The collapse of FTX wreaked havoc in the marketplace, wiping out billion from the market cap. Bitcoin took its heaviest hit this 12 months, dropping to a low of $15,500 and struggling to interrupt by the robust resistance at $16,000.

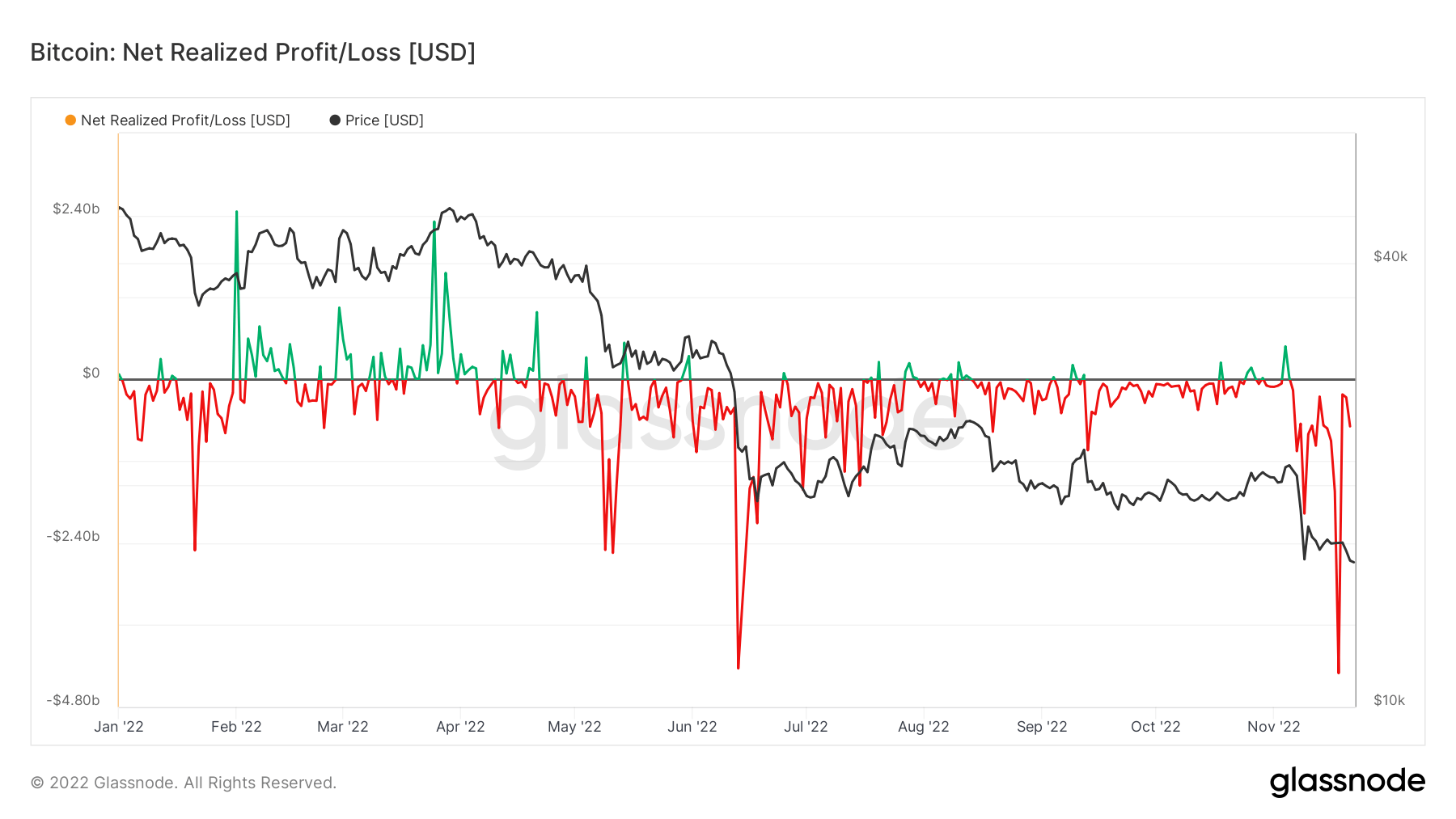

Bitcoin’s volatility appears to have shaken the arrogance of many buyers and pushed them to promote nicely under their shopping for value. Glassnode knowledge analyzed by CryptoSlate confirmed that realized Bitcoin losses reached their yearly excessive of $4.3 billion.

The primary wave of promoting stress seen in the beginning of November pushed realized loss to round $2 billion.

A slight consolidation in losses led many to imagine that the fallout was contained, however an extra wave of promoting stress pushed the losses even decrease. The realized losses attributable to the collapse of FTX at the moment are larger than the realized losses attributable to the Luna collapse in June this 12 months.

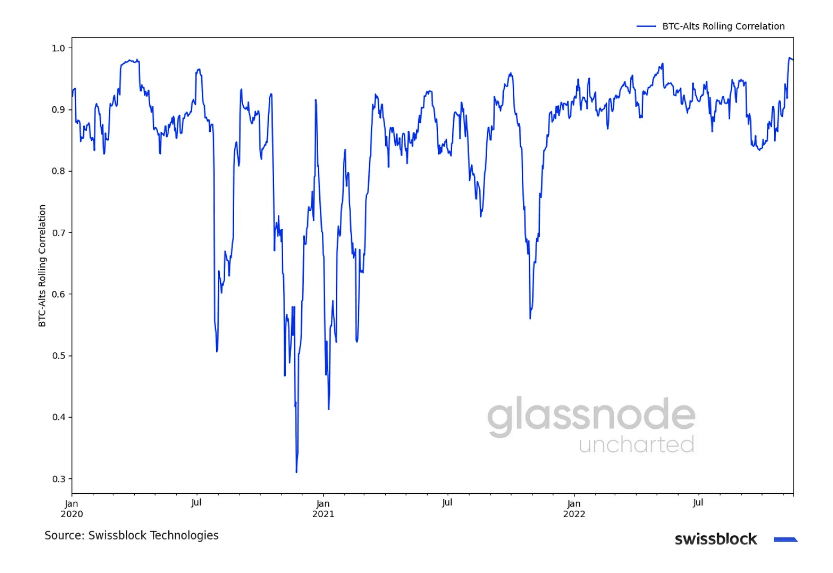

The losses suffered had an adversarial impact on Bitcoin’s correlation to different cryptocurrencies. Bitcoin and altcoins have been buying and selling at a 1:1 correlation because the starting of November, indicating a stage of volatility unseen because the starting of the COVID-19 pandemic in March 2020.