With the 14th anniversary of the Nice Monetary Disaster of 2008 approaching, we’re about to enter a brand new debt cycle that might reset the market. Navigating upcoming crises requires a deep understanding of how all earlier debt crises labored and why they occurred.

Ray Dalio, the founder and chairman of Bridgewater Associates, was the primary to place out the speculation of the archetypal large debt cycles. Dalio separates these into short-term and long-term cycles, the place short-term ones final 5 to 7 years and long-term ones final round 75 years.

These archetypes kind the muse of Bridgewater’s funding technique and have served as a lifeboat that enabled the hedge fund to navigate financial turmoil prior to now 30 years.

Wanting on the present market via this lens reveals that we’re nearing the top of the cycle that started in 1944 with the signing of the Bretton Woods settlement. The Bretton Woods system introduced on what can successfully be referred to as the U.S. greenback world order — which continued even after the abandonment of the gold customary in 1971.

Debt cycles

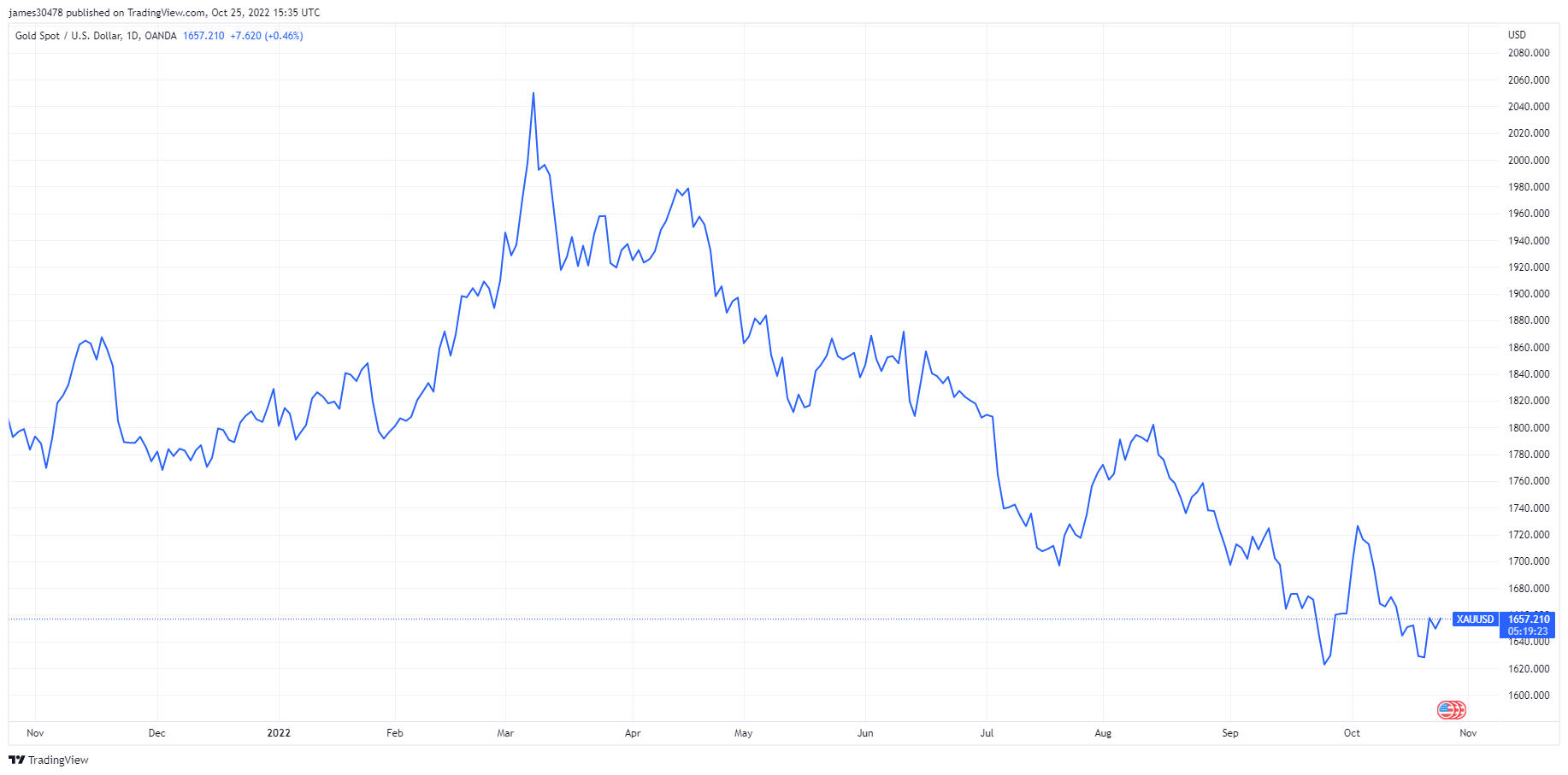

In a debt cycle, the shortage of credit score determines the place the cash finally ends up. When credit score is considerable, and cash flows via the economic system, folks spend money on scarce property like gold or actual property. When credit score is scarce and there’s a scarcity of cash within the economic system, folks flip to money, and scarce property see their worth drop.

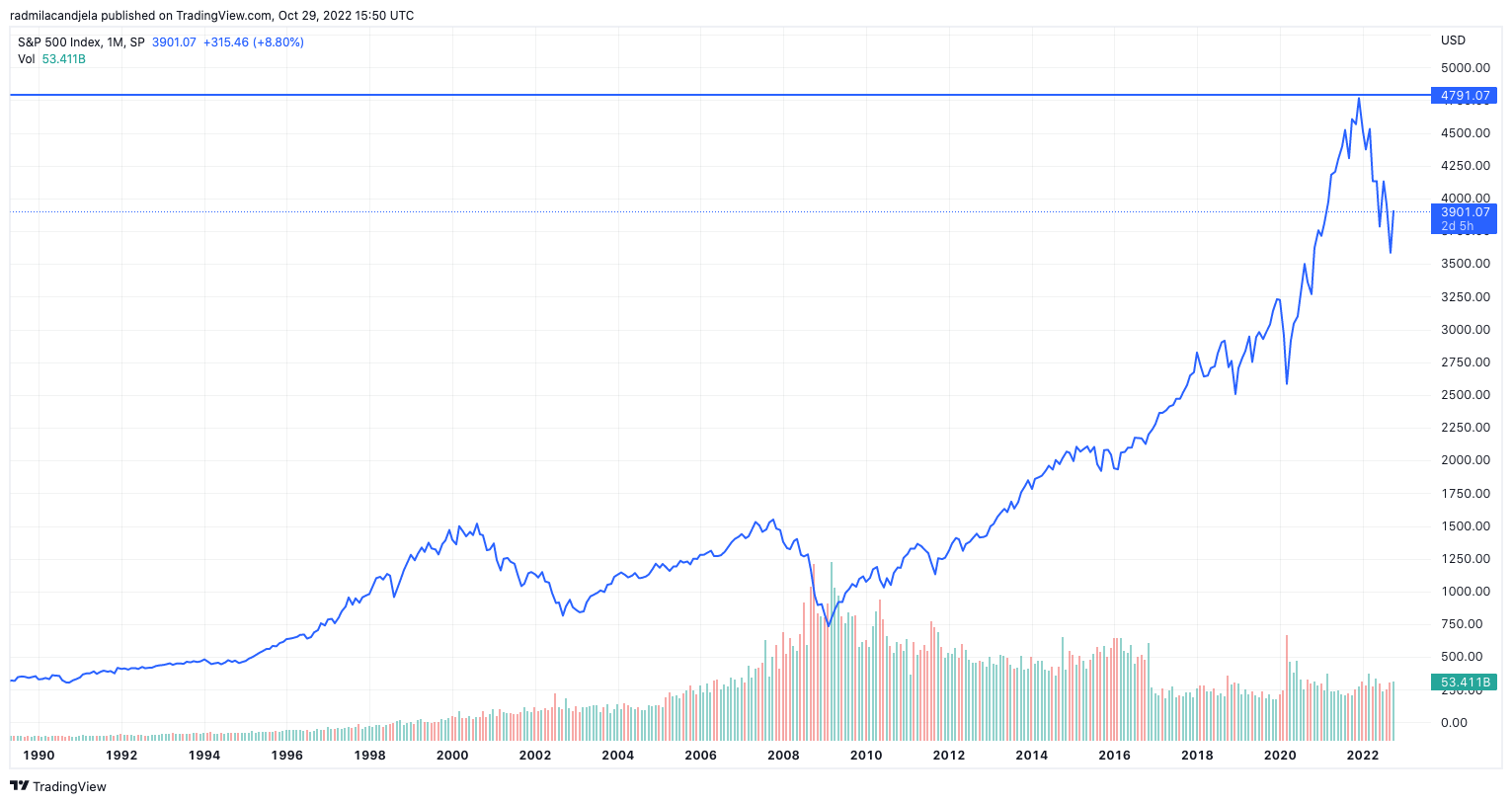

Since 2008, rates of interest have both been extremely low or close to zero, drastically growing the economic system’s abundance of credit score and cash. This decline led to a notable improve within the worth of scarce property corresponding to gold and actual property and speculative investments like shares.

Essentially the most excessive instance of this development is seen within the U.S., because it’s the biggest market-driven economic system on the earth. Nevertheless, this development led to the debt-to-GDP ratio within the U.S. rising over 100%, making its economic system extraordinarily delicate to the actions of rates of interest.

Traditionally, each time the market has seen a notable motion of rates of interest, a liquidity disaster ensued. With the Federal Reserve anticipated to proceed aggressively mountain climbing rates of interest properly into subsequent spring, the market may very well be gearing up for an unprecedented liquidity disaster.

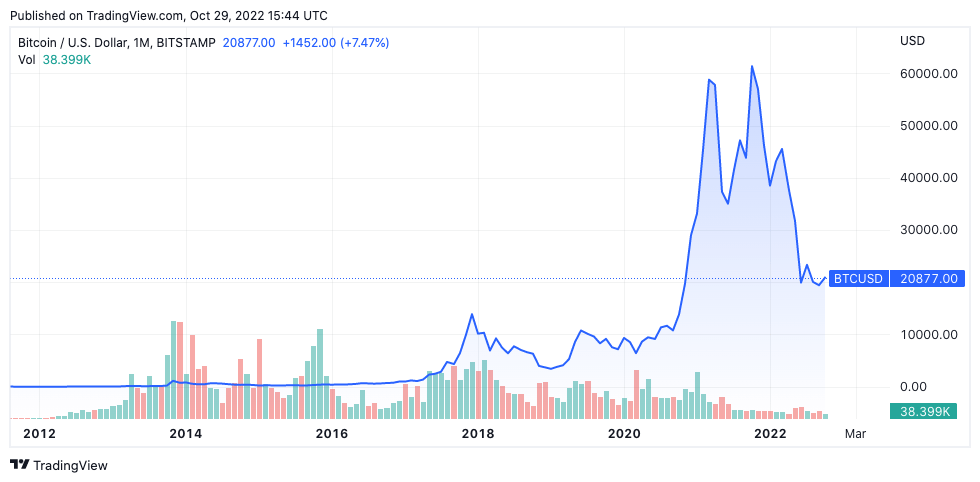

Bitcoin paints an image

Understanding the scope of the disaster requires taking a deep look into Bitcoin. Though it’s nonetheless among the many most novel asset courses, Bitcoin is likely one of the most liquid property on the earth.

Prior to now 12 months, Bitcoin’s efficiency served as a frontrunner to the efficiency of all different markets.

Initially of November 2021, Bitcoin reached its all-time excessive of $69,000.

Slightly below two months later, on the finish of December 2021, the S&P 500 noticed its peak.

In March 2022, gold adopted swimsuit and reached its all-time excessive.

Various property

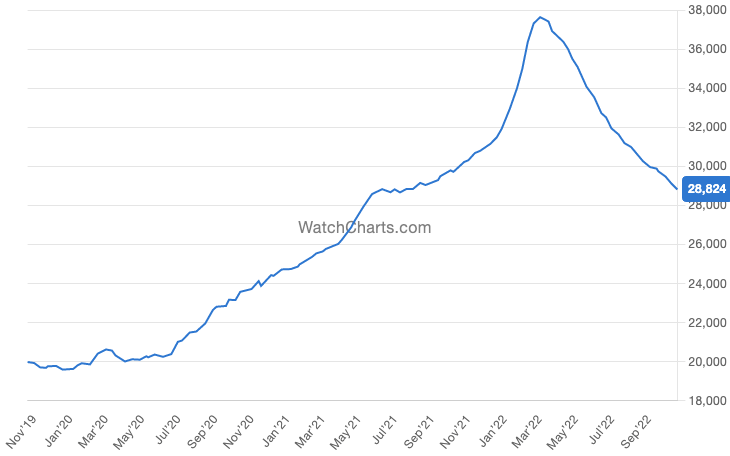

Watches, vehicles, and jewellery have additionally seen their peak alongside gold as an abundance of cash within the economic system pushed folks to spend money on luxurious and scarce property. This development is obvious within the Rolex Market Index, which reveals the monetary efficiency of the highest 30 Rolex watches on the secondhand market.

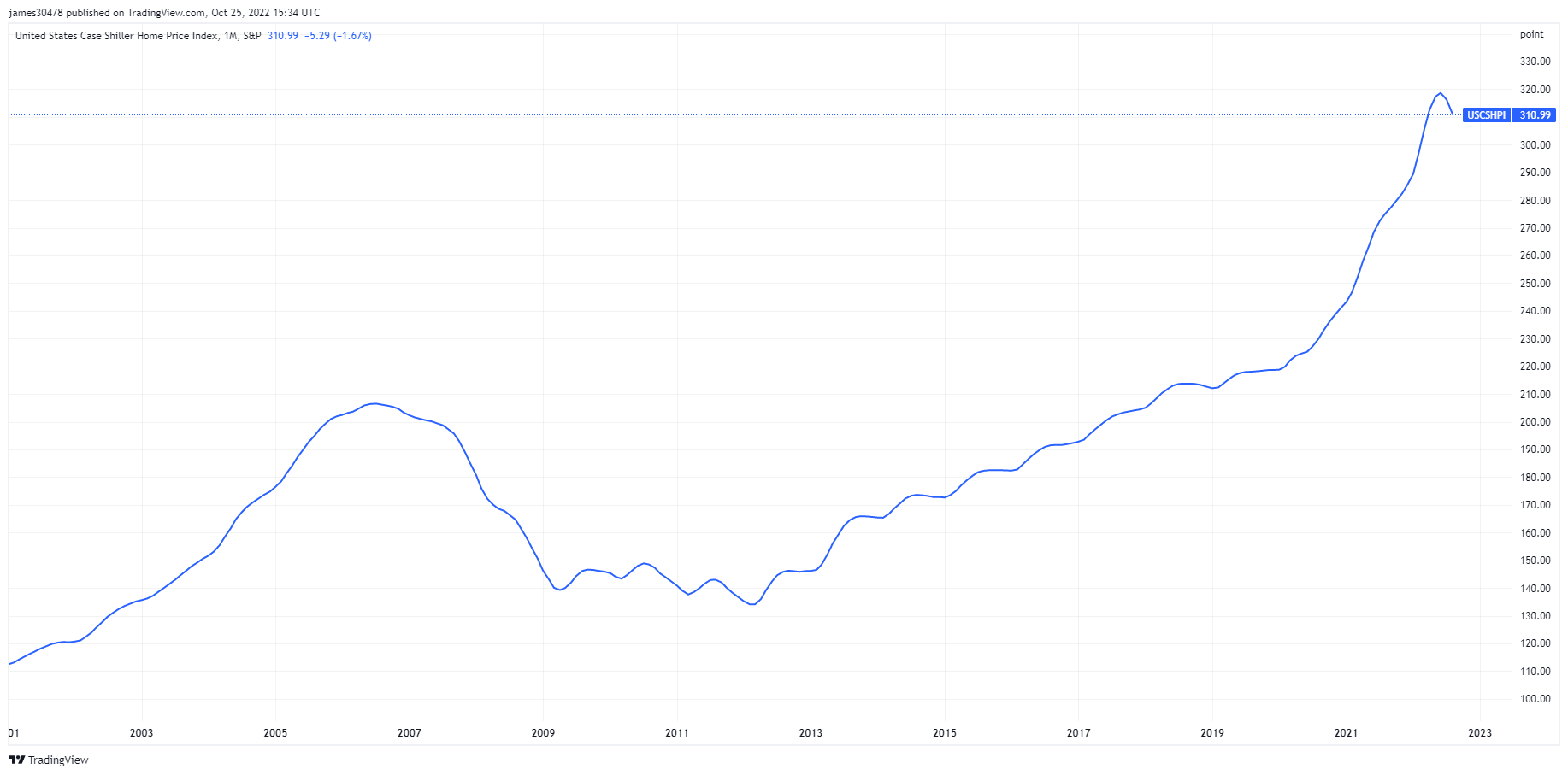

And now, as their most illiquid asset, actual property is about to see a pointy fall. The housing market within the U.S. reached its peak in September 2022, with the Case Shiller House Value Index reaching its all-time excessive of 320. The Federal Reserve’s aggressive charge hike has prompted mortgage charges within the nation to double in lower than six months. When mixed with hovering inflation and a struggling market, rising mortgage charges are set to push housing costs downwards and wipe out billions from the true property market.