Macro Overview

Fed scores a hat-trick

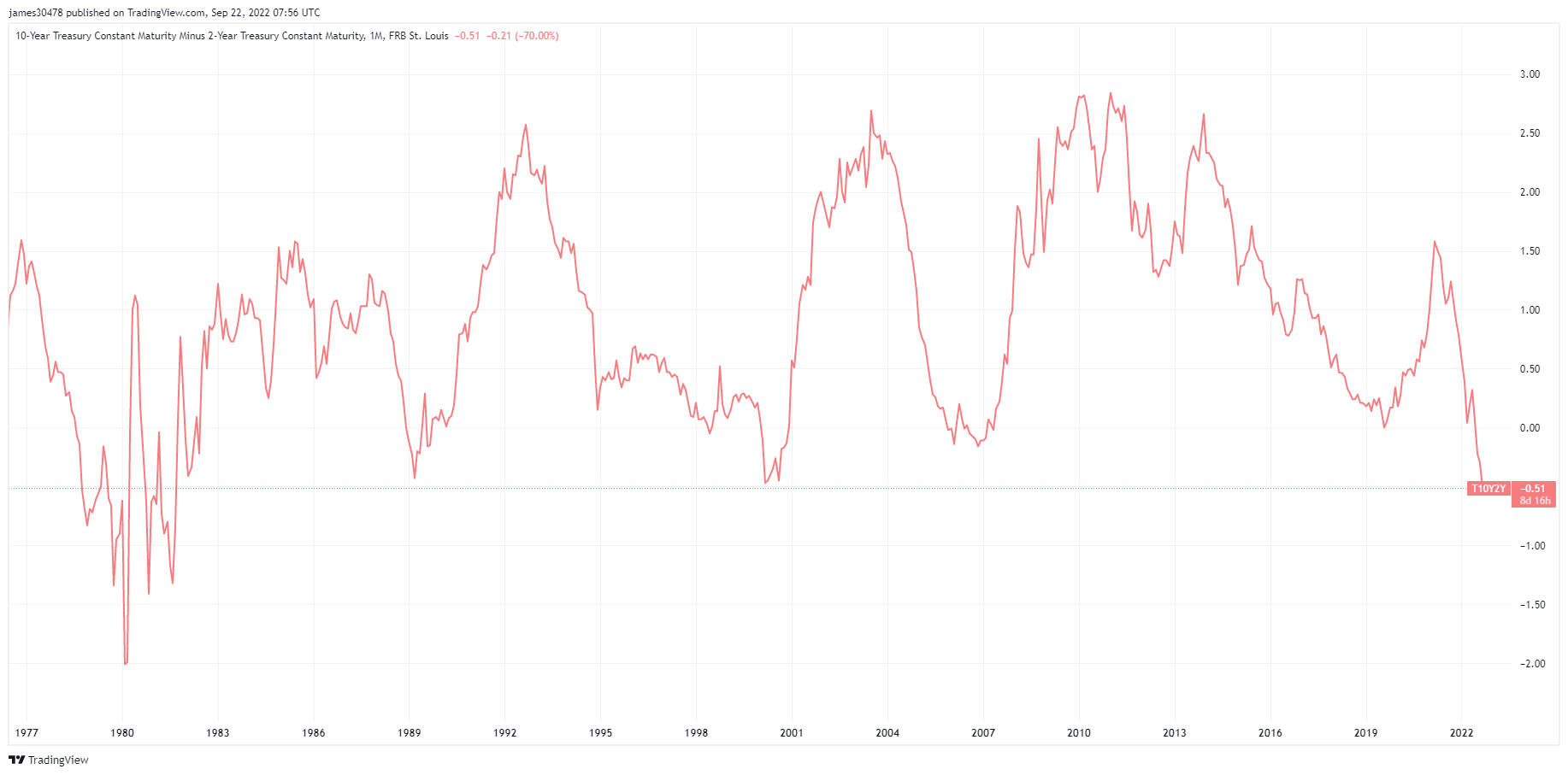

The fed delivered its third consecutive 75 foundation level hike accompanied by larger forecasts of future charges, pushing the greenback index and stuck earnings yields to new highs. Volatility throughout all asset courses had picked up, which had seen the ten-year minus two-year yields ultimately shut the widest because the 12 months 1988.

The FOMC’s 75bps hike took the goal vary from 3% to three.25%, with forecasts for the benchmark projected to succeed in the top of 2022 at 4.4%. Unemployment for 2023 elevated to 4.4% from 3.9%, with fee hikes anticipated to chill the labor market.

In consequence, the Euro hit its lowest level since 2002 vs. USD (0.96). The pound dropped to 1.08, and USDJPY had smashed by 145, with 10- 12 months Japanese authorities bonds nonetheless hitting 0.25%.

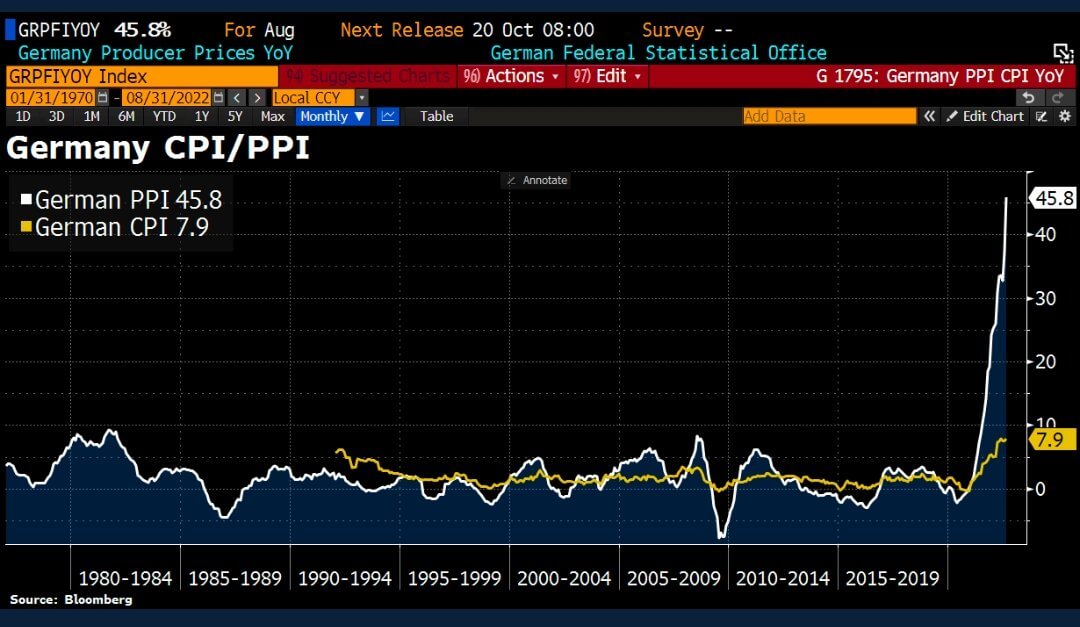

Weimar Republic II

German August Producer Costs Index (PPI) surged 45.8% (vs. 37.1% anticipated) from a 12 months in the past. This was pushed primarily by hovering vitality costs, elevating probabilities of larger CPI inflation within the subsequent studying.

Regarding vitality, PPI rose nearly 15% in comparison with August 2021; nevertheless, vitality costs have been twice as excessive as in the identical interval final 12 months, a rise of 139%. This might be why vitality costs aren’t thought of within the CPI print, as central banks must improve rates of interest aggressively.

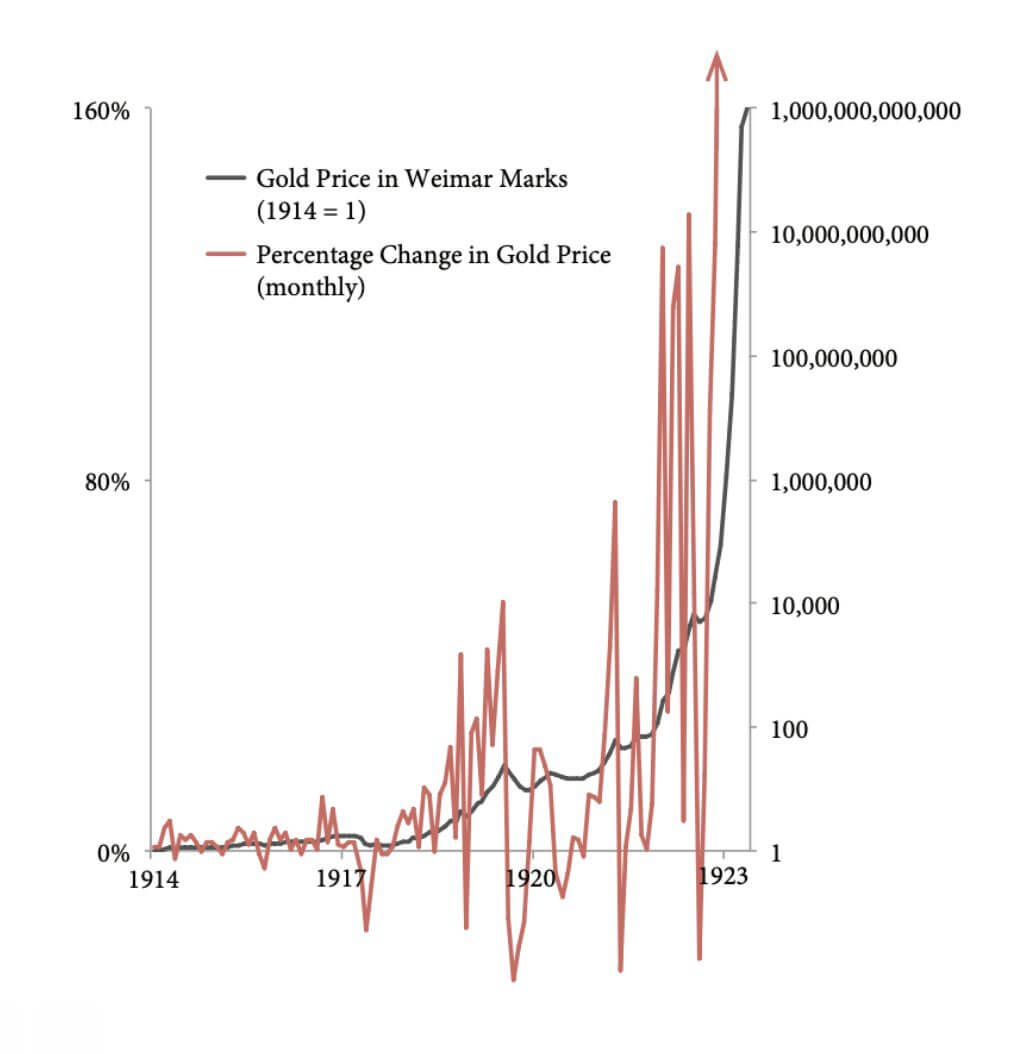

Germans have unhealthy recollections of hyperinflation because it affected the German Papiermark, the forex of the Weimar Republic, within the early Twenties. To pay for the reparations of WW1, Germany suspended the gold customary (convertibility of its forex to gold). The Germans used to pay conflict reparations by mass printing financial institution notes to purchase international forex to pay for the reparations, which led to larger and larger inflation.

“A loaf of bread in Berlin that price round 160 Marks on the finish of 1922 price 200,000,000,000 Marks by late 1923”- Historical past Each day

The gold value in Weimar Marks in 1914 equaled 1, as golds provide elevated solely round 2% a 12 months, a comparatively secure asset. Nonetheless, inside the subsequent decade, the proportion change in gold value fluctuated as a result of the denominator (Weimar Marks) elevated drastically within the cash provide.

An identical state of affairs occurred within the 2020s, as Bitcoin has related traits to gold. Bitcoin is unstable in nature but additionally exasperated because of the improve in M2 cash provide (consisting of M1 plus financial savings deposits).

Correlations

Manipulation of forex

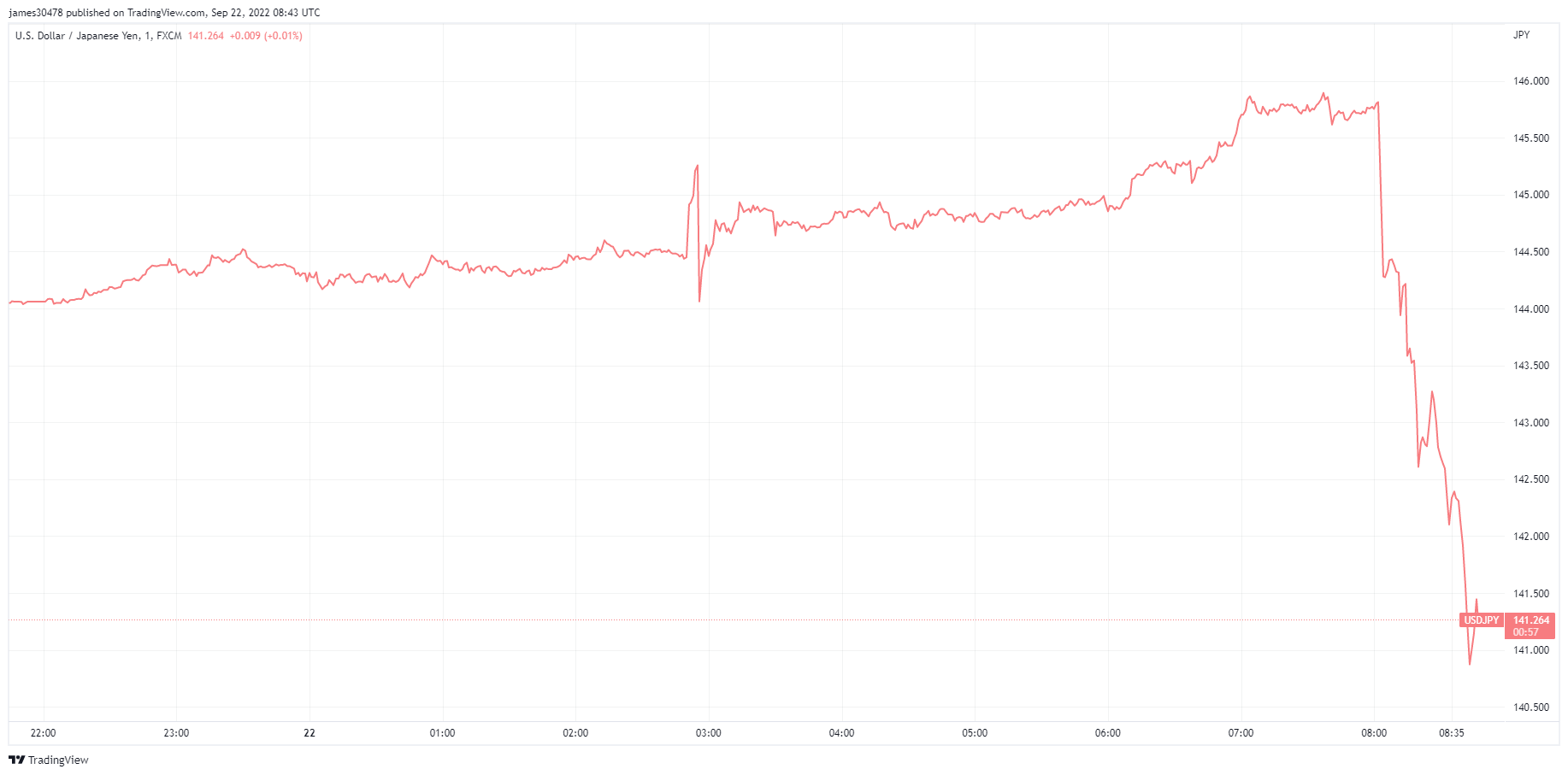

The Financial institution of Japan left its coverage fee unchanged at damaging 0.1% and dedicated to conserving the ten-year treasury to 0.25%, sending the yen to a 24-year low towards the greenback.

Nonetheless, on Sept 22, Japan’s high forex diplomat Kanda confirmed they intervened within the FX market. The Japanese authorities stepped into the market to purchase yen for {dollars} and performed the primary FX intervention since June 1998. The yen soared towards the DXY, dropping from 145 to 142.

“Should you manipulate the important thing side of cash, you manipulate all of our time. And when you may have manipulation in cash, you may have, you MUST have misinformation in all places in society… Bitcoin is the other system. Hope, reality, higher future. Spend time there.” – Jeff Sales space.

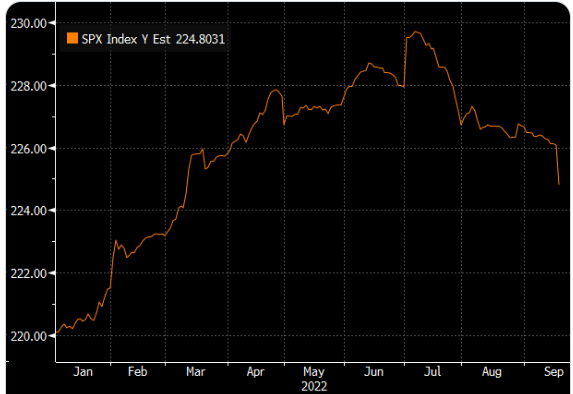

Equities & Volatility Gauge

The Customary and Poor’s 500, or just the S&P 500, is a inventory market index monitoring the inventory efficiency of 500 massive firms listed on exchanges in the USA. S&P 500 3,693 -4.51% (5D)

The Nasdaq Inventory Market is an American inventory alternate based mostly in New York Metropolis. It’s ranked second on the listing of inventory exchanges by market capitalization of shares traded, behind the New York Inventory Trade. NASDAQ 11,311 -4.43% (5D)

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the approaching 30 days. Buyers use the VIX to measure the extent of danger, concern, or stress available in the market when making funding selections. VIX 30 8.37% (5D)

Equities proceed to plunge

Equities tried to placed on a courageous face however continued to get battered by rising rates of interest. Thus far, in 2022, fairness markets have been downgraded massively in valuations. With the top of the quarter and quarterly earnings season approaching, anticipate downgrades in earnings to proceed this onslaught.

As provide chains proceed to interrupt down, the price of capital will increase, and a surging DXY are all liabilities for public firms. Count on to see the unemployment fee begin to spike from This fall onwards.

Commodities

The demand for gold is set by the quantity of gold within the central financial institution reserves, the worth of the U.S. greenback, and the will to carry gold as a hedge towards inflation and forex devaluation, all assist drive the worth of the valuable steel. Gold Worth $1,644 -2.00% (5D)

Much like most commodities, the silver value is set by hypothesis and provide and demand. It is usually affected by market situations (massive merchants or buyers and brief promoting), industrial, industrial, and client demand, hedge towards monetary stress, and gold costs. Silver Worth $-4 -3.64% (5D)

The worth of oil, or the oil value, usually refers back to the spot value of a barrel (159 litres) of benchmark crude oil. Crude Oil Worth $79 -7.56% (5D)

Don’t get left holding the true property bag

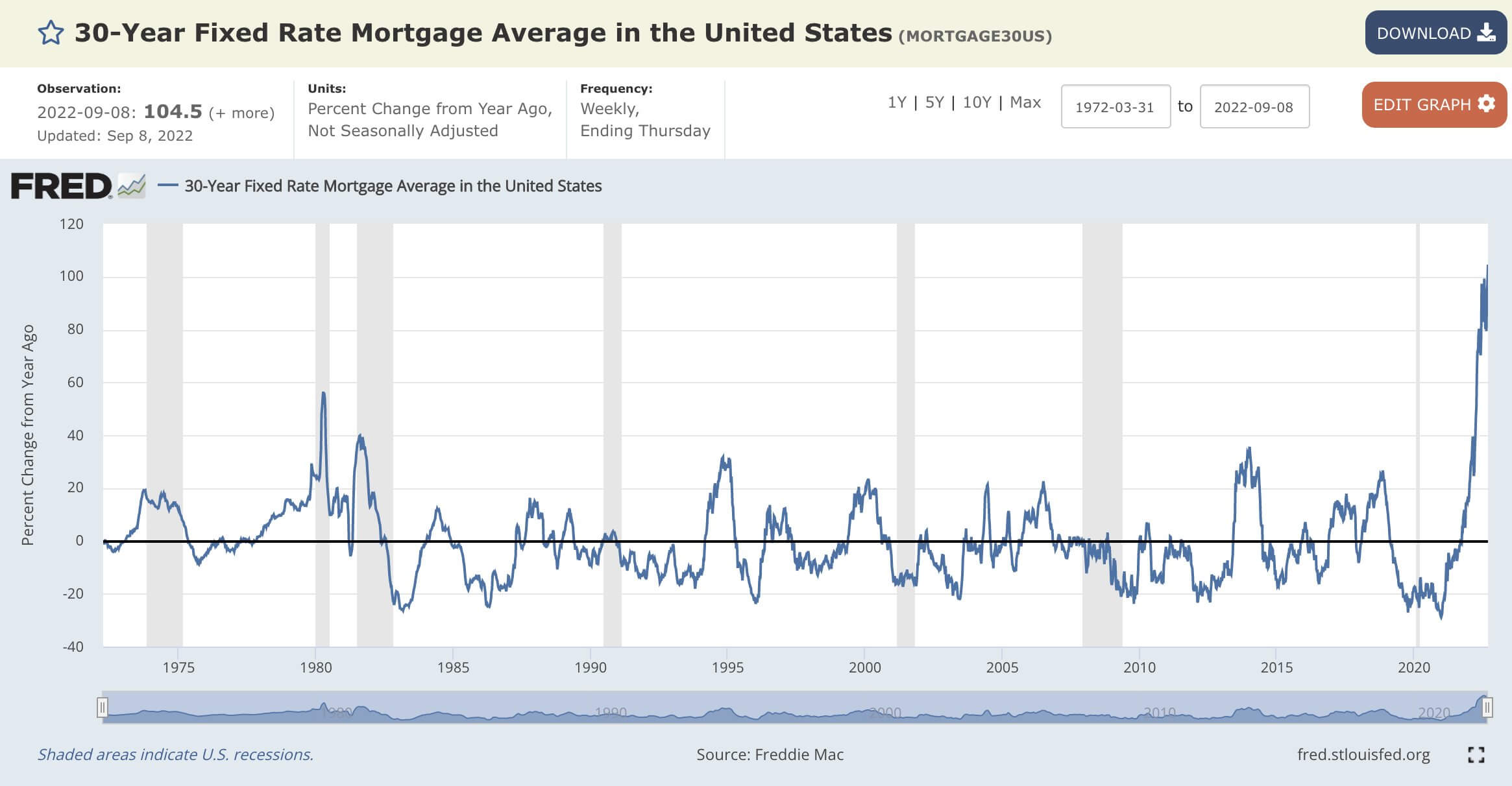

The typical mounted 30-year mortgage fee has accelerated by +104.5% on a year-over-year foundation. This seems to be the quickest change fee because the knowledge was collected in 1972.

The present 30-year mounted mortgage on Sept. 21 was 6.47% highest since 2008; it was simply 2.86% in September 2020.

September 2020: a median dwelling value of $337k with a 30-year mortgage fee of two.86% would see a complete paid over 30 years of $502k.

Nonetheless, in comparison with September 2022: a median dwelling value of $440k with a 30-year mortgage fee of 6.47% would see a complete paid over 30 years of $998k.

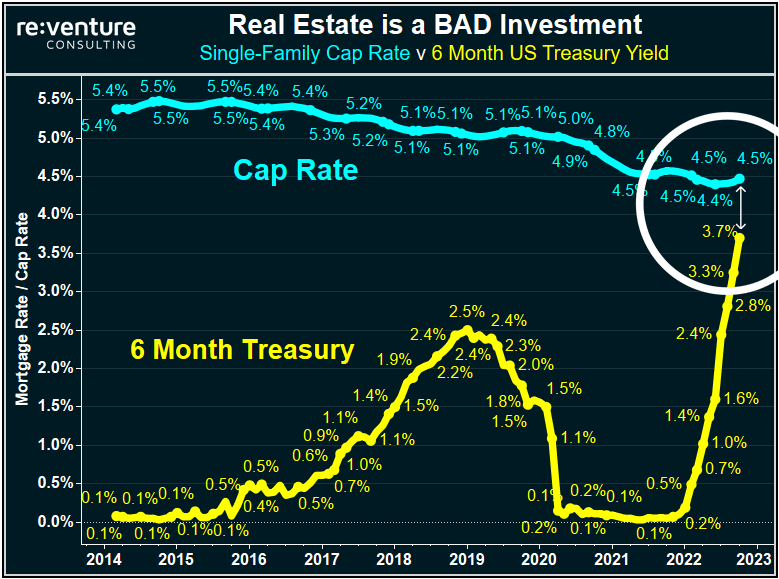

Issues proceed to pile up for actual property buyers. The one-family cap fee vs. six-month US treasury yield identifies why actual property is a legal responsibility with rising rates of interest. The 6-Month US Treasury now yields nearly the identical, if no more, in sure states as shopping for & renting out a home in America (aka Cap Fee).

Actual property has much less incentive for buyers to be in these markets resulting from costs taking place. The following obvious signal is decreased investor demand and margin calls to promote properties and get the asset off the books. Every time the federal reserve will increase rates of interest, the capital price will increase on present portfolios. A pattern to observe is to see wall road and large banks trying to exit as rapidly as doable, as they’ve already earned their charges.

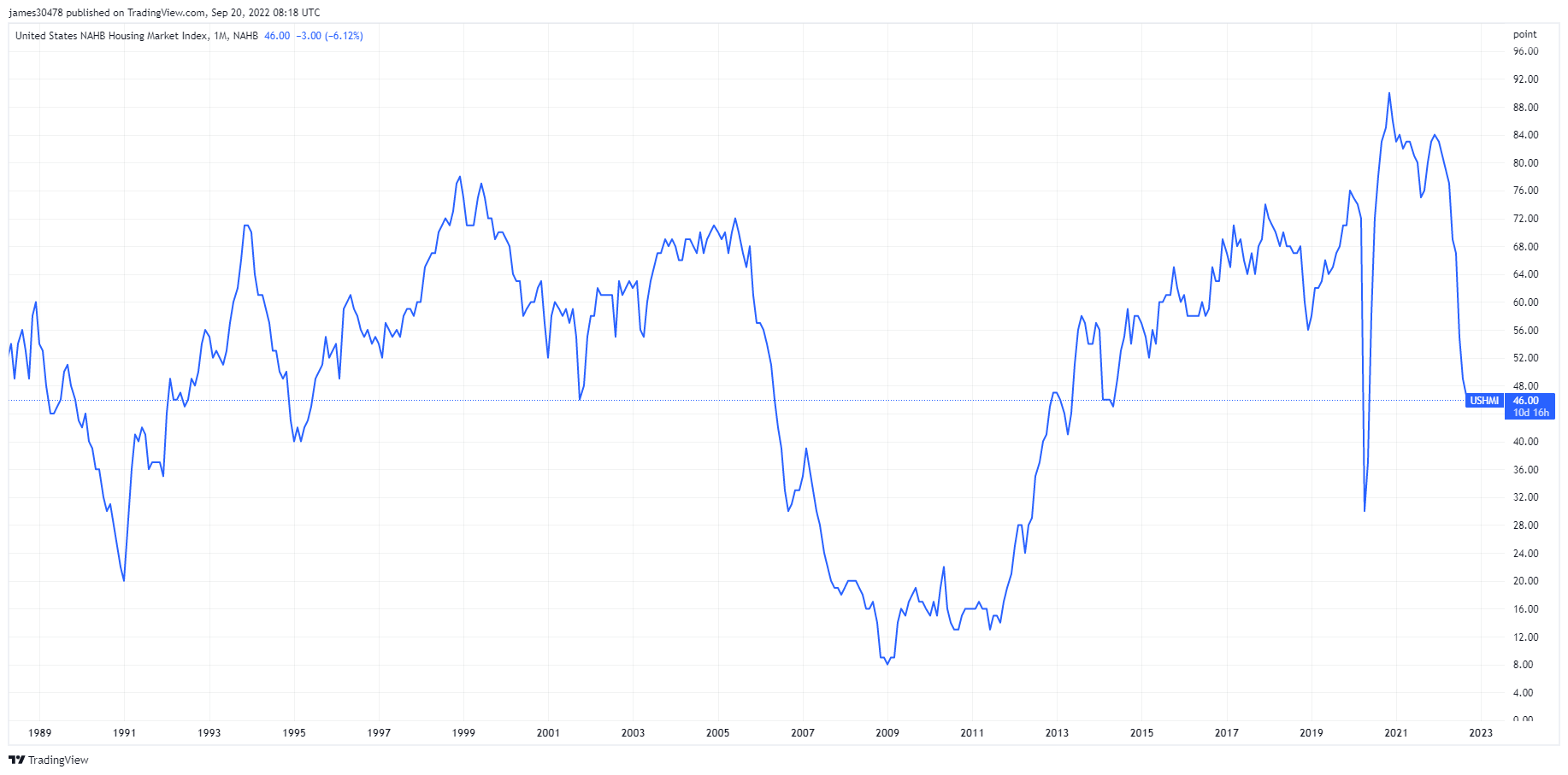

One other indicator that signifies a darkening outlook for US homebuilders is the NAHB housing market index which got here out on Sept. 19. The index fell for a ninth consecutive month and by greater than anticipated in September. The index is threatening to sink to ranges final seen in the course of the housing disaster between 2006 and 2013, with exercise in gross sales within the new properties market nearly grinding to a halt.

Charges & Forex

The ten-year Treasury word is a debt obligation issued by the USA authorities with a maturity of 10 years upon preliminary issuance. A ten-year Treasury word pays curiosity at a set fee as soon as each six months and pays the face worth to the holder at maturity. 10Y Treasury Yield 3.68% 6.78% (5D)

The U.S. greenback index is a measure of the worth of the U.S. greenback relative to a basket of foreign currency echange. DXY 112.97 3.09% (5D)

60/40 portfolio is bleeding out

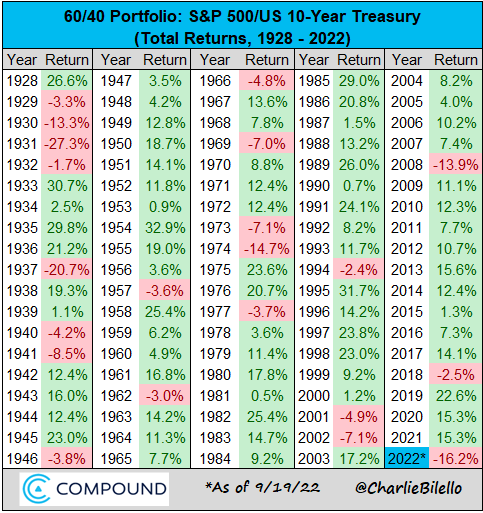

The 60/40 portfolio has served buyers effectively for the previous 40 years, with low inflation, volatility, and falling rates of interest. The balanced portfolio would see 60% in equities and 40% in bonds.

Why was this technique the last word insurance coverage

- Robust danger: in an period of low-interest charges, the buy-and-hold technique was good for equities. On the similar time, bonds offered portfolio insurance coverage throughout market stress, particularly in the course of the 2000 tech growth and GFC.

- A number of disinflationary forces, resembling globalization, the expansion of China, and growing old demographics and contained inflation.

Why it isn’t anymore

- Susceptible to inflation: buyers acquired cheap nominal returns within the Nineteen Seventies, however when you think about excessive inflation, portfolios misplaced a big worth. In an inflationary surroundings, bonds undergo greater than equities; they won’t defend the elemental significance of portfolios.

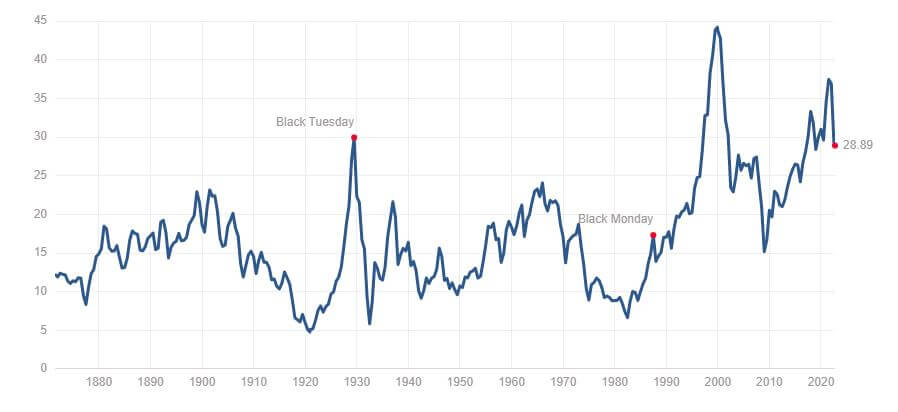

- Based on the CAPE ratio, bonds and equities have been close to all-time valuations. The ratio is calculated by dividing an organization’s inventory value by the common of the corporate’s earnings for the final ten years, adjusted for inflation. The present ratio is valued at round 29, coming down from ranges of 35. The index is at related ranges to black Tuesday (1929 nice melancholy) and considerably extra elevated than the GFC.

A 60/40 portfolio of US shares/bonds is down 16.2% in 2022, which is on tempo for its worst calendar 12 months since 1937.

Bitcoin Overview

The worth of Bitcoin (BTC) in USD. Bitcoin Worth $19,042 -2.58% (5D)

The measure of Bitcoin’s whole market cap towards the bigger cryptocurrency market cap. Bitcoin Dominance 40.61% -1.82% (5D)

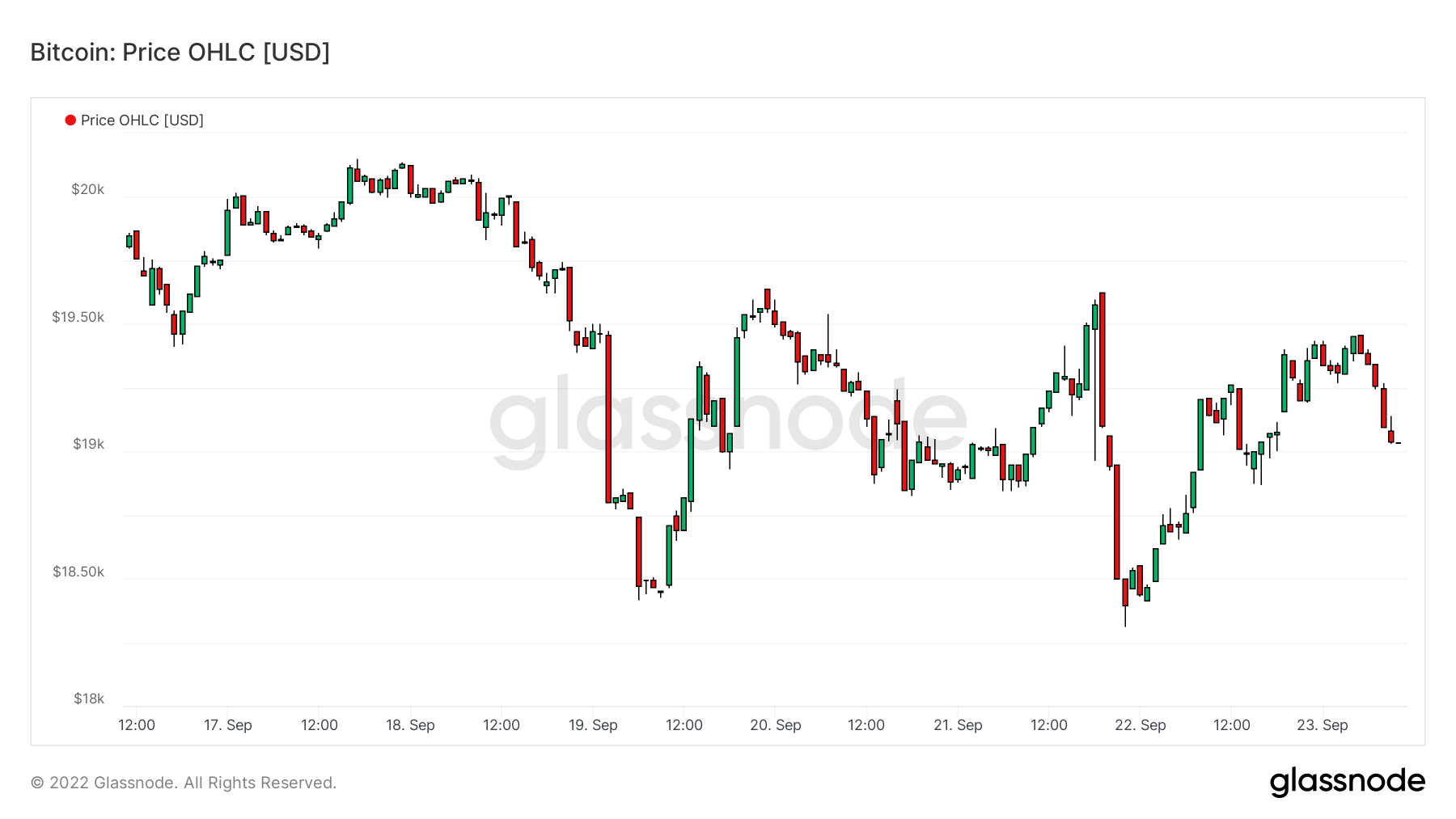

- Bitcoin has been ranging between the $18k and $20k vary for the week commencing Sept. 19

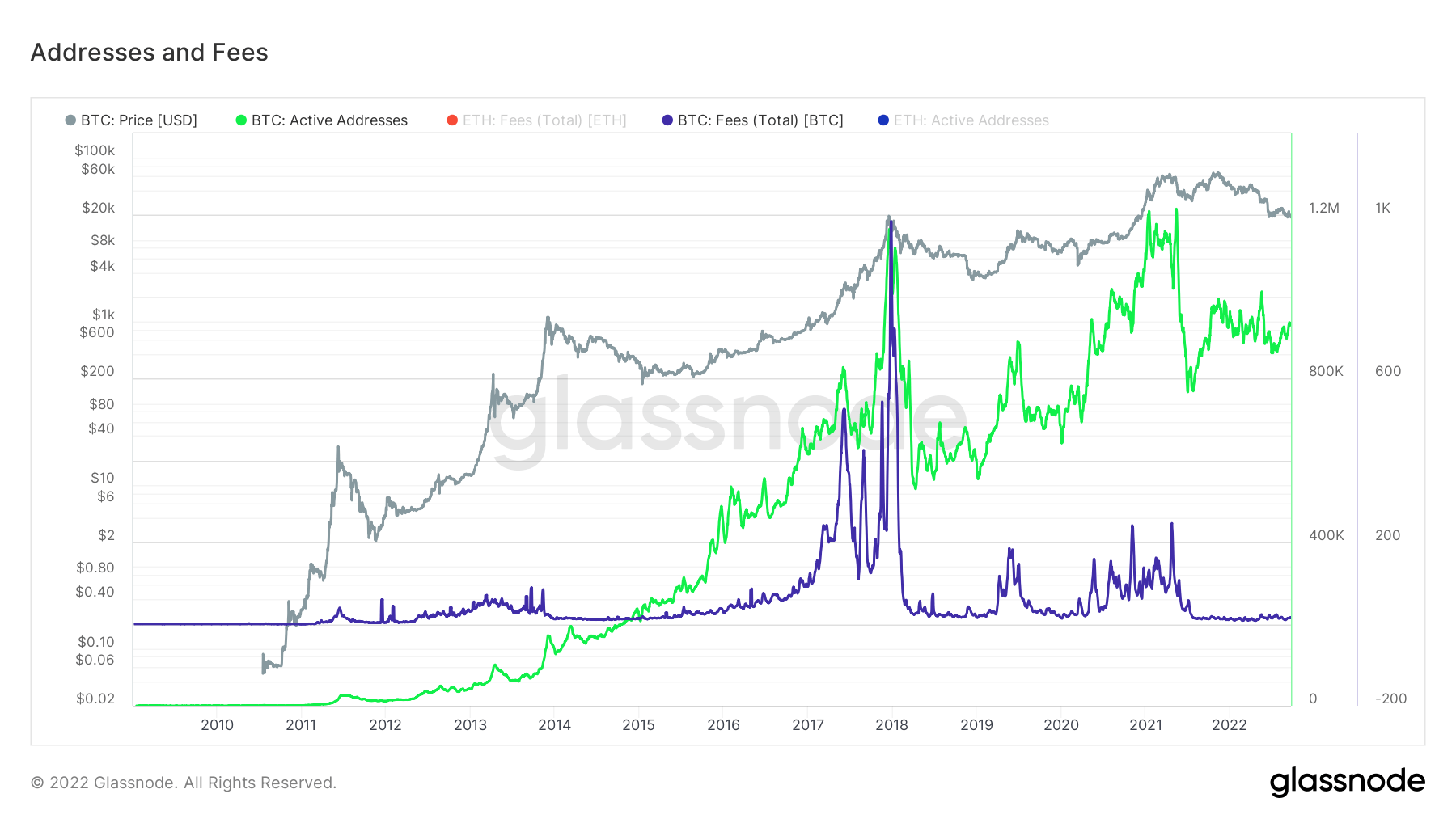

- Addresses and gasoline charges are at multi-year lows.

- MicroStrategy bought an extra 301 Bitcoins on Sept. 9; MicroStrategy now holds 130,000 Bitcoin.

- Miners’ income continues to get squeezed.

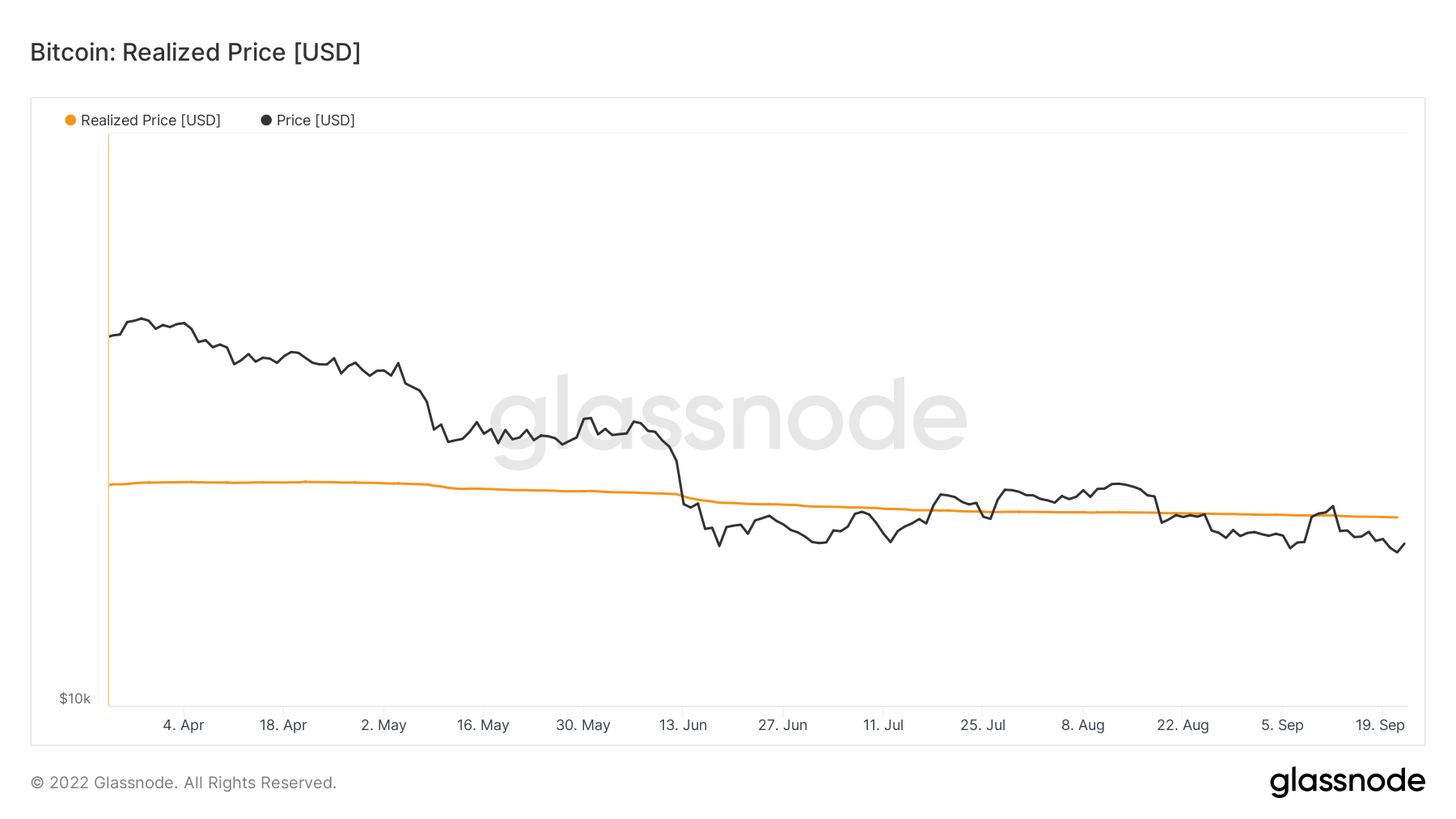

- BTC has been wrestling with the realized value because it went beneath it in mid-June

Addresses

Assortment of core handle metrics for the community.

The variety of distinctive addresses that have been lively within the community both as a sender or receiver. Solely addresses that have been lively in profitable transactions are counted. Lively Addresses 862,692 -9.54% (5D)

The variety of distinctive addresses that appeared for the primary time in a transaction of the native coin within the community. New Addresses 2,799,904 -4.16% (5D)

The variety of distinctive addresses holding 1 BTC or much less. Addresses with ≥ 1 BTC 904,423 0.24% (5D)

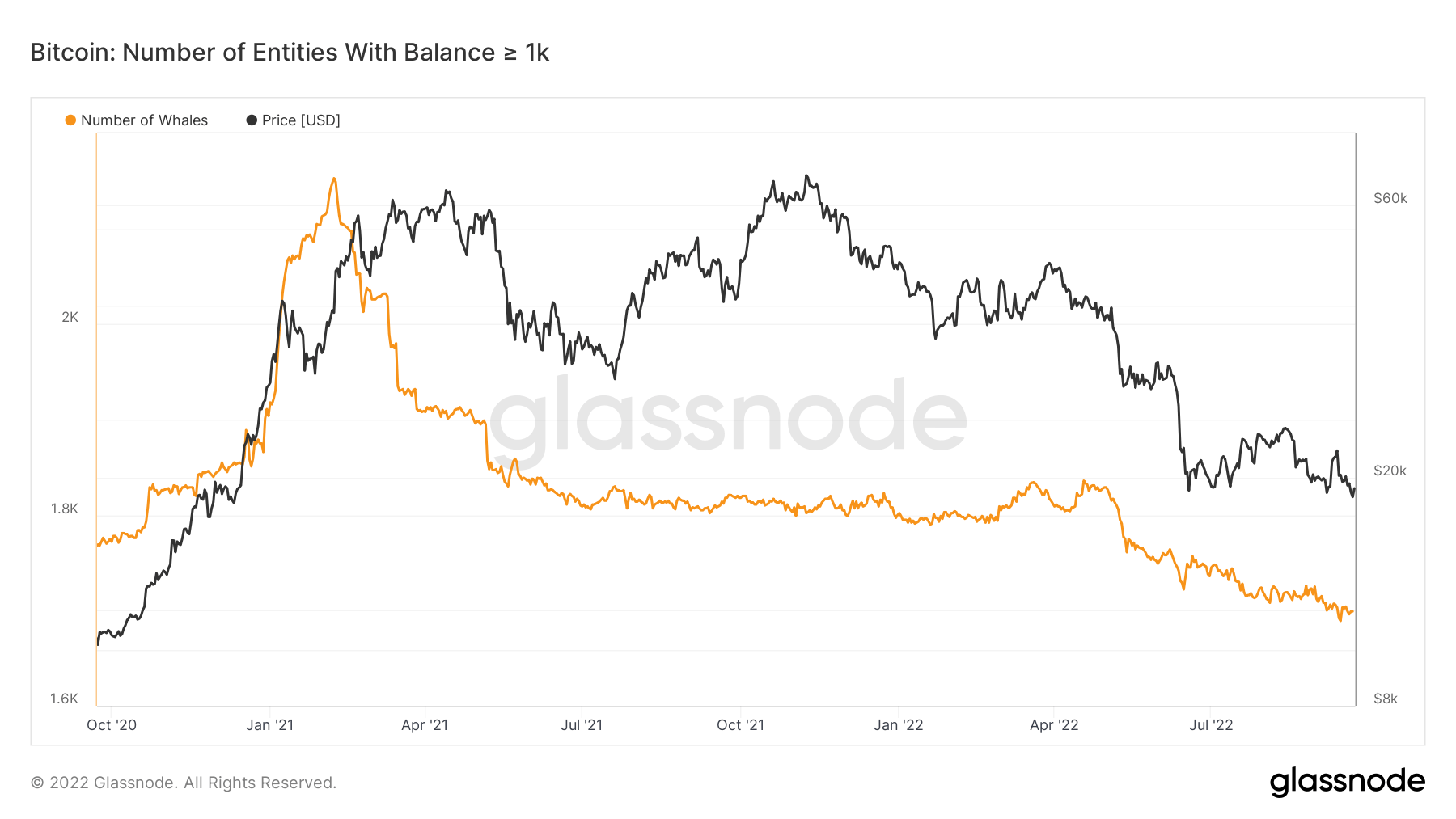

The variety of distinctive addresses holding a minimum of 1k BTC. Addresses with Steadiness ≤ 1k BTC 2,119 -0.7% (5D)

Ghost city

Lively addresses are the variety of distinctive addresses lively within the community, both as a sender or receiver. Solely addresses that have been lively in profitable transactions are counted. Addresses are a good way to grasp what exercise is going on on the community. Lively addresses have been flat/muted for nearly two years now, exhibiting little exercise on the community as speculators have left the ecosystem.

As well as, gasoline charges are meager and muted at ranges seen nearly since 2018. Charges will go up based mostly on transactional exercise, which additionally helps the case that it’s a ghost city on the Bitcoin community.

Entities

Entity-adjusted metrics use proprietary clustering algorithms to offer a extra exact estimate of the particular variety of customers within the community and measure their exercise.

The variety of distinctive entities that have been lively both as a sender or receiver. Entities are outlined as a cluster of addresses which might be managed by the identical community entity and are estimated by superior heuristics and Glassnode’s proprietary clustering algorithms. Lively Entities 273,390 -3.43% (5D)

The variety of BTC within the Goal Bitcoin ETF. Goal ETF Holdings 23,613 0.04% (5D)

The variety of distinctive entities holding a minimum of 1k BTC. Variety of Whales 1,698 -0.29% (5D)

The full quantity of BTC held on OTC desk addresses. OTC Desk Holdings 2,153 BTC -46.59% (5D)

Whales proceed to promote

The variety of entities with a steadiness of 1,000 or extra Bitcoin is taken into account a whale. In the course of the peak of the early 2021 bull run, there have been nearly 2,500 whales as Bitcoin approached $60,000. Nonetheless, as whales are thought of the good cash of the Bitcoin ecosystem, they bought when the worth was excessive; anticipate to see this cohort’s accumulation if Bitcoin developments decrease in value.

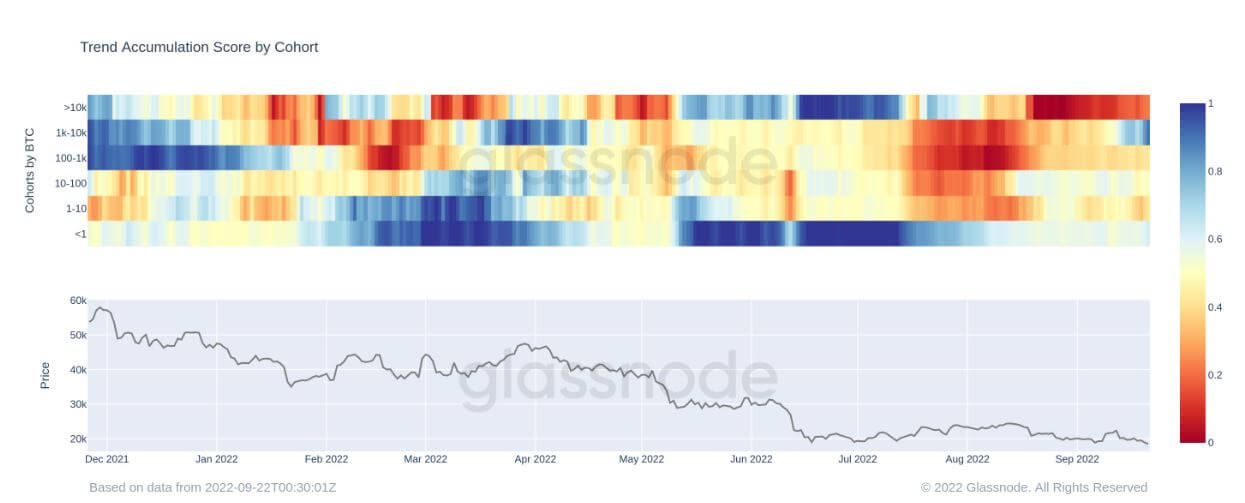

The buildup pattern rating by the cohort confirms the thesis above; the metric monitor’s distribution and accumulation by every entity’s pockets. The 1k-10k entity has began to extend its holdings since Sept. 19, signified by the darkish blue, which is encouraging to see as they see Bitcoin as worth for cash at these value ranges.

Miners

Overview of important miner metrics associated to hashing energy, income, and block manufacturing.

The typical estimated variety of hashes per second produced by the miners within the community. Hash Fee 230 TH/s 1.77% (5D)

The full provide held in miner addresses. Miner Steadiness 1,834,729 BTC -0.01% (5D)

The full quantity of cash transferred from miners to alternate wallets. Solely direct transfers are counted. Miner Web Place Change -17,692 BTC 21,838 BTC (5D)

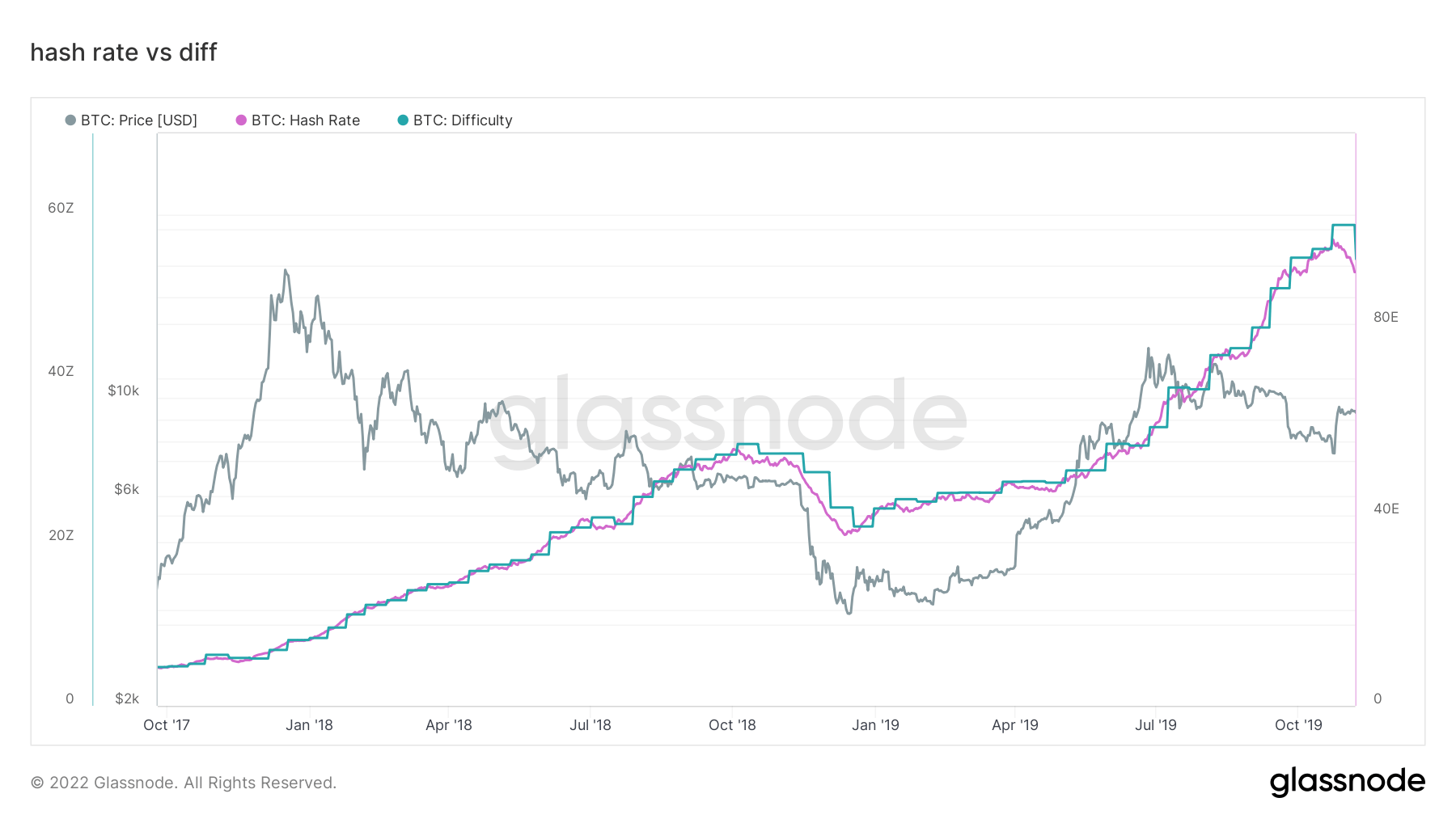

Miners must capitulate for the underside to be confirmed

Trying again on the 2017-18 cycle, the ultimate capitulation wasn’t till the miners capitulated. The Bitcoin hash fee fell over 30% from the height as miners shut down resulting from being unprofitable. With rising vitality payments and charges, one thing related probably happens in the course of the winter because the pressure will intensify on unprofitable miners.

As well as, miner income per TeraHash (hash fee/ miner income) hasn’t damaged down beneath its all-time lows, which has the potential to occur resulting from rising hash fee and BTC falling costs.

The mining business is a sport of survival of the fittest; any first rate minor makes use of stranded vitality and has a set PPA. As borrowing charges improve with vitality costs, unprofitable miners will begin to capitulate and fall off the community.

On-Chain Exercise

Assortment of on–chain metrics associated to centralized alternate exercise.

The full quantity of cash held on alternate addresses. Trade Steadiness 2,391,523 BTC 19,541 BTC (5D)

The 30 day change of the provision held in alternate wallets. Trade Web Place Change 281,432 BTC 262,089 BTC (30D)

The full quantity of cash transferred from alternate addresses. Trade Outflows Quantity 185,654 BTC -23 BTC (5D)

The full quantity of cash transferred to alternate addresses. Trade Inflows Quantity 173,456 BTC -32 BTC (5D)

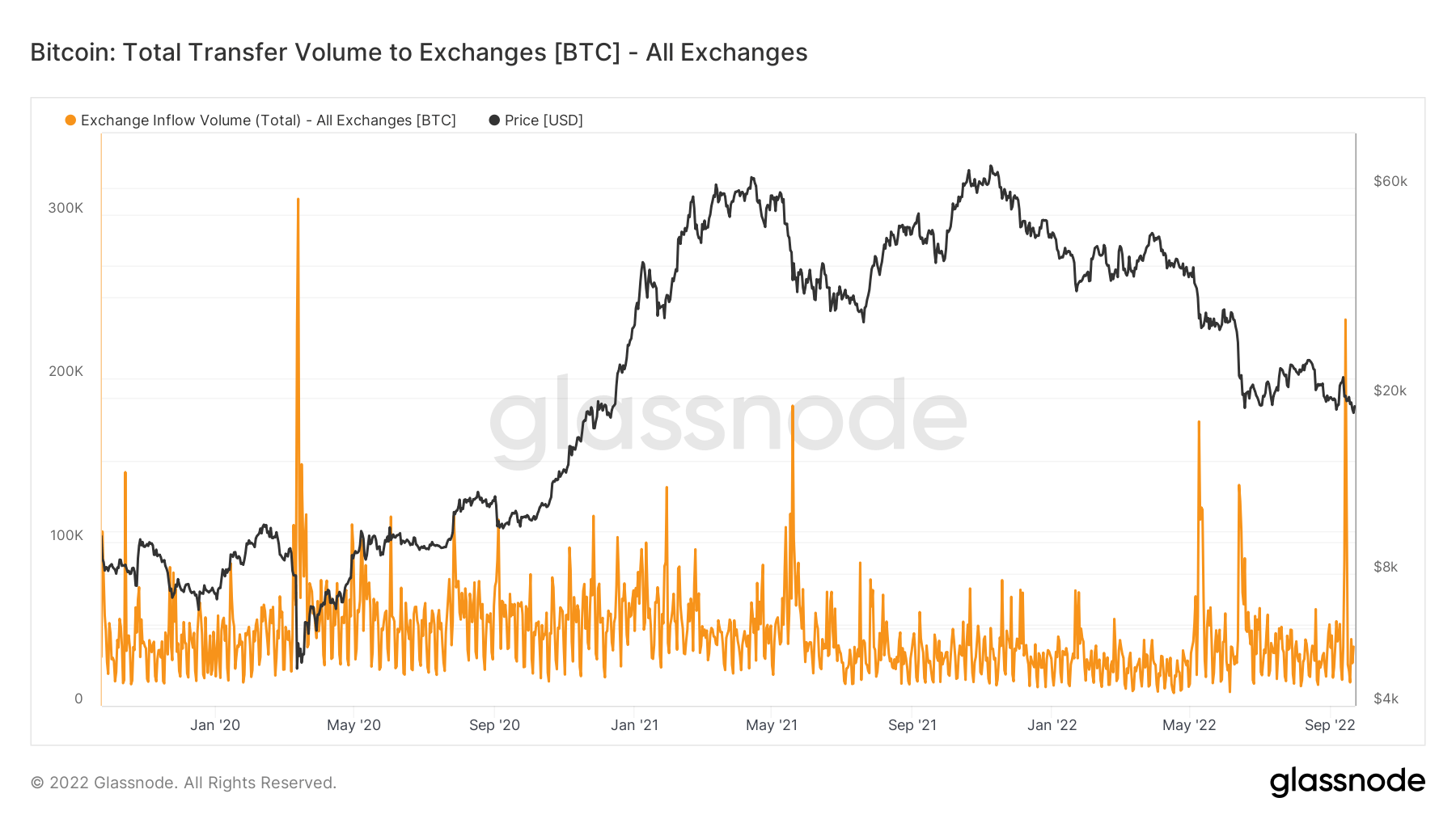

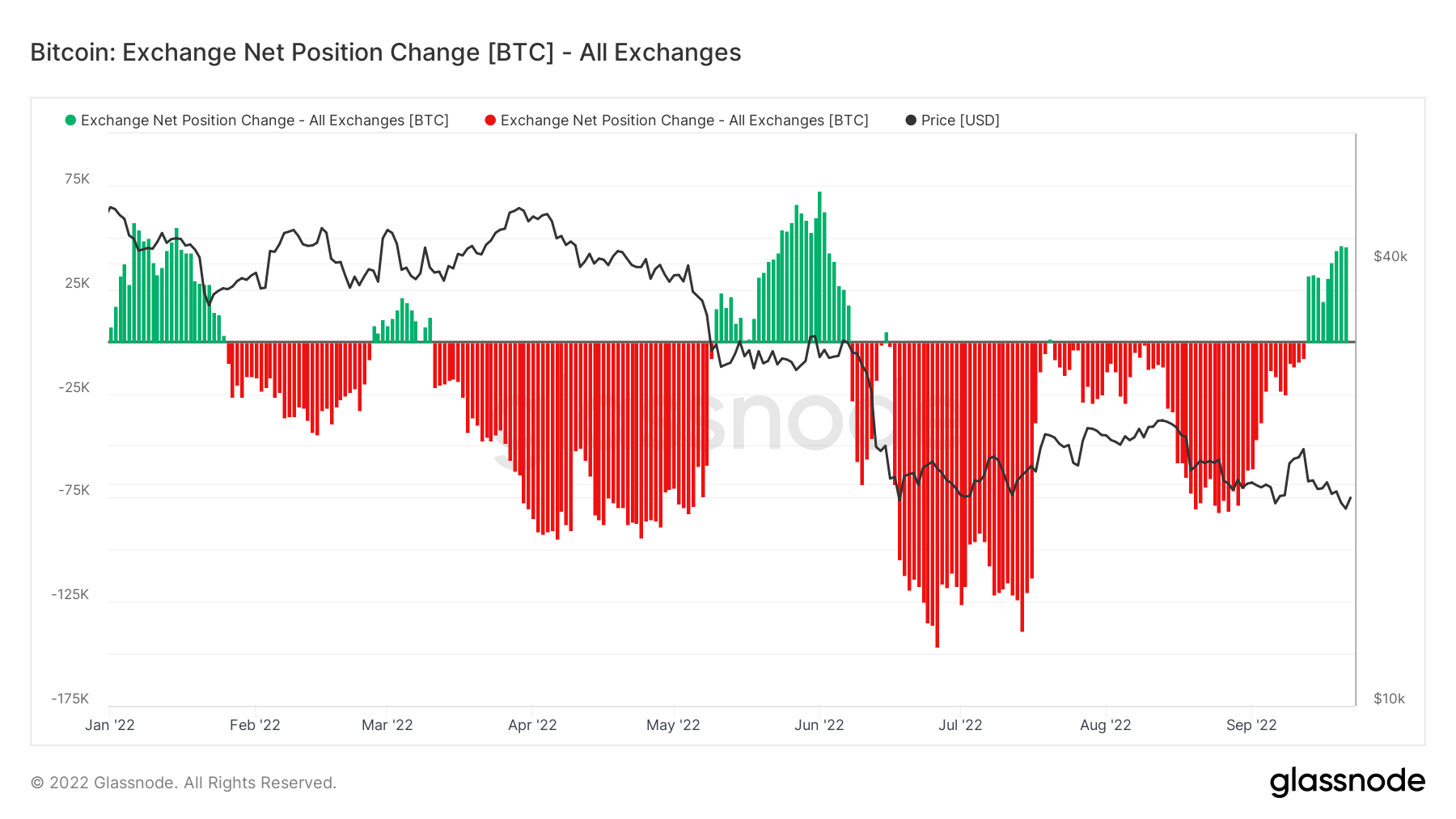

Bitcoin on-chain exercise appears bleak

On-chain exercise can decide what number of cash are being spent to and from exchanges. The primary metric contextualizes this, whole switch quantity to exchanges. On Sept 19, 250k BTC was despatched again onto exchanges which might be the highest quantity since March 2020.

That is additional supported by the metric alternate internet place change, which reveals inflows are the dominant regime. This has occurred solely 4 occasions this 12 months, each across the Russian invasion and the Luna collapse. Loads of bearish sentiment is being trickled by onto exchanges.

Provide

The full quantity of circulating provide held by totally different cohorts.

The full quantity of circulating provide held by long run holders. Lengthy Time period Holder Provide 13.65M BTC 0.29% (5D)

The full quantity of circulating provide held by brief time period holders. Quick Time period Holder Provide 3.07M BTC -1.64% (5D)

The p.c of circulating provide that has not moved in a minimum of 1 12 months. Provide Final Lively 1+ Yr In the past 66% 0.08% (5D)

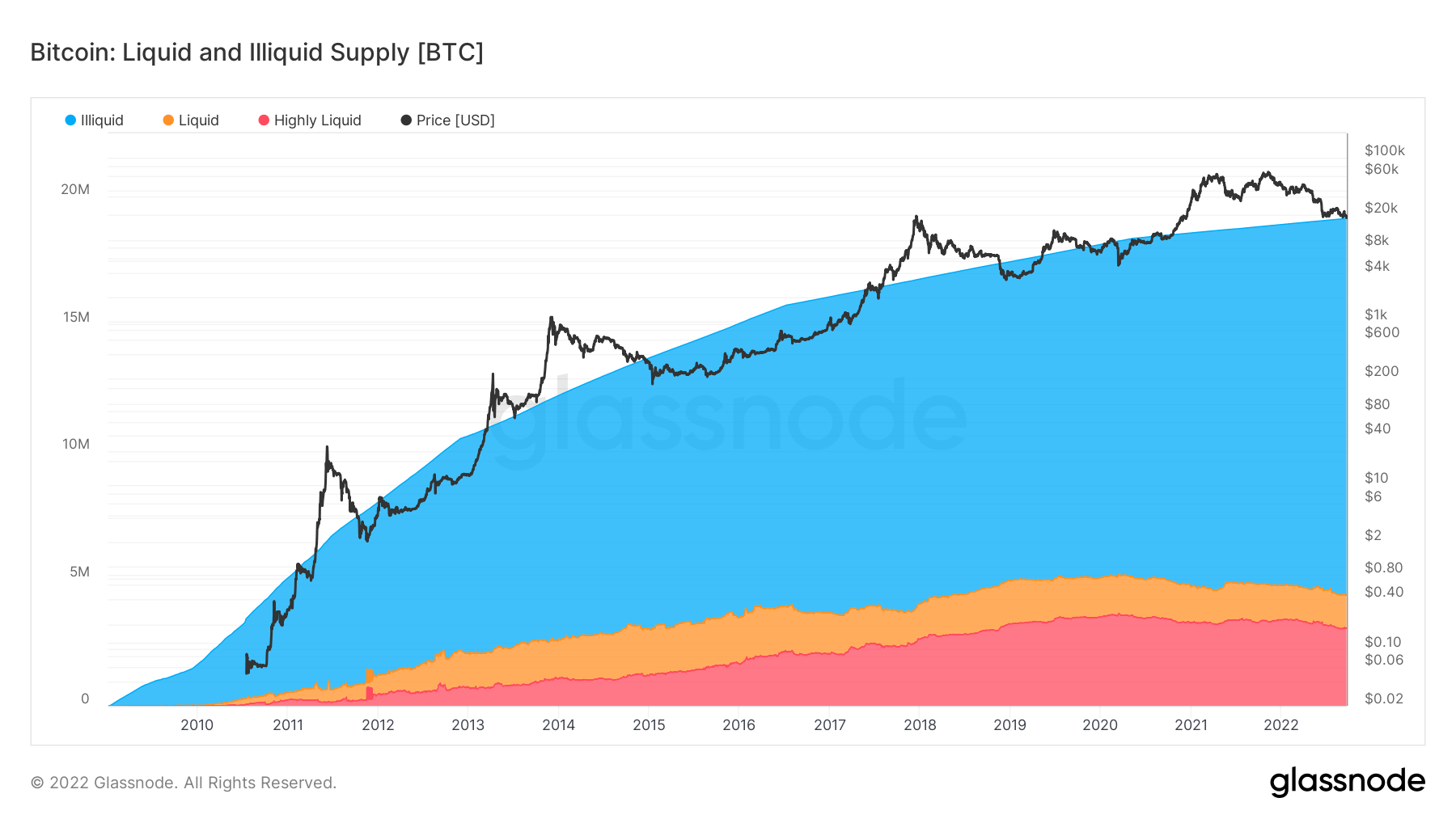

The full provide held by illiquid entities. The liquidity of an entity is outlined because the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is taken into account to be illiquid / liquid / extremely liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively. Illiquid Provide 14.8M BTC 0.01% (5D)

Observe the information

The full provide held by illiquid, liquid, and extremely liquid entities. The liquidity of an entity is outlined because the ratio of cumulative outflows and inflows over the entity’s lifespan. An entity is taken into account to be illiquid / liquid / extremely liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively.

Bitcoin is closing in on 15 millionth bitcoin turning into illiquid; these are cash saved offline in scorching or chilly storage wallets. The circulating provide is round 19 million, with a staggering quantity of the illiquid provide at the moment sitting at 79%.

This metric additionally breaks down the liquid and extremely liquid provide. Because the starting of the 12 months, liquid and extremely liquid BTC has decreased by round 400k BTC and turn out to be illiquid, which is bullish over the long run as fewer buyers are speculating over the asset and holding it as a retailer of worth.

Cohorts

Breaks down relative habits by numerous entities’ pockets.

SOPR – The Spent Output Revenue Ratio (SOPR) is computed by dividing the realized worth (in USD) divided by the worth at creation (USD) of a spent output. Or just: value bought / value paid. Lengthy-term Holder SOPR 0.57 -6.56% (5D)

Quick Time period Holder SOPR (STH-SOPR) is SOPR that takes under consideration solely spent outputs youthful than 155 days and serves as an indicator to evaluate the behaviour of brief time period buyers. Quick-term Holder SOPR 0.98 0.00% (5D)

The Accumulation Development Rating is an indicator that displays the relative measurement of entities which might be actively accumulating cash on-chain by way of their BTC holdings. The size of the Accumulation Development Rating represents each the scale of the entities steadiness (their participation rating), and the quantity of latest cash they’ve acquired/bought over the past month (their steadiness change rating). An Accumulation Development Rating of nearer to 1 signifies that on mixture, bigger entities (or a giant a part of the community) are accumulating, and a price nearer to 0 signifies they’re distributing or not accumulating. This offers perception into the steadiness measurement of market members, and their accumulation habits over the past month. Accumulation Development Rating 0.43 152.94% (5D)

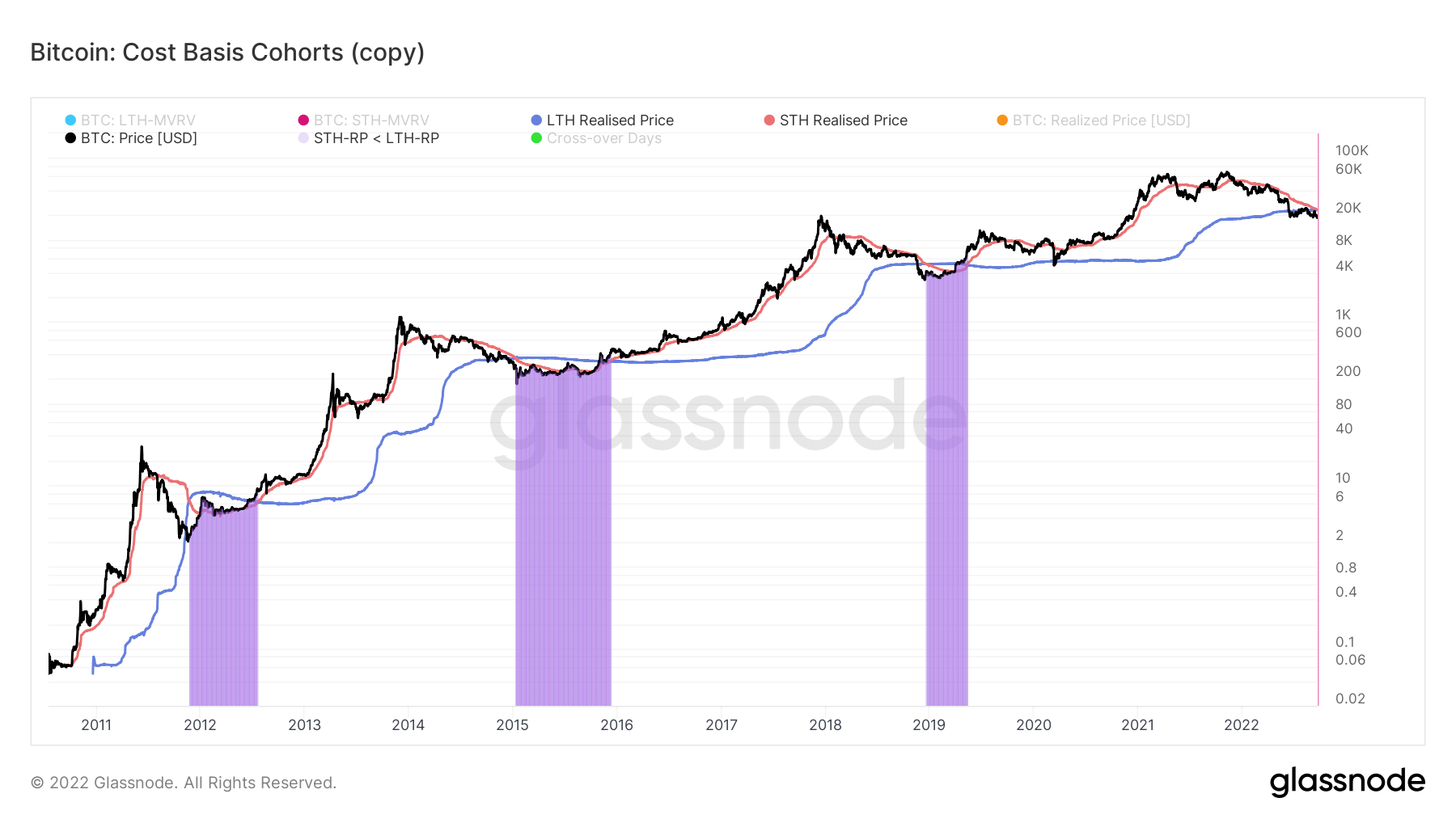

The place are we by way of cost-basis?

Realized value was the combination value when every coin was final spent on-chain. Additional analyzing brief and long-term holder cohorts, we will calculate the realized value to mirror the combination price foundation of every group.

This metric calculates the ratio between LTH and STH realized value:

- Uptrend when STHs understand a loss that could be a larger fee than LTHs (e.g., accumulation in a bear market)

- Downtrend when LTHs spend cash and switch them to STHs (e.g., bull market distribution)

Throughout bear markets, as the worth continues to fall, STH realized value will fall beneath LTH realized value. When capitulation happens, highlighted by the purple zone, these occasions normally occur throughout late-stage bear markets.

The worth has been in a downward spiral for nearly a 12 months, since November 2021, and we’re but to cross over; the expectation of this crossover may happen earlier than the top of September. In earlier bear market cycles, it normally takes on common 220 days to get well after the crossover.