Following the fallout from the Terra implosion and subsequent market deleveraging, Bitcoin bottomed at $17,600 on June 22.

Though the BTC value recovered to $25,300 some two months later, it’s truthful to say value motion since that native prime has been stagnant. Significantly since mid-September, with BTC ranging between $18,100 and $20,500.

On-chain metrics present the vast majority of BTC traders are underwater, placing additional pressure on an already tentative market dynamic.

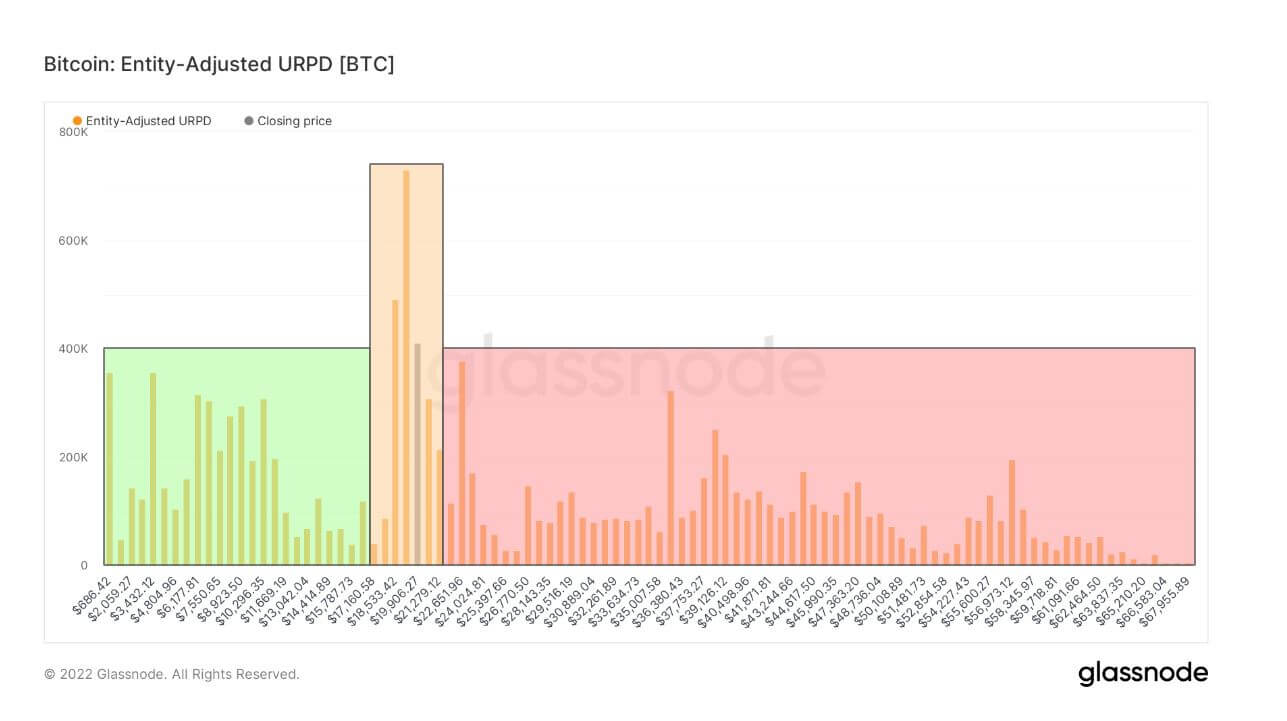

Bitcoin Entity Adjusted UTXO Realized Worth Distribution

The UTXO Realized Worth Distribution (URPD) metric reveals the costs at which the present set of Bitcoin UTXOs have been created.

Every bar within the chart under represents the variety of present Bitcoins that final moved inside the respective value bucket. Being entity-adjusted, the typical buying value is used for every entity to find out its steadiness inside the particular bucket.

To derive a extra consultant chart, coin actions between addresses managed by the identical entity are disregarded. Equally, alternate provide is excluded as a single averaged value for a lot of a number of customers would misrepresent the info giving rise to undesirable artifacts.

Buyers who bought Bitcoin at $17,600 or under symbolize solely 25% of token holders, with 14% shopping for between 17.6k and 22K. In the meantime, a staggering 61% of token holders have been underwater on the market backside.

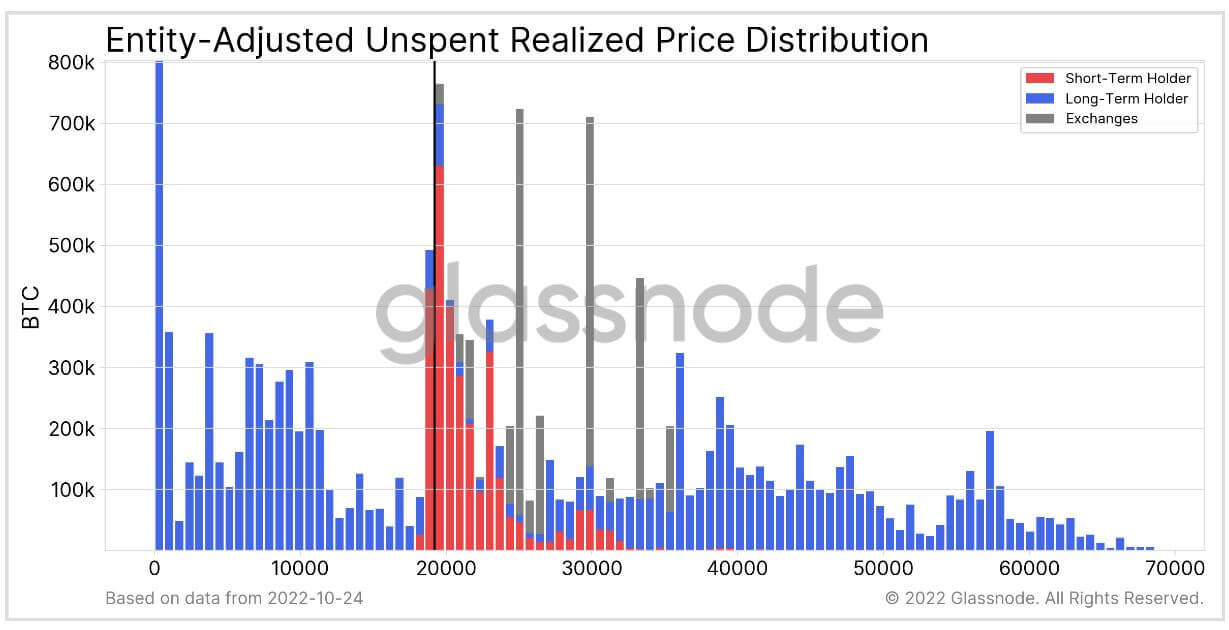

Unspent Realized Worth Distribution

Classifying entities as both short-term, long-term, or alternate holders, the chart under reveals short-term holders are clustered across the $18,500 and $32,000 buckets, with $19,000 being probably the most frequent value bucket for short-term holders.

A sign of agency perception can be extra short-term holders turning into long-term holders, thus nullifying value capitulation potential to a level throughout stagnant value motion.