The phrases GameFi 1.0, 2.0, and three.0 consult with the iteration of GameFi titles as they transfer from earliest and least sustainable to extra refined because the trade evolves.

Whereas tokenomics of various initiatives are a big issue (e.g., the variety of cash inside the sport), others, like funding and sport high quality, are additionally important.

This report will spotlight the constructive developments and shortcomings of GameFi 1.0 to suggest what a future GameFi 3.0 may seem like.

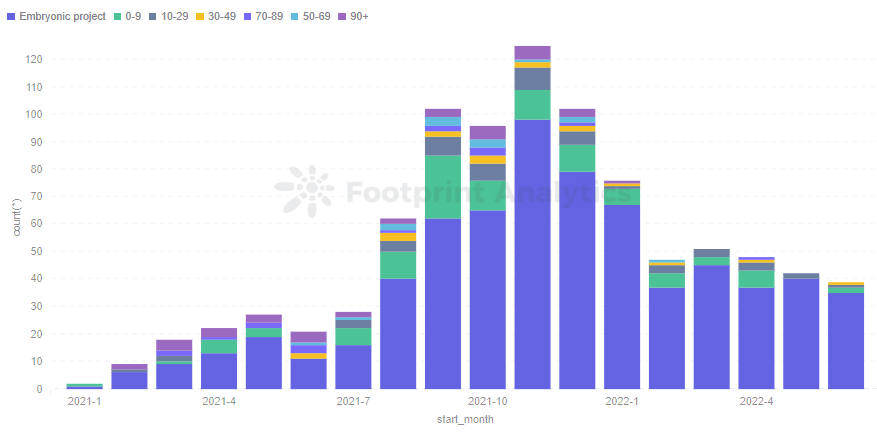

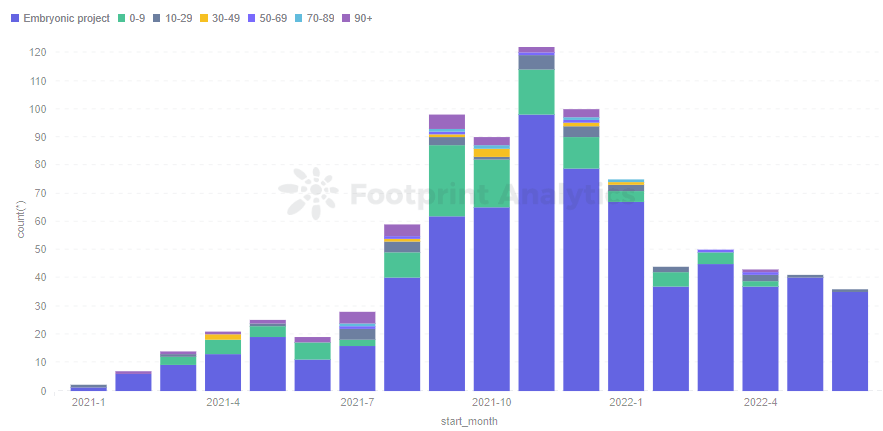

It’s been greater than a 12 months since GameFi took off, and from a fast upward climb in person numbers within the final quarter of 2021, it started to taper in early 2022, with a noticeable drop in February.

With the worldwide base of three billion players failing to flock to Web3 and the brief lifespan of most GameFi initiatives, it’s important to ask how this trade can turn out to be extra sustainable going ahead.

Three Findings in GameFi Improvement

Tasks that develop quick normally sacrifice high quality

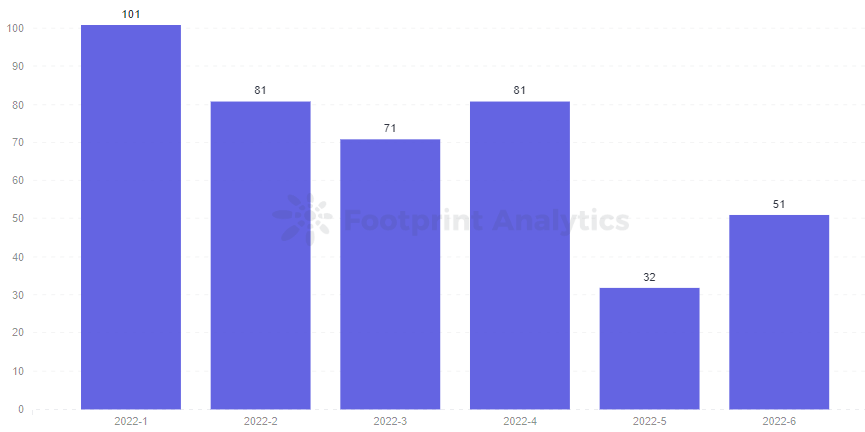

GameFi is a blended bag, and there’s no scarcity of fork initiatives hoping to make a straightforward buck. Between 70% and 80% of GameFi initiatives available in the market should not energetic, with a mean of 200 customers per day for five consecutive days. Despite the fact that 80% or extra of the initiatives launched in 2022 had been energetic inside 30 days of launch, the information signifies they’re failing to final lengthy.

Most initiatives fail to stay energetic

Knowledge reveals that 60% of initiatives die inside 30 days of being energetic, and few initiatives have been energetic for greater than three months since final November.

Most video games go from launch to energetic shortly however don’t keep energetic for lengthy.

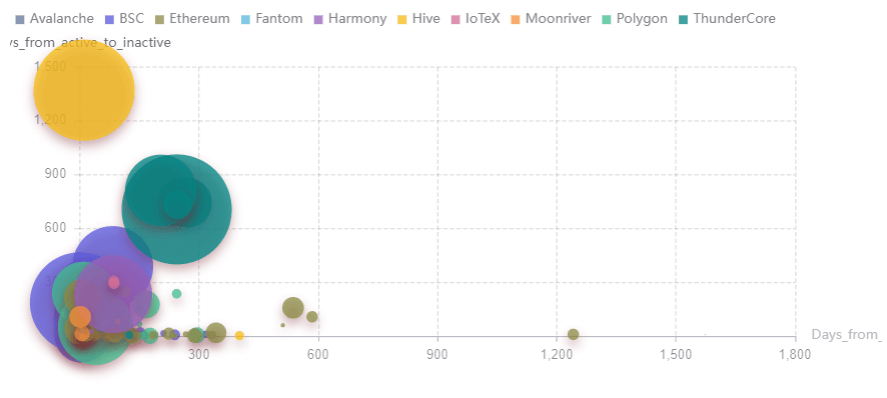

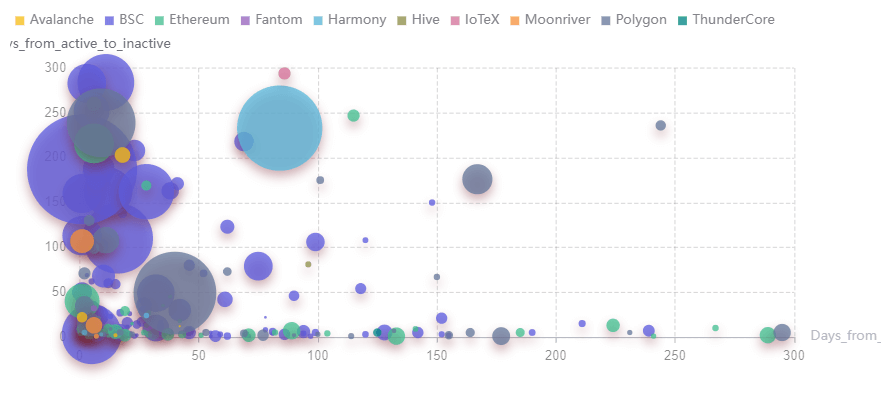

Chains differ of their improvement paths

The chart beneath reveals how shortly initiatives attain energetic standing after launch. The X axis is the variety of days a challenge takes from launch to energetic standing, the Y axis is the variety of days spent in energetic standing, and the bubble dimension is the whole variety of customers.

With Splinterlands, HIVE stands out from the remainder, because it has been energetic since its launch and continues to be going sturdy, making it the bigger yellow bubble within the high left nook.

Ethereum just isn’t GameFi-friendly by way of fuel charges and transaction effectivity, which makes it lower than superb for the GameFi house. Many initiatives have lengthy preliminary climbing intervals, brief energetic time, and low complete customers. However it has a robust basis, and perhaps after fixing these issues, extra high quality video games will come on-line to offer it a broader market share in GameFi.

However, BNB’s initiatives usually tend to get away shortly, have a medium length, and carry out comparatively nicely by way of person numbers. Polygon is reasonable, and ThunderCore reveals a surprisingly lengthy length of exercise.

Along with the bear market, GameFi’s structural issues have contributed to the present state of affairs. This report will try and uncover the causes of those issues and discover the potential way forward for GameFi.

Structural points with the GameFi 1.0

The Demise Spiral in GameFi 1.0

GameFi 1.0, a class wherein Axie Infinity was dominant for a very long time, revolves round Play-to-Earn.

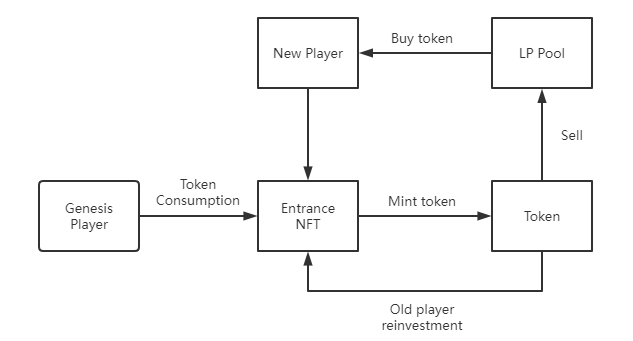

Regardless of variations in gameplay (e.g. staking, tower passing PVE, card battling PVP) or tokenomics (single token, twin token, token + NFT, token-standard, and many others.), these early titles are all Ponzi-like. They rely excessively on a gradual stream of incoming funds in an “exterior circulation” mannequin.

On this mannequin, previous gamers reinvest with the funds invested by new gamers, and new gamers maintain paying curiosity and short-term returns to previous gamers to create the phantasm that previous gamers are creating wealth.

All of the tokens minted by previous gamers must be consumed by new gamers, or in any other case, gamers will maintain promoting, inflicting the token movement pool to have solely sellers and no patrons. On this case, the token worth will enter a loss of life spiral.

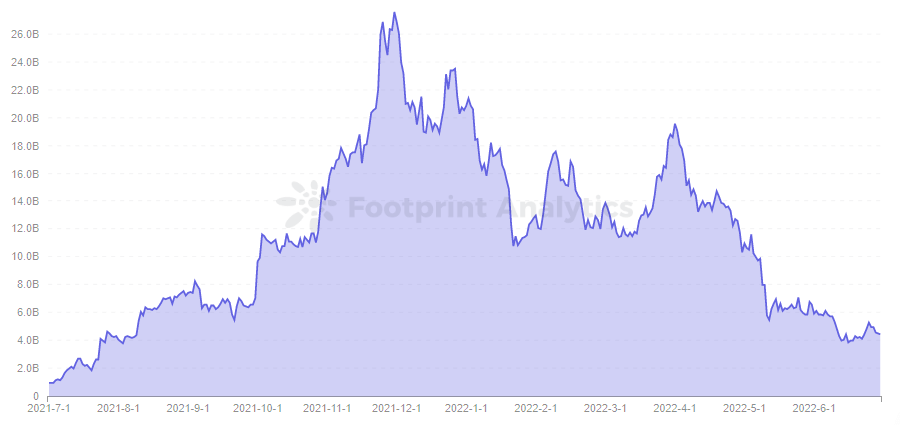

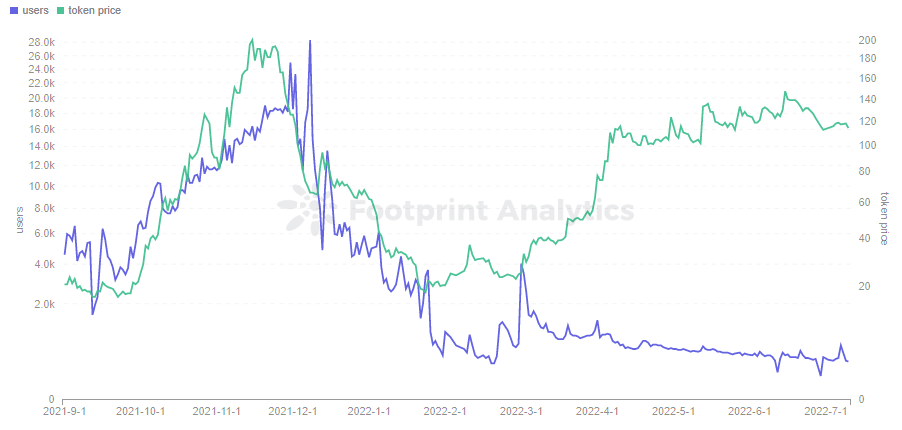

As seen from Footprint Analytics information, after regular progress from July to September 2021 and an explosive interval from October to November, incoming funds throughout the sector started to decelerate as a result of basic atmosphere and the impression of particular person initiatives.

Beneath such circumstances, the exterior circulation mannequin of GameFi 1.0 shortly grew to become problematic, as out-of-game funds can not meet the fixed demand for in-game funds to generate curiosity, thus regularly reworking the constructive spiral right into a loss of life spiral.

Thus, most GameFi 1.0 initiatives had, or can have, just one cycle, and as soon as the loss of life spiral begins, they can’t be revived. Totally different fashions, groups, backgrounds, operations, and environments affect the general challenge all through the method and may produce a wide range of cycle patterns.

The chilly GameFi winter was as a lot attributable to the trade’s Ponzi-like character because the macroeconomic atmosphere. The expansion price of the general capital growth of tokens has not stored up with the demand for capital income inside the video games, creating an inevitable bubble burst.

New Improvements

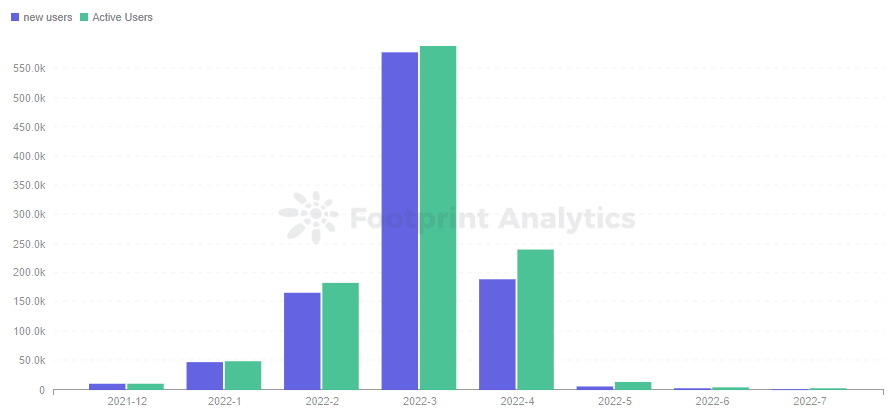

Some initiatives started to innovate with financial fashions and noticed a burst of constructive exercise from February to March regardless of the poor atmosphere.

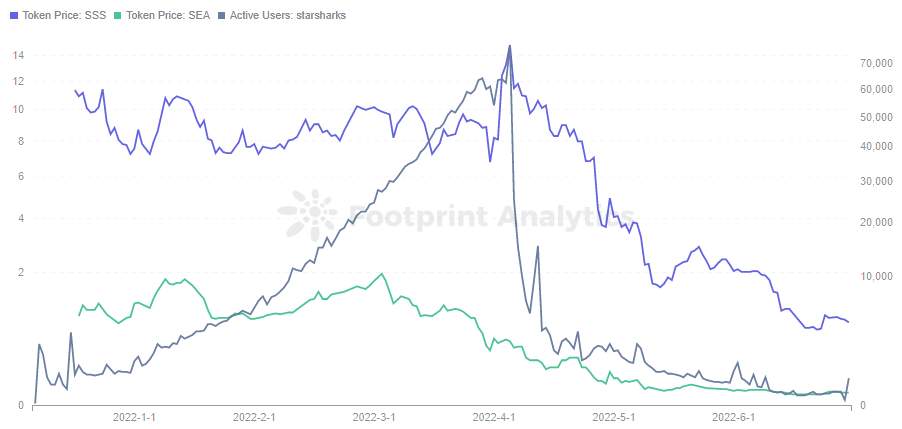

Crabada on Avalanche and StarSharks on BSC are essentially the most distinguished amongst them. StarSharks used its help from Binance within the early stage to maintain its recognition excessive, with “Genesis Thriller Containers”—an in-game NFT—having a excessive worth even earlier than the sport was launched.

Unluckily, the sport’s launch coincided with the GameFi winter. Due to this fact, StarSharks had few gamers within the early phases.

Nevertheless, StarSharks’ backing, financial mannequin, and sport high quality—in addition to its energetic neighborhood—allowed it to develop steadily all through Q1. It started to say no regularly after peaking in April.

III. Tokenomics of GameFi 1.0 initiatives

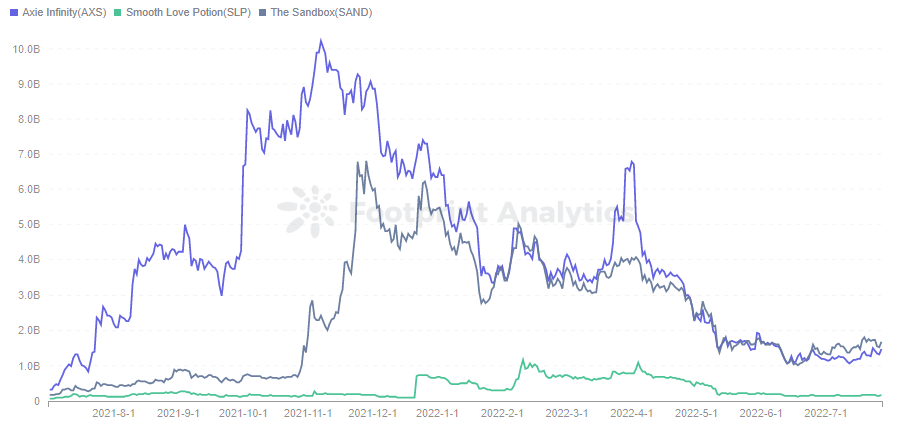

Tokenomics can decide the life cycle of a challenge, as might be seen by taking a look at a number of completely different video games.

Axie Infinity

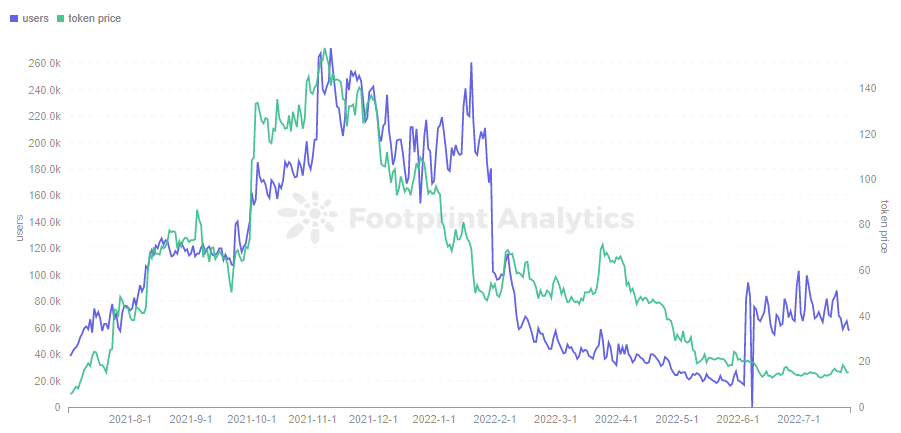

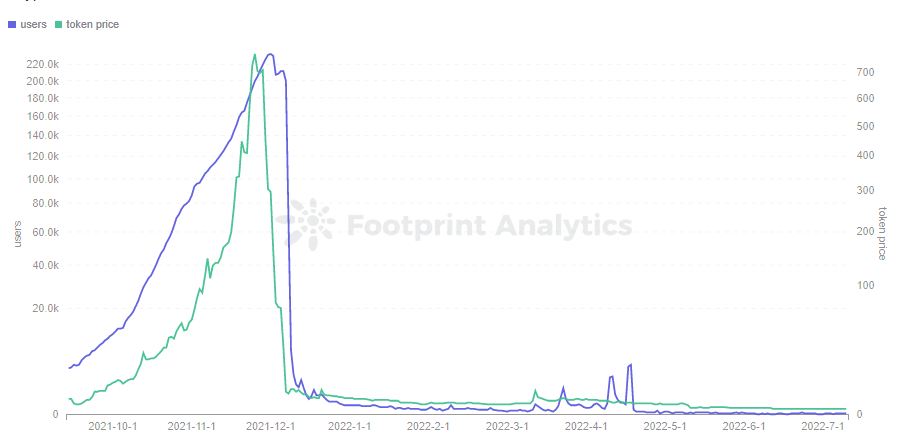

Axie Infinity, because the originator of P2E, had unmatched sources and a participant neighborhood at the start of the bull market. Due to this fact, it was capable of keep a number of months of upswing with solely the essential twin token mannequin and breeding system. Nevertheless, it confronted a gradual decline afterwards but nonetheless retains some loyal customers.

BinaryX

BinaryX attracted many customers within the early phases as a result of it paid out quite a lot of APY and returned to early gamers in a short time.Now it has an inflation drawback with its tokens. As soon as there may be not sufficient income, it should instantly enter the destructive suggestions part and the variety of customers will drop quickly.

Nevertheless, with the change and the challenge’s management over BNX, the worth of the token has rebounded, however there are nonetheless only a few customers.

CryptoMines

The only token mannequin of CryptoMines is pure Ponzi, and its lifecycle form is consultant of most degen initiatives.

Within the early stage of the challenge, with a really brief payback cycle to draw numerous funds, customers and market cap can have an enormous pull up. When the bubble blows to the important level of market capital and feelings shortly burst, the upper it rises the quicker it falls.

Whereas the financial fashions, working fashions, and life types of the initiatives fluctuate, each the blue-chip Axie Infinity, the degen CryptoMines, and the meta-universe idea The Sandbox all confronted hassle in December 2021.

StarSharks

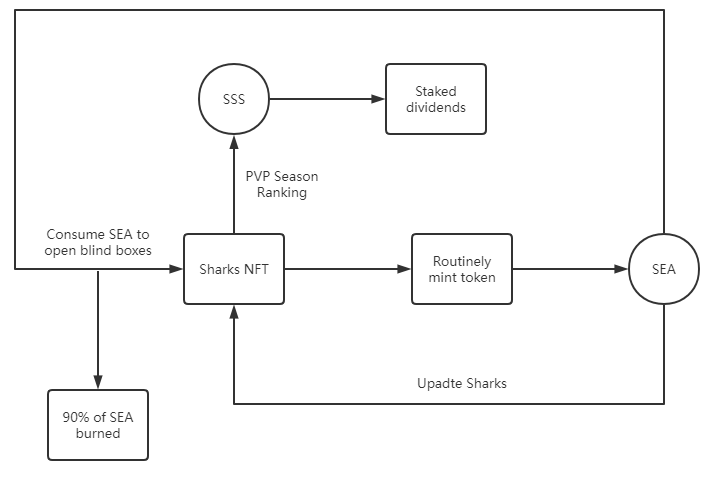

Based mostly on the expertise of the previous above, StarSharks’ additionally makes use of the basic twin token mannequin, with SEA as the primary output and SSS because the governing token. This has allowed it to create a small growth within the winter, and its mannequin deserves to be explored much more.

As a way to forestall the loss of life spiral attributable to infinite inflation of the in-game token SEA like different twin token fashions, StarSharks turns the requirement to enter the sport into consuming SEA to purchase a blind field, thus shifting the stress from token dumping to the NFT pool. So SEA takes the grasp management impact, and 90% of the consumed tokens are instantly burnt, so the circulation of tokens is even much less.

The governing token SSS is especially the empowerment of staking dividends, and its output just isn’t a lot within the case of its basic empowerment function.

From Footprint Analytics, the variety of energetic customers has been rising evenly from January to March, indicating that the variety of SEAs consumed on the time additionally elevated equally.

Nevertheless, from the start of March, the worth of SEA began to development downward, reflecting the buildup of a number of months. The variety of SEA minted within the sport reveals an accelerating development, and the output is bigger than the consumption, highlighted by the worth decline.

Because it turned out, StarSharks lit the fuse at the start of April when the variety of customers started to fall off a cliff after the cancellation of day by day duties and the rental market. So for the GameFi challenge, mannequin evaluation and information monitoring may give some indication of the cycle the challenge is in.

StarSharks couldn’t escape the loss of life spiral, and the sport’s strengths and weaknesses can train the GameFi house a number of classes.

Strengths

-

- GameFi quantity continues to be small, a number of hundred energetic customers can revitalize the challenge within the early phases.

- The challenge mixed with the background narrative, which added to gamers’ expectations for the GameFi challenge in March to April, and gained the curiosity and belief of numerous customers.

- The crew efficiently seized the turning level of the 2 intervals and adjusted the return cycle of short-term play-to-earn to the secure income, with the upkeep of the neighborhood and huge customers, to stabilize the unfold of the wealth creation impact.

Weaknesses

-

-

- Though the life cycle has been lengthened, it didn’t change the general construction.

- The rhythm of the following new updates didn’t sustain in time, ensuing within the exodus of some worthwhile customers and destroying the steadiness.

-

IV. What are the chances for GameFi’s future?

Whereas everybody was anticipating it, GameFi 1.0, which formally entered the second half of the 12 months, didn’t appear to have too vivid a efficiency in Q2. Irrespective of from the variety of video games or the general sport capital, all of them present a gradual decline.

So, what sort of mannequin can enable GameFi to develop sooner or later?

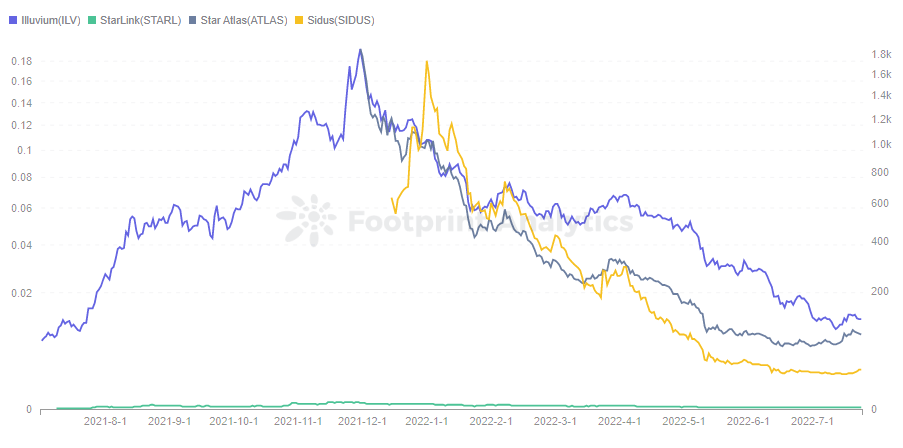

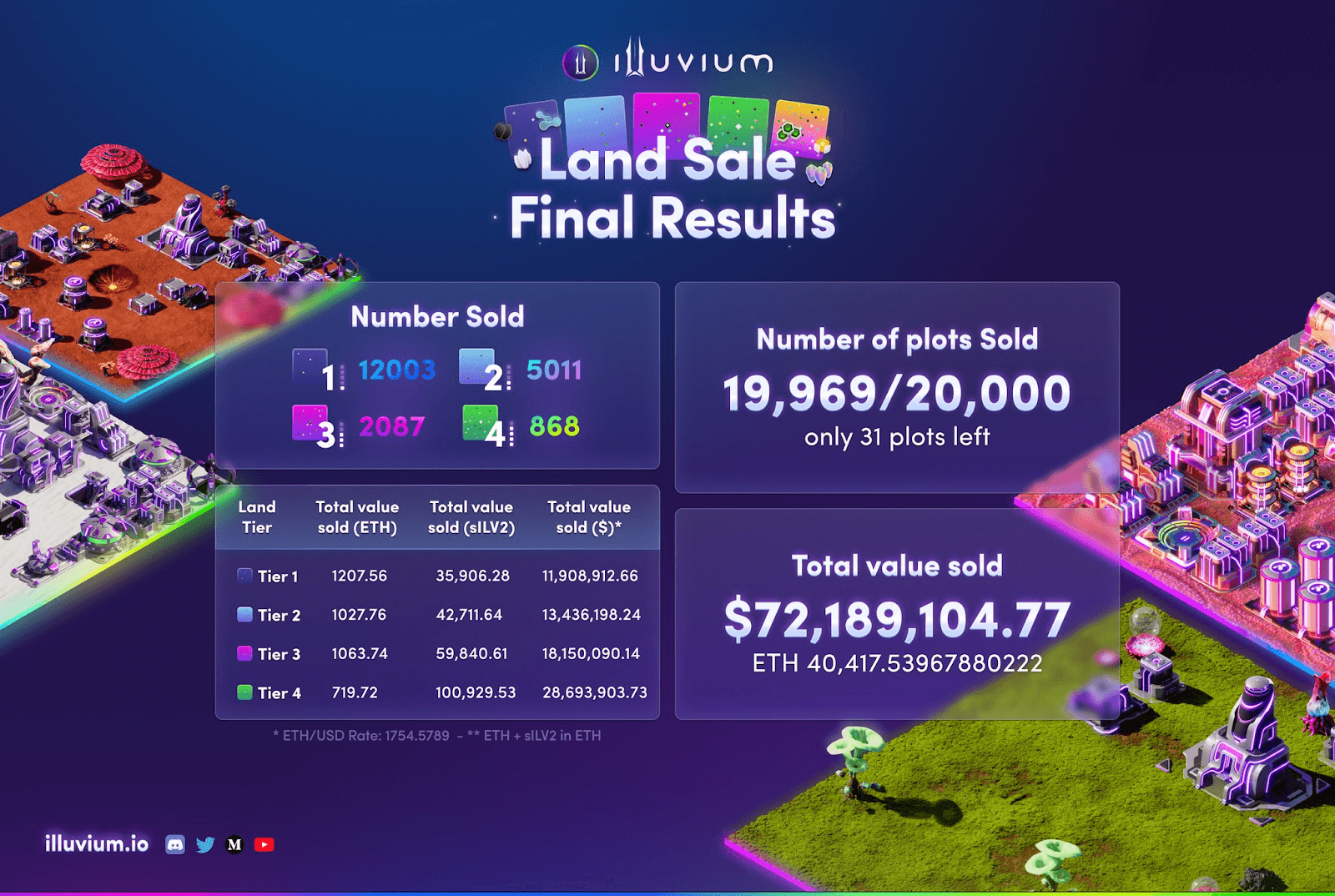

Excessive-quality AAA video games

3A video games consult with video games with excessive improvement prices and high quality. There is no such thing as a goal standards for 3A, so within the GameFi house, video games are typically rated primarily based on the energy, background, the imaginative and prescient of the challenge and the sport demo. At the moment, acknowledged 3A video games embody BigTime, Illuvium, StarTerra, Sidus, Shrapnel, and Phantom Galaxies.

These 3A video games have the plain benefit of typically gaining big consideration early within the challenge, however there are nonetheless varied points that gamers criticize.

- The event course of is simply too gradual.

- Content material and film high quality are solely barely higher than Web3, removed from the extent of conventional video games.

- IDO and INO should not sufficient to empower sport property.

- Roadmap is ambiguous or not totally carried out.

Among the initiatives which have issued tokens have adopted the general GameFi market downhill within the first half of the 12 months.

Sooner or later, there might be a time when 3A video games will blossom, with MOBA, RPG, SLG creating completely different scenes and completely different content material in keeping with their very own positioning. As an alternative of considering an excessive amount of about P2E, the sport will use fascinating gameplay and content material to draw customers to expertise the sport and benefit from the distinctive options enabled by blockchain. Perhaps customers have to attend for some time, perhaps subsequent 12 months Q2, Q3, and even longer, however that is the path of the market.

Narrative-based X2E merchandise

StepN launched the Transfer-to-Earn development. It has additionally created the “X2E” subcategory, which encompasses varied actions that is likely to be compensated through video games’ tokenomic fashions. E.g., Study-to-Earn, Sleep-to-Earn, Watch-to-Earn, and Sing-to-Earn.

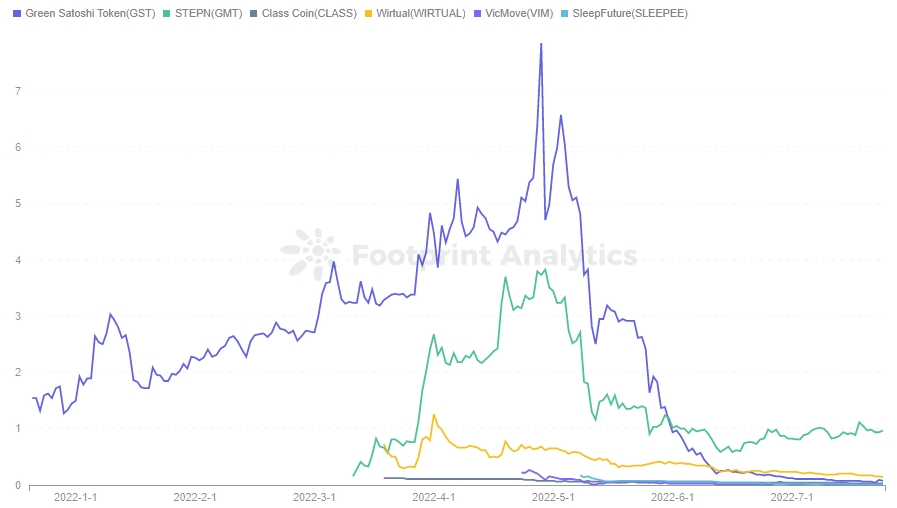

As seen by Footprint Analytics, whereas different fashions of X2E are nonetheless within the early conceptual phases, M2E’s StepN led the wave in Could, and different imitators are popping up all over.

Nevertheless, apart from Genopets, which is a sport within the mode of Pokémon, different X2E initiatives resembling StepN, SNKRZ, Melody, FitR are extra like Web3 merchandise with profit-making attributes, so this piece must focus extra on the social attributes dropped at customers.

As an enormous meta-universe scene, SocialFi can also be all the time what gamers are in search of. An enormous world chat, leaderboard comparability, sport exercise competitors, and guild battle content material can all give gamers significant experiences exterior of incomes.

An evolving finance mannequin

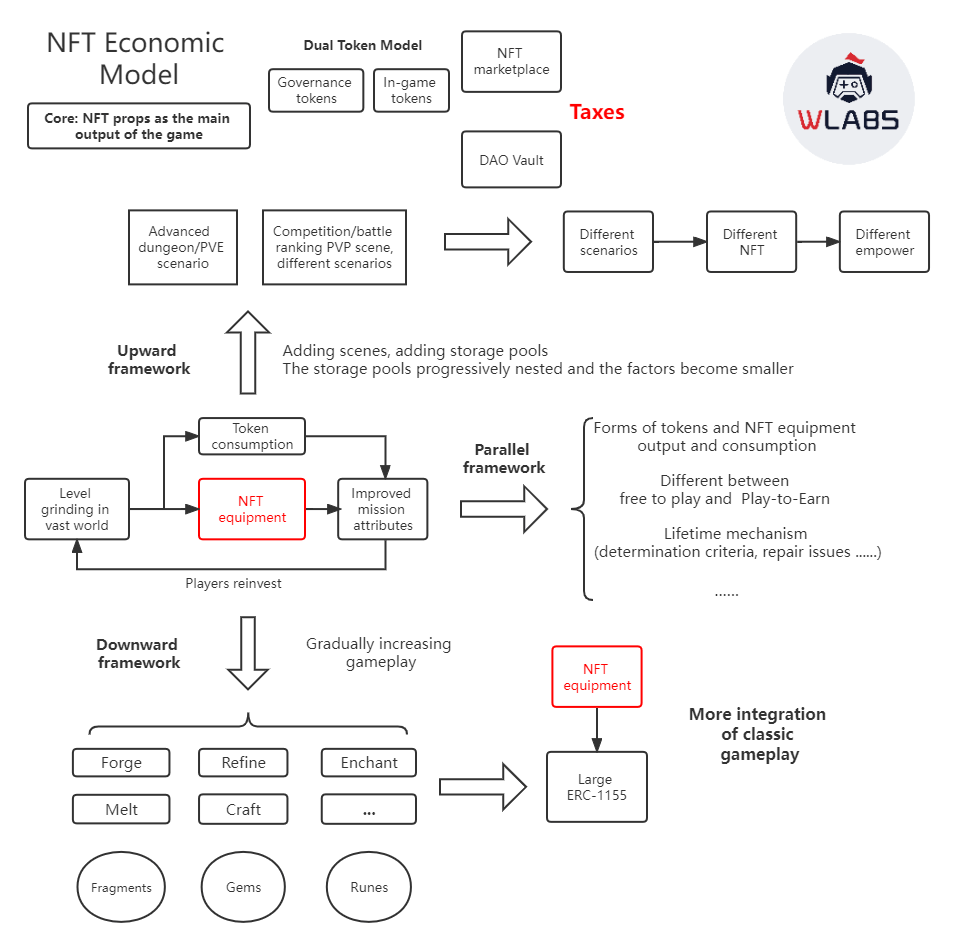

Most blockchain video games nonetheless revolve round P2E, and the twin token mannequin is essentially the most secure, confirmed system out there. Due to this fact, the longer term GameFi mannequin can nonetheless use this mannequin, nevertheless it additionally requires a DAO vault and an NFT market.

You will need to observe that the NFT market should be the challenge’s personal, in order that a minimum of tax income is the primary supply of earnings for the challenge at this stage, reasonably than relying fully on the cash of late-entry gamers.

Since NFTs might be an integral a part of GameFi, challenge homeowners can attempt to make NFT props the primary output of the sport, whether or not it’s ERC-721, ERC-1155 or a brand new evolvable protocol like EIP-3664.

The second most essential factor is the framework design of the sport mannequin, which is expounded to the sustainability of the challenge. A easy cycle of token and NFT between bettering character attributes like GameFi 1.0 can be too skinny. This mannequin is extra like a Ponzi framework, the place the late-entry cash retains contributing to the front-entry cash, and the challenge developer throws the token stress to the NFT, which can fall right into a loss of life spiral when the NFT pool overflows.

Enriching the sport’s ecosystem and lengthening its lifecycle requires extra extensions to the unique mannequin each horizontally and vertically. When the facility of the sport’s personal inside circulation is massive sufficient, it should generate the centrifugal pressure that may do away with the inertia of being caught within the loss of life spiral.

Horizontal extensions

Horizontal extensions embody including token and NFT output and consumption eventualities. For instance, setting the tools life mechanism and restore standards; or stratifying the free and P2E gamers to set completely different sport play types.

Vertical Extensions

Vertical extension might be break up into 2 buildings: upward and downward. The upward extension is used to resolve the issue that gamers have too few roles to select from. 99% of gamers depend on the one mode of minting and enjoying to make income, so extra eventualities might be added. For instance, add superior dungeons, PVE, PVP, and these eventualities needs to be differentiated to offer extra empowerment by way of advantages and consensus.

The downward extension is completely different from the upward extension, which lengthens the life cycle by considerably growing the variety of props and gameplay. Similar to growing the items of props, gems and thus growing the enchanting, melting operate, downward framework can draw rather a lot from the standard sport play.

Abstract

GameFi 1.0 has gone by way of a cycle that confirms that Web2 and Web3 gamers nonetheless have very completely different attributes. Ponzinomics can entice visitors at the start of a challenge, however it’s not possible to rely solely on the exterior circulation mannequin, and if the challenge can’t discover its personal inside circulation to soak up the earlier bubble it will likely be onerous to flee from the loss of life spiral.

Most present GameFi initiatives are nonetheless not playable and don’t replicate some great benefits of blockchain by way of know-how. Due to this fact, a transitional GameFi mannequin can solely be constructed from the angle of Web3 customers and financial fashions. The lifecycle of the initiatives just isn’t lengthy, and the event of chains just isn’t superb. Some chains have many video games however poor quantity, whereas others have a scorching sport however an unbalanced on-chain ecosystem.

The way forward for GameFi must discover a means to enhance content material, gameplay and tokenomics.

August 2022, Footprint Analytics × W Labs, Knowledge Supply: Footprint × W Labs GameFi Report Dashboard