The most important information within the cryptoverse for Nov. 22 consists of the rising fee of miner sellouts, realized Bitcoin loss from FTX fallout surpassing the losses attributable to the Terra collapse, and Digital Foreign money Group CEO Barry Silbert’s feedback relating to the liquidity scenario at Genesis.

CryptoSlate High Tales

Bitcoin miners promoting aggressively as crypto market continues to wrestle

Promoting stress on Bitcoin (BTC) miners continues because the Bitcoin value struggles beneath the $16,000 mark.

It is a Bitcoin miner massacre.

Most aggressive miner promoting in virtually 7 years now.

Up 400% in simply 3 weeks!If value does not go up quickly, we’re going to see quite a lot of Bitcoin miners out of enterprise. pic.twitter.com/4ePh0TIPmZ

— Charles Edwards (@caprioleio) November 21, 2022

In keeping with Capriole Fund’s founder Charles Edwards, miners are promoting at their most aggressive ranges in seven years, with a 400% improve in promoting stress over the past three weeks.

Realized Bitcoin loss from the FTX fallout surpasses LUNA collapse

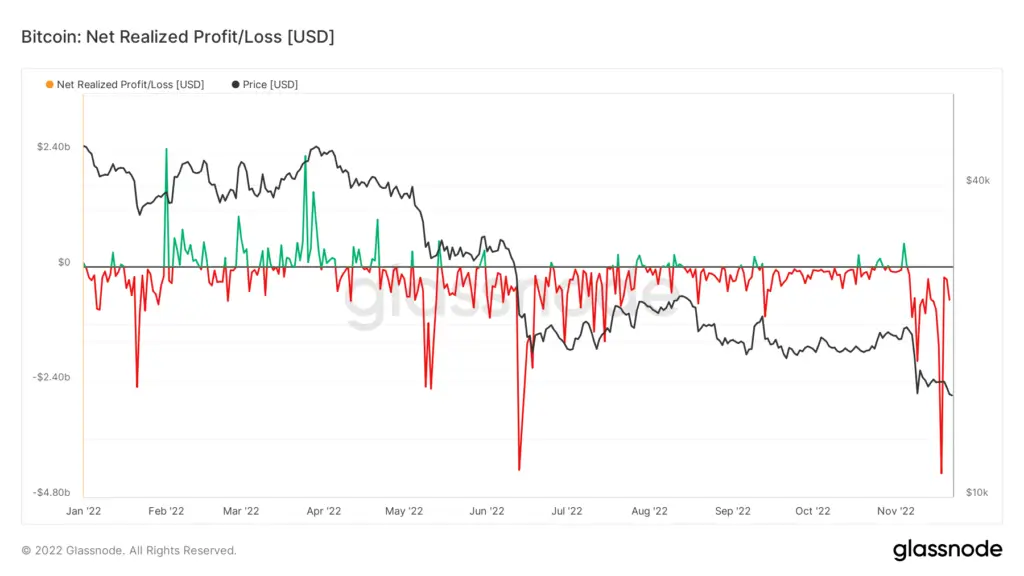

Realized Bitcoin loss as a result of FTX collapse has exceeded the losses attributable to the Terra (Terra) collapse in Might.

The primary wave of promoting stress got here in November and elevated the realized loss to round $2 billion. In keeping with knowledge, realized Bitcoin losses reached their yearly excessive of $4.3 billion.

Digital Foreign money Group CEO Barry Silbert downplays FTX impression on Genesis, expects $800M income in 2022

Digital Foreign money Group‘s (DCG) CEO, Barry Silbert, despatched a memo to the corporate shareholders to deal with the issues relating to the liquidity of Genesis

Silbert defined that the suspension of withdrawals at Genesis’ lending arm is because of a problem of “liquidity and length mismatch.” He continued to say that this challenge has no vital impression on Genesis and expects the DCG to succeed in $800 million in income in 2022.

FTX purchased $121M properties in Bahamas inside 2 years

FTX, its senior executives, and Sam Bankman-Fried‘s (SBF) mother and father purchased a minimum of 19 properties within the Bahamas within the final two years. The properties are value $121 million in whole.

Seven of those properties have been condominiums in a report group known as Albany and have been bought by FTX, that are value round $72 million in whole. FTX co-founder Gary Wang, SBF, and former head of engineering Nishad Singh additionally bought condos value $950,000 and $2 million for residential use.

FTX ordered to indemnify and reimburse Bahamas for property safekeeping

On Nov. 21, the Bahamas Supreme Courtroom ordered FTX to indemnify and reimburse the Securities Fee of Bahamas (SCB) for bills it is going to encounter whereas safekeeping its digital property.

The watchdog stated:

“[The court order]confirms the Fee is entitled to be indemnified underneath the legislation and FDM shall finally bear the prices the Fee incurs in safeguarding these property for the good thing about FDM’s prospects and collectors, in a fashion much like different regular prices of administering FDM’s property for the good thing about its prospects and collectors.”

Binance muscle tissues in on {hardware} pockets sector with collection A funding in NGRAVE

Trade big Binance introduced that it will be main pockets maker NGRAVE’s upcoming collection A funding spherical.

NGRAVE was based in 2018 and aimed to alter the way in which individuals expertise crypto by eliminating the possibility of loss. The staff stated that they made empowering individuals their mission to permit them to grasp their wealth and be free to reside the life they need.

U.S. Senators urge Constancy to drop BTC amid FTX fallout

Three U.S. senators composed a letter and despatched it to Constancy Investments to ask them to rethink its determination to supply Bitcoin publicity in its 401(okay) plans. The letter expressed the Senators’ issues in regards to the FTX fallout.

The letter said:

“As soon as once more, we strongly urge Constancy Investments to rethink its determination to permit 401(okay) plan sponsors to reveal plan individuals to Bitcoin.

Since our earlier letter, the digital asset business has solely grown extra unstable, tumultuous, and chaotic—all options of an asset class no plan sponsor or individual saving for retirement ought to need to go anyplace close to.”

Binance CZ denies Bloomberg report of Abu Dhabi fundraising try

Bloomberg revealed a report on November 21, saying that Binance was assembly with traders from Abu Dhani to boost money for the business’s restoration.

NEW: Abu Dhabi traders met with Binance to boost money for business restoration fund – Bloomberg

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) November 22, 2022

On Nov.22, Binance CEO Changpeng Zhao replied to this information and denied its reality.

Justin Solar desires to reportedly purchase FTX property

TRON Dao (TRX) founder Justin Solar reportedly revealed his curiosity in shopping for FTX property. He reportedly talked to Singaporean journalists about FTX and stated:

“We’re open to any type of deal. I feel all of the choices [are] on the desk. Proper now we’re evaluating property one after the other, however so far as I perceive the method goes to be lengthy since they’re already in this type of chapter process.”

Craig Wright creates ambiguity over Satoshi posts on BitcoinTalk discussion board

Craig Wright claimed that the precise Satoshi sends just some posts despatched by Satoshi to the BitcoinTalk discussion board.

Wright claimed to be Satoshi himself and stated that “It’s a fable that each one the posts on Bitcointalk (bitcointalk.org) from my account (Satoshi) are, the truth is, mine and haven’t been edited or modified and that the login on the web site belongs to me.”

Analysis Spotlight

Analysis: Lengthy-term Bitcoin holders stubbornly maintain on regardless of 33% holding losses

Regardless that Bitcoin marked its 106-week low and sank to $15,500, Lengthy Time period Holders (LTH) resist getting caught within the contagion fears and are persevering with to build up.

The whole provide held by long-term holders (TSHLTH) refers to Bitcoin that’s held for longer than six months. The chart above demonstrates that the LTHs are accumulating throughout value suppression and promoting throughout bull runs.

The present TSHLTH degree is at 13.8 million Bitcoin, which corresponds to 72% of the circulating provide and marks an all-time excessive for this metric.

Information from across the Cryptoverse

FTX Japan to permit withdrawals this 12 months

In keeping with native information sources, FTX Japan is trying to enable withdrawals by the top of this 12 months. To make that potential, the Japanese company is creating its personal system to permit withdrawals. Reportedly, FTX Japan at present holds 19.6 billion Yen in money and deposits.

FTX and Alameda misplaced billions earlier than 2022

In keeping with an article by Forbes, FTX and Alameda Analysis have misplaced $3.7 billion earlier than 2022. This challenges the picture SBF constructed for FTX and Alameda and makes the group query the extremely worthwhile 2021 12 months.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated by 2.08% to commerce at $16.149, whereas Ethereum (ETH) spiked by 2.09% to commerce at $1,128.