Twitter person @0x_shake, who recognized himself because the founding father of the Solana-based Cyber Samurai NFT undertaking, famous that regardless of a $1.2 billion valuation, Decentraland has simply 30 each day energetic customers (DAUs).

Decentraland ( $MANA ) has 30 Each day Energetic Customers

and a $1.2 Billion Market Cap pic.twitter.com/u4MBNsWvwk

— SHAKE (@0x_shake) October 6, 2022

The info was pulled from DappRadar however is below scrutiny given the low variety of DAUs. Another knowledge supply confirmed a discrepancy within the knowledge, however the quantity of DAUs per the choice knowledge supply was nonetheless within the tons of.

Nonetheless, the discovering has reignited a number of dialogue factors, together with metaverse tokens (and cryptocurrency usually) being a speculative pursuit, the pointlessness of market cap valuations, and the shortage of curiosity within the metaverse.

Decentraland (MANA) is caught in a worth droop.

Decentraland (MANA) is a digital world platform on Ethereum enabling customers to create, expertise, and monetize content material and functions. Its two-day-long Preliminary Coin Providing (ICO) ended on August 19, 2017, elevating $24.14 million.

The undertaking prides itself on being “owned by its customers,” which is achieved by means of a Decentralized Autonomous Group (DAO) that permits customers to vote on the platform’s future route.

“The primary totally decentralized world, Decentraland is managed by way of the DAO, which owns an important sensible contracts and belongings of Decentraland. By way of the DAO, you determine and vote on how the world works.”

Decentraland operates utilizing MANA, an ERC-20 token giving the fitting to vote, and LAND, an ERC-721 (non-fungible) token. MANA is burned to amass LAND. In flip, LAND is used to pay for varied issues within the digital world, together with avatars, wearables, and names.

However shopping for digital land requires Ethereum or MANA and is purchasable instantly from the Decentraland Market or OpenSea.

Per CryptoSlate knowledge, MANA’s 24-hour quantity got here in at $121 million, the present market cap is $1.31 billion, and the token is down 9% year-to-date and 88% down from its all-time excessive of $5.85, achieved in November 2021.

Even earlier than the Terra UST implosion, the value of MANA was on a pointy downtrend. Since late August, the token has settled right into a slim buying and selling band, with the $0.68 degree performing as assist.

Is DappRadar correct?

Commenting on the low variety of Decentraland DAUs, Coindesk reporter Sam Reynolds mentioned DaapRadar knowledge counts the variety of each day customers interacting with sensible contracts on the platform.

If that’s the case, this might indicate DAUs are underestimated, as customers could also be actively “enjoying” in Decentraland but not triggering sensible contract obligations, akin to buying and selling avatar wearables. Even so, the DAU determine per DaapRadar is extraordinarily low.

Knowledge from dapp.com explicitly states its knowledge on customers refers to “the variety of wallets that had interacted with a dapp’s sensible contracts.”

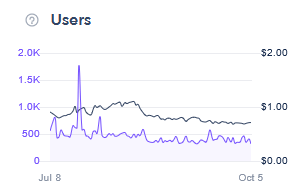

The chart beneath exhibits an approximate median baseline of 600 customers since July 8. Customers on October 5 got here in at simply 312.