Nothing shines a lightweight on the significance of vitality as a lot as a fast-approaching winter. When the temperature drops, the shortage of vitality turns into apparent and world efforts to protect it start.

This yr, the combat for vitality is extra aggressive than it’s ever been.

The fiscal and financial insurance policies set in place in the course of the COVID-19 pandemic brought about harmful inflation in virtually each nation on the planet. The quantitative easing that got down to curb the implications of the pandemic resulted in a traditionally unprecedented enhance within the M2 cash provide. This choice diluted the buying energy and led to a rise in vitality costs, sparking a disaster that’s set to culminate this winter.

CryptoSlate evaluation confirmed that the E.U. will probably be the one hit the toughest by the vitality disaster.

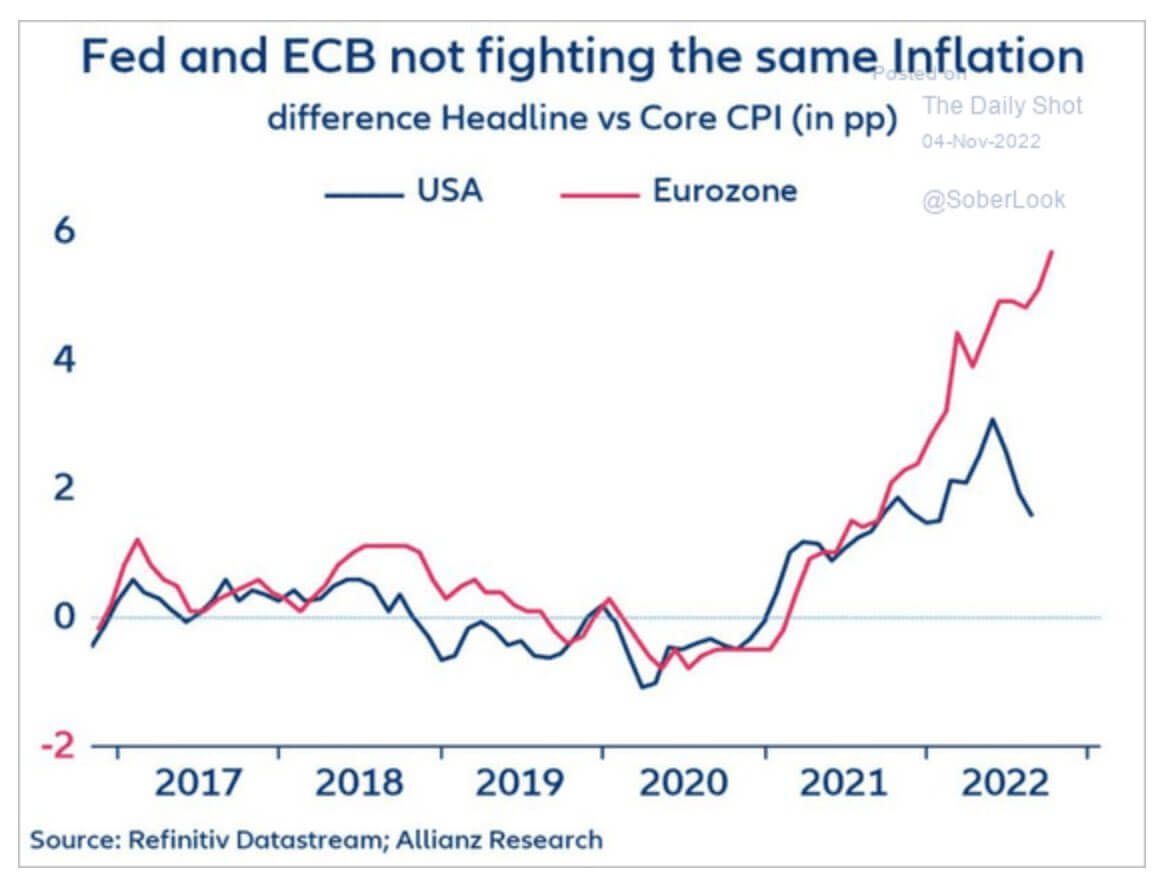

The European Central Financial institution (ECB) has been struggling to maintain core inflation down this yr. The Core Shopper Worth Index (CPI) started to extend considerably in 2021 because of the pandemic each within the U.S. and the E.U.

The U.S. has seen its Core CPI lower sharply since its end result in February and posted better-than-expected outcomes final month. Nevertheless, Core CPI within the Eurozone has continued to extend all year long and presently reveals no signal of stopping.

An identical enhance in Core CPI will also be seen in Japan and the U.Okay. One of many components that will have contributed to their financial instability is an absence of funding and assist for commodities like oil and gasoline. Widespread efforts to modify to renewable sources of vitality led to a lower in oil and gasoline purchases within the E.U. and the U.Okay.

In distinction, the U.S. and Russia have been investing closely in oil and gasoline and selling innovation within the area.

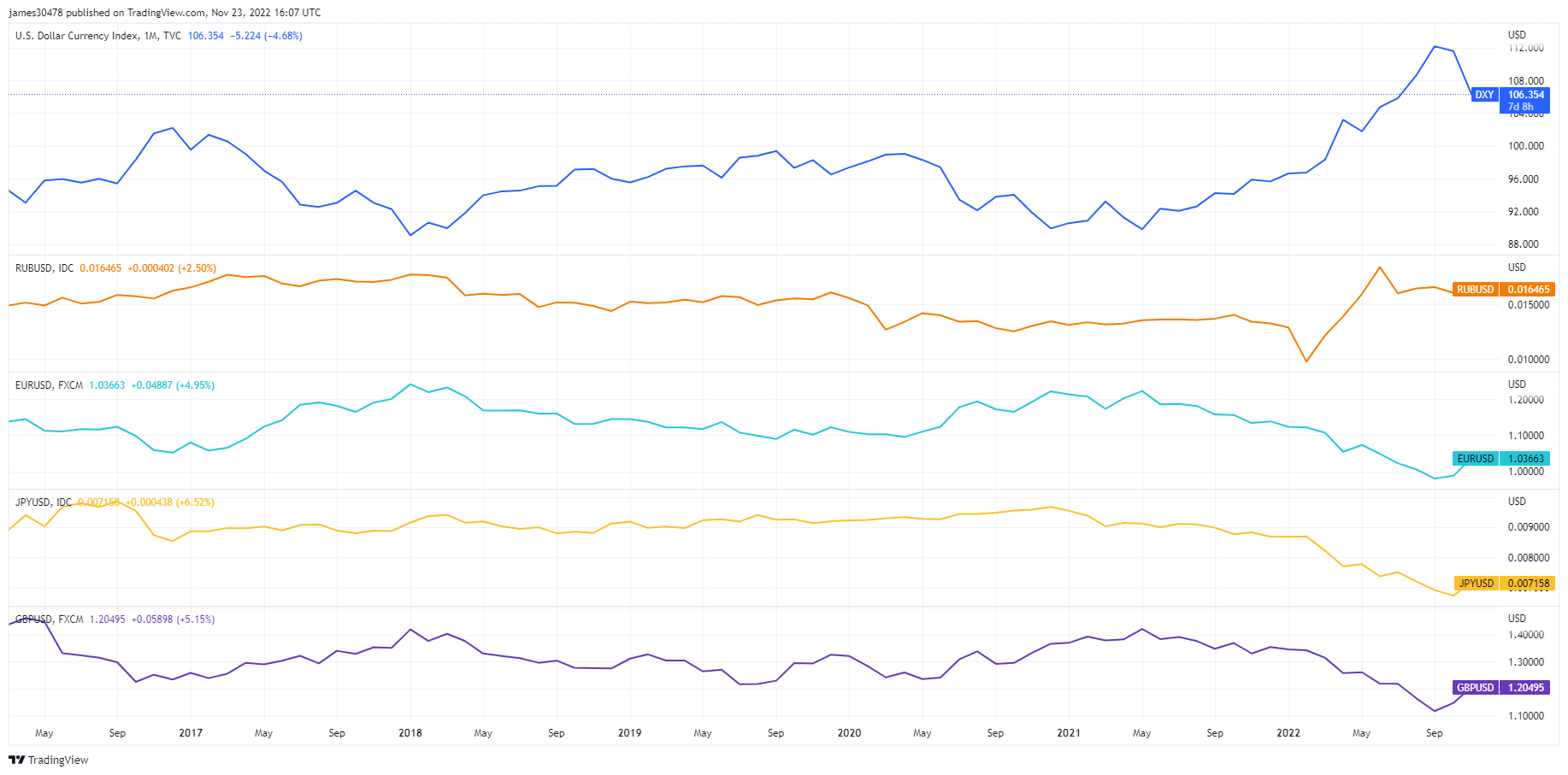

Wanting on the worth of fiat currencies in opposition to the U.S. greenback additional confirms this influence.

The Russian Ruble and the DXY have each elevated in worth prior to now two years, whereas the euro, British Pound, and Japanese Yen have all seen their Greenback worth lower.

With rising inflation and a critically weakened forex, the E.U. can have a tough time competing for oil and gasoline on the worldwide market. Pure gasoline producers warned that the majority long-term contracts for pure gasoline popping out of the U.S. have been bought out till 2026. Till then, when a brand new wave of pure gasoline provide is predicted to come back, the E.U. must compete with Asia for the restricted provide and swallow the excessive gasoline value.

All of this uncertainty may have a optimistic impact on Bitcoin. Whereas the broader crypto market struggles to stay afloat after the FTX fallout, Bitcoin has positioned itself as a pillar of stability in a market plagued with dangerous actors. Devalued fiat currencies may push retail traders away from safe-haven property like gold and commodities and in the direction of an asset like Bitcoin.