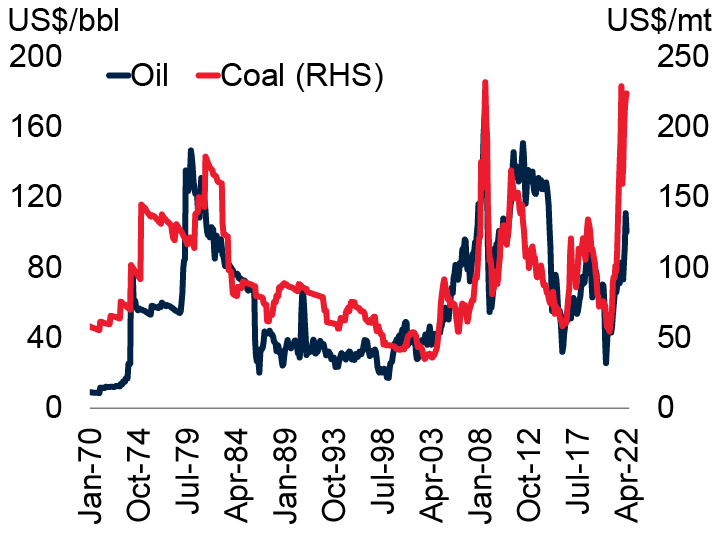

Does the present inflation pattern resemble the causes of inflation within the 70s and 80s?

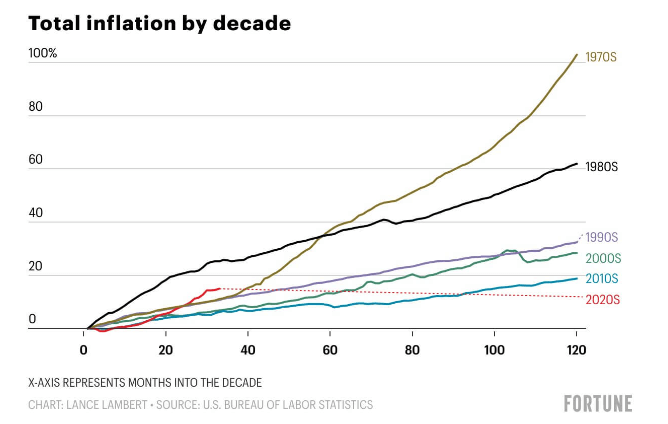

A number of latest comparisons have been drawn between inflation causes within the present decade and people within the Nineteen Seventies and Nineteen Eighties, when the U.S. financial system additionally confronted excessive inflation charges.

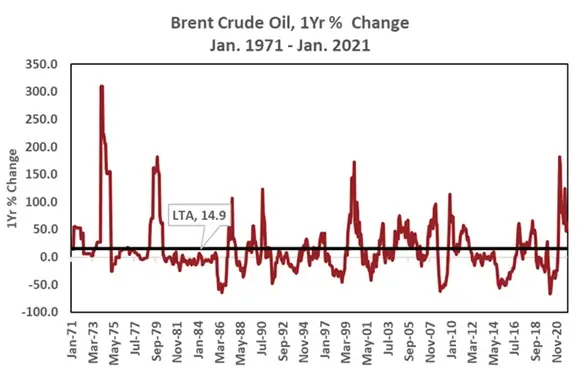

Experiences recommend that oil costs soared by 300% and 180% in 1974 and 1979, respectively. In that interval as properly, geopolitical tensions contributed to vitality shocks and oil value fluctuations.

At the moment, inflation was triggered by OPEC‘s improve in oil costs, generally known as the Oil growth by its members. Prior to now, many of the world’s economies relied closely on oil earlier than looking for options within the current period.

Different elements contributing to inflation through the 70s and 80s included low-interest charges, weak financial development, and decrease inflationary pressures.

Nonetheless, there are pointers that the latest inflation within the present decade began quicker than what was recorded within the earlier a long time.

The U.S. has skilled 15% inflation this decade over 33 months. If this pattern continues, we’re on monitor for a 50% improve this decade.

Fed’s Response to Inflation; Hike in Rates of interest and affect on Jobs within the U.S

In response to the prevailing inflation, the Federal Reserve has raised rates of interest on totally different events inside the 12 months. Just lately, the FED raised rates of interest by 75 foundation factors at its Nov 1-2 assembly for the fourth time in a row.

In the meantime, the increment has been a serious energy of the USD’s sturdy efficiency in opposition to the EUR and GBP, highlighting a powerful development of the US Greenback Index (DXY) by 14.57%.

Nonetheless, there are standing arguments by economists that the Fed may cut back the tempo of the hike in rates of interest originally of 2023.

On a easy observe, the strategy of the Fed will be described as an try to destroy demand whereas encouraging corporations and people to save lots of.

At each alternative, enterprise house owners will cut back their expenditures which may end in a stagnant employment charge, leaving staff’ wages at the established order and discouraging them from spending extra.

Cryptocurrency response to inflation

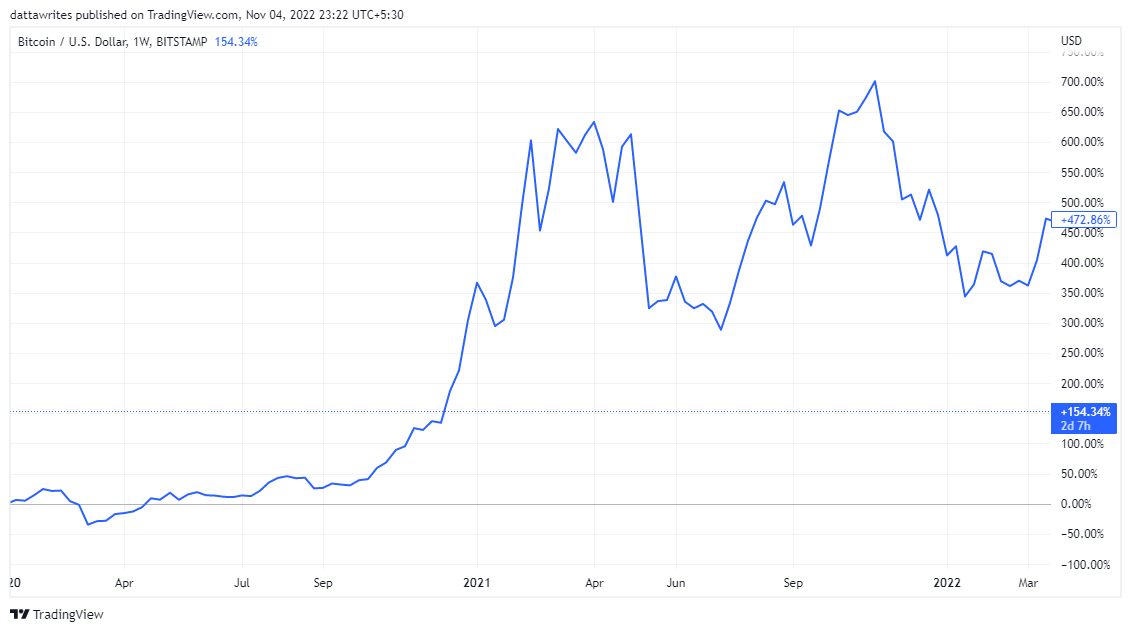

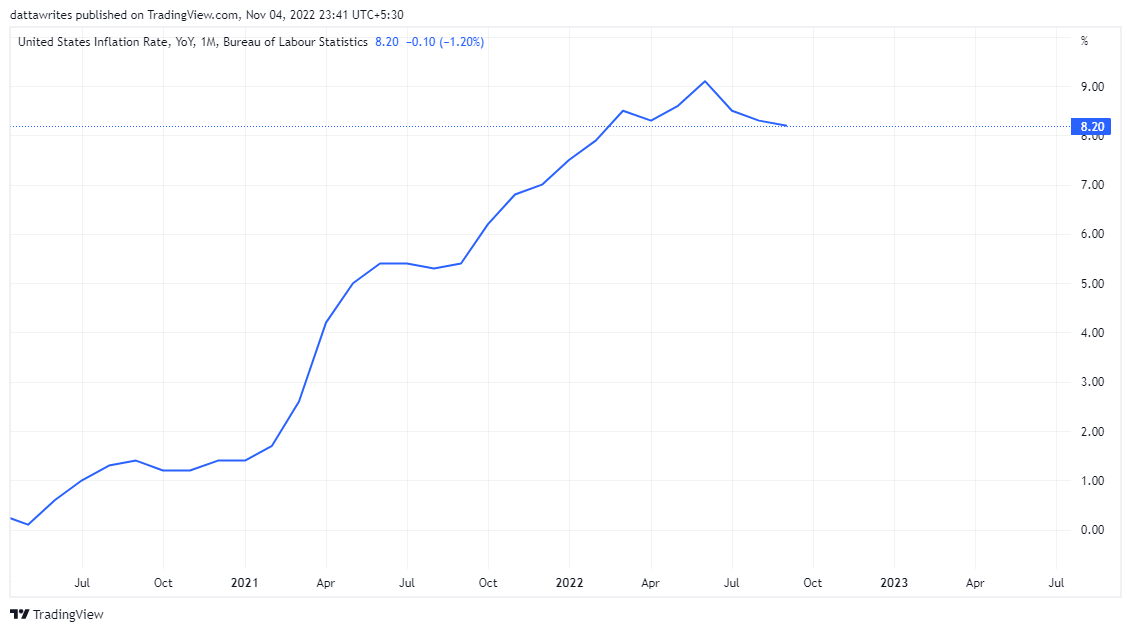

Because the begin of 2020, BTC has been up 184.28%, whereas gold has gone up Gold by solely 5.38%. These figures replicate how cryptocurrency property surged, strongly against conventional property like Gold.

Prior to now, property like Gold gained a lot relevance as an inflation hedge. Nonetheless, Cryptocurrency has confirmed to be a really perfect possibility in comparison with Gold as an funding in opposition to extreme inflation.