Macro Overview

Recap of vital occasions, week commencing Oct. 10

As CryptSslate attended Bitcoin Amsterdam, there was no weekly MacroSlate report for the week commencing Oct. 10. Key macro subjects that occurred have been;

On Oct. 13, the U.S. CPI inflation report confirmed a worrying leap in costs excluding meals and vitality for September, pushing the ten-year treasury to a excessive of 4.08%.

Whereas Oct. 14 noticed the U.Okay expertise U-turn after U-turn on fiscal coverage. BOE jumbo-sized gilt purchases have been finalized, which stabilized yields. This leaves Japan as the one G7 central financial institution nonetheless supporting its authorities debt, whereas the ten-year treasury was above 25 bps and the yen towards the greenback saved making contemporary highs.

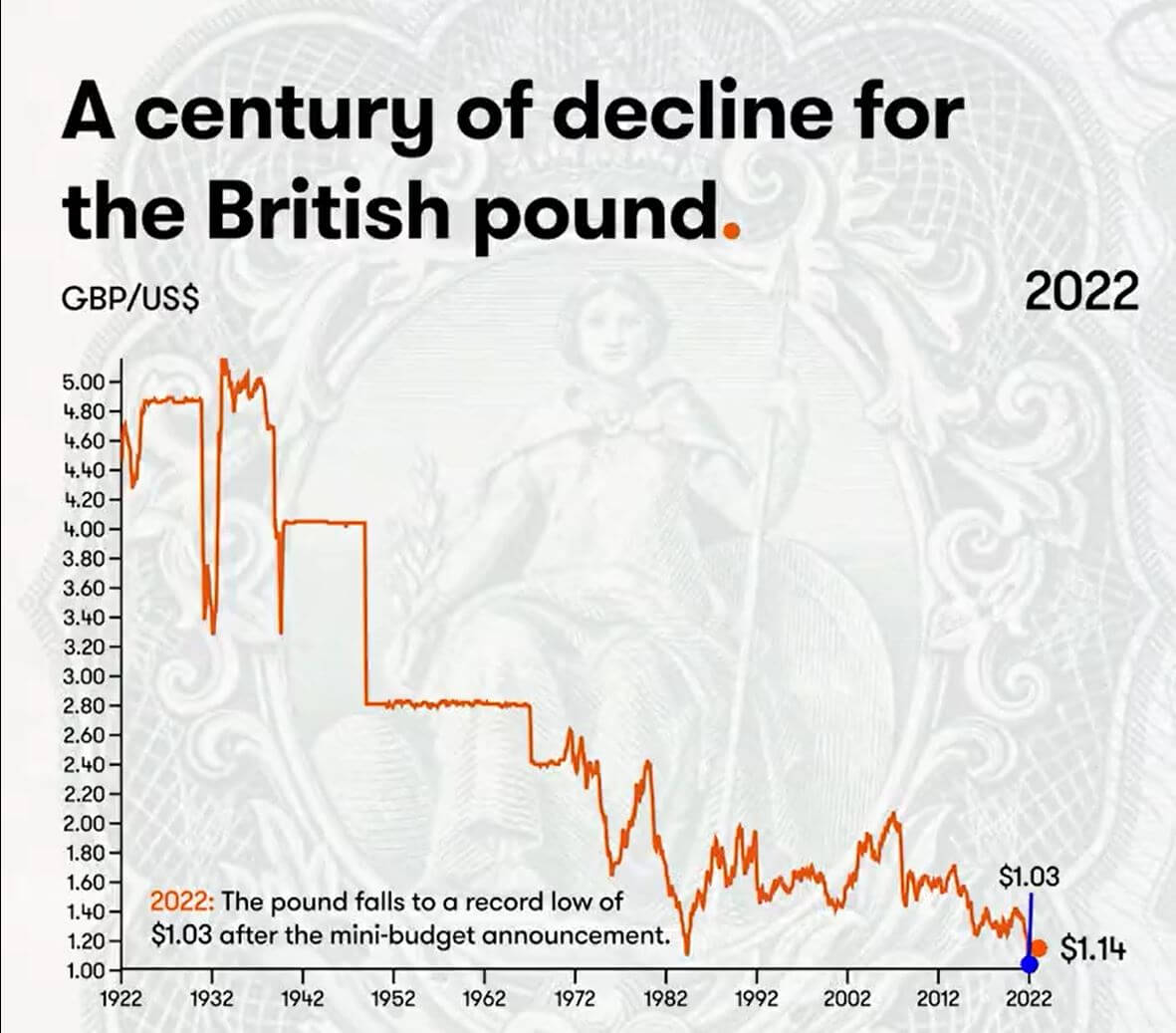

A century of decline for the British pound

The 12 months 2022 has seen new lows for the British pound, with a authorities in disarray, the gilt market unstable, and the BOE appearing as a backstop. The influence of poor financial and financial coverage choices as its long-term bond yields convulsed and threatened the solvency of over-leveraged pension funds.

Nevertheless, many traders imagine this can be a cycle, and the pound will return. If it’s low-cost to purchase, traders will purchase it. Nevertheless, this will not be the case; the U.Okay. is dealing with acute vitality shortages and minimal fx reserves to defend the foreign money.

The final century has seen an enormous decline within the British pound, and it doesn’t appear like it is going to get higher quickly.

Since the usdollar got here into existence in 1791, the free market charge was $4.55 to £1. Quick ahead to 1925, and the pound has been sliding down towards the greenback.

- 1925 – Winston Churchill returns sterling to the gold commonplace on the pre-war charge of $4.86.

- 1931 – The sterling comes off the gold commonplace, and the pound drops significantly. £1 is equal to $3.28.

- 1940 – Sterling drops with the outbreak of WWII. The British authorities pegs the worth at £1 to $4.03.

- 1949 – The British authorities devalues the pound to $2.80 to help exports and rebalance the economic system.

- 1967 – An financial disaster strikes. The British authorities devalues the pound to $2.40

- 1976 – Excessive unemployment and inflation compelled Britain to request an IMF mortgage. Sterling is allowed to drift.

- 1985 – Ronald Regan’s tax cuts boosted the useconomy and led to immense greenback energy.

- 1992 – the U.Okay exits the Alternate Charge Mechanism, and the pound drops to $1.48.

- 2001 – The pound falls to $1.40 after the dot-com bubble.

- 2008 – International monetary crash sees the greenback act as a haven foreign money.

- 2016 – Brexit referendum sees the pound fall to $1.23.

- 2022 – The pound falls to a document low of $1.03 after the mini-budget announcement.

(If you’re curious, from 1861 – 1864, the £ surge to $~9 was US cash fleeing the Civil Battle.)

Correlations

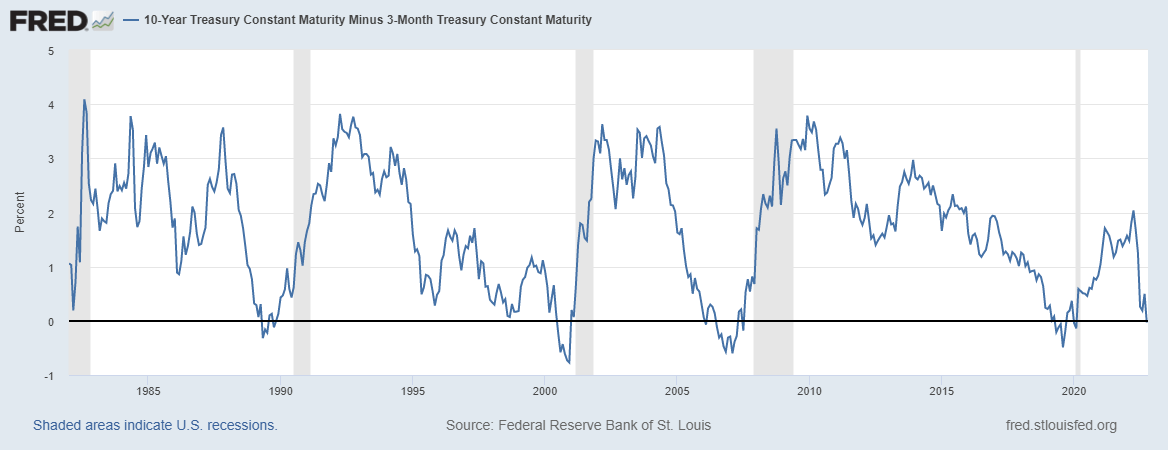

10 Yr minus three-month treasury inverts has preceded each recession since WWII

When the 10-year and 2-year treasury notice unfold inverts, it’s typically thought of a warning of extreme financial weak spot; In distinction, when the credit score spreads widen throughout occasions of economic stress, the flight to safe-haven property such because the DXY, or the quick want for greenback redemptions to satisfy funds.

The ten- year-three month unfold inverted on Oct. 18, at present at -0.03bps, as many economists imagine that is the correct recession sign. The inversion of every yield curve has presaged each recession going again greater than 40 years, and a recession normally happens inside the subsequent six-twelve months.

Equities & Volatility Gauge

The Customary and Poor’s 500, or just the S&P 500, is a inventory market index monitoring the inventory efficiency of 500 giant firms listed on exchanges in america. S&P 500 3,753 2.14% (5D)

The Nasdaq Inventory Market is an American inventory change primarily based in New York Metropolis. It’s ranked second on the listing of inventory exchanges by market capitalization of shares traded, behind the New York Inventory Alternate. NASDAQ 11,310 2.48% (5D)

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the approaching 30 days. Traders use the VIX to measure the extent of threat, worry, or stress available in the market when making funding choices. VIX 30 -8.33% (5D)

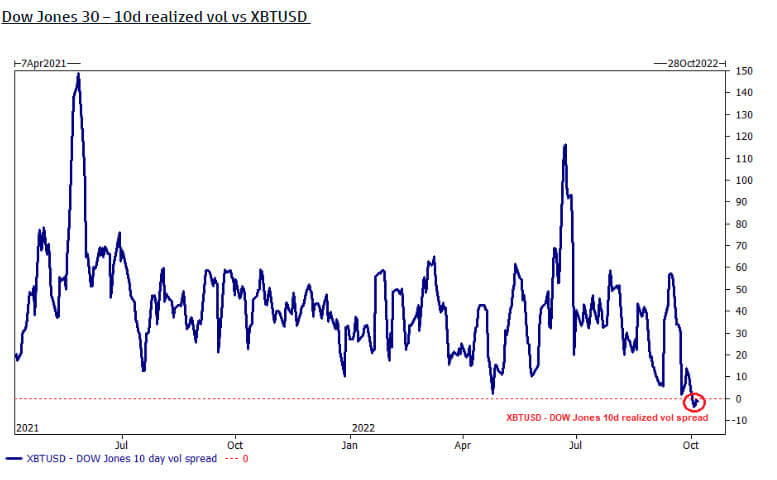

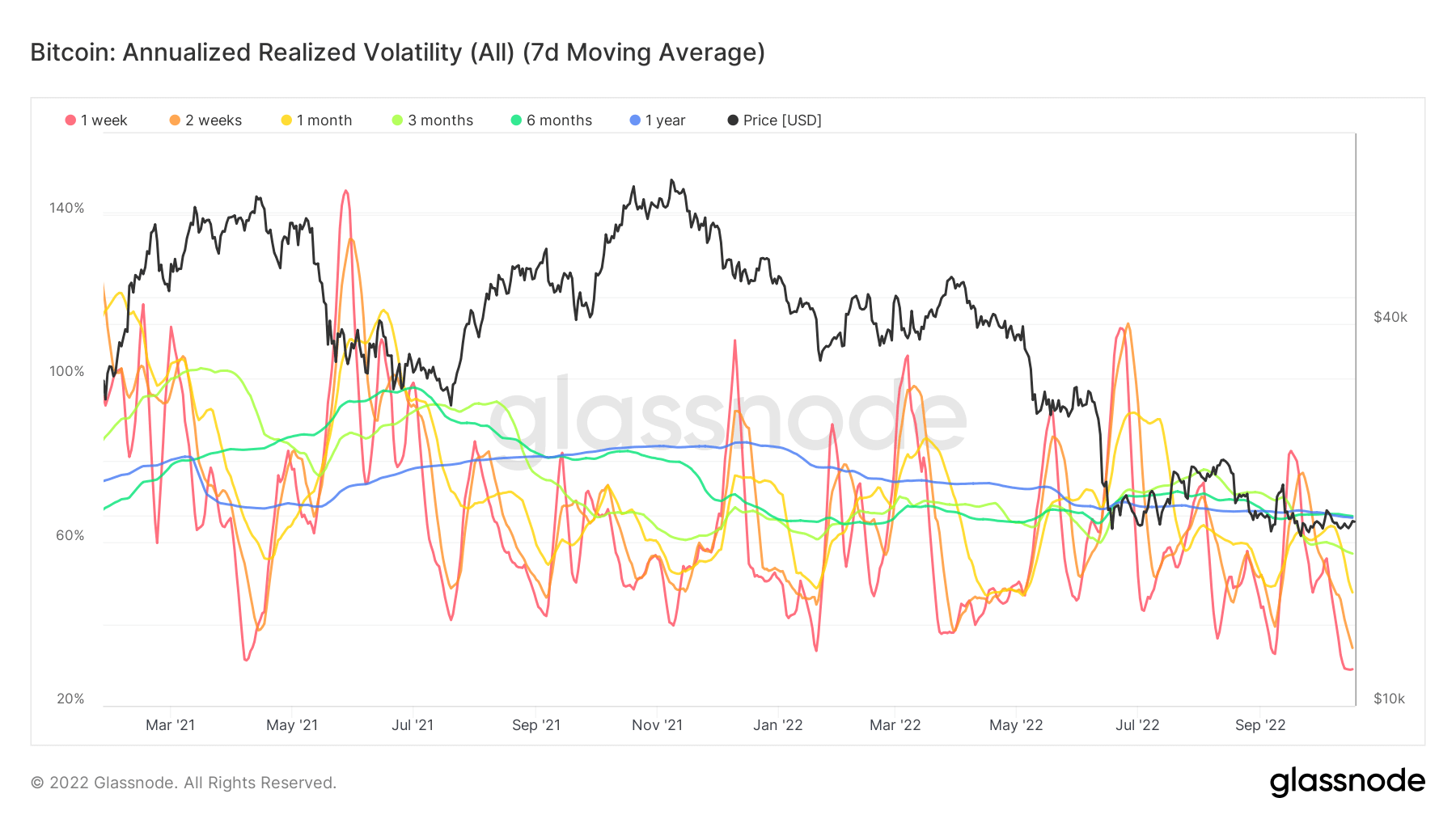

Bitcoin is much less unstable than the Dow Jones

The Dow Jones (30 largest industrial shares) is formally extra unstable than Bitcoin, in response to the ten-day realized vol unfold. Nevertheless, it’s because Bitcoin over Q3 has stayed comparatively flat when it comes to USD worth.

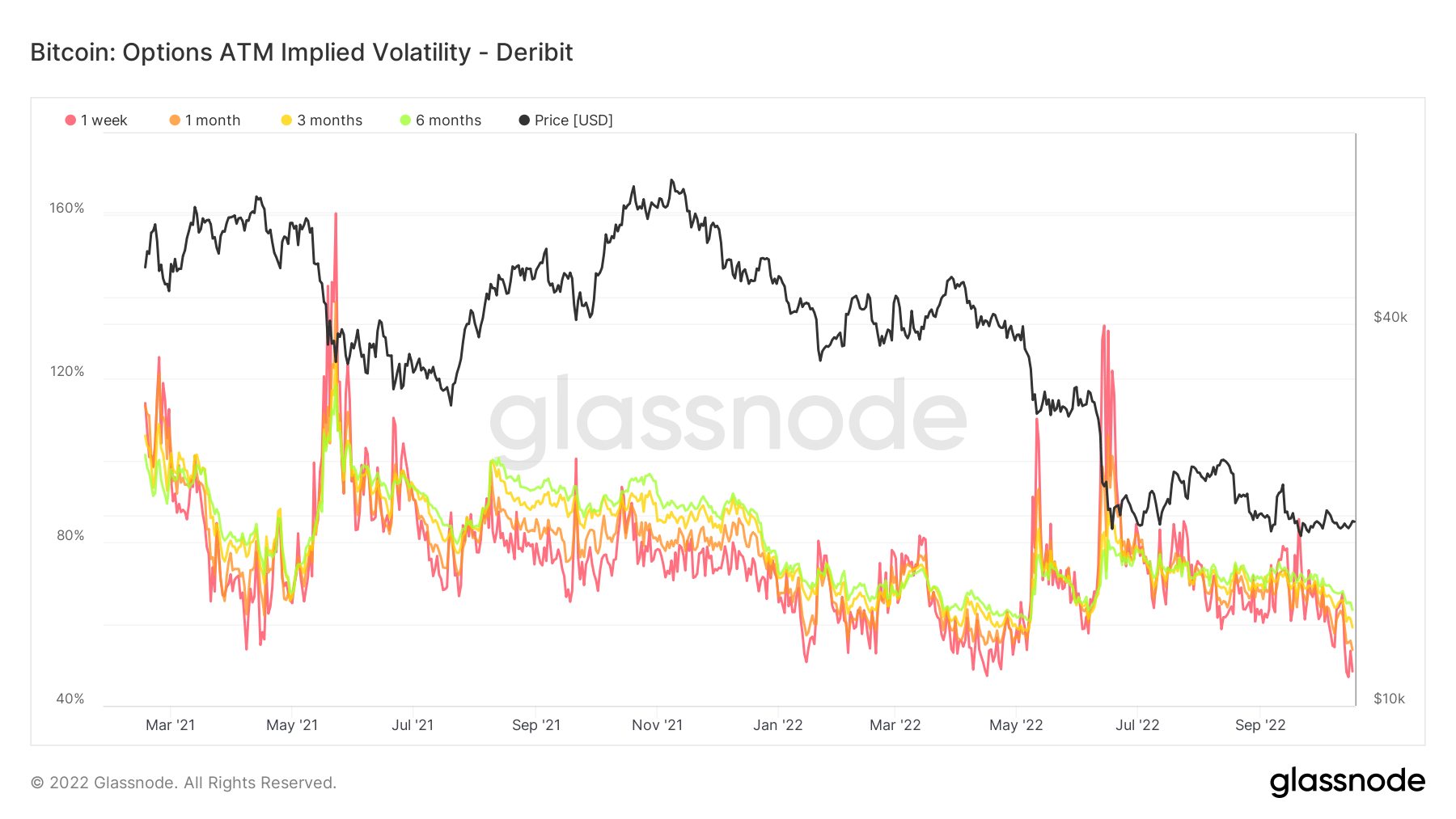

Bitcoin volatility at year-to-date lows

On-chain analytics reveals the annualized realized volatility at an all-time low, just below 50% this week. Since March 2021, choices implied volatility has been underneath 50% 4 occasions and has seen violent swings in worth shortly after.

Whereas implied volatility refers back to the market’s evaluation of future volatility, realized volatility measures what occurred up to now. Insinuating that volatility has been at extraordinarily low ranges is encouraging, whereas conventional monetary property and currencies are as unstable as they arrive.

Commodities

The demand for gold is set by the quantity of gold within the central financial institution reserves, the worth of the U.S. greenback, and the will to carry gold as a hedge towards inflation and foreign money devaluation, all assist drive the worth of the dear metallic. Gold Worth $1,658 0.61% (5D)

Just like most commodities, the silver worth is set by hypothesis and provide and demand. It is usually affected by market circumstances (giant merchants or traders and quick promoting), industrial, business, and client demand, hedge towards monetary stress, and gold costs. Silver Worth $19 5.52% (5D)

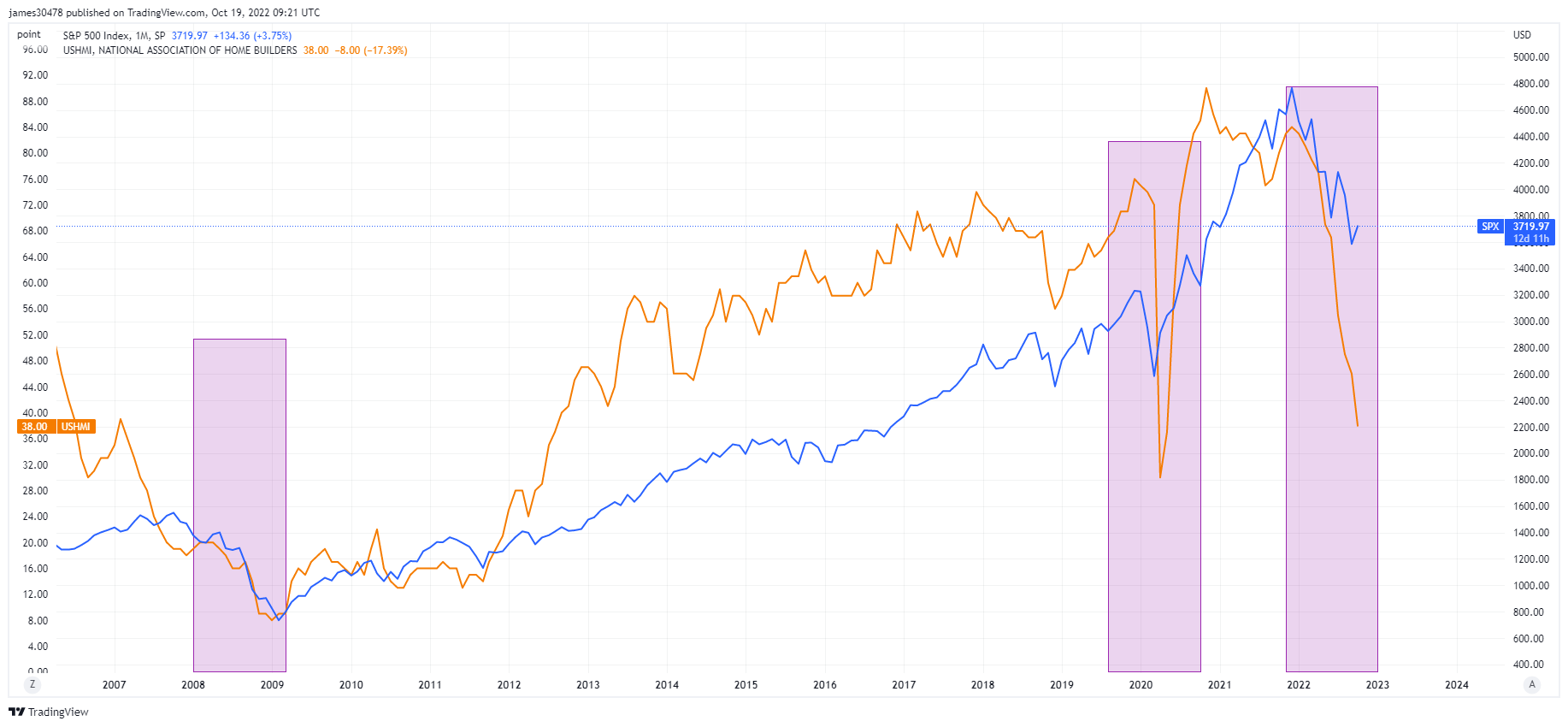

U.S. homebuilders’ sentiment hits a brand new low

The Nationwide Affiliation of Home Builders, housing market index sank one other 8 factors to 38 in October, going again to lows final seen in 2012, simply after the GFC restoration. Mortgage charges approaching 7% have considerably weakened demand.

Overlaying the NAHB and S&P 500, with the previous two recessions in 2008 and 2020, doesn’t bode properly for what’s coming on the finish of this 12 months and into 2023; equities might proceed to plunge additional to the draw back if the pattern continues to be your pal.

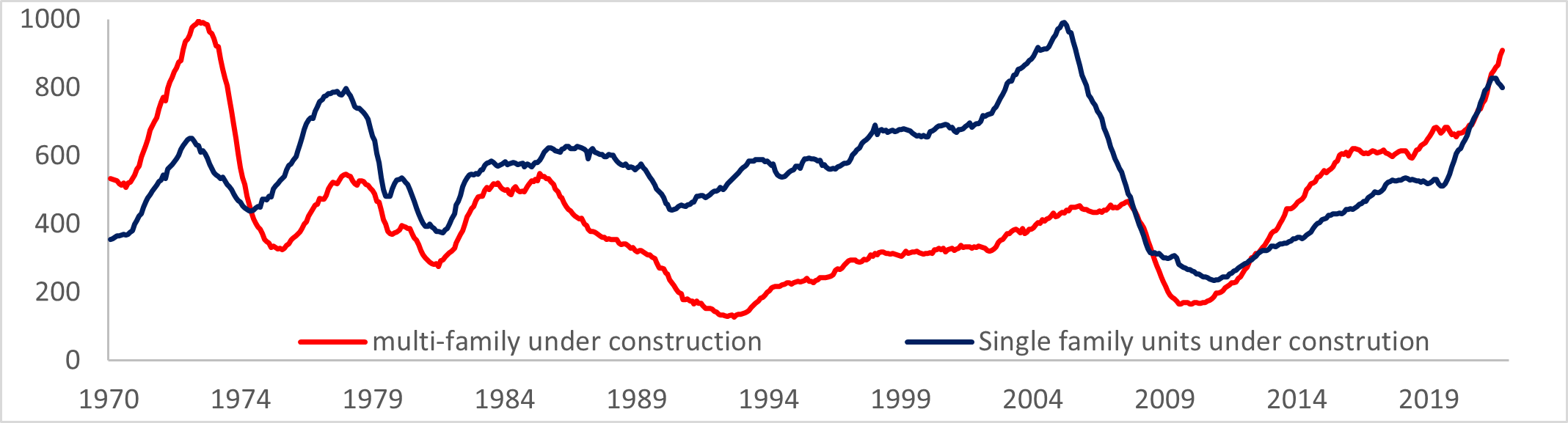

U.S. Development constructing an even bigger downside

In keeping with MBA, the typical 30- 12 months mortgage charge rose 6.92%, and mortgage functions for house purchases fell significantly, virtually 4%.

Improve in permits following continued robust demand for rental items, whereas single-home household permits declined to the bottom because the pandemic. Extra items are at present underneath development than at any time since 1974; this doesn’t appear to bode properly for multifamily development.

Charges & Forex

The ten-year Treasury notice is a debt obligation issued by america authorities with a maturity of 10 years upon preliminary issuance. A ten-year Treasury notice pays curiosity at a hard and fast charge as soon as each six months and pays the face worth to the holder at maturity. 10Y Treasury Yield 4.221% 4.95% (5D)

The U.S. greenback index is a measure of the worth of the U.S. greenback relative to a basket of foreign exchange. DXY 111.875 -1.12% (5D)

Unparalleled strikes within the fixed-income market

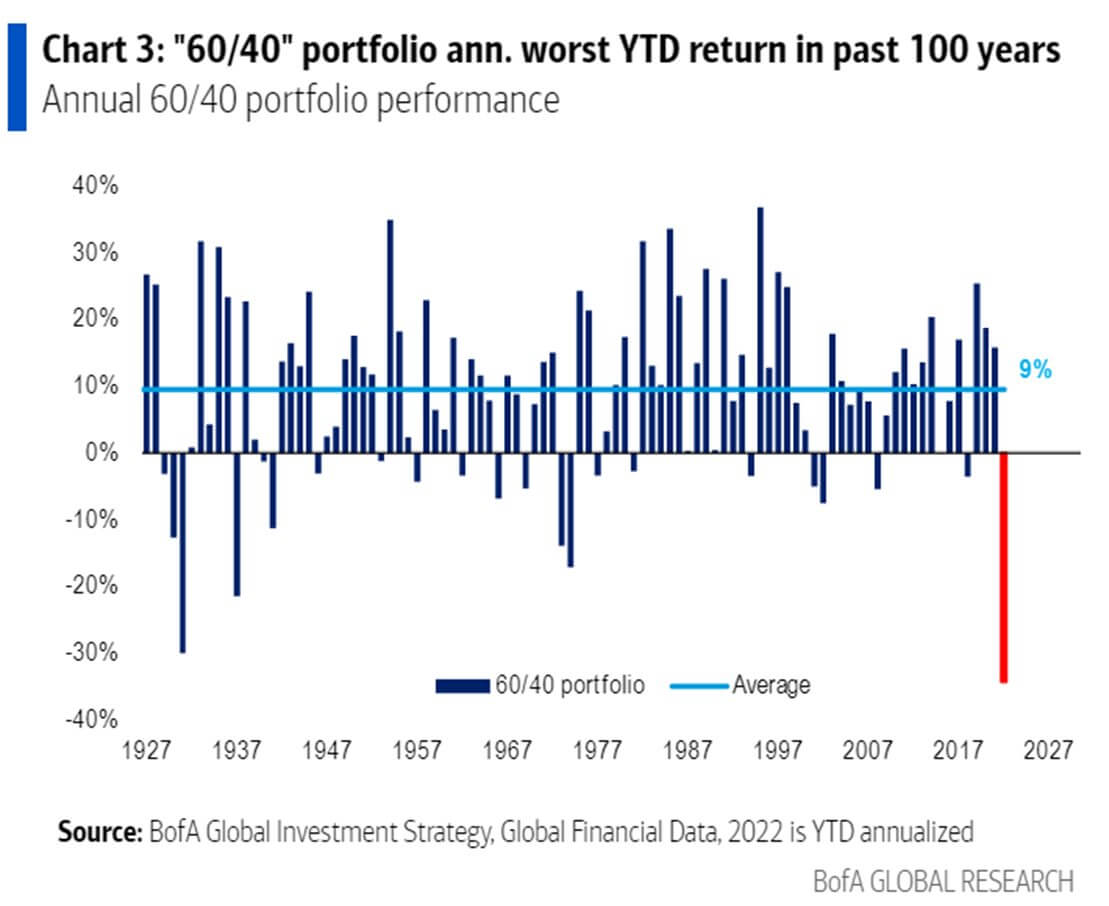

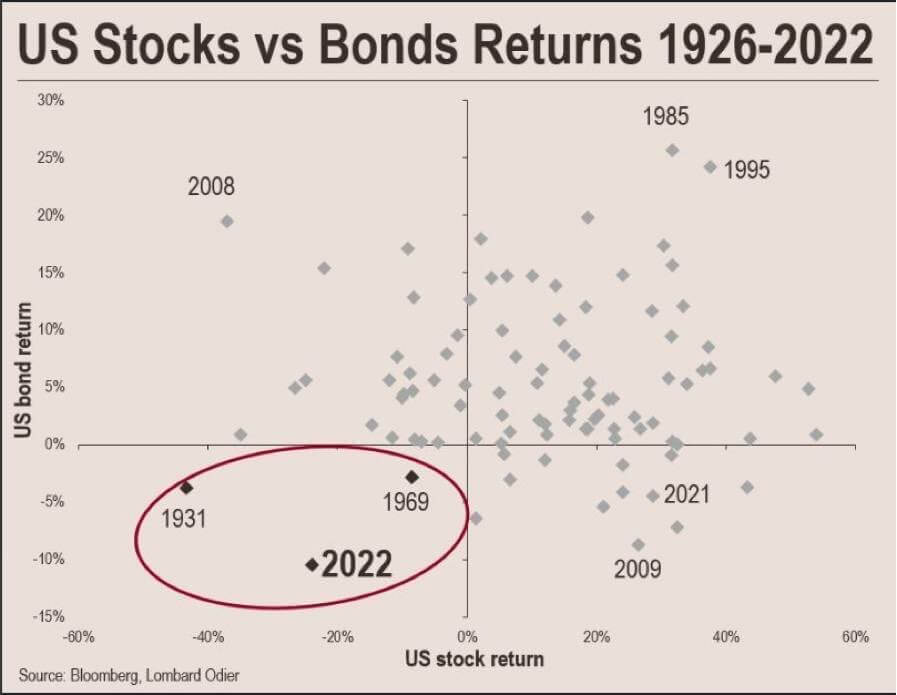

2022 has been an unprecedented 12 months for asset efficiency; the 60/40 portfolio 12 months to this point is the more severe efficiency in 100 years, in response to BofA, even worse than the worldwide melancholy of 1929.

To this point, in 2022, the usstock and bond market has misplaced a mixed worth of almost $60 trillion. The final time the U.S. markets confronted a drawdown of this severity, the U.S. authorities defaulted its gold peg inside the subsequent two years.

In 1933, govt order 6102 required all individuals to ship gold bullion to the Federal Reserve for $20.67 per troy ounce. The united stateshad been on a gold commonplace since 1879, however the Nice Melancholy within the Thirties frightened the general public into hoarding gold.

Second, in 1971, in the course of the Nixon shock, President Nixon closed the gold window 1971, the convertibility of U.S {dollars} into gold, to deal with the nation’s inflation downside and to discourage overseas governments from redeeming extra {dollars} for gold.

Bitcoin Overview

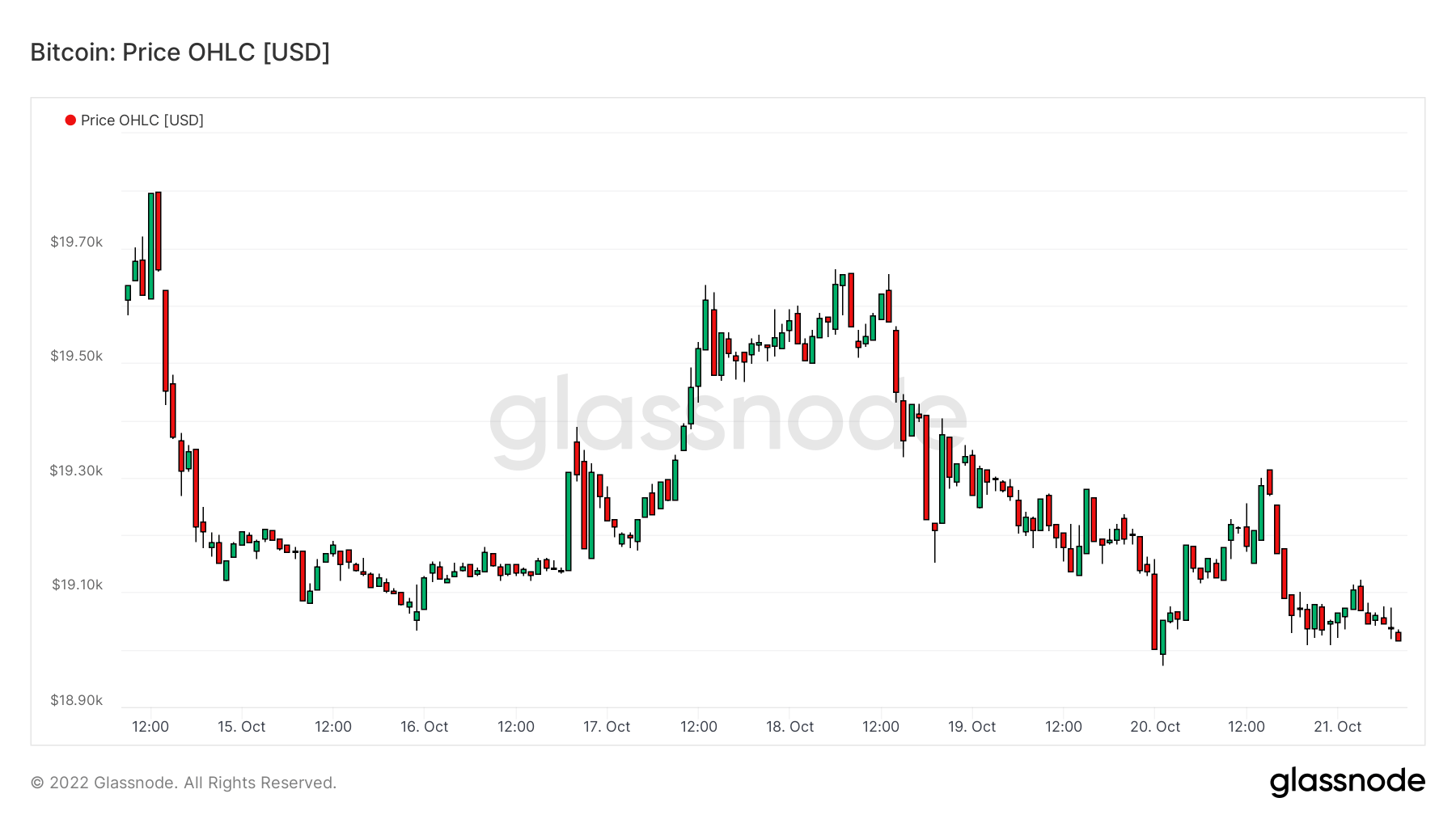

The worth of Bitcoin (BTC) in USD. Bitcoin Worth $19,160 -1.93% (5D)

The measure of Bitcoin’s complete market cap towards the bigger cryptocurrency market cap. Bitcoin Dominance 41.93% 0.36% (5D)

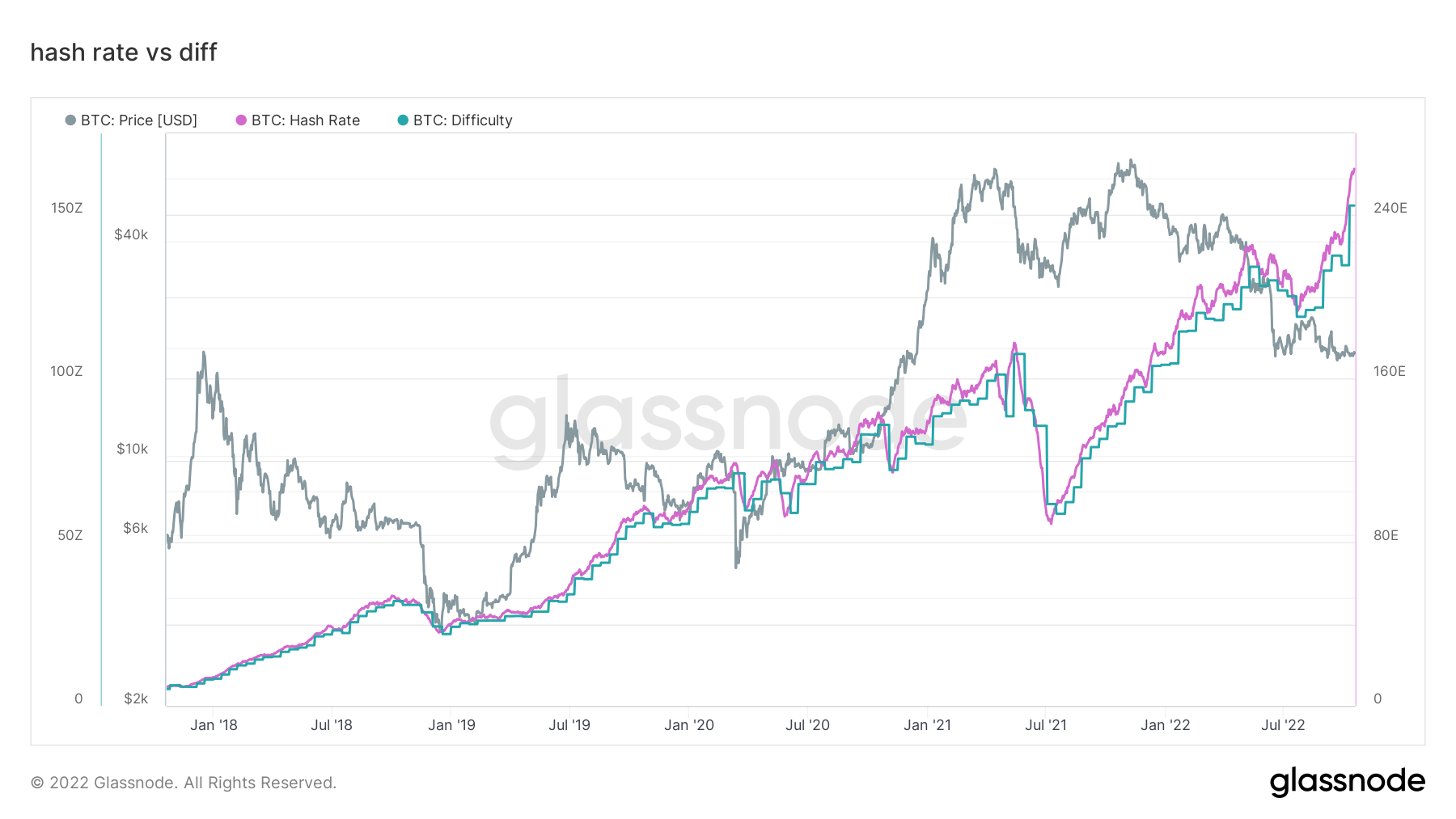

- Bitcoin hash charge continued to soar – 260 EH/S

- Futures open curiosity denominated in BTC hits 650k

- Problem projected to extend by 3%

- Asia commerce premium at its highest because the final bear market in 2019-2020

Addresses

Assortment of core handle metrics for the community.

The variety of distinctive addresses that have been energetic within the community both as a sender or receiver. Solely addresses that have been energetic in profitable transactions are counted. Energetic Addresses 889,323 3.64% (5D)

The variety of distinctive addresses that appeared for the primary time in a transaction of the native coin within the community. New Addresses 406,205 1.97% (5D)

The variety of distinctive addresses holding 1 BTC or much less. Addresses with ≥ 1 BTC 908,988 0.40% (5D)

The variety of distinctive addresses holding at the least 1k BTC. Addresses with Steadiness ≤ 1k BTC 2,128 0.52% (5D)

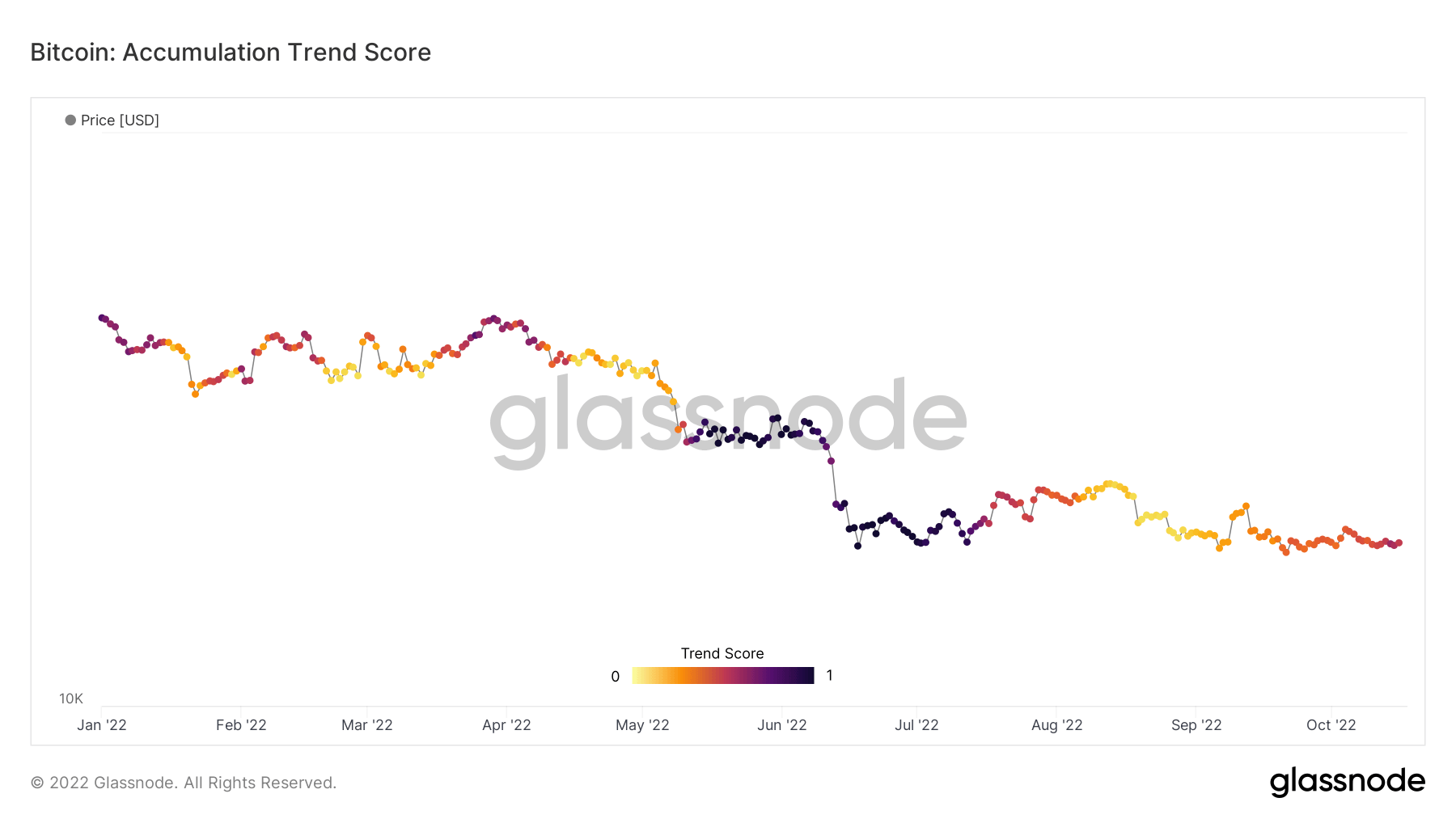

Web accumulation for the primary time since July

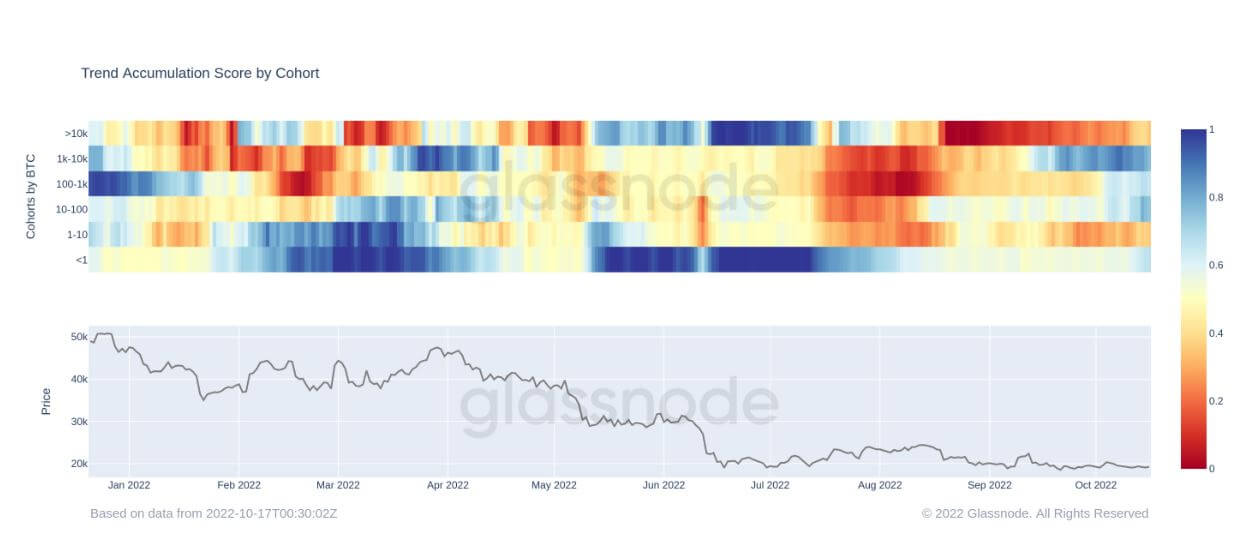

The Accumulation Development Rating is an indicator that displays the relative measurement of entities which can be actively accumulating cash on-chain when it comes to their BTC holdings. The size of the Accumulation Development Rating represents each the dimensions of the entities steadiness (their participation rating) and the quantity of recent cash they’ve acquired/offered during the last month (their steadiness change rating).

An Accumulation Development Rating of nearer to 1 signifies that, on mixture, bigger entities (or a giant a part of the community) are accumulating, and a worth extra relative to 0 means they’re distributing or not accumulating. This offers perception into the steadiness measurement of market contributors and their accumulation habits during the last month.

Because the starting of August, the Bitcoin ecosystem has seen internet distributors resulting from worry across the macro uncertainty with conventional finance property getting hammered. Nevertheless, since then, BTC has stayed comparatively flat, hovering across the $20k mark, which has been encouraging to see and has most probably alerted wall avenue that this asset is right here to remain.

By trying on the cohorts under, a variety of them are accumulating once more, resembling whales between 1k-10k BTC and retail with lower than 1 BTC. Whales that maintain 10k BTC or extra are nonetheless internet sellers however have become extra of an orange than a pink, which reveals their distribution is being diminished and fewer promoting strain has occurred.

Dervatives

A spinoff is a contract between two events which derives its worth/worth from an underlying asset. The commonest kinds of derivatives are futures, choices and swaps. It’s a monetary instrument which derives its worth/worth from the underlying property.

The whole quantity of funds (USD Worth) allotted in open futures contracts. Futures Open Curiosity $12.68B 5.20% (5D)

The whole quantity (USD Worth) traded in futures contracts within the final 24 hours. Futures Quantity $24.35B $153.29 (5D)

The sum liquidated quantity (USD Worth) from quick positions in futures contracts. Complete Lengthy Liquidations $42.01M $0 (5D)

The sum liquidated quantity (USD Worth) from lengthy positions in futures contracts. Complete Quick Liquidations $42.01M $3.25M (5D)

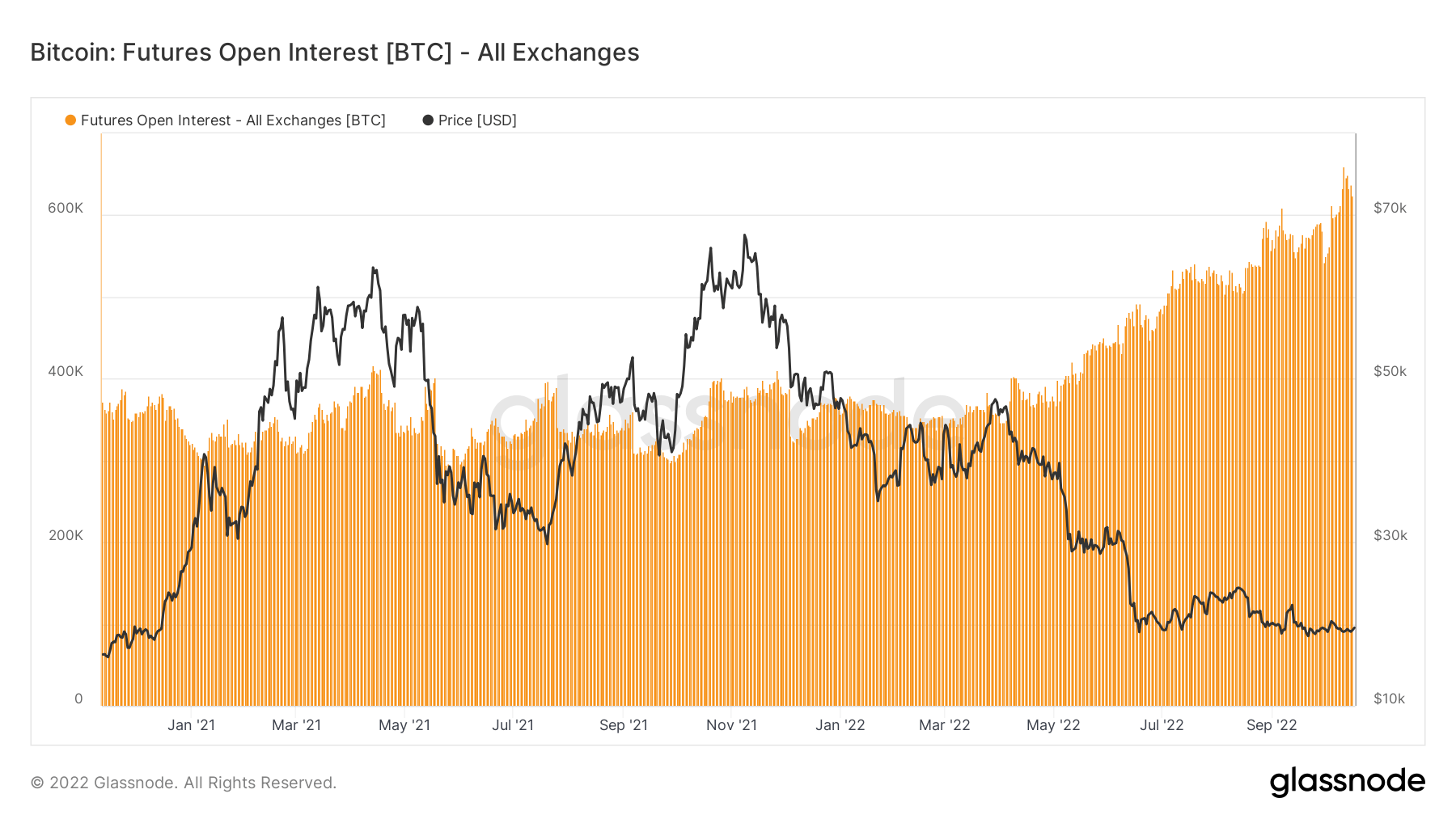

Futures open curiosity at all-time highs denominated in Bitcoin

Futures’ open curiosity, the full quantity of (USD worth) allotted in out there futures contracts, has hit an all-time excessive. This tells us that ranges of hypothesis inside the market are growing, regardless of Bitcoin falling over 70% from its all-time excessive.

Futures open curiosity has stayed comparatively flat from January 2021 to Could 2022, roughly 350k BTC however has soared to 640k denominated in Bitcoin futures open curiosity.

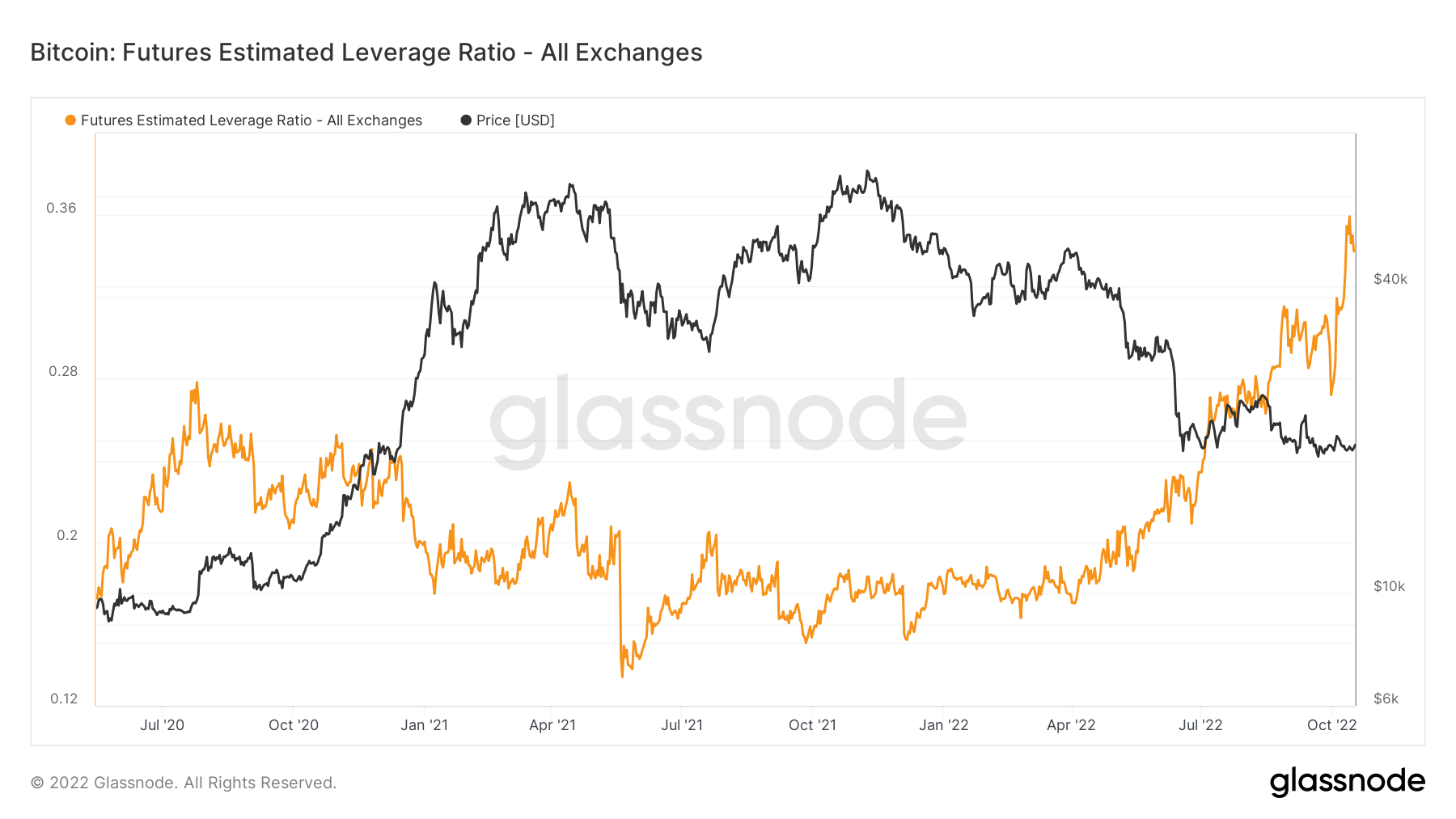

Leverage continues to extend

The Estimated Leverage Ratio is outlined because the ratio of the open curiosity in futures contracts and the steadiness of the corresponding change.

From Could 2020 to Could 2022, the ELR has stayed in a relentless vary of round 0.17 to 0.25; nevertheless, since June 2022, the ELR has seen a outstanding climb. The ELR is at an all-time excessive, and a big quantity of leverage must be unwound. The BTC ecosystem has low liquidity proper now resulting from being in a bear market whereas a considerable amount of money stays on the sidelines; anticipate to see this leverage begin to come down.

Miners

Overview of important miner metrics associated to hashing energy, income, and block manufacturing.

The common estimated variety of hashes per second produced by the miners within the community. Hash Charge 262 TH/s 2.34% (5D)

The present estimated variety of hashes required to mine a block. Word: Bitcoin problem is usually denoted because the relative problem with respect to the genesis block, which required roughly 2^32 hashes. For higher comparability throughout blockchains, our values are denoted in uncooked hashes. Problem 152 T 13.43% (14D)

The whole provide held in miner addresses. Miner Steadiness 1,830,490 BTC -0.20% (5D)

The whole quantity of cash transferred from miners to change wallets. Solely direct transfers are counted. Miner Web Place Change -23,592 BTC -14,681 BTC (5D)

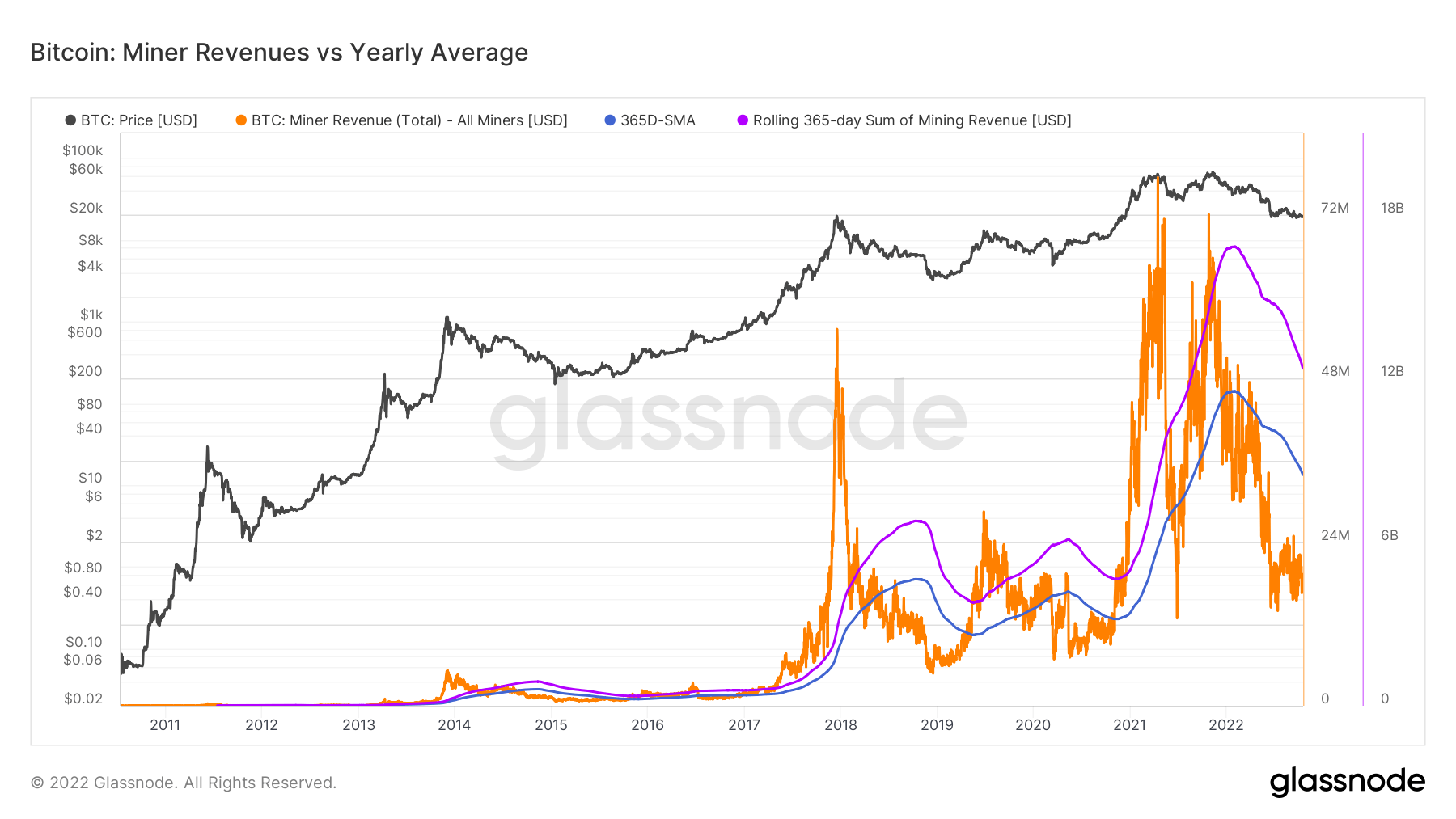

Miners proceed to get squeezed

All through August to October, the hash charge has gone exponential, from 220 EH/S as much as 260 EH/s, that is unparalleled throughout a bear market, and problem is enjoying catch up, which can also be at an all-time excessive, persevering with to squeeze miner income. When the following problem epoch is accomplished, it’s projected to regulate one other 3% to the upside. A distant reminiscence of Could 2021, when China banned mining and noticed the community drop to 84 EH/S.

To contextualize the stress miners are underneath and the shortage of income they’re incurring is the metric under miner income vs. the yearly common. Demonstrates the every day USD income paid to BTC miners in orange and examine it to the 365-day shifting common. Whereas additionally observing the mixture business earnings on a rolling 365-day sum of miner revenues.

On-Chain Exercise

Assortment of on–chain metrics associated to centralized change exercise.

The whole quantity of cash held on change addresses. Alternate Steadiness 2,343,473 BTC -57,299 BTC (5D)

The 30 day change of the provision held in change wallets. Alternate Web Place Change 281,432 BTC -395,437 BTC (30D)

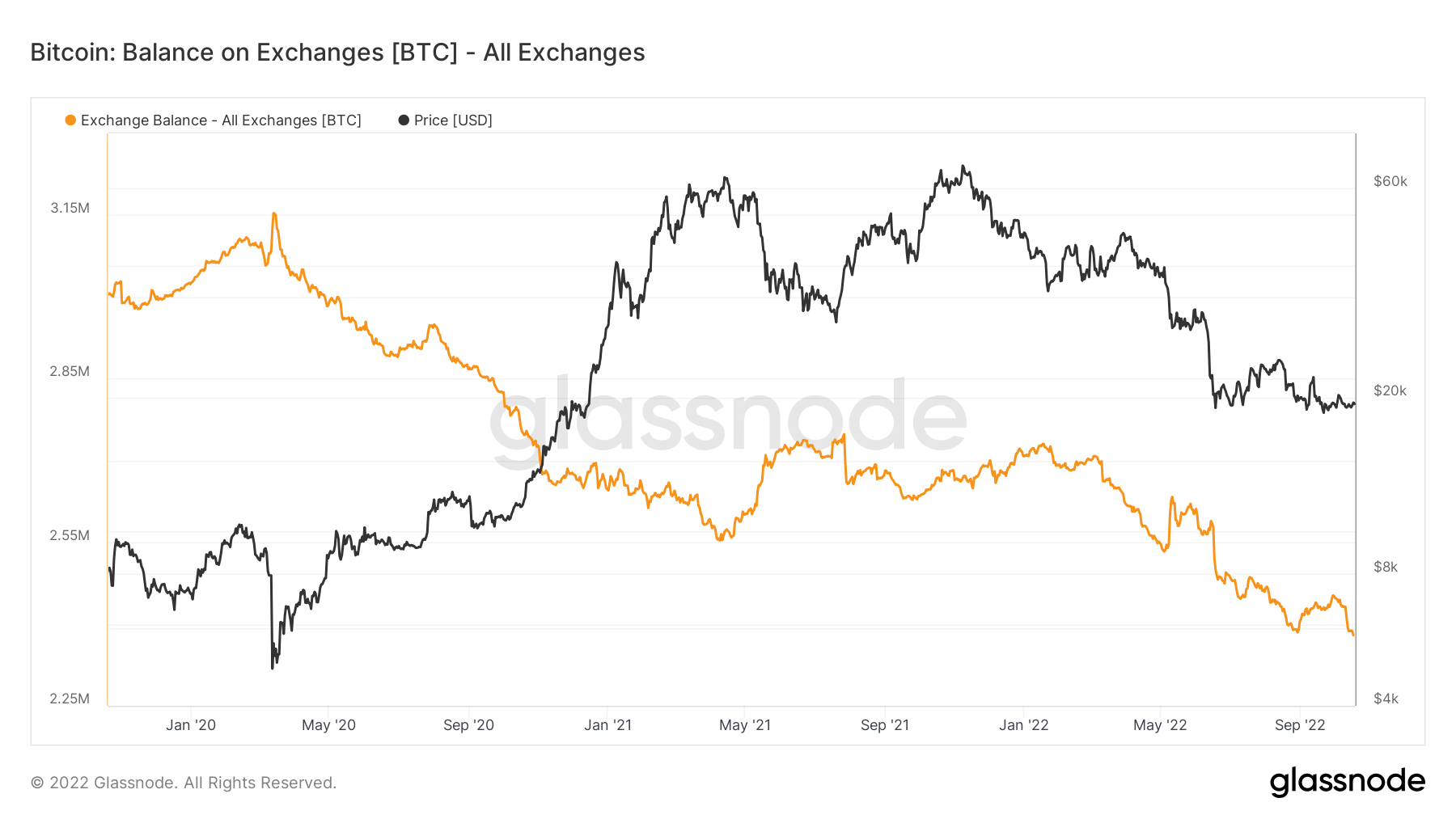

Bitcoin held on exchanges reached its lowest in 4 years

Bitcoin held by exchanges has reached its lowest in 4 years. At the moment, the Bitcoin quantity held by exchanges is just below $2,4 million, which is represented by the orange line within the chart under.

Over 300,000 Bitcoins have been faraway from the exchanges throughout winter, indicating a bullish pattern amongst traders. This lowered the provision held by exchanges to its 4-year lowest. The final time the Bitcoin steadiness on exchanges was round $2,4 million was in late 2018.

The present $2,4 million held inside exchanges equate to roughly 12% of all Bitcoin provide available in the market.

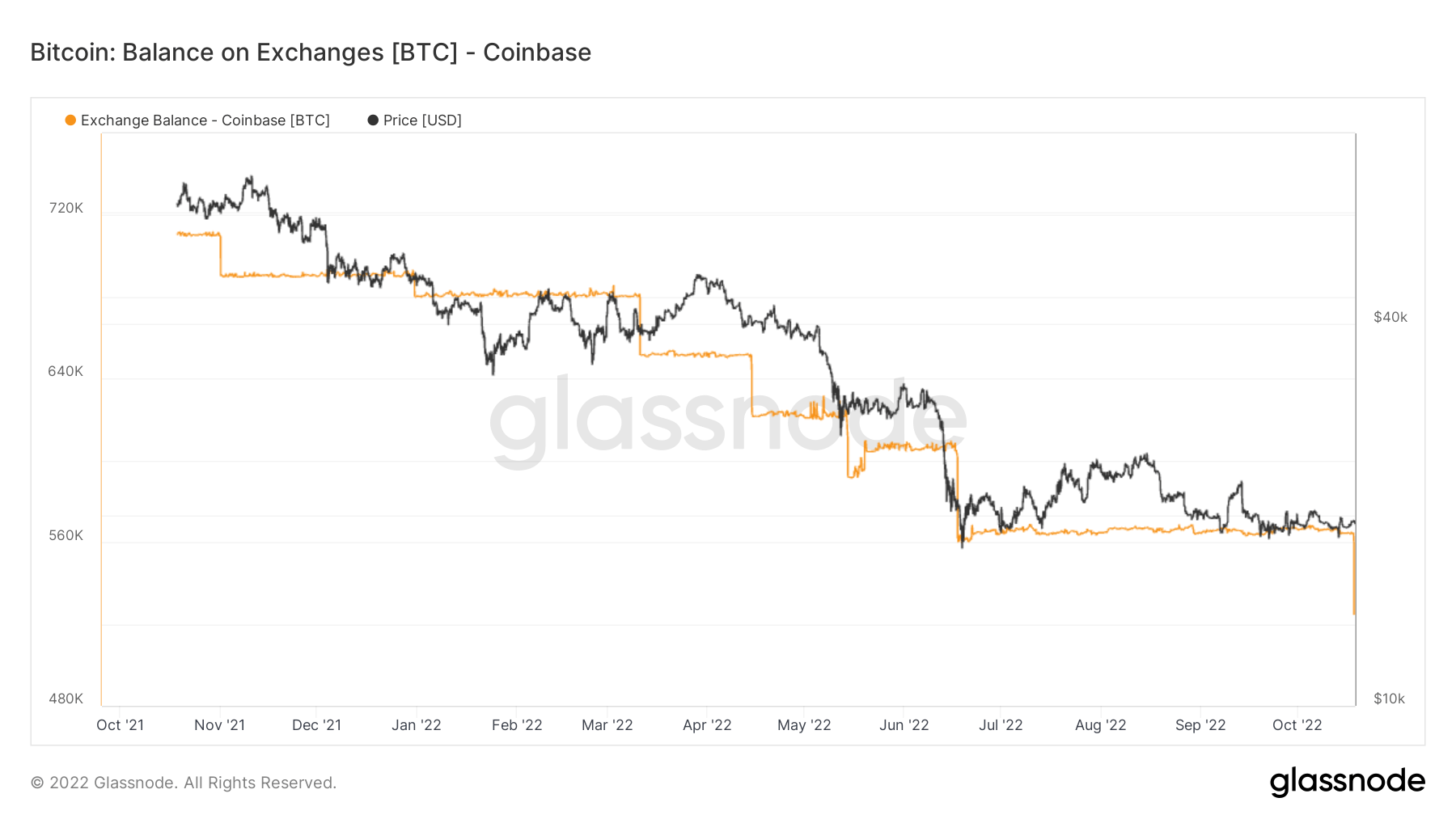

Because the November 2021 bull run, a minimal quantity of Bitcoins have been launched again onto the change. On the time, Coinbase held virtually 4% of the full Bitcoin provide. The change misplaced 1% of complete Bitcoin in almost a 12 months and has just below 3% of it.

Coinbase is primarily utilized by giant establishments within the U.S., that are identified for his or her tendency to purchase and maintain. As can also be demonstrated by the chart above, the change misplaced vital quantities of Bitcoin after the bear market hit.

Coinbase had almost 680,000 Bitcoins originally of the 12 months, and that quantity had fallen to 560,000 in eight months in August. The change misplaced one other 50,000 Bitcoins on Oct. 18, which dropped the full quantity held by Coinbase to 525,000.

Geo Breakdown

Regional costs are constructed in a two-step course of: First, worth actions are assigned to areas primarily based on working hours within the US, Europe, and Asia. Regional costs are then decided by calculating the cumulative sum of the worth modifications over time for every area.

This metric reveals the 30-day change within the regional worth set throughout Asia working hours, i.e. between 8am and 8pm China Customary Time (00:00-12:00 UTC). Asia 3,724 BTC -2,159 BTC (5D)

This metric reveals the 30-day change within the regional worth set throughout EU working hours, i.e. between 8am and 8pm Central European Time (07:00-19:00 UTC), respectively Central European Summer time Time (06:00-18:00 UTC). Europe -3,464 BTC 4,093 BTC (5D)

This metric reveals the 30-day change within the regional worth set throughout US working hours, i.e. between 8am and 8pm Japanese Time (13:00-01:00 UTC), respectively Japanese Daylight Time (12:00-0:00 UTC). U.S. -3,445 BTC 5,721 BTC (5D)

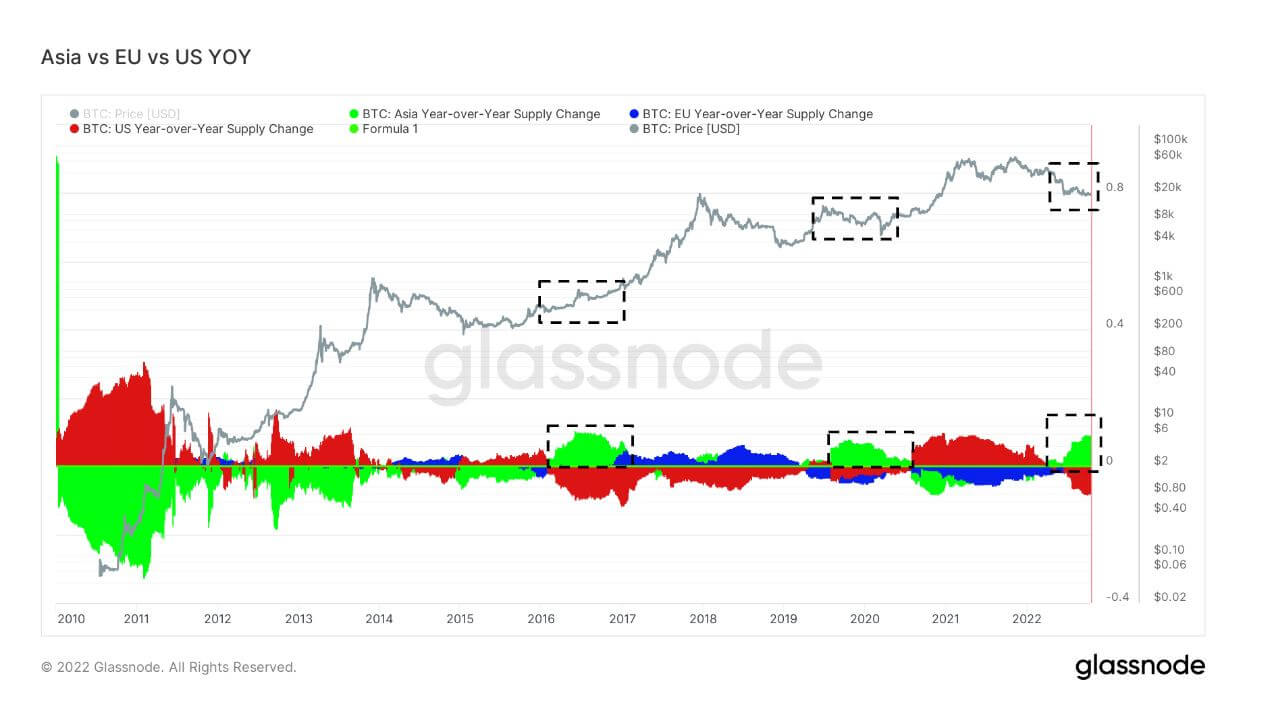

When Asia buys Bitcoin, it’s normally time to purchase Bitcoin

The final three bear markets, 2016-2017, 2019-2020, and 2022, have seen Asia’s share of BTC possession go up. That is at present essentially the most vital Asia premium for a number of years. Cryptoslate has talked about Asia turning into the good cash within the ecosystem. earlier bear markets, it’s obvious that Asia scoops up low-cost BTC.

Cohorts

Breaks down relative habits by varied entities’ pockets.

SOPR – The Spent Output Revenue Ratio (SOPR) is computed by dividing the realized worth (in USD) divided by the worth at creation (USD) of a spent output. Or just: worth offered / worth paid. Lengthy-term Holder SOPR 0.50 -16.67% (5D)

Quick Time period Holder SOPR (STH-SOPR) is SOPR that takes into consideration solely spent outputs youthful than 155 days and serves as an indicator to evaluate the behaviour of quick time period traders. Quick-term Holder SOPR 0.99 -1.00% (5D)

Lengthy-term holders holding down the fort

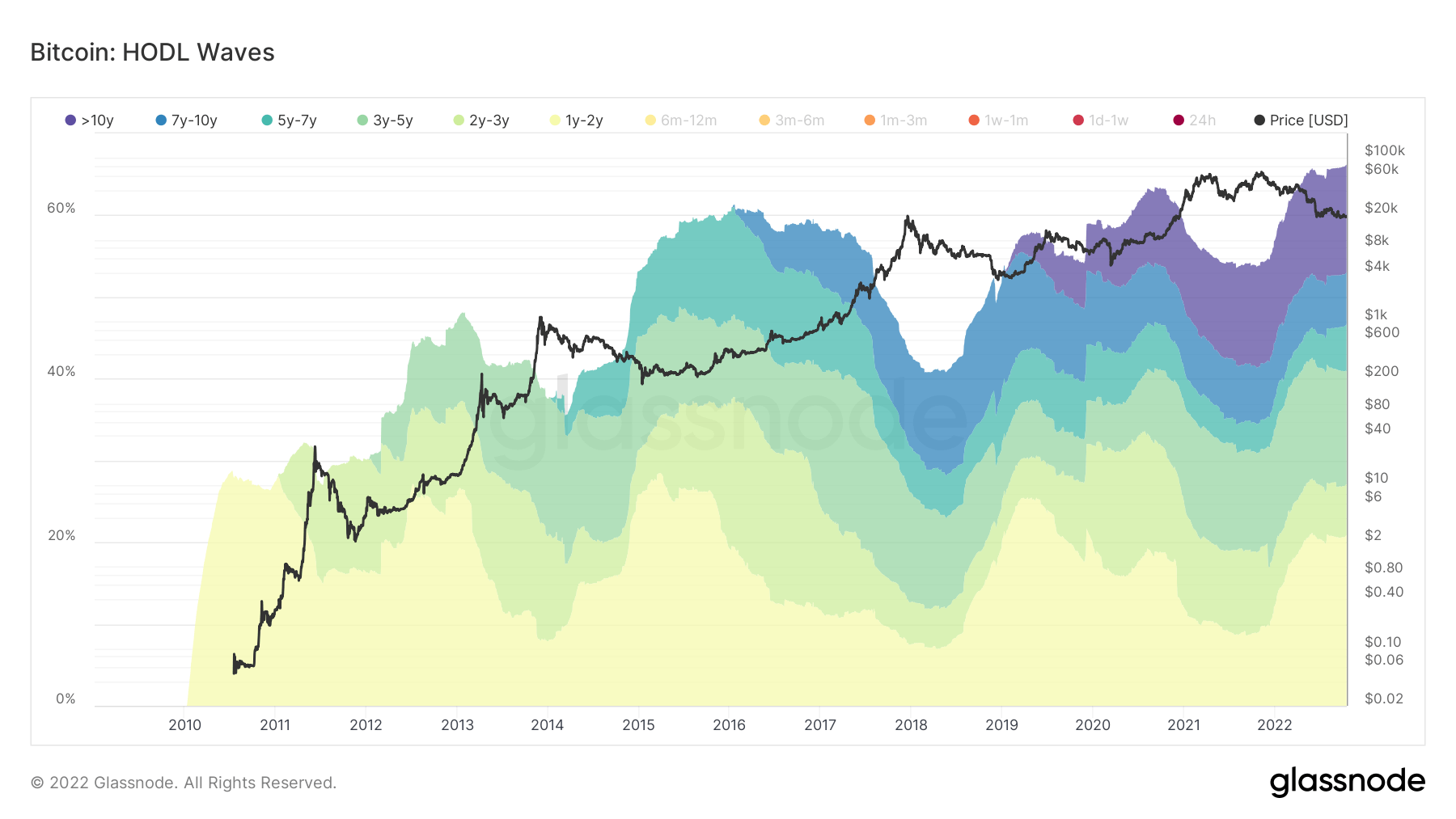

Lengthy-term holders are outlined as a cohort that has held Bitcoin longer than 155 days and is taken into account to be the good cash of the ecosystem. As BTC’s all-time excessive got here in November 2021, one-year cohorts have been chosen over six months to indicate this cohort has held from a 75% drawdown and remains to be hodling.

Throughout bear market cycles, LTHs accumulate whereas the worth is suppressed after STHs have left the ecosystem as they entered for worth hypothesis. At the moment, 66% of the provision is held by LTH, which is essentially the most quantity ever; throughout bear markets, LTH’s assortment portion grows, forming the brand new base for every bear market cycle.

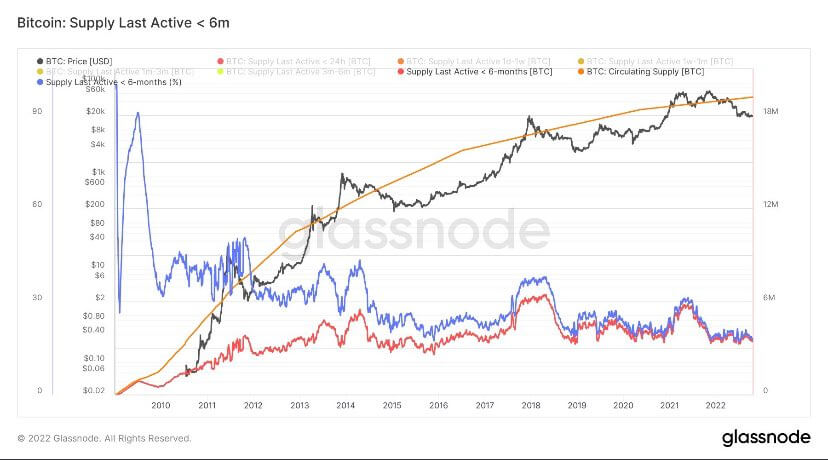

Quick-term holders are at bear market lows

Quick-term holders (6 months or much less) are holding Bitcoin at extraordinarily low ranges, much like earlier bear market cycles. STH’s at present have round 3 million of the provision; in the course of the 2021 bull run, this cohort acquired as much as 6 million, and the identical might be seen with the final bull run of 2017. Not all STH’s offered for worry of worth; a migration occurred from STHs to LTH, which noticed a rise of 10 million of the provision to 13 million throughout the again finish of 2021.

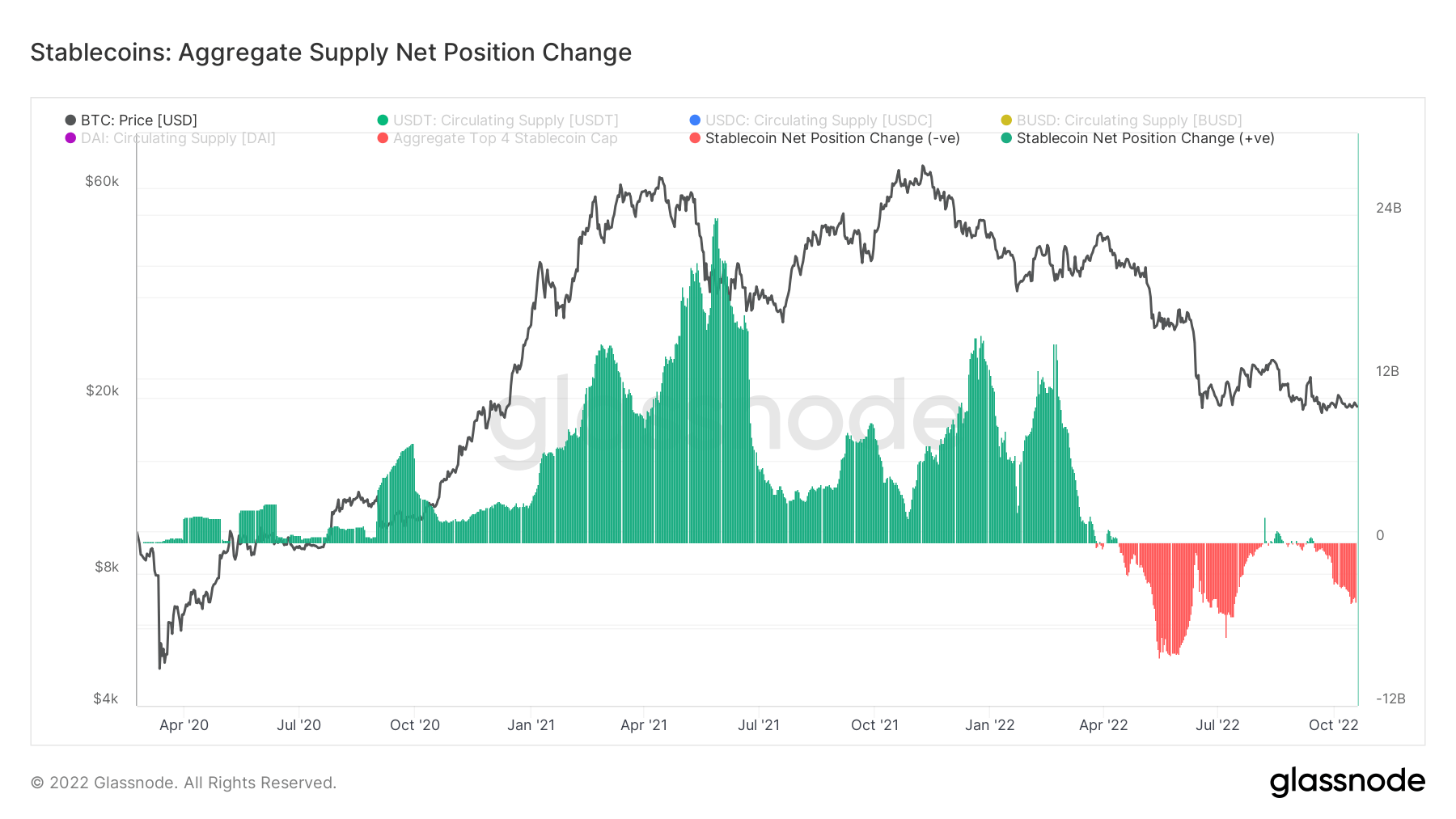

Stablecoins

A sort of cryptocurrency that’s backed by reserve property and subsequently can provide worth stability.

The whole quantity of cash held on change addresses. Stablecoin Alternate Steadiness $40.14B -0.05% (5D)

The whole quantity of USDC held on change addresses. USDC Alternate Steadiness $1.82B -23.87% (5D)

The whole quantity of USDT held on change addresses. USDT Alternate Steadiness $17.09B -0.05% (5D)

Change of regime for stablecoins

2021 was a monumental 12 months for stablecoins, and going into 2022, the market cap of simply the highest 4 stablecoins alone was upwards of over $160 billion. Fairly evidently, 2021 was a bubble propped up by futures and unsustainable yields. Through the bull run of 2021, virtually $24 billion of stablecoins have been being put onto exchanges and most probably utilized in defi.

Nevertheless, because the luna collapse, with Bitcoin dropping from $40k to $20k, distribution has been the central regime of stablecoins, at its peak of $12 billion of promote strain. In a world deleveraging occasion within the macro world, promoting happens from stablecoins to fiat to make debt obligations; anticipate this regime to proceed.