Nov. 2022, Vincy

Information Supply: Footprint Analytics – NFT Aggregators Tendencies Overview

Whereas there are a number of NFT marketplaces to select from when shopping for your digital property, it’s inefficient to always swap between them when buying and selling. One other drawback within the fragmented market is having to pay fuel charges greater than as soon as when shopping for from completely different marketplaces.

NFT aggregators permit individuals to purchase a number of NFTs from numerous platforms in bulk, thereby saving on fuel charges and being environment friendly. Past that, aggregators are additionally experimenting with novel fashions for NFT buying and selling, specifically AMM market, pledging and NFT tokenization.

Will they change into the go-to locations to purchase NFTs?

Early NFT marketplaces

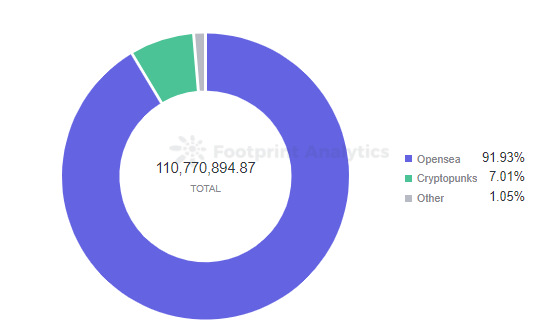

From 2016 to 2018, the primary NFT buying and selling marketplaces—OpenSea, MakersPlace, and SuperRare—emerged. Since then, OpenSea has occupied greater than 90% of the market share, regardless of its unstable buying and selling system, hacking assaults, and even scandals such because the theft of consumer NFT property.

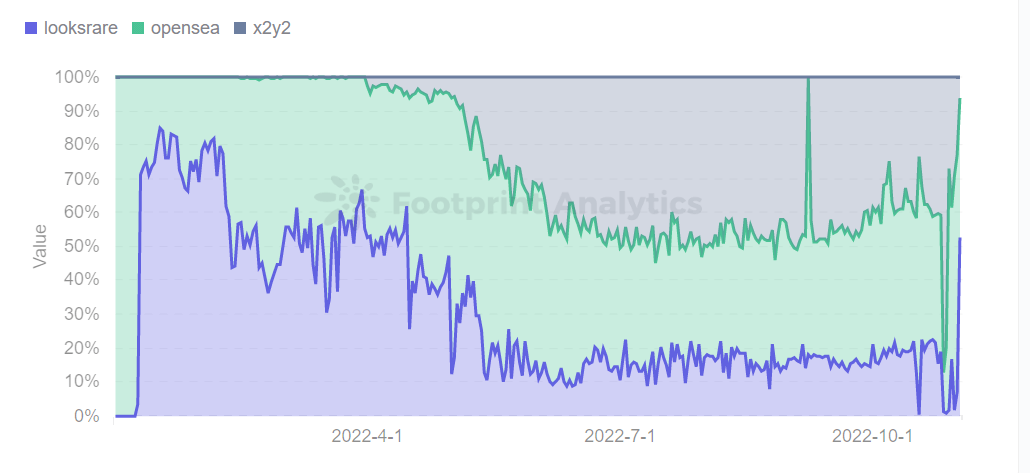

At first of 2022, X2Y2 and LooksRare each began to problem OpenSea with decentralization, decrease charges, and platform income sharing. This started to divide the NFT market.

Nevertheless, these platforms have been gradual to handle issues with batch shopping for, which is the place NFT aggregation platforms gained a foothold.

What issues does aggregation clear up?

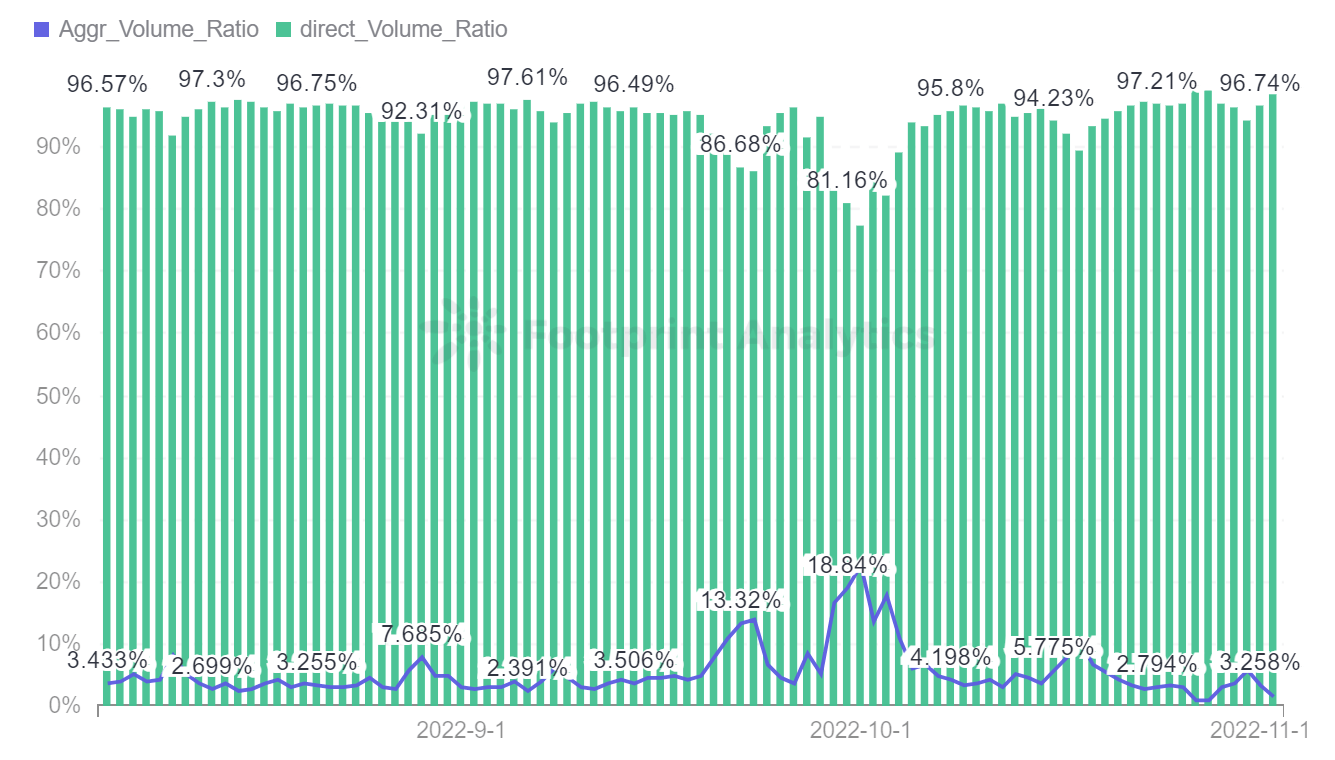

In response to Footprint Analytics, the proportion of transactions on Ethereum-based aggregated buying and selling platforms (13 platforms) step by step elevated from August to October, reaching a most of greater than 18%, after which resumed regular transactions. This means a development wherein the NFT market is step by step getting into into aggregated transactions.

Nevertheless, many builders are starting to hunt worth innovation, chasing benefits corresponding to better comfort and quicker effectivity. There are clear boundaries between current markets, and which varieties of companies customers want are created.

In flip, OpenSea has upgraded its product and purchased opponents.

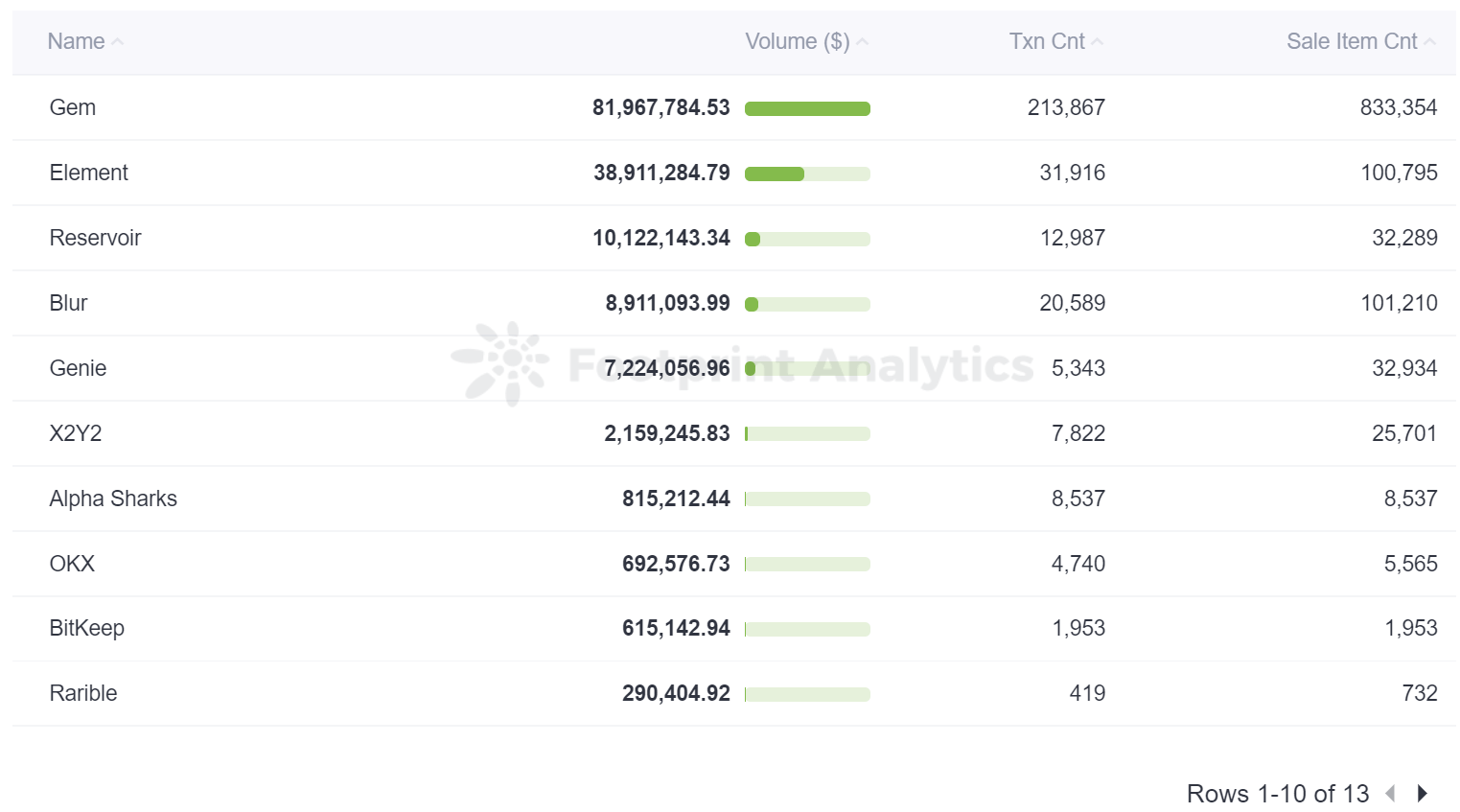

- In April, OpenSea acquired the NFT aggregation protocol GEM.

- In Might, OpenSea allowed customers to commerce NFTs utilizing different technique of cost moreover cryptocurrency.

- In October, it was introduced that bulk order and buy performance was formally supported, and customers can now record and buy as much as 30 objects in a single transaction on the platform.

There may be the promise of a complete market enchancment by way of numerous options, low charges and time price of looking for NFTs. For instance, Ingredient aggregates layouts from all the most well-liked blockchains (Ethereum, BNB Chain, Polygon, Avalanche and Solana) to allow cross-chain transactions and broaden the consumer base.

The emergence and improvement of varied aggregated buying and selling markets, for customers to cut back the tedious operation of a transaction, permitting customers to batch itemizing and buy operations, lowering transaction prices and the time price of looking out NFT.

Abstract

OpenSea has had a near-monopoly on NFT buying and selling for a number of years. Whilst different marketplaces launched with aggressive options, it has been the go-to platform for getting and promoting NFTs. Nevertheless, NFT aggregators have emerged with distinctive fashions and options to issues within the trade.

This piece is contributed by Footprint Analytics group.

The Footprint Neighborhood is a spot the place knowledge and crypto fanatics worldwide assist one another perceive and acquire insights about Web3, the metaverse, DeFi, GameFi, or another space of the fledgling world of blockchain. Right here you’ll discover lively, numerous voices supporting one another and driving the group ahead.

Footprint Web site: https://www.footprint.community

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data