A take a look at the Bitcoin transactions and accumulation amongst numerous teams utilizing the Accumulation Pattern Rating (ATS) reveals that that is the third most aggressive dumping by Bitcoin (BTC) whales in historical past.

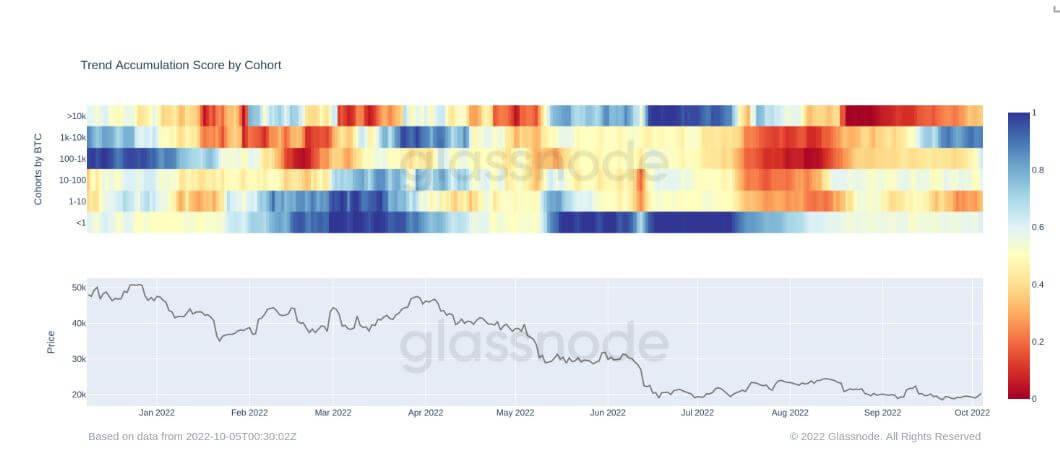

The buildup development rating is a metric that gauges the habits of assorted Pockets cohorts. It measures the relative power of accumulation for every entity by wanting on the dimension of the entities and the way a lot they’ve acquired or offered within the final 15 days.

The place the worth is near 1, it signifies that the entity is accumulating, and when it’s near 0, it means the group is distributing. For Bitcoin, the metric excludes miners and exchanges from that group, specializing in whales and shrimps.

Based on the ATS, whales, i.e., these with greater than 1000 Bitcoin of their pockets, have been the online sellers in latest occasions and for many of 2022. Nevertheless, shrimps, i.e., wallets with 1 Bitcoin or much less, have been fairly lively relating to accumulation.

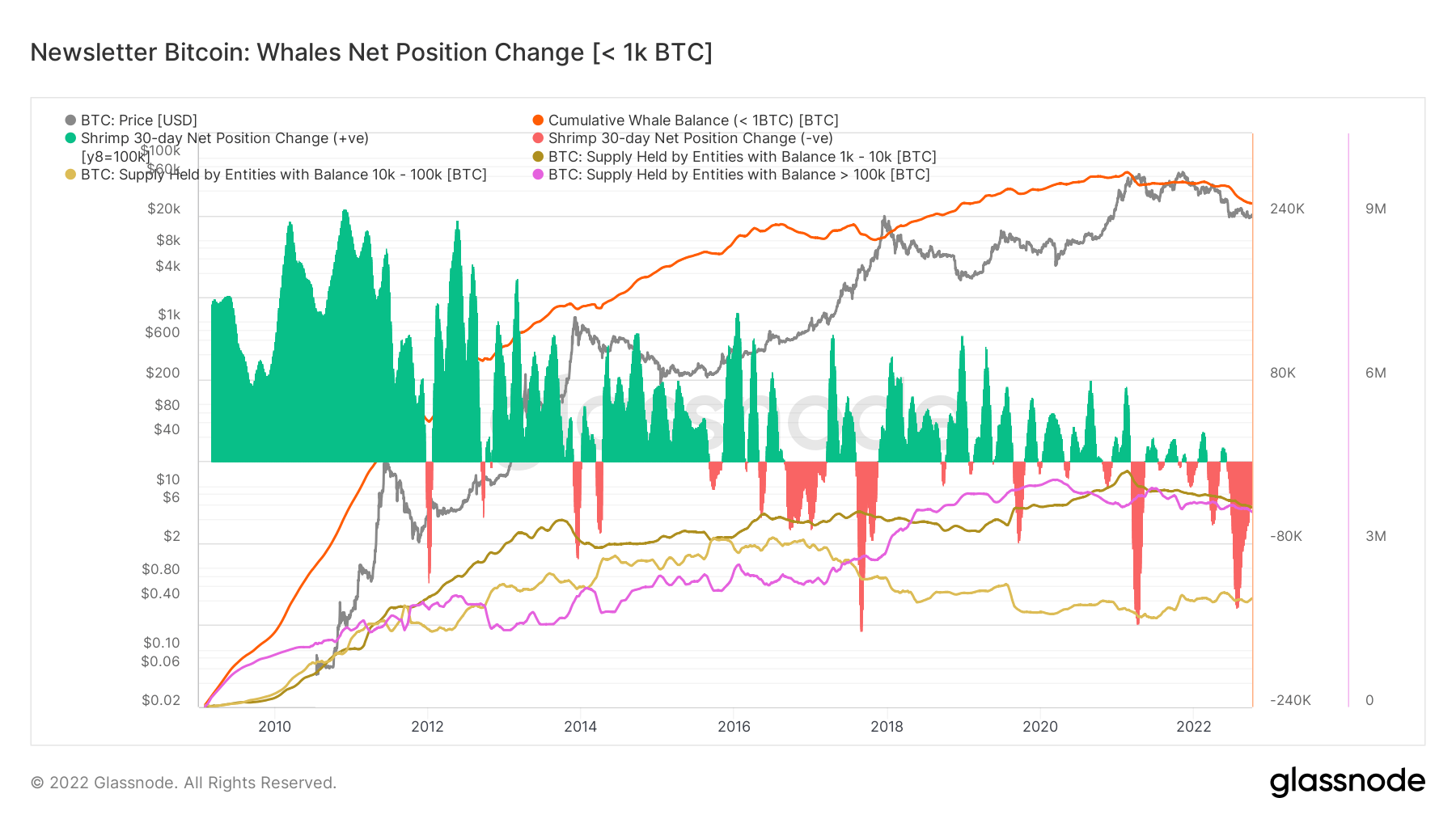

The chart reveals that whereas whales account for many Bitcoin purchases since inception, their acquisition charge has declined and is at the moment at its lowest.

The whales’ web place change chart identifies the 30-day web place change of whales shopping for and promoting BTC. Inexperienced denotes that whales are shopping for and that habits has trended downward since BTC’s inception.

By comparability, the speed of distribution is at its third highest. In two circumstances of the 2017 and 2021 bull run, whales had been promoting for revenue. However the 2022 distribution is because of a decline in costs.

Whales at the moment are promoting to hedge their losses. This implies they’re making the most of any constructive flip available in the market to dump the digital asset.

Though not all whales are promoting, a couple of whales, resembling Microstrategy, are accumulating. However the truth that many of the whales are promoting doesn’t bode properly for BTC within the brief time period.

Nevertheless, the shrimps are nonetheless accumulating, and a brand new group of short-term hodlers is forming. With the worth vary largely between $17,000 and $22,000, most small hodlers are taking benefit to extend their holdings.

The truth that most new hodlers have unrealized losses suggests they won’t promote anytime quickly.