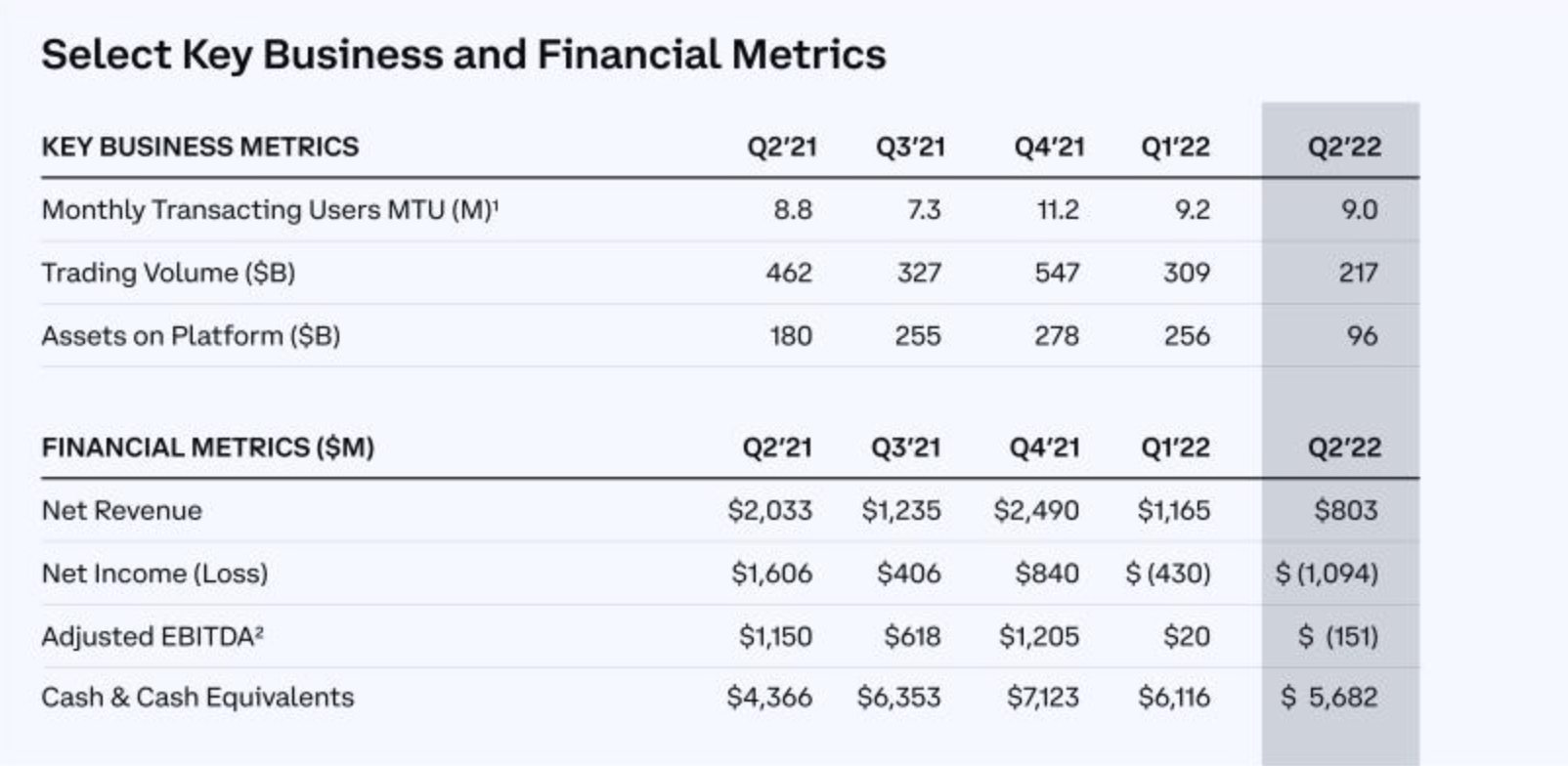

Coinbase Global’s second-quarter results show that the crypto exchange recorded a net loss of $1.10 billion during the period. This compares to a loss of $430 million in the first quarter and a net income of $1.61 billion in the second quarter of 2021.

Net revenue for Q2 came in at $803 million, down from $1.17 billion in Q1 and $2.03 billion in Q2 2021. Further, the value of crypto assets on the exchange fell to just $96 billion in Q2 from $256 billion in Q1. A year ago, in Q2 2021, the assets on the exchange totaled $180 billion.

In the supporting shareholder letter, the company compared recent data to 2020, where it saw massive growth. From 2020 to 2022, verified users have tripled, monthly volume is up 6x, and assets on the platform have increased 4x.

Coinbase stated that “down markets are not as bad as they may seem.” It continued, “it can feel scary and near-term financials can be heavily impacted,” but it will “emerge stronger than ever before.”

While the figures may appear bearish for the US-based exchange, many in the crypto industry would agree with Coinbase’s sentiment that “crypto markets are cyclical.” While several exchanges such as Celsius and Voyager have filed for Bankruptcy this quarter, Coinbase remains bullish on its future outlook. Its monthly transacting users (MTU) only dropped 0.2%.

“Despite continued market softness, we were pleased to serve 9.0 million MTUs in Q2, a decrease of 0.2 million or 2% compared to Q1.”

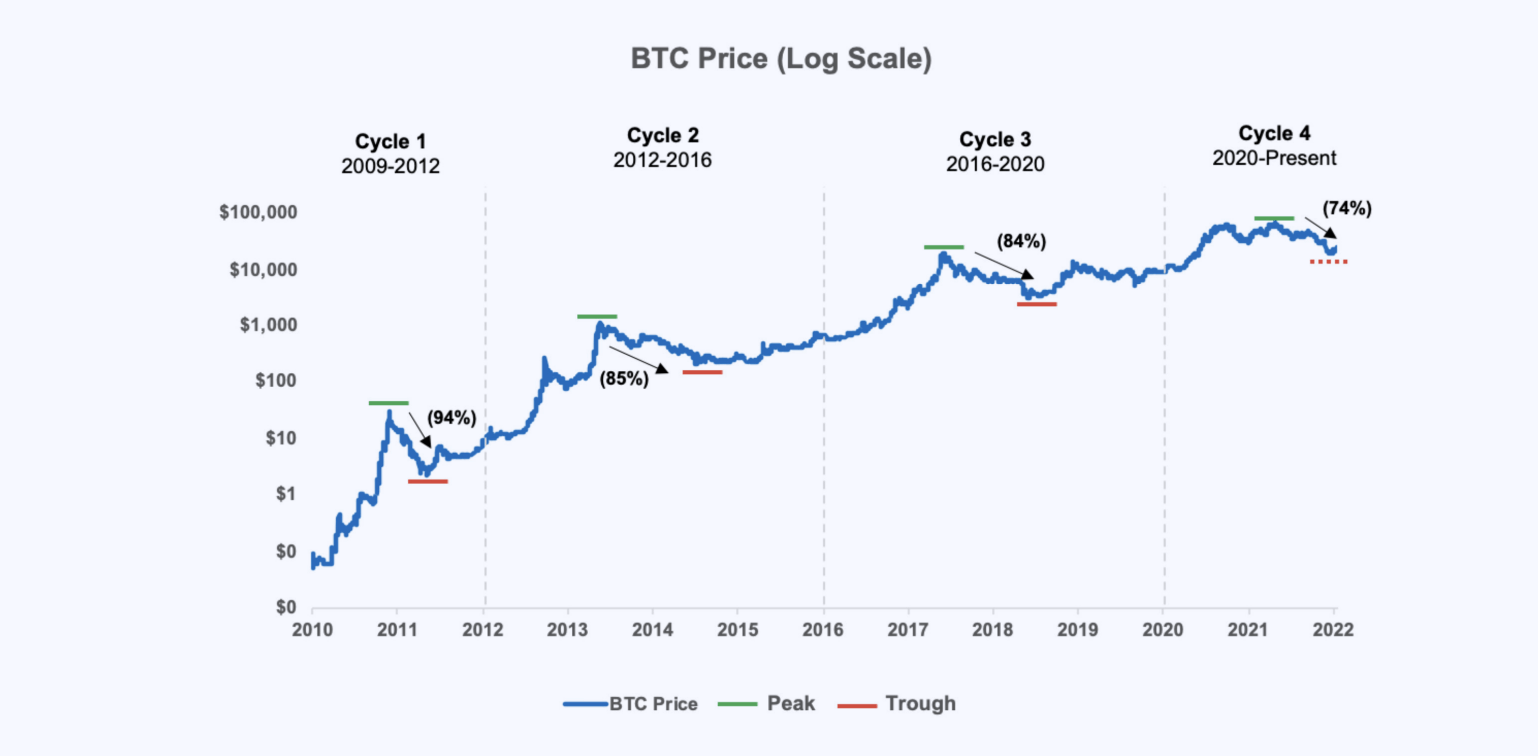

Coinbase may appear to be indicating it believes the market bottom is in, as the below graph compares the 74% drawdown from Bitcoin’s all-time high to lows from previous halving cycles.

Bitcoin trading volume and transactional value both rose 7% and 6%, respectively, in Q2. The volume of retail transactions fell $28 billion from a high of $145 billion in Q1 2021. Institutional volume also fell from a high of $371 billion in Q4 2021 to just $171 in Q2 2022.

Further, regarding institutional engagement, Coinbase notes,

“On the institutional side, with all of the market volatility it can be easy to lose sight that both new and existing clients continued to use our platform as they embrace crypto as a new asset class.”

Coinbase states that three themes underpin its decline in trading volume;

- Core U.S. retail customers were less active but have not left the platform

- A “large amount of trading volume” took place on off-shore exchanges that can list crypto derivatives with which Coinbase does not have “product parity with.”

- Coinbase did not have “exposure to the significant trading volumes related to the liquidation events of $LUNA.”

While Coinbase claimed it did not have significant exposure to $LUNA and that it was an “unsupported asset,” it did list the wrapped version of the token, wLUNA; something omitted from the Shareholder letter.

This is a developing story and may be updated with more details.