The largest information within the cryptoverse for Nov. 17 contains the excessive promoting tendency of Bitcoin holders older than 10 years, SBF’s $1.6 billion private mortgage from Alameda Analysis, and Bitcoin and Ethereum’s emergence because the second and third most shorted crypto asset.

CryptoSlate Prime Tales

Who offered probably the most BTC within the aftermath of the FTX collapse? 10yr holders promote at highest ever charge

The collapse of FTX put immense strain on traders, whereas the value of Bitcoin (BTC) fell as little as $15,000.

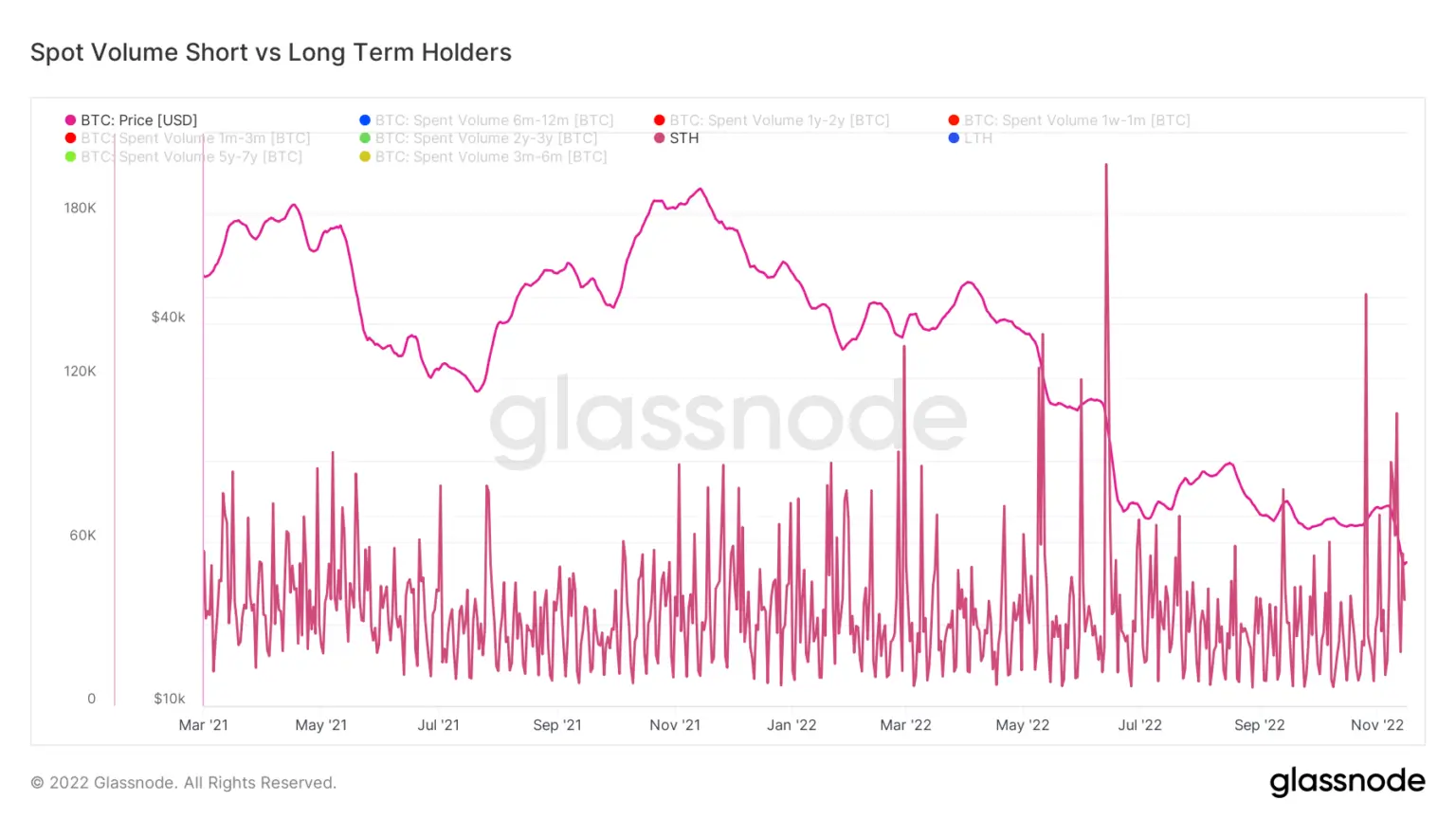

To disclose the place the promoting strain was coming from, CryptoSlate analysts examined the short-term (STH) and long-term holders (LTH).

Whereas historical past exhibits that the LTH is the primary to promote their cash when the numbers begin to fall, the turmoil following the FTX collapse didn’t shake the arrogance of long-term holders.

As an alternative, the market recorded its fifth-largest variety of STH sellers since March 2021, which interprets to round 400,000 Bitcoins offered by STH between Nov. 10 and Nov. 17.

FTX chapter court docket submitting reveals Alameda gave $1.6B in loans to SBF, others

FTX’s new CEO John Ray III’s court docket submitting revealed that Sam Bankman Fried (SBF) bought $1 billion in private loans from Alameda Analysis.

Ray referred to the state of affairs as a “full failure of company controls and such an entire absence of reliable monetary data.”

The submitting additionally disclosed that Alameda lent $543 million to FTX director of engineering Nishad Singh and $55 million to FTX Co-CEO Ryan Salame.

FTX collapse sees Bitcoin, Ethereum to be shorted the second and third-most quantity

After the FTX collapse, Ethereum (ETH) turned the second-most shorted crypto out there, adopted by Bitcoin because the third.

In response to the typical funding charge set by exchanges for perpetual futures contracts, lengthy positions pay periodically, whereas shorts pay each time the speed share turns constructive. The latest profound unfavorable fund charges point out an upcoming melancholy earlier than the markets begin therapeutic.

Genesis sought $1B emergency mortgage however by no means bought it

Crypto lender genesis sought out an emergency mortgage of $1 billion from traders however by no means bought it, because the Wall Road Journal reported.

The reviews famous that Genesis sought the funds due to a “liquidity crunch as a result of sure illiquid property on its stability sheets.”

FTX attacker continues swapping tokens; exchanges $7.95M BNB for BUSD, ETH

The FTX attacker stored their fingers busy on Nov. 17 and drained round $600 million in in the future. In three transactions, they swapped 30,000 BNB tokens for Ethereum and Binance USD (BUSD).

The exploiter presently holds $11.8 million BNB and ETH, value round $346.8 million on the present value ranges.

President Bukele reveals El Salvador will purchase 1 Bitcoin day by day

El Salvador’s president Nayib Bukele introduced that the nation would begin shopping for one Bitcoin day by day, starting on Nov. 18.

We’re shopping for one #Bitcoin on daily basis beginning tomorrow.

— Nayib Bukele (@nayibbukele) November 17, 2022

El Salvador has been closely criticized for its Bitcoin investments. Nonetheless, the nation didn’t cave and continued to specific its confidence in crypto. El Salvador spent over $100 million to amass the 2,381 Bitcoins it presently holds.

Mainstream media known as out for gaslighting over Sam Bankman-Fried’ good man’ narrative

The crypto neighborhood reacted to the mainstream media retailers for publishing articles that favor SBF, even after the FTX’s collapse.

The neighborhood reminded the imprisonment of the Twister Money developer Alexey Pertsev and expressed its frustration about SBF being free.

Circle drops Yield charges to 0%

USD Coin (USDC) issuer Circle dropped its yield product APY charge to 0% and mentioned that its yield product is overcollateralized and secured by “strong collateral agreements.”

An announcement on Circle’s official Twitter additionally detailed its overcollateralized fixed-term yield product.

1/ Circle Yield is an overcollateralized fixed-term yield product. Genesis is a counterparty to Circle on this product. Complete Circle Yield buyer loans excellent are $2.6 million as of 11/16/22 and are protected by strong collateral agreements.

— Circle (@circle) November 16, 2022

Singapore’s Temasek writes off $275M FTX funding, had misplaced perception in Sam Bankman-Fried

Singapore-based funding fund Temasek said that it’s writing off its $275 million funding in FTX, saying it had misplaced its “perception within the actions, judgment, and management” by placing them on SBF.

The corporate mentioned:

“The thesis for our funding in FTX was to put money into a number one digital asset alternate offering us with protocol agnostic and market impartial publicity to crypto markets with a price earnings mannequin and no buying and selling or stability sheet danger.”

Information from across the Cryptoverse

Analysis Spotlight

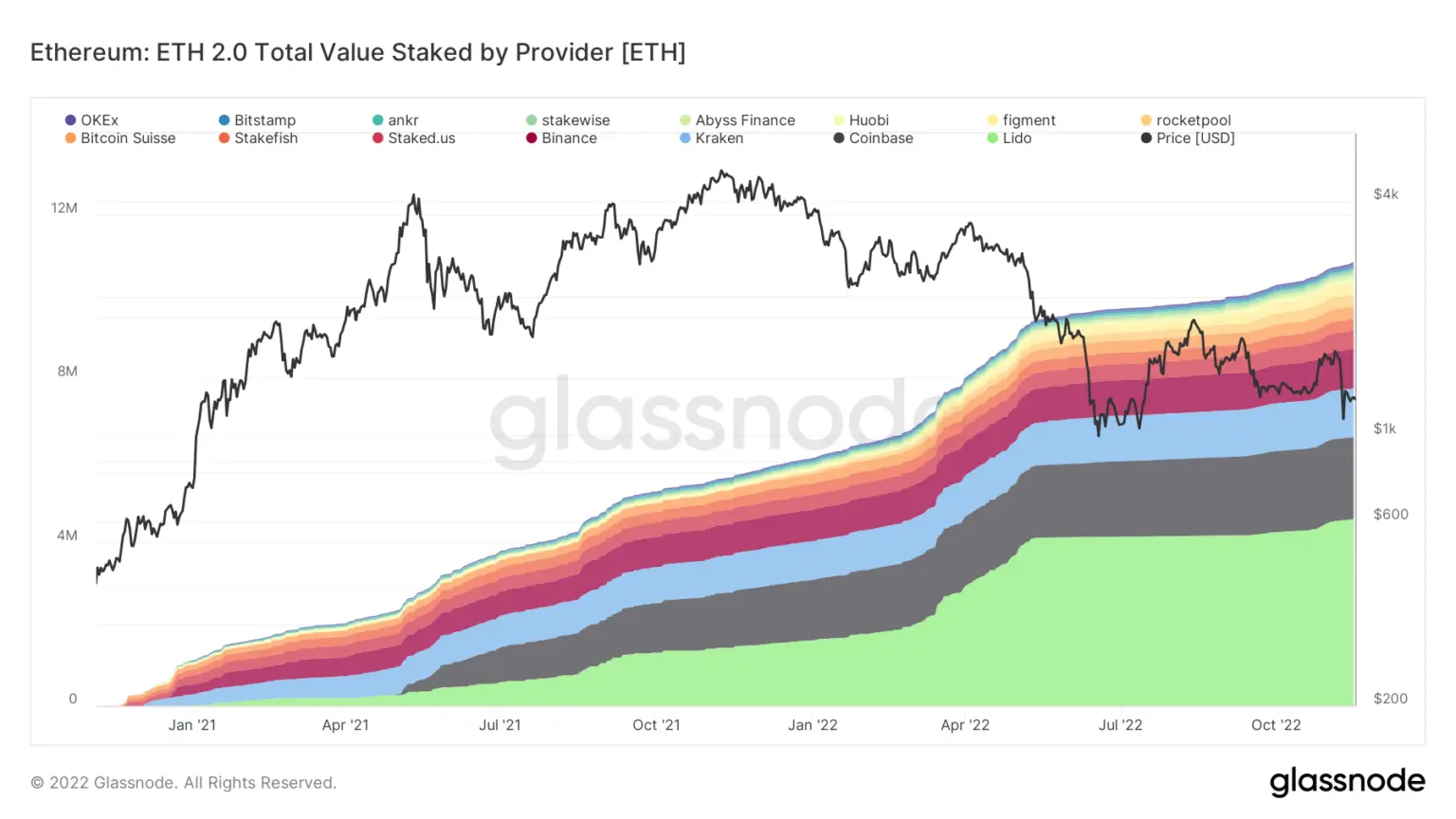

Analysis: 78% of all staked ETH is throughout 4 centralized suppliers; 74% of all blocks are OFAC compliant

CryptoSlate analysts examined Ethereum staking on-chain knowledge and revealed that round 78% of all staked Ethereum is dispersed throughout 4 centralized suppliers.

There are 8-9 million Ethereum presently staked throughout Lido (4,5 million), Coinbase (2 million), Kraken (1,2 million), and Binance (1 million).

Virtually 75% of all Ethereum blocks are thought-about to be OFAC compliant. 15% of all blocks produced by Ethereum are nonetheless non-OFAC compliant, and the opposite 11% are non-MEV-Increase blocks.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated by 0.58% to commerce at $16,678, whereas Ethereum (ETH) declined by 0.73% to commerce at $1,202.