Yield aggregators are protocols that automate the method generally known as “yield farming.” Yield farming is the time period used to outline the next course of:

- To put money into a protocol that may generate curiosity (or yield)

- To gather these returns, often paid within the native token of the protocol the place the capital is invested (additionally referred to as “harvest”)

- To promote these tokens in a DEX

- Take this revenue and reinvest it on the identical protocol, rising the funding dimension and the returns.

- Repeat all steps whereas it’s worthwhile.

How do yield aggregators assist buyers?

To do all these steps manually requires a variety of time, data, and interactions with totally different blockchains and protocols. The primary advantages of utilizing a yield aggregator to handle it are to scale back prices, optimize the harvest cycles (because the protocol is scanning the community continuously), and cut back the time wanted to handle all investments.

Through the use of a yield aggregator protocol, the one step that the investor might want to do is switch the asset to their sensible contract and obtain a receipt of this transaction. It’ll then deploy the capital into totally different funding methods. They may handle the positions and care for reinvestments and compounding. Thome protocols can even add new methods and mechanically deploy capital to those new alternatives.

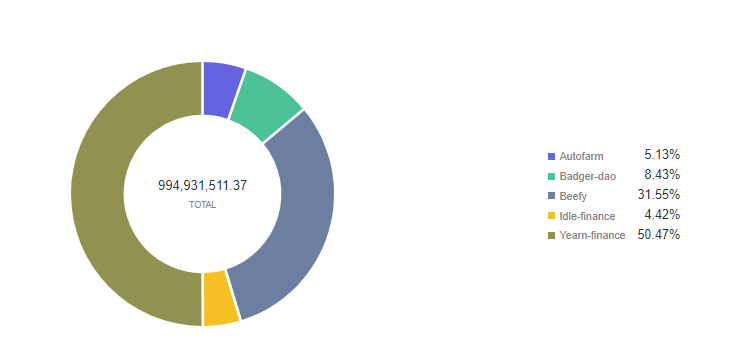

This text will cowl the highest 5 yield aggregators by TVL and discover their most important options.

Yearn Finance

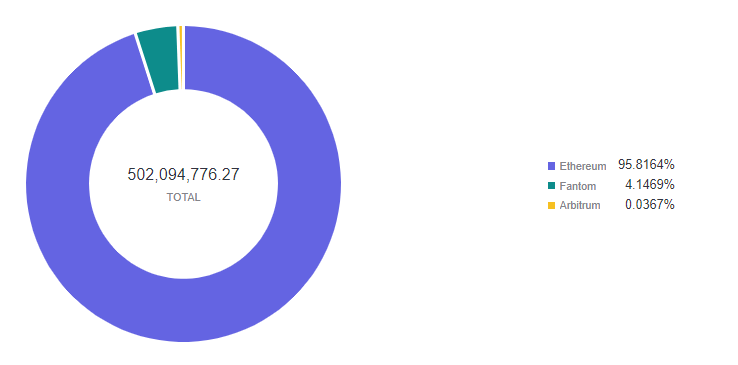

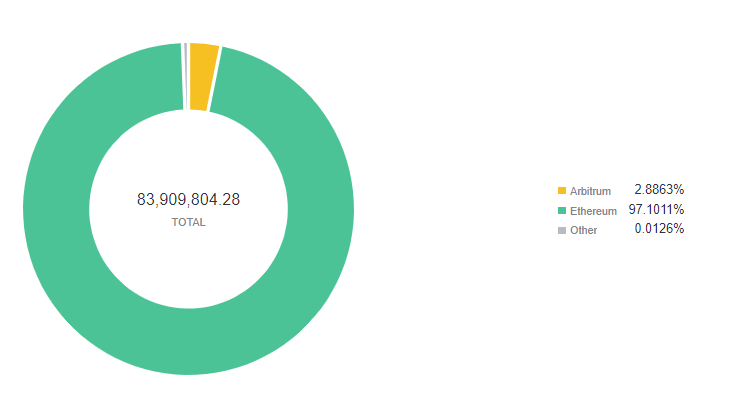

Yearn Finance was one of many first yield aggregators, launched on July 17, 2020. The prototype for it was a protocol referred to as iEarn launched by Andre Cronje on the Ethereum Blockchain. At present, it’s deployed at Ethereum, Fantom, and Arbitrum blockchains, with a scheduled enlargement to Optimism. The chart beneath exhibits its TVL divided by chains:

Regardless of it being closely focused on the Ethereum Blockchain, Yearn Finance began to combine different chains originally of 2022 because it recognized new alternatives.

Yearn Finance Options

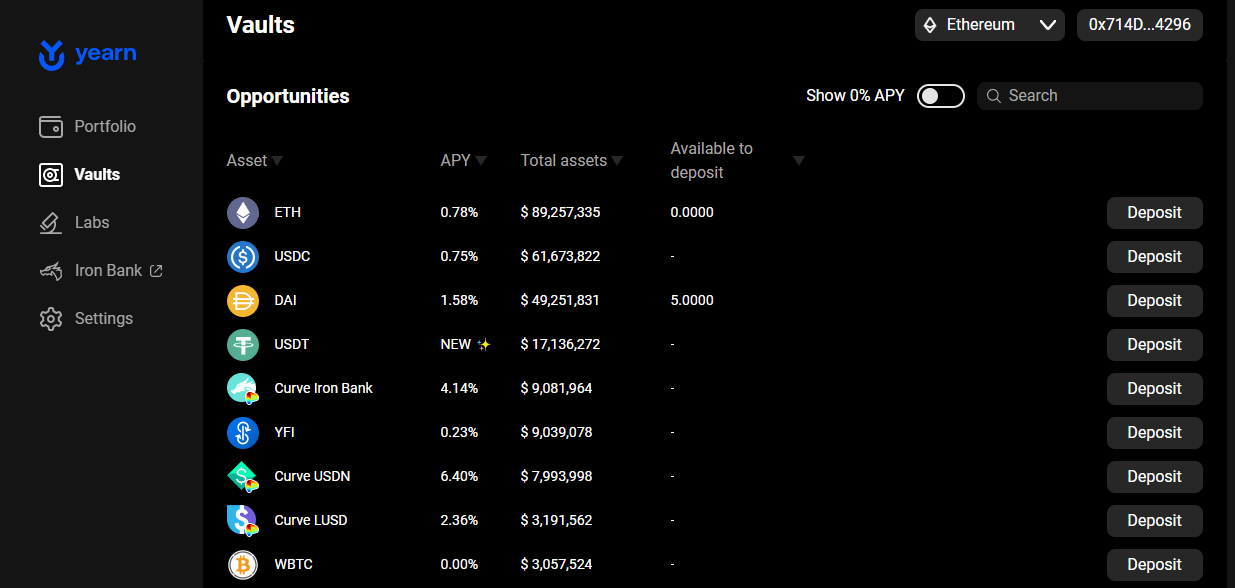

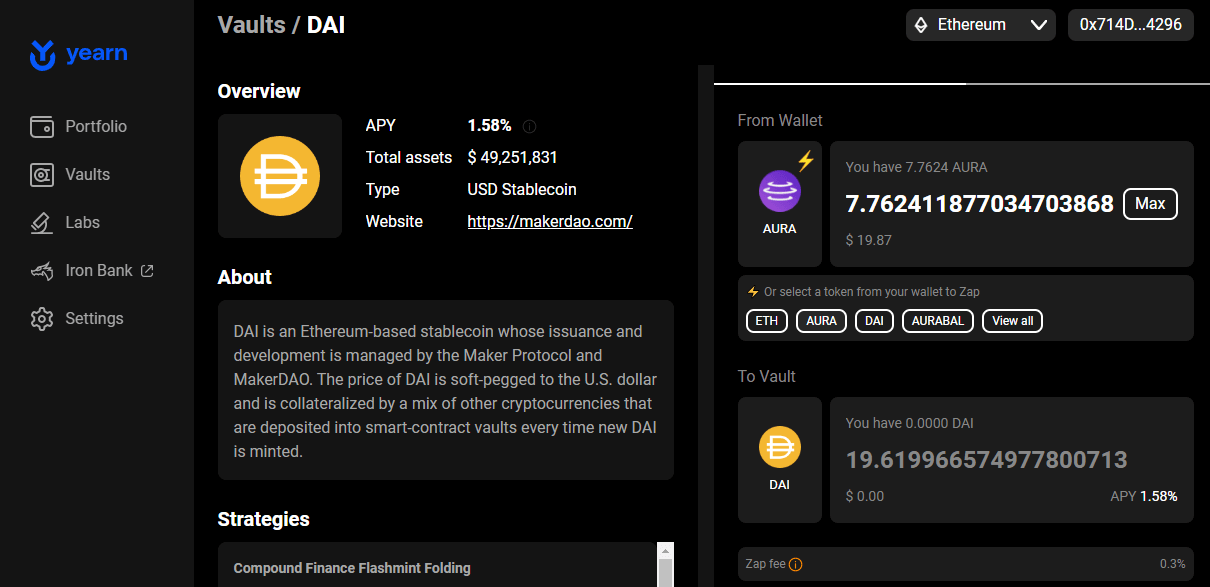

Its most important product is the yVaults, the place the investor can deposit an asset to obtain returns (yield) over time. They’ve an enormous choice of out there property (over 100), and the investor can filter the search by the APY (returns), complete property (TVL of every Vault), or the asset out there within the pockets.

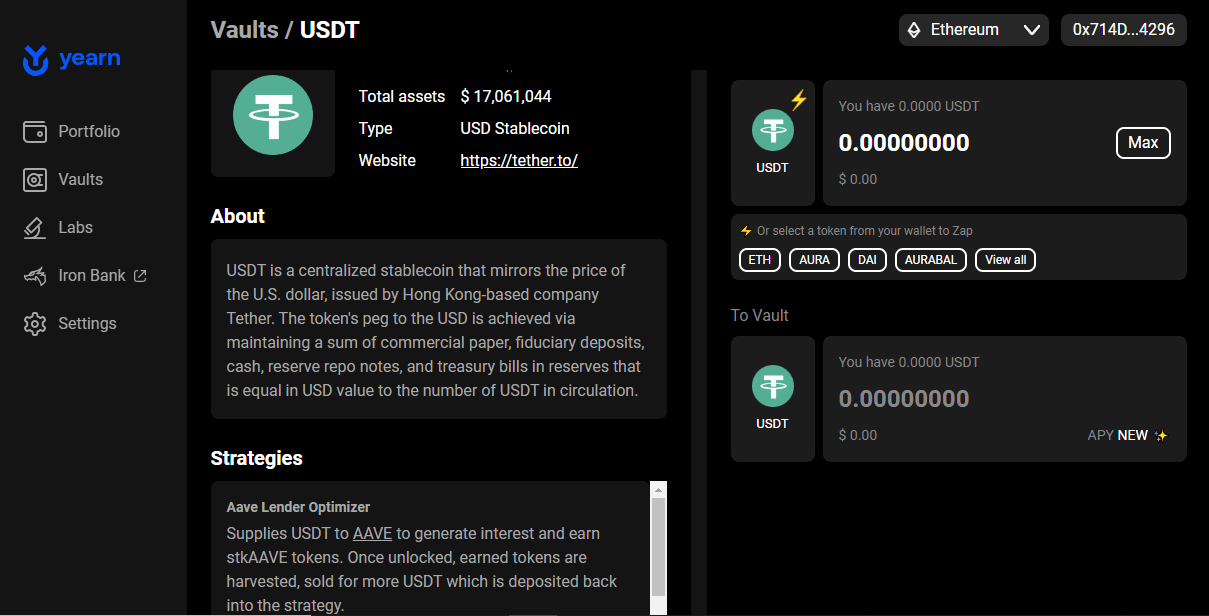

When clicking on an asset icon, the particular vault web page opens, the place extra data could be discovered, resembling the outline of the funding methods linked to the vault. Every yVault can deal with 20 methods on the identical time.

Yearn Finance additionally makes out there a swap perform (referred to as “Zap”) on the deposit. If the investor needs to make a deposit within the DAI vault, for instance, however doesn’t have the DAI token within the pockets, he can use a distinct one, with the protocol caring for the swap and the deposit into the vault.

Yearn Finance Token: YFI

Yearn Finance has a token, YFI. Token holders can take an lively half within the protocol’s governance. Nonetheless, a proposal gave some freedom to the totally different teams of contributors engaged on the protocol. That signifies that not each resolution shall be submitted to a vote.

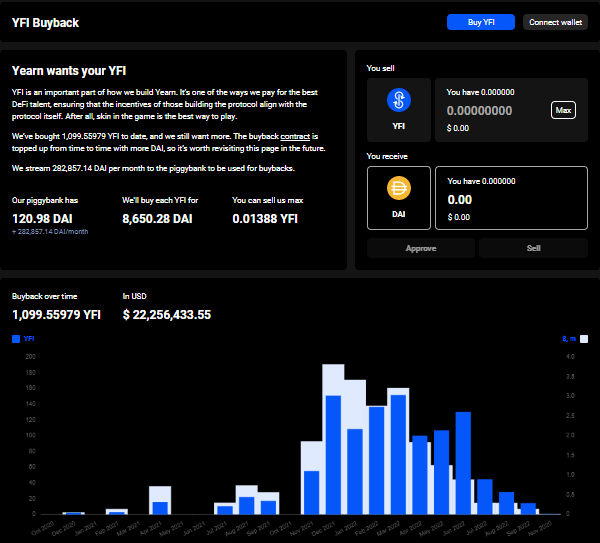

At present, the token holders don’t obtain any a part of the revenues of the protocol. The operating proposal is that the treasury buys again the token from the market, decreasing the circulating provide. The governance accepted a change on it, opening the opportunity of a part of the income to be shared with the token holders.

Yearn Finance Execs and Cons

Execs

- The investor could make a deposit in a token totally different from the one of many Vault

- Fixed updates on the methods used to generate returns

Cons

- The token holder doesn’t obtain a share of the platform revenues.

Beefy Finance

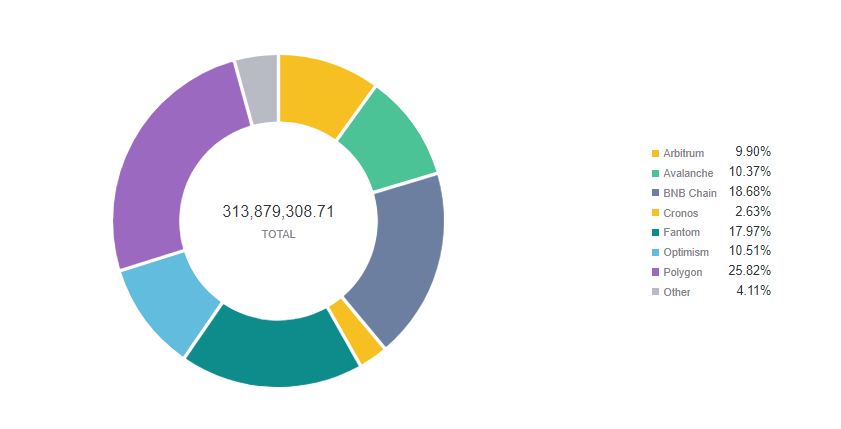

Beefy Finance went reside on October 8, 2020, on the Binance Good Chain (BNB Chain), being the primary yield aggregator on BNB Chain. It later expanded to different blockchains (at the moment 15+), and the chart beneath exhibits Beefy Finance TVL for every chain:

Beefy isn’t out there on the Ethereum blockchain, however compensates for it by having a robust presence, once we have a look at Belongings Beneath Administration (AUM), at Polygon ($78 million), BNB Chain ($66 million), and Fantom ($55 million).

Beefy Finance Options

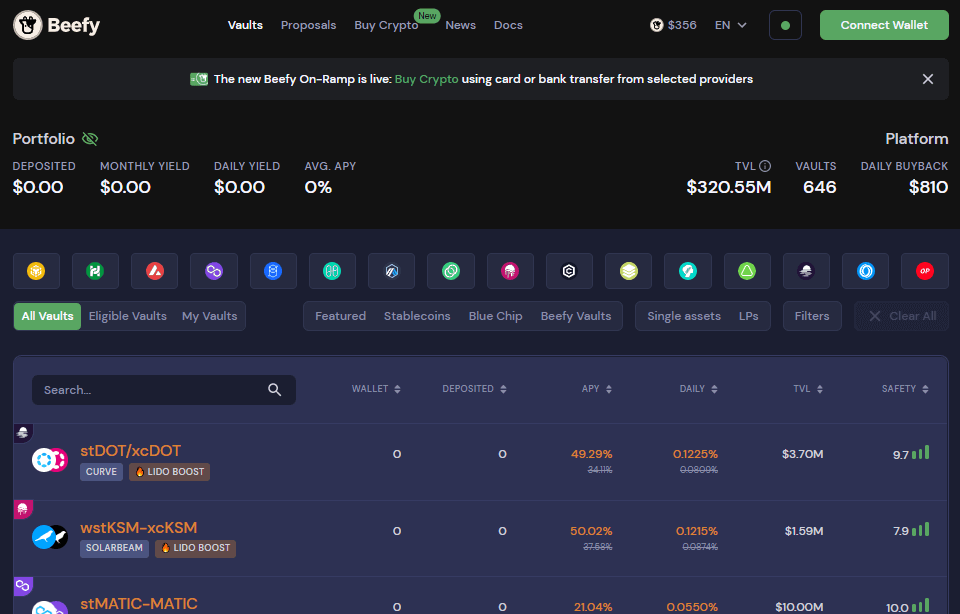

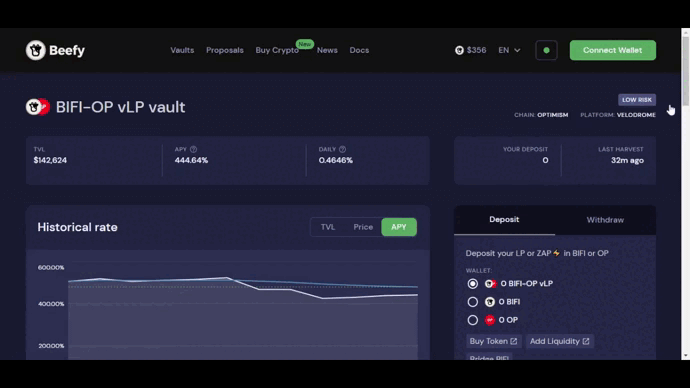

Its most important product is also the Vault, however the breakdown of it’s totally different. As an alternative of getting an asset vault and linking it with totally different methods, Beefy Finance creates a brand new vault for every technique it develops. It at the moment has 646 vaults.

The vaults could be filtered by the chain, asset kind, and in addition APY, day by day return, TVL, and Security rating. When clicking on any vault, the Overview web page is proven.

On this web page it’s potential to entry additional details about the vault, like the outline of the technique used, the property that compose this vault, and a chart with previous metrics of it. Beefy Finance additionally presents the “Zap” function, however with restricted performance: It’s out there solely at some vaults, and the swap is enabled for the property that make a part of that vault.

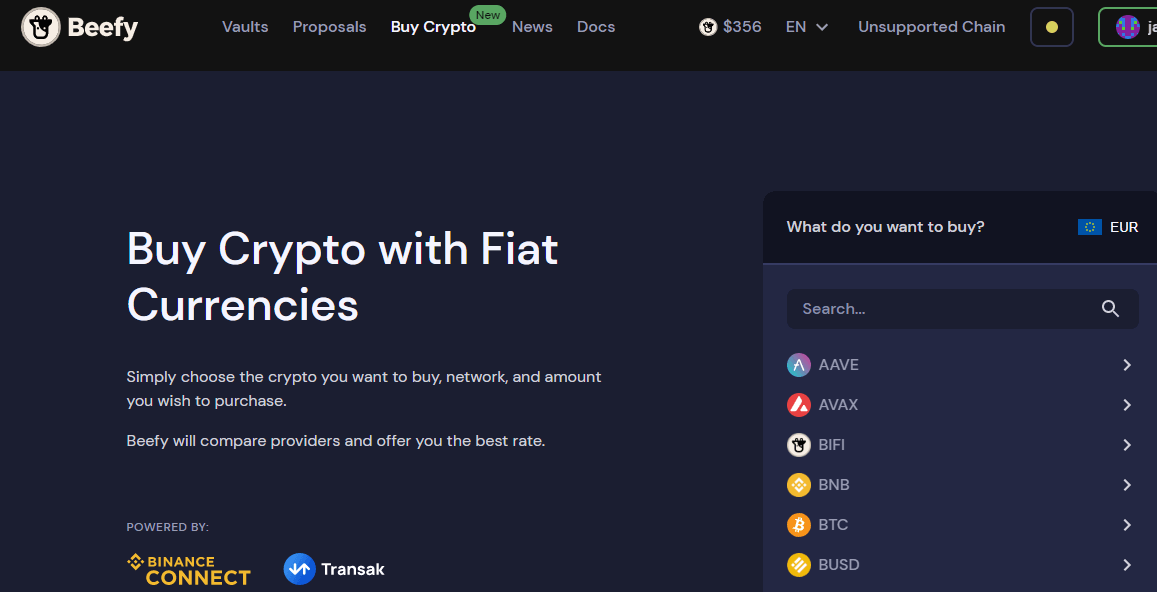

Beefy Finance additionally presents an on-ramp choice, the place the investor should purchase crypto with fiat currencies to later deposit at one in every of their vaults.

Beefy Finance Token: BIFI

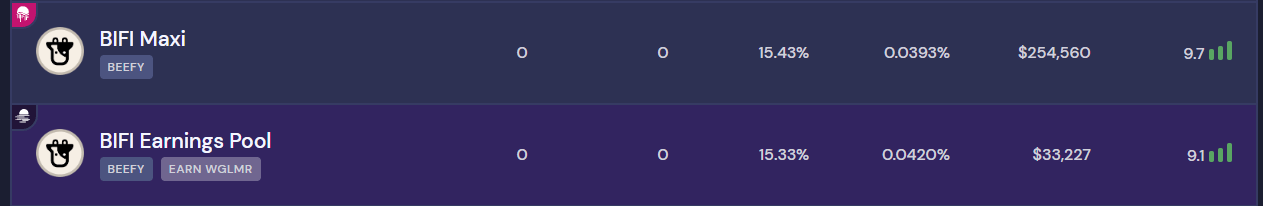

Beefy Finance token is BIFI. It may be used for governance (to vote on proposals to enhance the protocol). The investor can deposit it in two particular vaults: BIFI Maxi and BIFI Earnings Pool.

The primary one takes the income share to be distributed to the token holder, buys BIFI in the marketplace, and distributes it to the pool individuals. As no new BIFI shall be minted, this buyback and distribution enhance the relative share of every token holder.

The second pool takes the income generated (within the native token of the blockchain) and distributes it to the pool individuals. Every chain will distribute a distinct token.

Beefy Finance Execs and Cons

Execs

- The protocol has an enormous choice of property and chains

- The protocol shares income with token holders

Cons

- The protocol isn’t deployed at Ethereum Mainnet

- The Zap Operate is restricted

Badger DAO

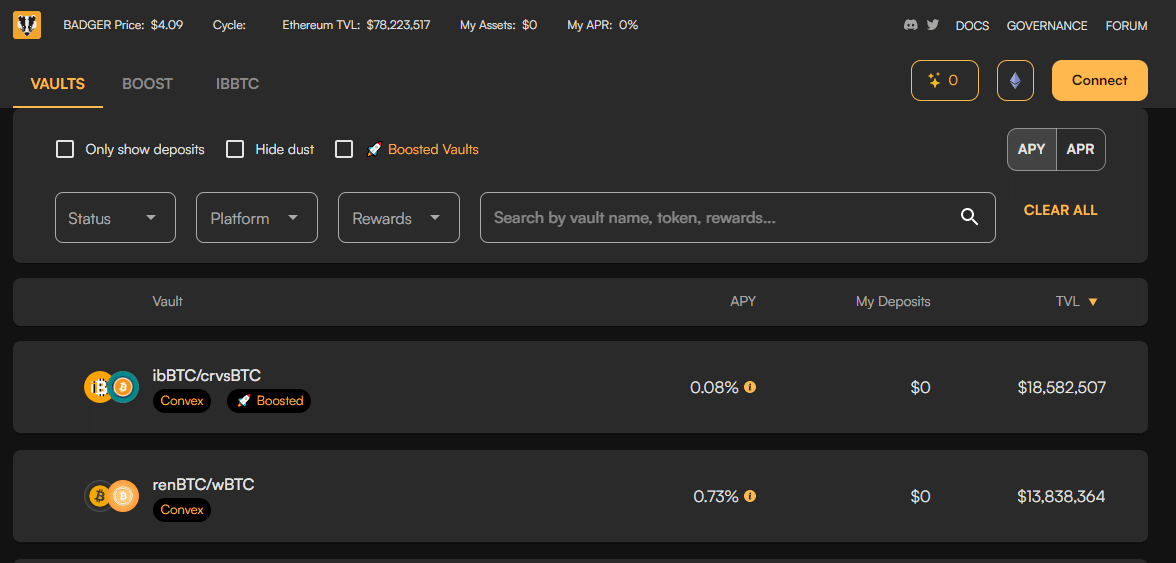

BadgerDAO is a decentralized autonomous group (DAO) targeted on enhancing Bitcoin utilization in Decentralized Finance (DeFi) throughout a number of blockchains. It was launched on December third, 2020, and now operates on Ethereum, Polygon, Arbitrum, and Fantom. The chart beneath exhibits the TVL distribution between chains.

A lot of the TVL is focused on Ethereum, however this can be a reflection of the asset Badger DAO has targeted on: Bitcoin wrapped into different blockchains. Nearly all of it’s out there on Ethereum Mainnet.

Badger DAO most important options

Its most important product is a vault (additionally referred to as sett) that works the identical means as within the different yield farming aggregators however is targeted on tokenized BTC.

The investor makes a deposit into the vault. After that, the sensible contract places these property to work by executing the chosen technique for the actual Sett the consumer deposited funds on. Badger doesn’t provide the “Zap” perform to alternate the property for the specified one.

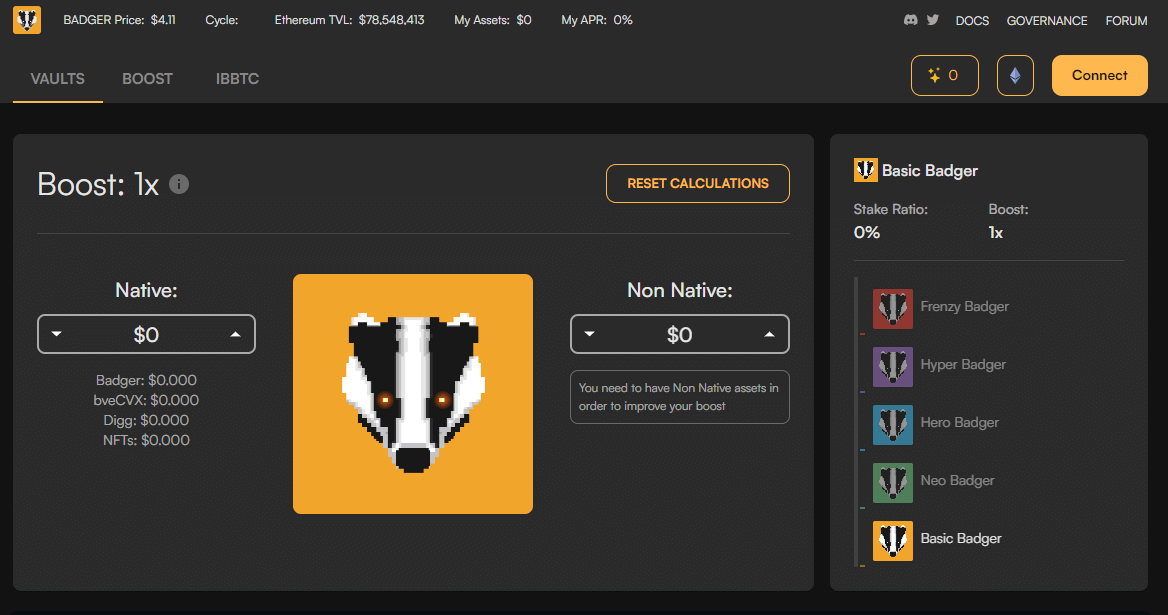

The investor can increase the deposit returns by holding the native property from the protocol. The ratio between these native property and the non-native will dictate the increase acquired.

Badger DAO Token: Badger

Badger is the native governance token of BadgerDAO, so its holder can vote on the proposals held by the DAO. It has a most fastened provide of 21 million, and will also be used as collateral on totally different platforms throughout DeFi.

Holding Badger in your pockets will increase your APYs in different Sett Vaults as a part of the Badger Increase system.

Badger DAO Execs and Cons

Execs

- The protocol gives excessive APY to BTC into DeFi

Cons

- The protocol doesn’t share income with token holder

- There isn’t any Zap Operate

Autofarm

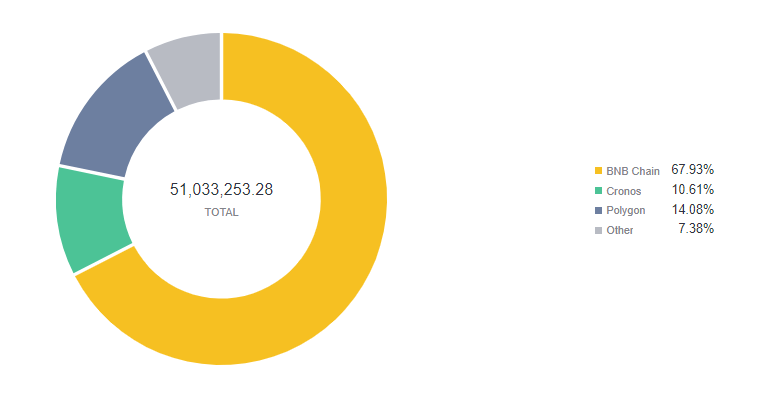

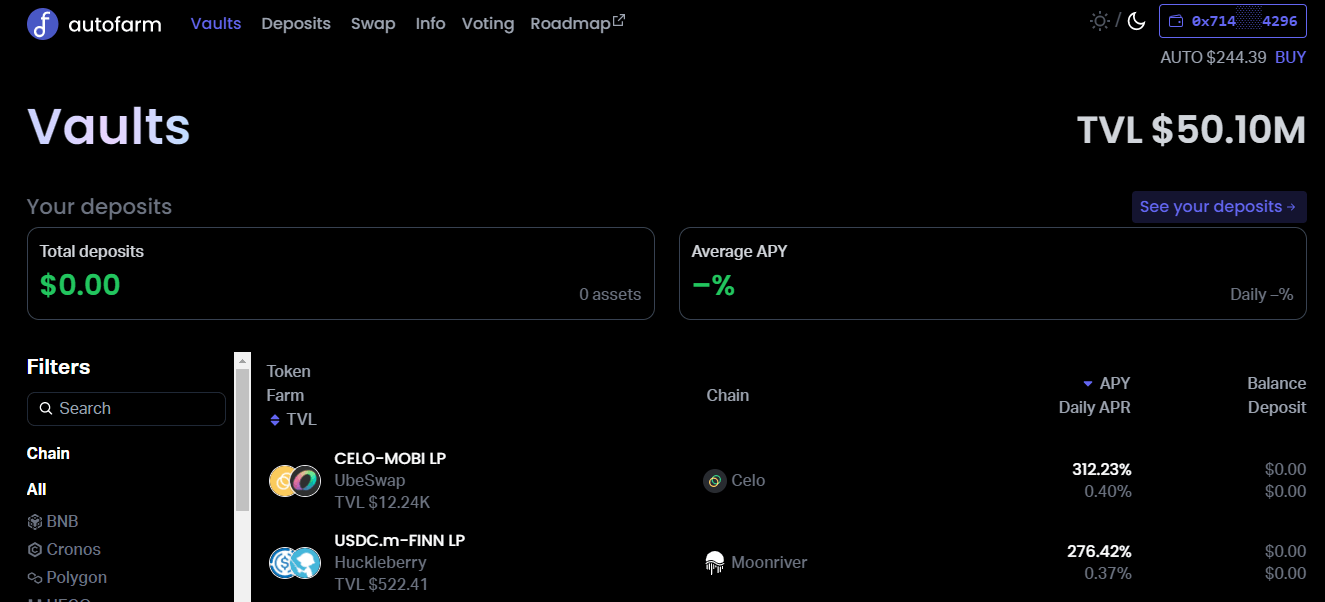

Autofarm is a protocol that gives a DeFi device suite. It was launched in December 2020 on BNB Chain and has expanded to a complete of 19 chains. The chart beneath exhibits the TVL distribution between all chains:

Autofarm TVL continues to focus on BNB Chain (USD 34 million), however Polygon (USD 7.18 million) and Cronos (USD 5.41 million) even have a major TVL.

Autofarm Major Options

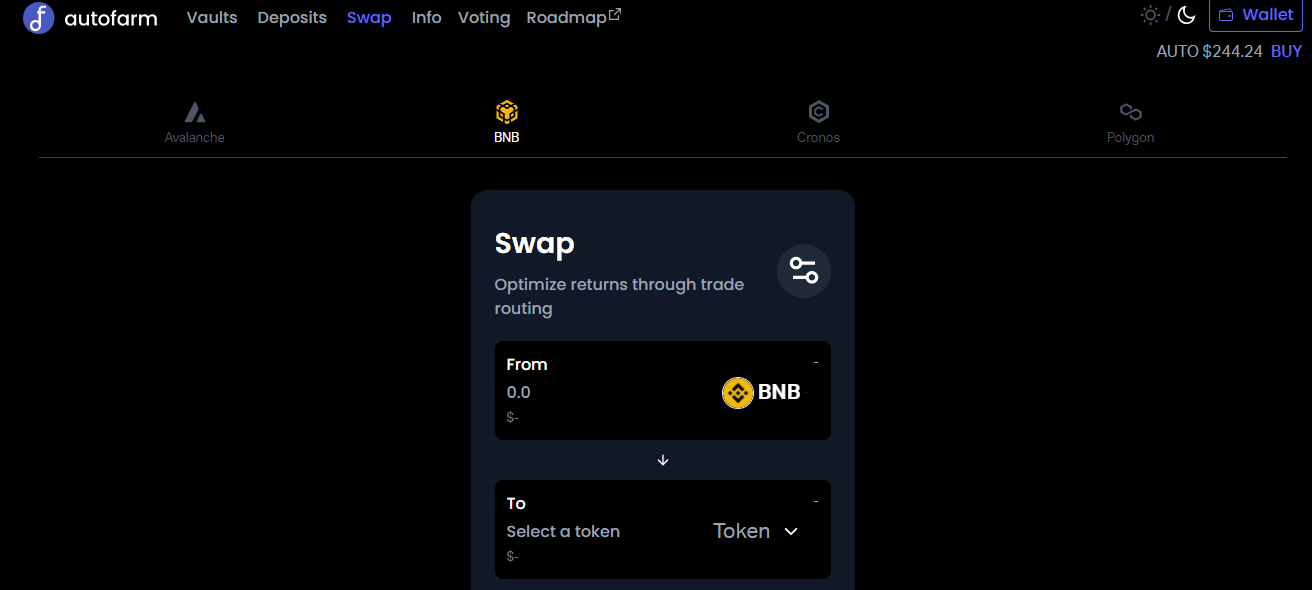

It presents two merchandise: A Yield Aggregator and a Swap Aggregator. The swap aggregator compares the very best routes to make the swap the consumer needs. It’s out there in BNB Chain, Avalanche, Cronos, and Polygon. So, whereas it doesn’t present the native Zap perform, in these chains the consumer can alternate the asset with out having to go away the protocol interface.

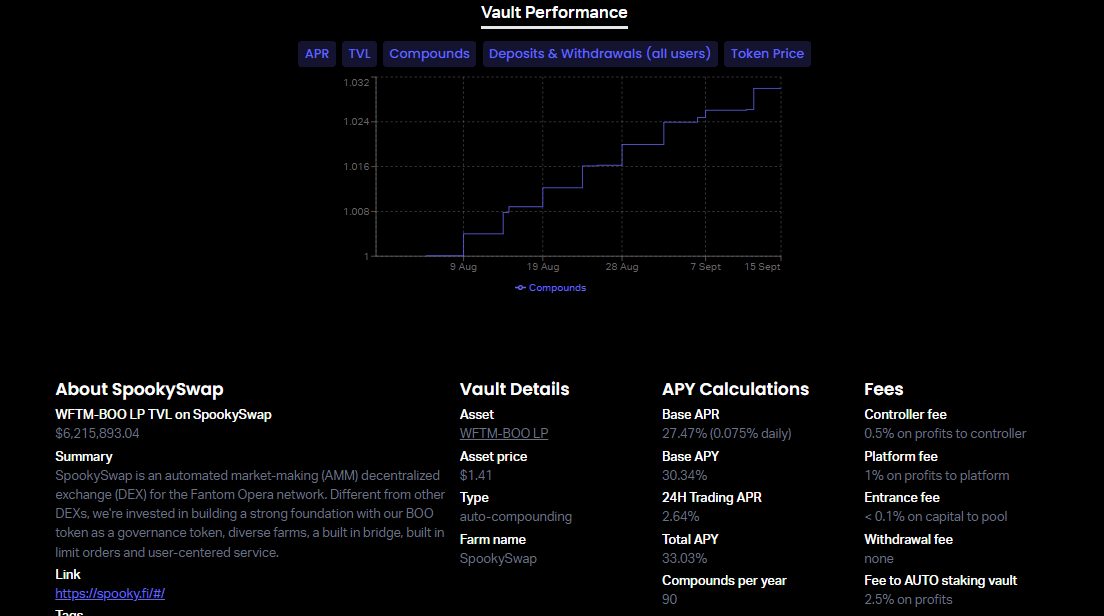

The primary product can be the vaults. The investor can use the filters to pick out the chain, asset, and order by APY.

When clicking on a vault, its web page opens with detailed details about the vault’s efficiency, the technique it makes use of, and the property on it.

Autofarm Token: Auto

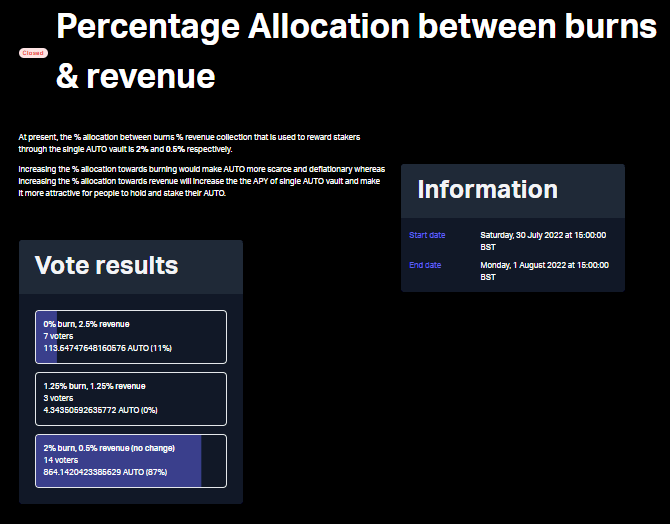

Auto is the native governance token of Autofarm. It’s used to vote concerning the quantity of Auto that shall be burnt or distributed as income to Auto holders that stake it on the Auto Vault. This vote is held month-to-month.

Autofarm Execs and Cons

Execs

- The protocol shares income with token holders

Cons

- The interface is complicated

- There isn’t any Zap Operate

Idle Finance

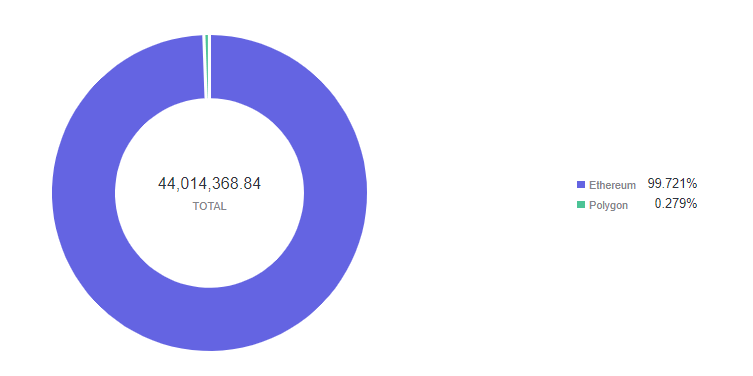

Idle Finance is a protocol with a set of merchandise that permit customers to optimize their digital asset allocation algorithmically throughout main DeFi protocols. The present iteration went reside on Might 18th, 2020, and its TVL is proven within the chart beneath.

Regardless of launching at Polygon on November tenth, 2021, virtually all liquidity stays on Ethereum Mainnet.

Idle Finance Major Options

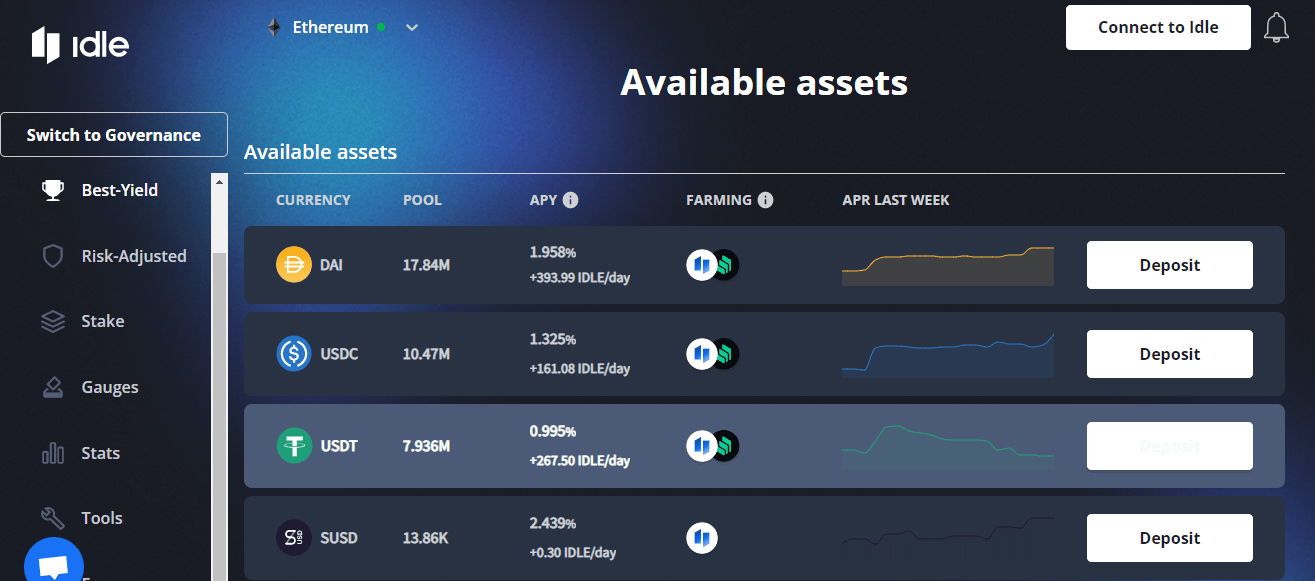

It presents two merchandise: Greatest Yield and Tranches. The Greatest Yield product goals to mechanically get the very best provide charges from totally different lending protocols, so the investor doesn’t want to try this manually.

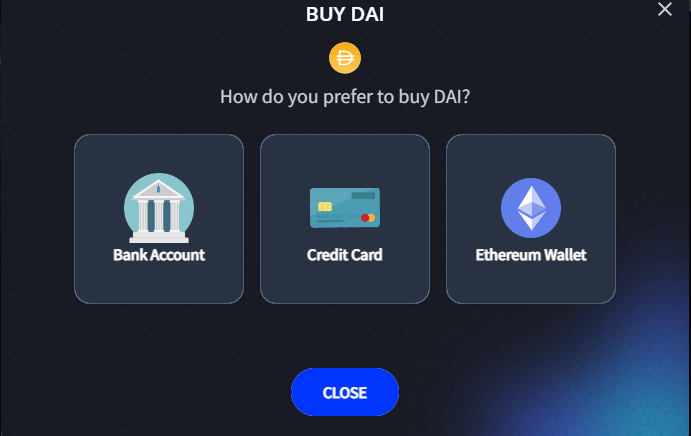

If the investor doesn’t have the asset within the pockets, it may be bought with fiat or crypto.

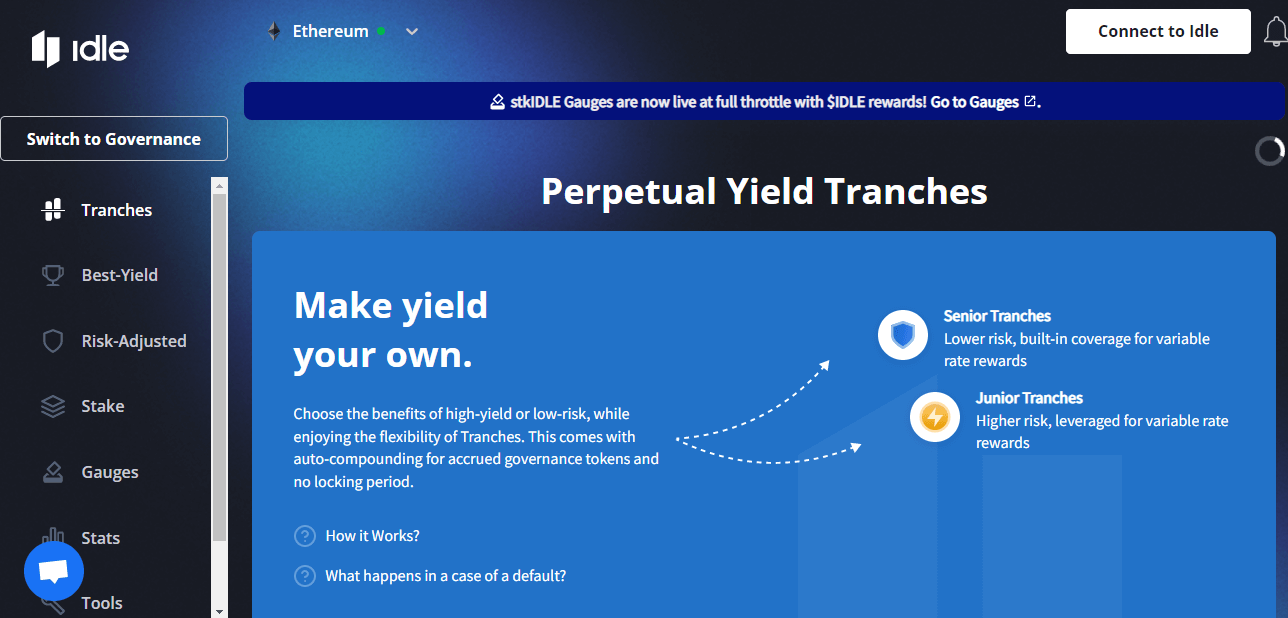

The Tranches product is split into two: Junior and Senior Tranches. The primary distinction between them is the danger publicity. Junior tranches can obtain higher outcomes by taking additional dangers.

When the investor clicks on any tranche, the vault web page is loaded, the place all of the details about it’s out there.

Idle Finance Token: Idle

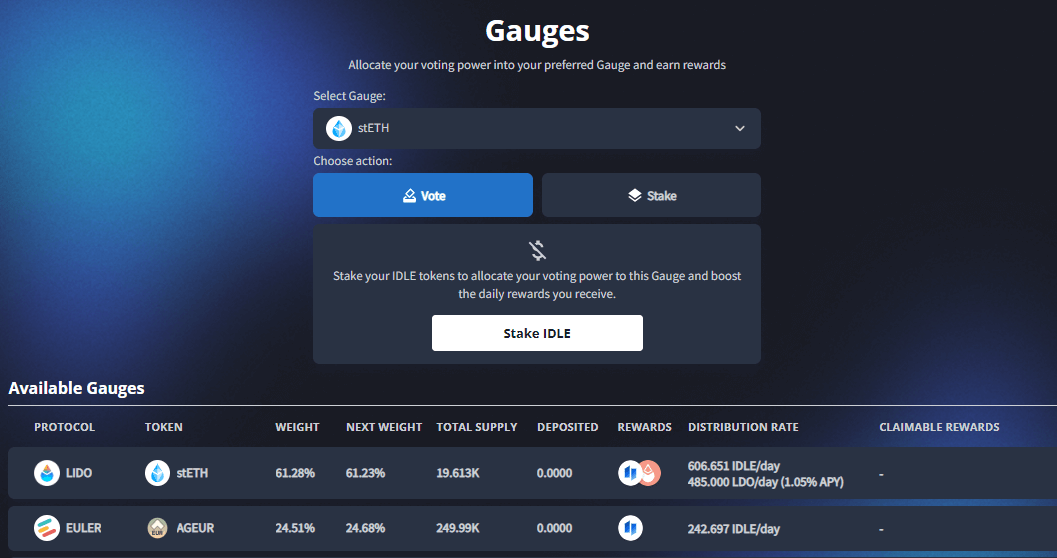

Idle Finance Token is Idle. It’s used for governance and could be staked to spice up the returns of the deposit on a vault. The protocol additionally makes use of to incentivize buyers to deposit property on the protocol.

Idle Finance Execs and Cons

Execs

- Tranches with dangers well-defined

Cons

- Solely out there on Ethereum Mainnet

- There isn’t any Zap Operate

Metrics

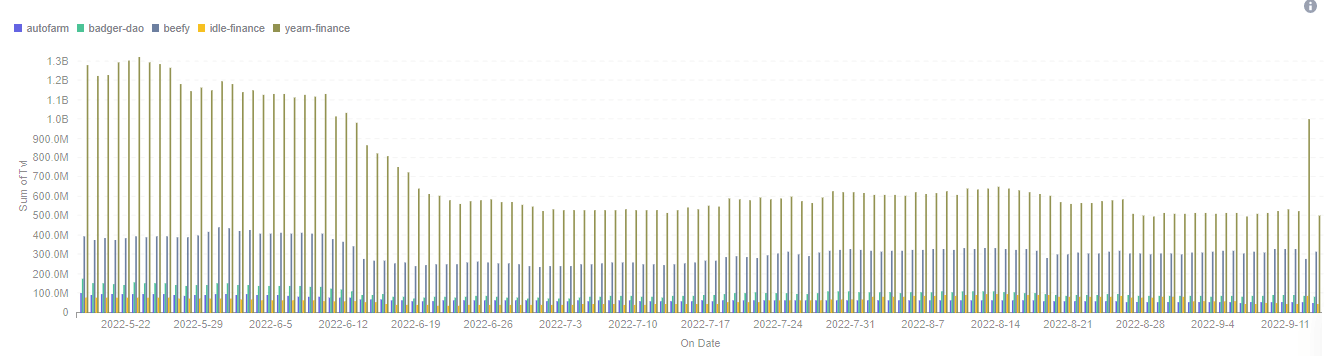

Wanting on the TVL variation within the final 120 days, Yearn Finance had a giant drop in worth (from USD 1.2 billion to USD 500 million), whereas Beefy Finance fell from USD 420 million to USD 300 million. Yearn Finance was closely impacted by the aftermath of Luna + 3AC downfall.

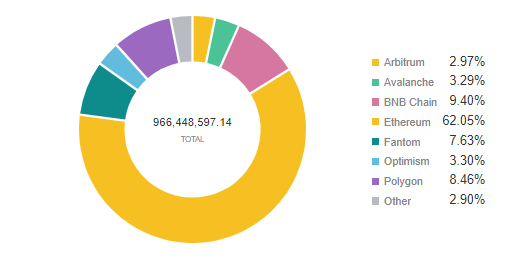

Ethereum stays the popular funding vacation spot, because it has extra DeFi protocols deployed and is a part of the yield aggregators’ technique to farm new tokens supplied by new protocols.

This additionally helps to elucidate why Arbitrum and Optimism are within the high 5, because it launched campaigns to retain customers and protocols not too long ago (Arbitrum Odyssey and Optimism token airdrop).

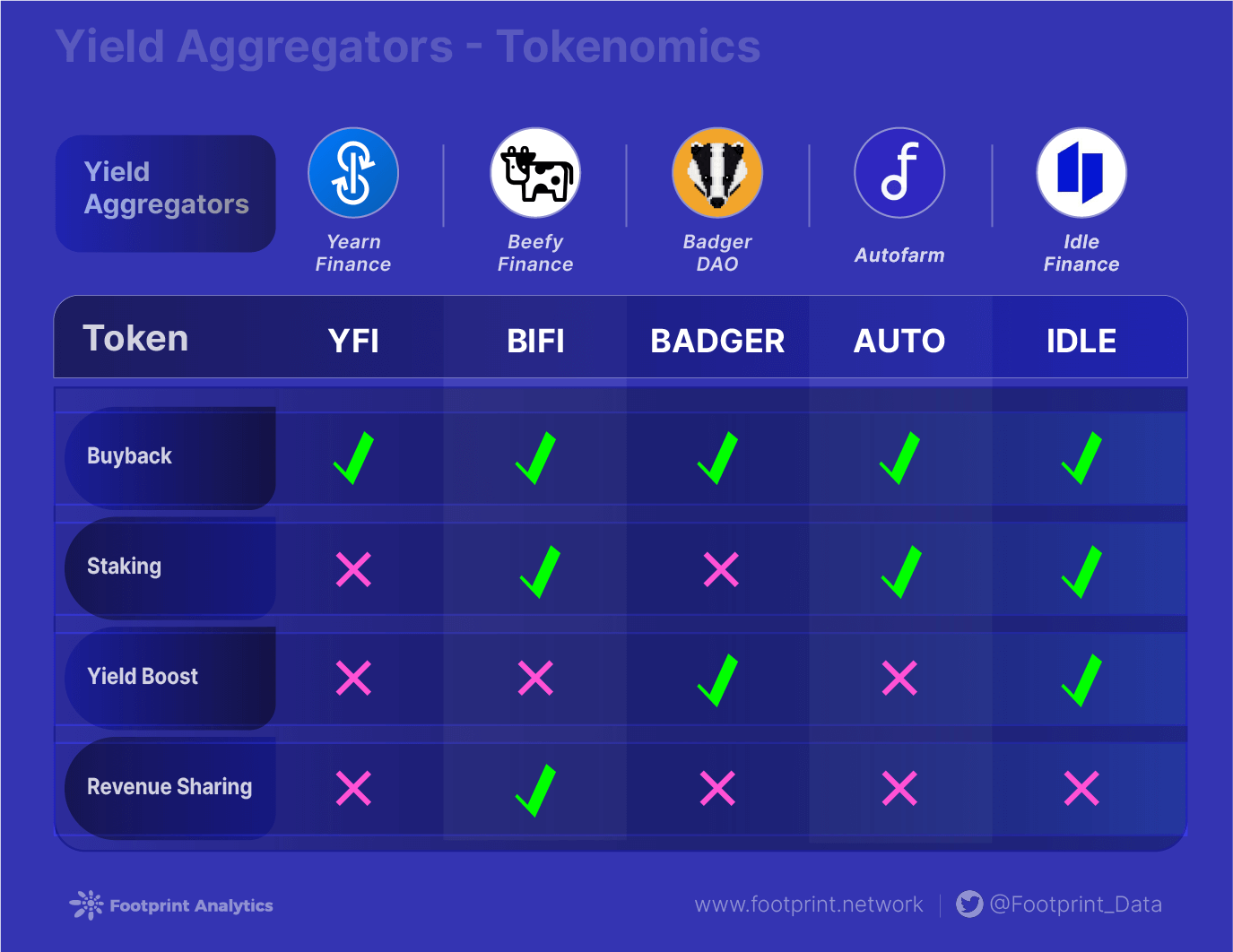

Every yield aggregator has a distinct technique for its native token. Badger and Idle use it as a lift to the vaults’ rewards. All protocols execute buybacks with income to decrease the circulating provide, however Beefy Finance is the one one to participate of the revenues and share with token holders (with their BIFI earnings pool).

Every yield aggregator has a distinct technique for its native token. Badger and Idle use it as a lift to the vaults’ rewards. All protocols execute buybacks with income to decrease the circulating provide, however Beefy Finance is the one one to participate of the revenues and share with token holders (with their BIFI earnings pool).

Major takeaways for buyers

A yield aggregator is a protocol that takes all of the burden of managing the yield farming from the investor. These days, it’s potential to make use of one in virtually all chains out there.

For the buyers, there are two clear alternatives:

- Use it to handle their investments. All it takes is to search for the protocol/chain providing the very best returns for the asset of curiosity and make a deposit there. There are alternatives for various danger profiles.

- To put money into their token. Nearly all yield aggregator protocols have their very own token. Apart from the worth variations which might be linked with the market and with the efficiency of the protocol, the very best tokens are those that make their proprietor eligible to obtain a part of the protocol’s income.

This piece is contributed by Footprint Analytics group.

Sept. 2022, Thiago Freitas

Information Supply: Footprint Analytics-Yield Aggregators Comparability

The Footprint Group is a spot the place information and crypto lovers worldwide assist one another perceive and acquire insights about Web3, the metaverse, DeFi, GameFi, or some other space of the fledgling world of blockchain. Right here you’ll discover lively, various voices supporting one another and driving the group ahead.