Usually an missed a part of the cryptocurrency market, stablecoins can be utilized to find out the present state of the market. Stablecoin steadiness on exchanges represents “dry powder,” or idle liquidity that may turn out to be a robust driving power out there.

The whole stablecoin steadiness on exchanges has solely just lately turn out to be a big issue out there. The quantity of stablecoins on exchanges remained comparatively flat till 2020, with outflows roughly equalling inflows.

Nonetheless, following the 2020 COVID-19 pandemic, the market noticed exponential progress in stablecoin balances on exchanges. In accordance with knowledge from Glassnode analyzed by CryptoSlate, the slight progress of 2020 changed into a parabolic rise at the start of 2021.

The 2 important driving forces behind this progress had been USD Coin and USDT.

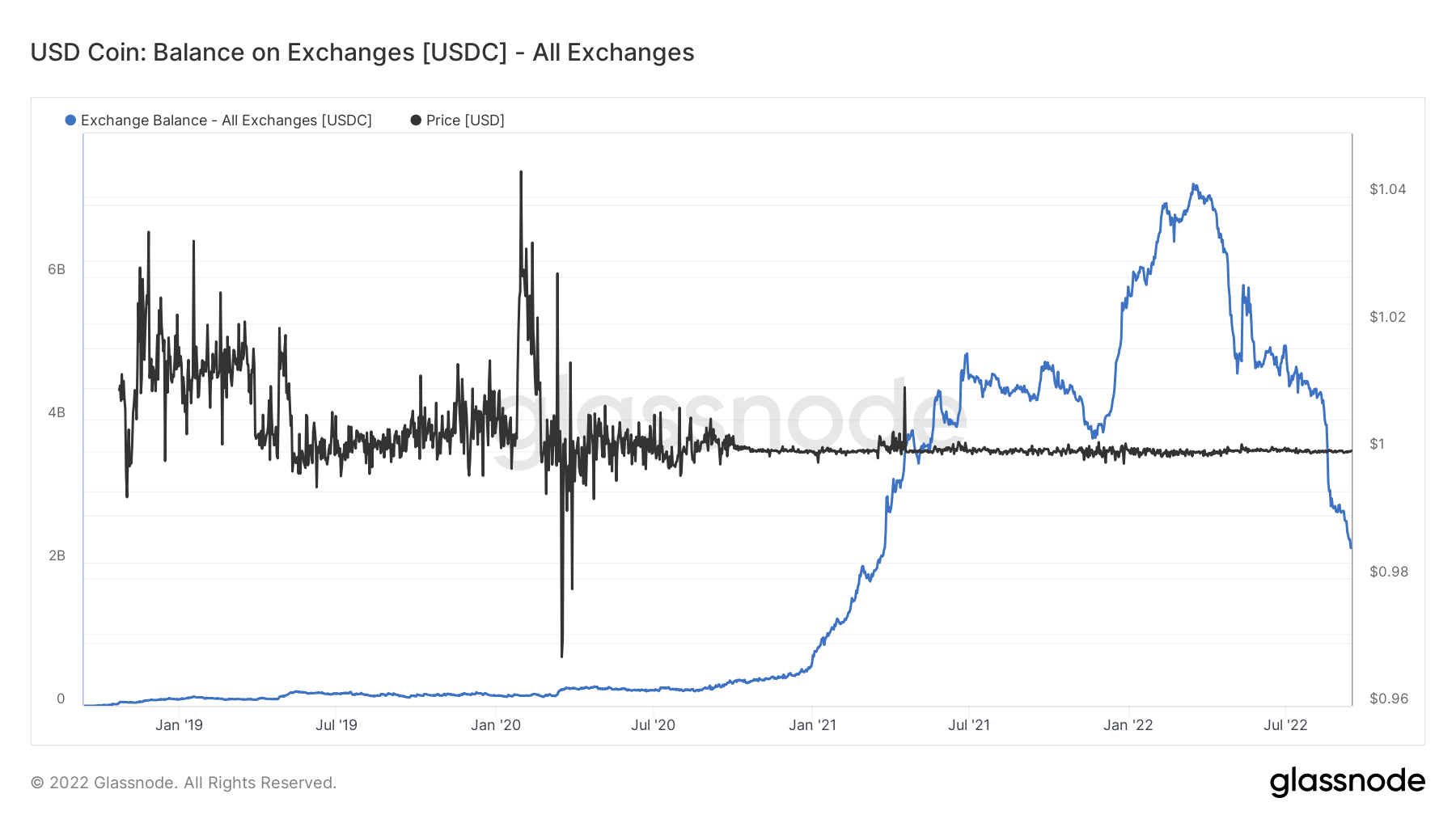

Circle’s USD Coin stood out amongst most different stablecoins almost certainly to take the reign from Tether’s USDT. It reached its peak in February 2022 with over $7 billion USDC sitting on exchanges. It got here surprisingly near USDT and its change steadiness of round $10 billion.

Nonetheless, USDC failed to keep up its progress. Since February 2022, the stablecoin has seen its steadiness on exchanges drop regularly and is now reaching the extent it recorded at the start of 2021 — $2.1 billion.

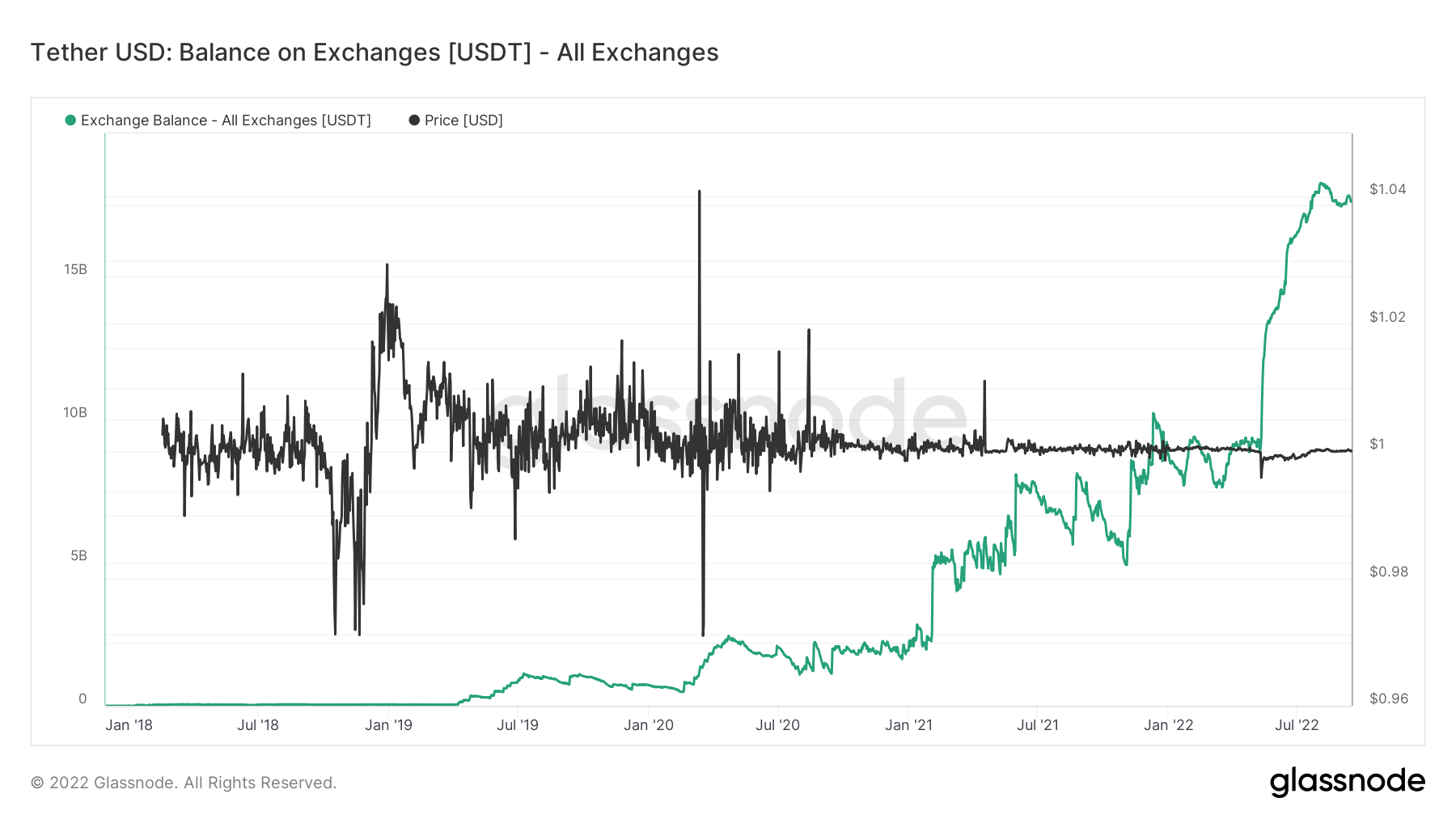

USDC’s diminishing presence on exchanges stands in sharp distinction to USDT. Tether’s stablecoin powerhouse has seen its steadiness on exchanges double in 2022 and now stands at round $17.7 billion.

The divergence between USDC and USDT balances may turn out to be much more important because the quarter progresses. As beforehand lined by CryptoSlate, USDC leaving Binance reached its yearly excessive at the start of September. Within the first week of September, round $1 billion left Binance’s USDC scorching wallets per day.

Whereas this has been in step with the broader business pattern, USDC had topped the charts when it got here to outflows. One of many elements that contributed to its large outflows was Binance’s determination to cease supporting USDC. The change stated it will convert clients’ holdings in USDC, USDP, and TUSD into its native BUSD stablecoin to boost liquidity and capital effectivity.

Binance is the most important cryptocurrency change by buying and selling quantity and the most important change by USDC steadiness. Eradicating help for USDC landed a heavy blow to the stablecoin.

One other important issue that additional deepened the divergence between USDC and USDT was Tether’s latest dedication to transparency. The corporate was broadly criticized for avoiding auditing its money reserves and confirming its claims that USDT was backed with fiat forex reserves.

Initiated by Paolo Ardoino, Tether’s CTO, the corporate has just lately ramped up its efforts to current a clear perception into its reserves, publishing each day values of its fiat forex and gold reserves.