The largest information within the cryptoverse for Oct. 27 contains Vitalik Buterin affirming that crypto is healthier than gold, FTX planning to create its stablecoin, Bitcoin mining agency Core Scientific on the verge of insolvency, and a consumer paying simply $0.08 in charges to settle a transaction of over $500 million on the Bitcoin community.

CryptoSlate High Tales

Buterin says crypto is a greater guess than gold

Zach Weinersmith initiated an argument claiming that Gold was higher than Bitcoin because the former fulfills crypto’s advocacy for cash that’s not centralized.

In response, Ethereum co-founder Vitalik Buterin mentioned crypto is a greater deal, provided that gold is inconvenient to make use of in buying and selling and has no secure storage mechanism for a number of customers.

World’s largest Bitcoin mining agency Core Scientific on the verge of insolvency

Bitcoin mining firm Core Scientific mentioned it could file for chapter quickly, because the rising electrical energy prices and falling Bitcoin costs have rendered its enterprise unprofitable.

With simply 24 BTC and roughly $26.6 million in money, the mining firm mentioned it could not maintain its operation past the tip of 2022, until it succeeds in elevating further capital.

SBF hints FTX may probably create its personal stablecoin

FTX CEO Sam Bankman-Fried was stay with the Huge Whale, the place he hinted at plans to launch a stablecoin for his crypto alternate.

SBF mentioned FTX has been holding on from creating one as a result of it’s collaborating with some stablecoin issuers. Nevertheless, an FTX-backed stablecoin could possibly be launched within the not-too-distant future.

Crew Finance loses $14.5M to good contract bug exploit

Token safety protocol Crew Finance suffered a $14.7 million assault after a hacker exploited a vulnerability in its V2 to V3 migration function.

Consequently, the protocol has suspended all buying and selling actions until the bug is mounted. Nevertheless, it assured customers that the remaining funds are secure and shall be accessible as soon as it resumes operation.

Bitcoin transaction price $500M value $0.80 in charges

About 24,530 BTC price over $500 million was despatched over the Bitcoin community and charged simply $0.83 as a price to execute the transaction inside minutes.

In distinction, conventional fee networks like SWIFT will cost about $15 million, at a 3% alternate charge price to execute a $500 million transaction.

Ethereum turns into fiftieth largest asset by market cap after current value motion

Ethereum’s current value motion to $1,560 noticed the second-largest crypto asset rise to turn into the fiftieth most dear asset on this planet.

With a market cap of $190 billion, Ethereum has surpassed Cisco and Alibaba, whereas gunning to high Toyota and Walt Disney, whose market cap sits at $195 billion.

Messina CEO prepared to guess his Porsche on BTC reaching $60K once more

Bitcoin maximalist Jim Messina mentioned he’s shopping for extra Bitcoin regardless of the declining value. He added that he may guess his Porsche that Bitcoin will return to $60,000.

Analysis Spotlight

A deep-dive into Bitcoin hash charge, causes behind enhance, and whether or not it is going to rise once more

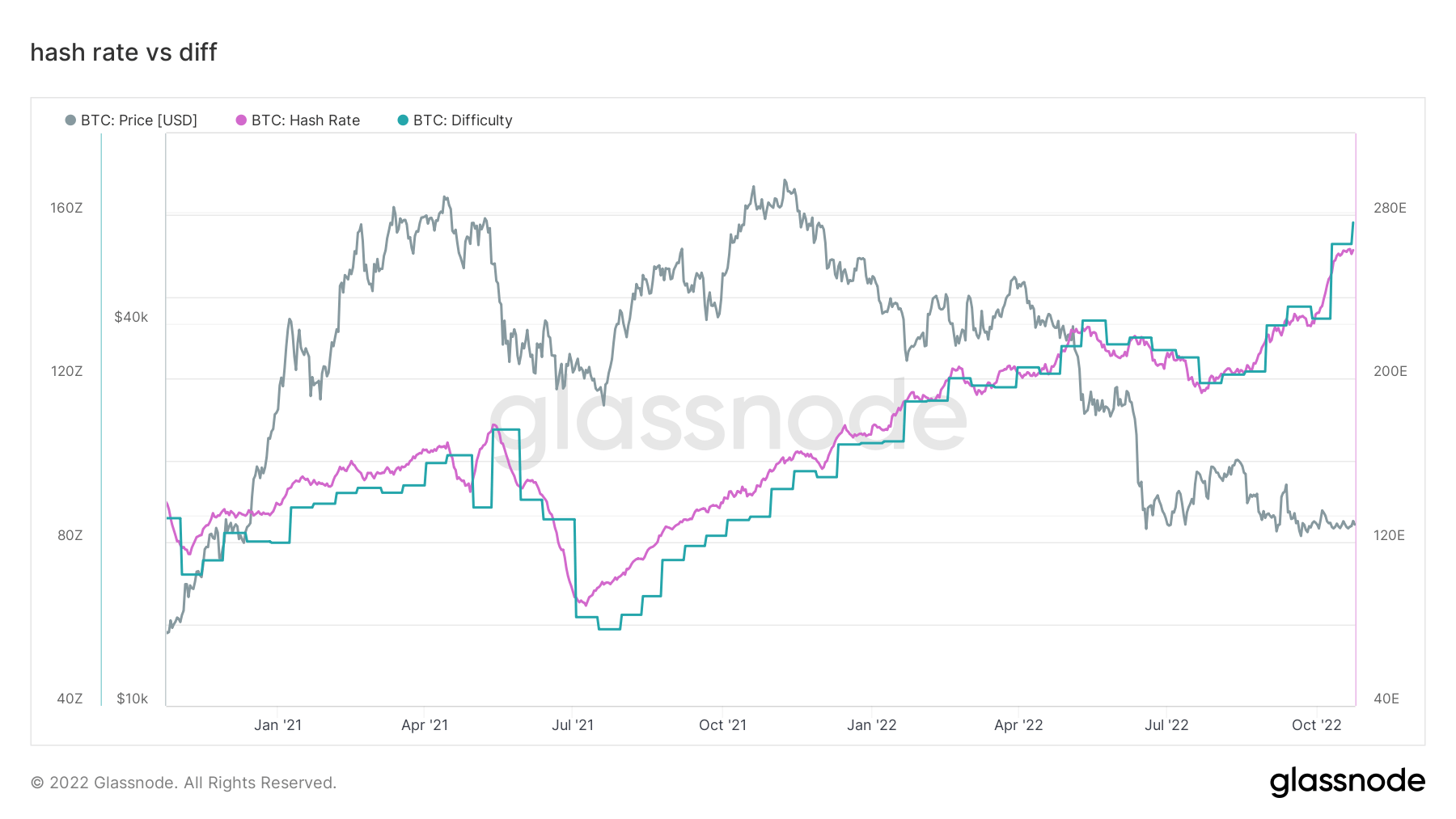

CryptoSlate evaluation confirmed that Bitcoin mining issue and hash charge have been making new all-time highs because the begin of the yr regardless of declining Bitcoin value.

Earlier on Jan. 21, the Bitcoin mining issue reached a excessive of 26.64 trillion. By Feb. 18, it had surged to 27.97 trillion. Nevertheless, Oct. 24 recorded the very best spike ever because the mining issue reached at 36.84 trillion, whereas the hash charge sits at 260 EH/s.

A potential clarification for the sustained surge could possibly be linked to the Ethereum merge. Put up-merge, ETH miners flocked into the Bitcoin ecosystem resulting in the elevated issue of processing transactions on the community.

Information from across the Cryptoverse

LooksRare provide zero-royalty buying and selling

LookRare mentioned it is going to direct 25% of its protocol price to pay NFT creators as royalties. For buying and selling rewards, 95% will go to the vendor, whereas the client receives a cash-back of 5%.

Huobi to delist its HUSD stablecoin

Crypto alternate Huobi introduced that will probably be delisting its native HUSD stablecoin. All pending HUSD on the crypto alternate shall be transformed to USDT earlier than it’s delisted on Oct. 28.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) decreased by -0.51% to commerce at $20,648, whereas Ethereum (ETH) additionally elevated by +0.03% to commerce at $1,563.